- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

SSF Plastics India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

SSF Plastics India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

SSF Plastics India Limited

Since 2006, SSF Plastics India Limited has been a leading manufacturer of rigid plastic packaging and engineering plastic components. The company offers end-to-end packaging solutions, covering design to delivery, across segments like bottles, containers, caps, tubs, and engineered components. Serving industries such as personal care, homecare, F&B, electronics, lubricants, and pharmaceuticals, it specialises in customised packaging. With in-house design, mould making, automation, and decoration capabilities, SSF processes various polymers including HDPE, PP, PET, and PCR, while also handling engineered compounds for electronics applications.

SSF Plastics India Limited IPO Overview

SSF Plastics India Limited is launching an IPO through the book-building process, aiming to raise ₹550 crore. The offering comprises a fresh issue of ₹300 crore and an offer for sale worth ₹250 crore. The IPO dates, price band, allotment, and lot size are yet to be announced. IIFL Securities Ltd and Nuvama Wealth Management Limited are serving as the book running lead managers, while Link Intime India Private Ltd is the registrar. The shares, having a face value of ₹5 each, will be listed on both BSE and NSE. As per the Draft Red Herring Prospectus (DRHP), the total pre-issue shareholding stands at 4,13,28,000 shares, with 100% held by promoters Kapil Dhawan, Sunil Dhawan, Ramesh Madhavdas Chugh, Saurabh Dhawan, Daksh Sunil Dhawan, and Pulkeet Sunil Dhawan. The post-issue shareholding will reflect equity dilution. The DRHP was filed with SEBI on March 25, 2025.

SSF Plastics India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹550 crores

Offer for Sale (OFS): |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,13,28,000 shares |

| Shareholding post -issue | TBA |

SSF Plastics India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

SSF Plastics India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

SSF Plastics India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 7.70 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 16.79% |

| Net Asset Value (NAV) | 77.35 |

| Return on Equity | 17.88% |

| Return on Capital Employed (ROCE) | 16.41% |

| EBITDA Margin | 17.89% |

| PAT Margin | 8% |

| Debt to Equity Ratio | 0.99 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Re-payment/ pre-payment, in full or in part, of certain outstanding borrowings availed by the company | 1600 |

| Funding capital expenditure requirements for purchase of plant and machinery | 800 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

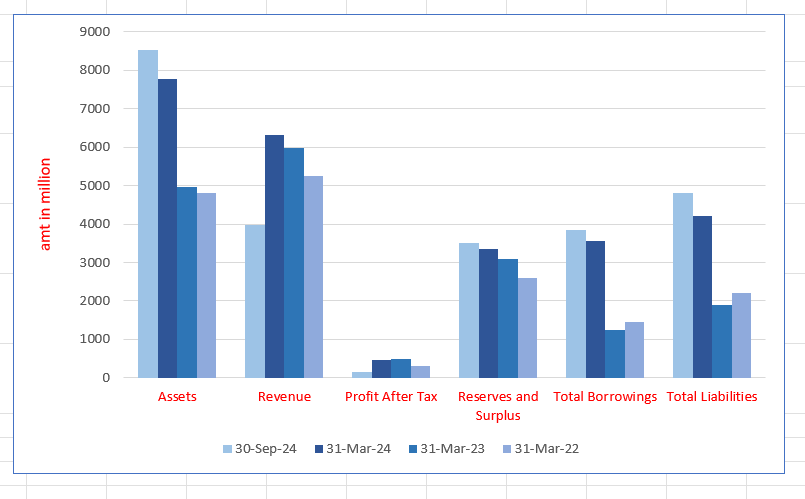

SSF Plastics India Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 8527.04 | 7765.13 | 4974.23 | 4819.55 |

| Revenue | 3974.17 | 6309.06 | 5987.43 | 5238.22 |

| Profit After Tax | 151.93 | 461.00 | 485.83 | 318.43 |

| Reserves and Surplus | 3508.21 | 3360.46 | 3081.20 | 2593.49 |

| Total Borrowings | 3853.55 | 3558.10 | 1238.43 | 1450.96 |

| Total Liabilities | 4812.19 | 4198.03 | 1883.19 | 2216.22 |

Financial Status of SSF Plastics India Limited

SWOT Analysis of SSF Plastics India IPO

Strength and Opportunities

- Extensive manufacturing network with 15 facilities across India .

