- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sri Lotus Developers and Realty IPO

₹14,000/100 shares

Minimum Investment

IPO Details

30 Jul 25

01 Aug 25

₹14,000

100

₹140 to ₹150

NSE, BSE

₹792 Cr

06 Aug 25

Sri Lotus Developers and Realty IPO Timeline

Bidding Start

30 Jul 25

Bidding Ends

01 Aug 25

Allotment Finalisation

04 Aug 25

Refund Initiation

05 Aug 25

Demat Transfer

05 Aug 25

Listing

06 Aug 25

Sri Lotus Developers and Realty Limited

Lotus Developers is a leading real estate developer in Mumbai, specialising in luxury residential and commercial properties. Since its establishment, the company has focused on high-end redevelopment projects in Mumbai’s western suburbs, particularly in the ultra-luxury and luxury segments. Lotus Developers is renowned for its quality construction, contemporary architecture, and timely project delivery. The company has developed over 10 million square feet of residential and commercial spaces, contributing significantly to Mumbai’s thriving real estate market. The company’s growth is attributed to its expert promoters, in-depth market understanding, design capabilities, execution excellence, and strong brand reputation.

Sri Lotus Developers and Realty Limited IPO Overview

Sri Lotus Developers and Realty Ltd. is launching a ₹792 crore book-built IPO, comprising a complete fresh issue of 5.28 crore equity shares. The public offer will open for subscription on July 30, 2025, and will close on August 1, 2025. The basis of allotment is expected to be finalised on Monday, August 4, 2025, with tentative listing scheduled on both BSE and NSE on Wednesday, August 6, 2025.

The price band for the IPO has been set between ₹140 and ₹150 per share. The lot size is 100 shares per application. Accordingly, the minimum investment required by retail investors is ₹14,000. For non-institutional investors, the small HNI (sNII) category starts at 14 lots (1,400 shares), amounting to ₹2,10,000, while the big HNI (bNII) segment begins at 67 lots (6,700 shares), requiring an investment of ₹10,05,000.

The promoters of Sri Lotus Developers are Anand Kamalnayan Pandit, Roopa Anand Pandit, and Ashka Anand Pandit. Prior to the IPO, the promoter holding stood at 91.78%, amounting to 43,59,09,986 shares. After the issue, their holding is expected to reduce to 81.86%, with the total share count increasing to 48,87,09,986 shares.

Sri Lotus Developers and Realty Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹792 crore

Offer for Sale (OFS): NA |

| IPO Dates | 30 July 2025 to 1 August 2025 |

| Price Bands | ₹140 to ₹150 per share |

| Lot Size | 100 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 43,59,09,986 shares |

| Shareholding post -issue | 48,87,09,986 shares |

Important Dates

| IPO Activity | Date |

| IPO Open Date | 30 July 2025 |

| IPO Close Date | 1 August 2025 |

| Basis of Allotment Date | 4 August 2025 |

| Refunds Initiation | 5 August 2025 |

| Credit of Shares to Demat | 5 August 2025 |

| IPO Listing Date | 6 August 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 100 | ₹15,000 |

| Retail (Max) | 13 | 1,300 | ₹1,95,000 |

| S-HNI (Min) | 14 | 1,400 | ₹2,10,000 |

| S-HNI (Max) | 66 | 6,600 | ₹9,90,000 |

| B-HNI (Min) | 67 | 6,700 | ₹10,05,000 |

Sri Lotus Developers and Realty Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sri Lotus Developers and Realty Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS)(Pre-/Post-IPO) | 5.23/4.66 |

| Price/Earnings (P/E) Ratio(Pre-/Post-IPO) | 28.69/32.17 |

| Return on Net Worth (RoNW) | 24.39% |

| Net Asset Value (NAV) | 4.24 |

| Return on Equity | 24.39% |

| Return on Capital Employed (ROCE) | 27.22% |

| EBITDA Margin | 52.57% |

| PAT Margin | 41.46% |

| Debt to Equity Ratio | 0.13 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in our Subsidiaries, Richfeel Real Estate Private Limited, Dhyan Projects Private Limited and Tryksha Real Estate Private Limited for part-funding development and construction cost of our Ongoing Projects, Amalfi, The Arcadian and Varun, respectively | 5,500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