- End-to-end packaging solutions from design to delivery .

- In-house capabilities in design, mould making, and automation .

- Processes a wide range of polymers, including recycled materials .

- Serves diverse industries: personal care, homecare, F&B, electronics, lubricants, pharmaceuticals .

- Strong focus on sustainability and use of post-consumer recycled polymers .

- Proven track record with over 350 successful moulds .

- Continuous innovation in tamper-proof and lightweight packaging solutions .

- Strong financial profile with healthy liquidity and promoter support .

Risks and Threats

- High dependence on a single client, HUL, contributing 25–30% of revenue .

- Operates in a highly fragmented industry with intense competition and low entry barriers .

- Exposure to volatile raw material prices affecting cost structures.

- Regulatory challenges related to environmental concerns and plastic usage.

- Potential delays in receivables from major clients impacting cash flow.

- Limited global footprint may restrict international market access.

- Dependence on the Indian market makes it susceptible to domestic economic fluctuations.

- Challenges in scaling operations amidst rapidly changing technology trends.

- Need for continuous investment in R&D to stay ahead in innovation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

SSF Plastics India Limited IPO Strengths

Long-standing Partnerships with Marquee Customers Across Diverse Industries

SSF Plastics India Limited, since its inception in 2006, has built enduring relationships with a marquee customer base across multiple industries. With deep customer insight, innovation-led solutions, and consistent delivery, SSF serves over 340 clients including Hindustan Unilever, Dabur, Emami, Himalaya, and Alkem, across FMCG, pharma, electronics, and automotive sectors.

Broad and Differentiated Product Portfolio Enabling SSF Plastics India Limited to Serve as a Comprehensive Plastic Packaging Solution Provider

SSF Plastics India Limited offers end-to-end packaging solutions across bottles, containers, caps, closures, tubs, and engineering plastic components. With in-house design, mould-making, automation, and polymer versatility, the company delivers customised, multi-industry packaging—from personal care to electronics—backed by strong client collaboration and innovation.

Innovation-Driven Growth Through Product and Process Advancement at SSF Plastics India Limited

SSF Plastics India Limited drives innovation through advanced product design and process development. With patented tamper-proof technologies, sustainable packaging, automation, and high PCR usage, the company delivers cost-effective, high-quality, eco-friendly solutions—enhancing functionality, efficiency, and customer value while supporting environmental goals and Extended Producer Responsibility (EPR) targets.

Integrated Business Model Focused on Operational Efficiency at SSF Plastics India Limited

SSF Plastics India Limited operates a fully integrated model—from in-house design to mould development and manufacturing—enabling efficiency, cost control, and swift delivery. With advanced tool rooms, 15 strategically located plants, and recyclable, PCR-enabled products, it ensures scale advantages, sustainability, and unmatched customer responsiveness across diverse packaging needs.

Proven Track Record of Strategic Growth Through Inorganic Acquisitions

SSF Plastics India Limited has consistently strengthened its market position through successful acquisitions. Strategic integrations in Tamil Nadu and Gujarat expanded capacity, product lines, and customer base—especially in the PET, beverages, and pharma sectors—demonstrating expertise in commercial, operational, and technology integration within a fragmented industry.

Experienced Leadership Driving Innovation and Strategic Growth

SSF Plastics India Limited is led by a skilled management team with deep industry expertise. Promoters and directors, with decades of experience in plastics and packaging, have built a strong foundation and growth trajectory. Their collective leadership continues to drive innovation, expansion, and competitive advantage.

Consistent Financial Performance in a High-Barrier Industry

SSF Plastics India Limited has demonstrated sustained profitability and robust financial growth, driven by strong revenue and PAT increases from Fiscal 2022 to 2024. Operating in a capital-intensive, expertise-driven industry, the company continues to benefit from high entry barriers and its ability to generate steady operational cash flows.

More About SSF Plastics India Limited

SSF Plastics India Limited stands as the fourth largest manufacturer of rigid plastic packaging products (RPP) among organized players in India by revenue in Fiscal 2024 (Technopak Report). The company offers comprehensive end-to-end packaging solutions, covering design to delivery across multiple product categories including bottles, containers, caps/closures, tubs, and engineering plastic components.

Diverse Industry Presence

SSF Plastics serves a broad spectrum of industries such as:

- Personal Care

- Homecare

- Food & Beverages (F&B)

- Consumer Electronics

- Engine Oil & Lubricants

- Pharmaceuticals

Its versatile packaging solutions cater to growing consumption trends across these sectors.

Customized Packaging & Innovation

Driven by its in-house design and innovation center, SSF Plastics provides tailor-made packaging solutions. Key capabilities include:

- Mould making and decoration processes

- In-house automation machinery

- Expertise in polymers like HDPE, PP, LDPE, PET, and post-consumer recycled polymers (PCR)

- Processing engineered compounds for electronics applications

This enables the company to deliver innovative, sustainable, and efficient packaging products.

Strong Customer Base

SSF Plastics’ clientele expanded to 347 customers by September 2024, up from 246 in Fiscal 2022. It maintains long-standing relationships with major FMCG players, including Hindustan Unilever Limited (over 18 years), Wipro, Dabur, Emami, Himalaya Wellness, Colgate, and others.

Manufacturing Capabilities

The company operates 15 manufacturing facilities strategically located across India in Daman, Baddi, Dehradun, Hosur, Pardi, and Hyderabad. Facilities utilize advanced technologies such as:

- Injection moulding

- Blow moulding

- Compression moulding

- In-mould labelling and multi-layer extrusion

Cleanroom environments support pharmaceutical packaging to maintain high safety and quality standards. Total production capacity exceeds 50,000 tons of polymer annually.

Global Reach and Sustainability

SSF Plastics exports products internationally to countries including the UAE, Bangladesh, Sri Lanka, Thailand, South Africa, Bahrain, and Germany. The company is a leader in sustainable packaging practices, employing renewable power and recycled plastics, supported by partnerships for recycling and PCR granule manufacturing.

Innovation and Compliance

Its Mumbai-based innovation center focuses on developing industry-leading packaging solutions and regulatory compliance. The company holds specific drug master file (DMF) registrations for pharmaceutical packaging, underscoring its commitment to quality and trust in the pharma sector

Industry Outlook

Market Size & Growth Projections

- 2024 Value: The Indian rigid plastic packaging market was valued at approximately USD 10.68 billion in 2024.

- 2030 Projection: Expected to reach USD 17.0 billion by 2030, growing at a CAGR of 3.26% from 2025 to 2033.

- 2025 Estimate: Projected to grow from 5.27 million tonnes in 2025 to 7.00 million tonnes by 2030, at a CAGR of 5.83%.

Key Growth Drivers

- Rising Consumer Demand: Increasing consumption in sectors like food & beverages, personal care, and pharmaceuticals.

- Urbanization & Lifestyle Changes: Urban growth and changing lifestyles boost demand for packaged goods.

- E-commerce Expansion: Online retail growth necessitates durable packaging solutions.

- Sustainability Trends: Shift towards eco-friendly packaging materials and practices.

- Regulatory Support: Government initiatives promoting manufacturing and export.

SSF Plastics India Limited’s Position

SSF Plastics India Limited, as the fourth-largest manufacturer of rigid plastic packaging products among organized players in India by revenue in Fiscal 2024, is well-positioned to capitalize on these industry trends.

Product Categories Manufactured by SSF Plastics India Limited:

- Bottles & Containers: Serving the food & beverage, personal care, and pharmaceutical sectors.

- Caps & Closures: Providing sealing solutions for various consumer goods.

- Tubs & Jars: Used in packaging for homecare and personal care products.

- Engineering Plastic Components: Catering to the consumer electronics and automotive industries.

Sustainability & Innovation

- Recycled Materials: Utilization of post-consumer recycled polymers to promote sustainability.