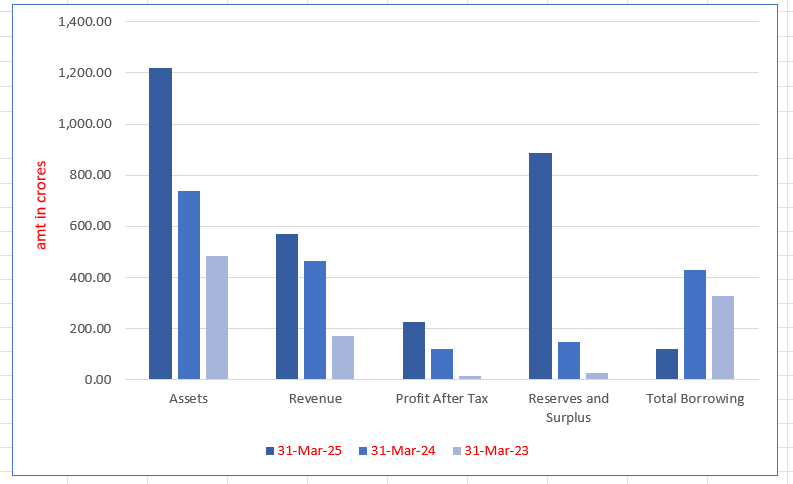

Sri Lotus Developers and Realty Limited Financials (in crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,218.60 | 736.81 | 486.23 |

| Revenue | 569.28 | 466.19 | 169.95 |

| Profit After Tax | 227.89 | 119.14 | 16.80 |

| Reserves and Surplus | 888.93 | 149.60 | 28.32 |

| Total Borrowing | 122.13 | 428.24 | 328.93 |

Financial Status of Sri Lotus Developers and Realty Limited

SWOT Analysis of Sri Lotus Developers and Realty IPO

Strength and Opportunities

- The company has established a strong brand reputation in the market.

- Sri Lotus Developers has a diverse portfolio of residential and commercial properties.

- The leadership is experienced and adept at navigating challenges in the industry.

- Known for delivering high-quality projects, the company ensures customer satisfaction.

- Strong relationships with contractors and suppliers enable efficient project execution.

- Increased demand for housing due to urbanisation presents significant growth opportunities.

- Government infrastructure development initiatives create new real estate opportunities in emerging urban areas.

- Expanding into affordable housing is an opportunity given growing demand for budget-friendly homes.

- Sustainability trends in the real estate sector provide an opportunity to adopt eco-friendly building practices.

- The increasing adoption of digital technology could streamline property management and sales processes.

- Rising demand for commercial spaces in urban areas opens opportunities for further development.

- Expansion into tier-2 and tier-3 cities could allow the company to tap into untapped markets.

Risks and Threats

- The company may have a limited geographical reach, limiting its growth prospects.

- It relies heavily on the real estate sector, making it susceptible to market downturns.

- Long construction timelines and delays in regulatory approvals can hinder project delivery.

- The company may face financial constraints limiting its ability to expand operations or invest in new ventures.

- Economic instability can negatively affect real estate demand and reduce the company's profitability.

- Stringent regulatory challenges, including land acquisition and permits, can delay projects and increase costs.

- Intense competition in the real estate market could pressure margins and reduce market share.

- Fluctuating raw material prices may affect the company's cost structure and profit margins.

- Oversupply in the market due to rapid construction may lead to reduced property values and longer sales cycles.

- Potential legal issues related to land titles and construction regulations may create operational hurdles.

- Rising inflation and interest rates could deter potential homebuyers, reducing the company’s sales potential.

- Real estate projects are vulnerable to environmental risks, such as floods or natural disasters, affecting project timelines.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Sri Lotus Developers and Realty Limited IPO

Sri Lotus Developers and Realty Limited IPO Strengths

- Strategic Position in the Luxury Segment

Sri Lotus Developers and Realty Limited holds a strong position in Mumbai’s ultra-luxury and luxury residential real estate market, particularly in the western suburbs. With an extensive pipeline of projects, the company benefits from Mumbai’s status as India’s commercial hub and a growing high-income customer base. Their focus on creating premium residential and commercial properties aligns with the city’s market demand, achieving significant sales share in Maharashtra’s competitive real estate sector.

- Experienced Leadership

Sri Lotus Developers is guided by its Promoter, Anand Kamalnayan Pandit, a real estate veteran with over 24 years of expertise. Having delivered 12 projects spanning 3.32 million square feet, including residential and commercial spaces, his leadership strengthens the company’s operations. His experience in Mumbai’s western suburbs real estate market ensures strategic project execution, fostering growth and solidifying the company’s reputation for high-quality developments.

- Customer-Centric Business Model

Sri Lotus Developers employs a customer-first approach, conducting detailed research to design projects tailored to its target demographic. This involves optimising layouts, amenities, and designs based on market needs. Notable examples include innovative commercial spaces like “Arc One” with compact, high-utility offices, and residential projects in Juhu, which integrate rooftop amenities due to space constraints. These strategies cater to customer preferences, enhancing the company’s appeal in the luxury real estate segment.

- Market Share in Juhu Real Estate

With approximately 10% market share in Juhu for ultra-luxury residential units priced above ₹7 crores, Sri Lotus Developers has cemented its presence. By addressing land constraints and incorporating exclusive features like rooftop amenities, their projects offer gated communities with recreational facilities. Their innovative approach positions them as a key player in Mumbai’s high-value real estate market, catering to discerning buyers seeking premium properties in prime locations.