- Design & Innovation Center: In-house facility focusing on developing eco-friendly and innovative packaging solutions.

- Regulatory Compliance: Adherence to industry standards and certifications, ensuring product quality and safety.

Export Markets

SSF Plastics India Limited exports its products to various international markets, including the UAE, Bangladesh, Sri Lanka, Thailand, South Africa, Bahrain, and Germany, demonstrating its global reach and adherence to international quality standards.

How Will SSF Plastics India Limited Benefit

- Positioned as the fourth-largest rigid plastic packaging manufacturer in India, enabling strong market influence and growth potential.

- Broad product portfolio including bottles, caps, tubs, and engineering components, catering to diverse industries like FMCG, pharma, electronics, and food & beverages.

- Robust customer base with long-term contracts from major FMCG players, ensuring steady revenue and brand credibility.

- Advanced manufacturing capabilities across 15 facilities with modern technologies, supporting high-volume and quality production.

- In-house innovation center enabling customized, sustainable packaging solutions with expertise in polymers and recycled materials.

- Commitment to sustainability through use of post-consumer recycled polymers and renewable energy, aligning with global eco-friendly trends.

- Global export footprint to multiple countries, enhancing revenue streams and international presence.

- Regulatory compliance, including pharmaceutical DMF registrations, strengthening trust in sensitive product packaging sectors.

Peer Group Comparison

| Name of Company | Face Value per Share (₹) | Revenue (₹ million) | EPS Basic (₹) | EPS Diluted (₹) | NAV per Share (₹) | RoNW (%) |

| SSF Plastics India Limited | 15 | 6,309.06 | 11.15 | 11.15 | 77.35 | 15.53 |

| Peer Groups | ||||||

| Mold-Tek Packaging Limited | 5 | 6,986.50 | 20.07 | 20.07 | 178.70 | 11.56 |

| Time Technoplast Limited | 13 | 49,925.01 | 13.71 | 13.67 | 112.00 | 12.94 |

| Shaily Engineering Plastic Ltd | 21 | 6,438.71 | 12.49 | 12.49 | 99.90 | 13.34 |

Key Strategies for SSF Plastics India Limited

Specialised Product Expansion Across Diverse Sectors

SSF Plastics India Limited focuses on expanding its product portfolio by entering new industries like pharmaceuticals, agrochemicals, and F&B. Leveraging its advanced engineering and manufacturing capabilities, the company aims to deliver innovative, high-quality packaging tailored to evolving industry needs and emerging global opportunities.

Strengthening Footprint Through Organic and Inorganic Growth

SSF Plastics India Limited aims to expand geographically by establishing greenfield facilities and pursuing strategic acquisitions. With past successes in business integration and localisation, the company seeks to grow its reach, enhance production capacity, and cater to region-specific packaging demands across high-growth market segments.

Increasing Market Share and Customer Base

By enhancing product offerings and innovating in sustainable packaging, SSF Plastics India Limited strives to deepen engagement with existing clients and attract new ones. Its strong brand associations, customisation capabilities, and end-to-end solutions position the company to expand wallet share and overall market presence.

Commitment to Sustainable Manufacturing

SSF Plastics India Limited integrates sustainability by using renewable energy, adopting hybrid technology, reducing material waste, and recycling post-consumer plastics. From solar panels to EV adoption, the company aligns its production with eco-friendly practices, reinforcing its leadership in responsible and energy-efficient manufacturing in India.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On SSF Plastics India Limited IPO

How can I apply for SSF Plastics India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the SSF Plastics India IPO?

The IPO aims to raise ₹550 crore, comprising ₹300 crore fresh issue and ₹250 crore offer for sale.

How will the IPO proceeds be utilized?

Funds will repay debts, purchase machinery, and support general corporate purposes.

When is the SSF Plastics India IPO expected to open?

The IPO is anticipated to open in October 2025; exact dates are yet to be announced.

On which stock exchanges will SSF Plastics India be listed?

The company’s shares are proposed to be listed on both the NSE and BSE.

Who are the lead managers and registrar for the IPO?

IIFL Capital Services and Nuvama Wealth Management are lead managers; MUFG Intime India is the registrar.