- Strong Brand Recognition

Sri Lotus Developers operates under the esteemed “Lotus Developers” brand, synonymous with luxury, quality, and timely delivery. Their reputation for creating customer-focused environments has earned industry accolades, including the Best Realty Brand 2024 award. This brand equity enables the company to sell properties at premium prices during construction phases, ensuring strong cash flows and minimal reliance on debt, while reinforcing its market leadership in the luxury real estate sector.

- Asset-Light Model for Development

Sri Lotus Developers employs an asset-light model, leveraging redevelopment and joint development agreements to minimise upfront land acquisition costs. This strategy enables efficient capital utilisation, allowing the company to diversify into high-potential micro-markets. Partnerships with housing societies and landowners reduce risks, strengthen cash flow, and enhance returns. Their expertise in redevelopment positions them to navigate Mumbai’s stringent regulatory landscape, securing strategic growth while maintaining financial stability.

- Timely Project Completion

Sri Lotus Developers excels in delivering projects within or before their scheduled timelines, reflecting strong project management capabilities. This efficiency enhances their market reputation and customer trust. By adhering to deadlines consistently, the company has established a track record of reliability, ensuring customer satisfaction and reinforcing its brand value. Their ability to meet commitments positions them favourably in Mumbai’s competitive real estate market.

More About Sri Lotus Developers and Realty Limited

Sri Lotus Developers and Realty Limited, a premier real estate developer, specialises in residential and commercial properties across Mumbai, Maharashtra. Their primary focus is on redevelopment projects in the ultra-luxury and luxury segments, particularly in the western suburbs. Since inception, the company has aimed to build a brand synonymous with customer satisfaction, creating environments that elevate lifestyles.

Strategic Operations and Growth

- Market Leadership: The company operates in Mumbai, one of India’s largest real estate markets, ranked first for residential supply, absorption, and price from 2019 to 2023.

- Land Acquisition: In 2017, Sri Lotus expanded into the western suburbs of Mumbai, targeting the ultra-luxury and luxury residential markets.

- Promoter’s Expertise: Led by Anand Kamalnayan Pandit, who brings over 24 years of experience, the company benefits from his strategic guidance, having completed over 3.32 million square feet of development in the western suburbs.

Project Categories

Sri Lotus undertakes three primary types of projects:

- Greenfield Projects: Constructed on undeveloped land with no existing infrastructure.

- Redevelopment Projects: Developed through agreements with housing societies or commercial unit holders.

- Joint Development Projects: Collaborating with landholders to jointly develop projects with shared profits or revenue.

As of November 2024, the company has a developable area of 0.68 million square feet, including both residential and commercial properties.

Residential and Commercial Segments

- Luxury Residential: 2BHK and 3BHK flats ranging from ₹3 crore to ₹7 crore.

- Ultra-Luxury Residential: 3BHK, 4BHK, and penthouses priced above ₹7 crore.

- Commercial Segment: Development of office spaces catering to high-end business needs.

Technological Integration

To streamline operations, the company uses advanced technology such as 3D Building Information Modelling (BIM) and virtual reality for project walkthroughs, ensuring better coordination, cost efficiency, and enhanced customer experience.

Future Expansion

Sri Lotus is expanding into new micro-markets in southern and central Mumbai, aiming to capture emerging opportunities in areas like Nepean Sea Road, Prabhadevi, and Ghatkopar. This strategic move ensures their continued leadership in Mumbai’s dynamic real estate market.

Industry Outlook

The Indian real estate sector is being reshaped by robust economic growth, a demographic dividend, and structural reforms. The convergence of rising incomes, improving infrastructure, and supportive government policy has led to sustained momentum in housing and commercial demand.

Strong GDP Growth Drives Real Estate Expansion

- India became the world’s fifth-largest economy in 2022.

- In 2023, it contributed over 16% to global growth.

- Real GDP growth is projected at 7.8% in 2023, 6.8% in 2024, and 6.5% in 2025.

Real Estate Market Growth Trajectory

- Market size rose from USD 50 billion (2008) to USD 180 billion (2020) at 11% CAGR.

- Expected to touch USD 1,000 billion by 2030 and USD 5,800 billion by 2047.

- Contribution to GDP to reach 13% by 2025.

Socio-Economic Shifts and Urbanisation Boost Demand

- Enhanced education and incomes have lifted housing demand.

- Homeownership rose by 28.36% between 2001 and 2011.

- Urban housing need is rising with 50% urban population projected by 2046.

Policy Interventions Accelerate Sector Recovery

- Government initiatives like PMAY, SWAMIH Fund, loan restructuring, and stamp duty cuts have helped spur real estate recovery.

- Maharashtra waived property tax for homes up to 500 sq. ft. in Mumbai.

Housing Finance and Market Trends

- Affordability index improved from 22 (1995) to 3.3 (2023).

- Top cities show increased supply, absorption, and price growth till 2026.

- Ready-to-move homes dominate consumer preferences.

Mumbai Micro-Markets and Infrastructure Fuel Local Demand

- South Central Mumbai and Western Suburbs see rising luxury housing due to connectivity and strategic location.

- Andheri West’s Grade A office market thrives on media sector demand, metro links, and airport proximity.

How Will Sri Lotus Developers and Realty Limited Benefit?

- Leverages Mumbai’s real estate growth through strong presence in premium housing market.

- Targets rising housing demand driven by rapid urbanisation in Mumbai’s western suburbs.

- Benefits from metro and road projects improving connectivity and property value.

- Aligns with growing preference for premium housing due to better affordability index.

- Gains from government-backed housing schemes and supportive mortgage policy environment.

- Enhances efficiency and customer experience using 3D BIM and virtual walkthroughs.

- Caters to increasing housing demand from India’s growing young working population.

- Secures premium land in high-demand western suburbs for luxury project development.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Basic EPS (₹) | P/E | Return on Networth (%) | NAV per Equity Share (₹) |

| Sri Lotus Developers and Realty Ltd | 1 | 3.00 | [●] | 70.68% | 4.24 |

| Arkade Developers Limited | 10 | 8.08 | 20.15 | 38.01% | 21.28 |

| Keystone Realtors Limited | 10 | 9.85 | 69.81 | 6.18% | 157.85 |

| Suraj Estate Developers Limited | 5 | 19.39 | 29.91 | 13.07% | 120.43 |

| Sunteck Realty Limited | 1 | 4.99 | 101.78 | 2.27% | 213.28 |

| Mahindra Lifespaces Limited | 10 | 6.34 | 73.02 | 5.25% | 120.82 |

| Hubtown Limited | 10 | (11.16) | (23.98) | (6.85%) | 157.38 |

Key Strategies for Sri Lotus Developers and Realty Limited

- Strengthening Position in the Ultra Luxury and Luxury Segments

Sri Lotus Developers and Realty Limited aims to reinforce its position in the ultra-luxury and luxury markets in Mumbai’s western suburbs. With rising demand driven by increased affluence, the company is strategically focusing on projects in this high-end real estate sector, particularly in the > ₹2.5 Cr segment, as the market shows substantial growth.

- Enhanced Focus on Asset-Light Model

Sri Lotus Developers and Realty Limited prioritises an asset-light approach, emphasising redevelopment and joint development projects. This model enables capital efficiency while minimising investment risks, allowing the company to expand its project portfolio with reduced financial burden.

- Expansion into New Micro-Markets

Sri Lotus Developers and Realty Limited is expanding into new micro-markets like south-central and eastern Mumbai. Leveraging its established brand reputation in luxury real estate, the company targets prime areas like Prabhadevi, Nepean Sea Road, and Ghatkopar, capitalising on rising demand and high capital appreciation.

- Selective Development of Commercial Projects

The company continues to selectively develop commercial projects in high-demand areas such as Andheri West. With strong growth in rental and sale prices, Sri Lotus Developers and Realty Limited seeks to strengthen its presence in commercial real estate, focusing on delivering quality office spaces in prime business districts.

- Enhancing Brand Visibility and Reputation

Sri Lotus Developers and Realty Limited aims to enhance its brand visibility by delivering quality real estate projects. The company focuses on innovation, customer satisfaction, and efficient project execution, while promoting its brand through strategic marketing campaigns and participation in real estate exhibitions to build recognition.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sri Lotus Developer's IPO

What is the purpose of Sri Lotus Developer's IPO?

The company intends to utilise the funds raised from the IPO to finance its upcoming real estate projects, including both residential and commercial developments in and around Mumbai.

When did Sri Lotus Developers file its DRHP with SEBI?

Sri Lotus Developers filed its Draft Red Herring Prospectus (DRHP) with SEBI on December 26, 2024, marking the initiation of the IPO process.

What is the size of the IPO?

The company aims to raise approximately ₹792 crore through the IPO, which will be conducted via a book-building process.

Who are the promoters backing Sri Lotus Developers?

The company has garnered investments from notable figures, including Bollywood celebrities and investor Ashish Kacholia, indicating strong backing and confidence in its business model.

What is the expected timeline for the IPO?

The exact dates for the IPO opening and closing are 30 July 2025 and 1 August 2025, respectively

How can investors apply for the IPO?

Investors can apply for the IPO through the book-building process, details of which will be provided in the Red Herring Prospectus (RHP) once it is filed and approved by SEBI.