- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Steel Infra Solutions Company IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Steel Infra Solutions Company IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Steel Infra Solutions Company Limited

Steel Infra Solutions Company Private Limited, incorporated in October 2017, is an integrated structural steel solutions provider offering design, engineering, fabrication, and erection for industrial and commercial structures, including plants, airports, metros, hospitals, warehouses, and data centres. By March 31, 2025, it completed 187 projects, delivering 261,735 MT of fabricated steel. With six units in Bhilai, Vadodara, and Hyderabad, capacity stands at 100,000 MT, set to rise by 15,000 MT in Vadodara by Fiscal 2027. Its 335 engineers, 1,068 suppliers, and offices nationwide strengthen customer relationships.

Steel Infra Solutions Company Limited IPO Overview

Steel Infra Solutions Co. Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 28, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Building Issue, comprising a fresh issue of ₹96.00 crores and an offer for sale (OFS) of up to 1.42 crore equity shares. The equity shares are proposed to be listed on NSE and BSE. Dam Capital Advisors Ltd. acts as the book running lead manager, while MUFG Intime India Pvt. Ltd. is the registrar. Key details such as IPO dates, price band, and lot size are awaited. Investors can refer to SISCOL IPO DRHP for further details.

Steel Infra Solutions Company Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹96 crore |

| Offer for Sale (OFS) | 1.42 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 40,60,39,420 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Steel Infra Solutions Company Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Steel Infra Solutions Company Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.12 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 16.25% |

| Net Asset Value (NAV) | ₹53.54 |

| Return on Equity (RoE) | 15.16% |

| Return on Capital Employed (RoCE) | 23.80% |

| EBITDA Margin | 10.42% |

| PAT Margin | 5.16% |

| Debt to Equity Ratio | 0.06 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements for Back-Side Expansion of manufacturing unit located in Vadodara | 296.99 |

| Funding capital expenditure requirements for Bay 4 Expansion of our manufacturing unit located in Vadodara | 97.04 |

| Funding capital expenditure requirements for our manufacturing units located in Hyderabad and Bhilai | 59.67 |

| Funding working capital requirements of the Company | 270 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

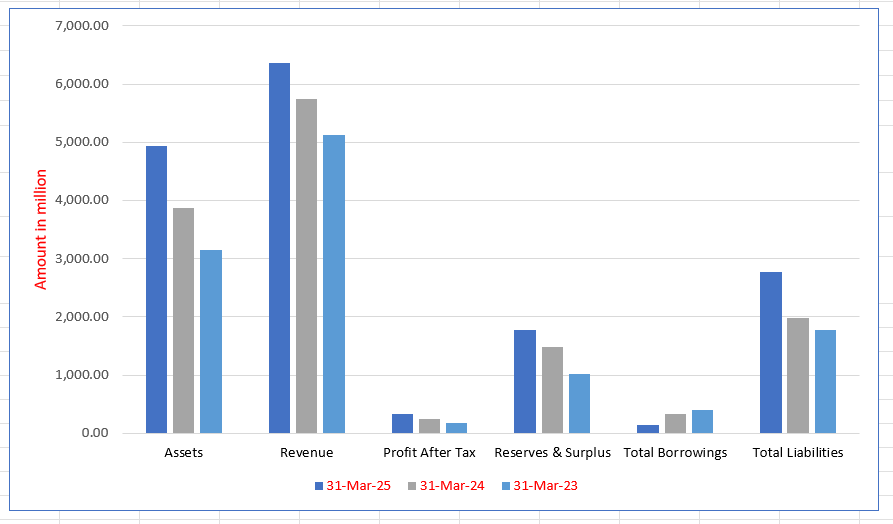

Steel Infra Solutions Company Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,942.96 | 3,868.27 | 3,154.98 |

| Revenue | 6,360.99 | 5,734.87 | 5,117.17 |

| Profit After Tax | 329.62 | 248.45 | 175.33 |

| Reserves & Surplus | 1,767.91 | 1,476.20 | 1,009.17 |

| Total Borrowings | 135.79 | 338.68 | 405.34 |

| Total Liabilities | 2,769.01 | 1,986.03 | 1,778.54 |

Financial Status of Steel Infra Solutions Company Limited

SWOT Analysis of Steel Infra Solutions Company IPO

Strength and Opportunities

- Comprehensive in-house capabilities across design, engineering, procurement, fabrication, erection and installation

- Multi-sector exposure spanning refineries, airports, bridges, metros, high-rises, hospitality

- Strong execution track record, with significant cumulative deliveries

- Extensive manufacturing presence across multiple facilities and planned capacity expansion

- Flexible manufacturing capacity across Bhilai, Vadodara, Hyderabad

- Large and diversified order book across infrastructure verticals

- Positioned as an infra-enabler for India’s mega projects

- Strong engineering workforce and supplier network across India

- Benefits from integrated management systems and multiple ISO certifications

Risks and Threats

- Tender-based business model exposes SISCOL to high cyclicality and tender award risk

- Intense competition from large established players and unorganised segment

- High reliance on key clients leading to customer concentration risk

- Profitability susceptible to raw material price volatility

- Working-capital-intensive operations with financial leverage concerns

- Margin pressure under fixed-price contracts if input costs rise

- Earnings and operations vulnerable to slowdown in infrastructure capex

- Fragmented steel fabrication industry heightens pricing and competition risk

- Exposure to regulatory compliance requirements and evolving safety standards

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Steel Infra Solutions Company Limited

Steel Infra Solutions Company Limited IPO Strengths

Strategic Manufacturing and Design Network

Steel Infra Solutions leverages a robust operating model supported by four engineering hubs and six strategically located manufacturing units. This infrastructure enables rapid scalability, export readiness, and close customer proximity. The company’s 71-strong in-house engineering team provides end-to-end design and customization expertise, ensuring timely delivery and efficient project execution for clients across key industrial regions.

Enduring Relationships with Marquee Clients

The company has cultivated long-term, trusted partnerships with large domestic and multinational EPC, PMC, and end-use customers. This is evidenced by a strong order book and repeat business from industry leaders. Their consultative approach and proven execution reliability have transformed single-project engagements into multi-project partnerships, validating their position as a strategic supplier.

Agile and Cost-Efficient Supply Chain

Steel Infra Solutions benefits from a vast, robust sourcing network of over 1,000 suppliers, allowing efficient procurement of specialized steel grades. Their active management of logistics and inventory contributes to lower working capital requirements. This agile supply chain, combined with modest net borrowings, ensures cost-efficient operations and supports a stable financial position.

Sustained Financial Health and Robust Growth

The company demonstrates a track record of strong financial performance with significant growth in revenue, EBITDA, and PAT. This organic growth is supported by high operational efficiency, productivity, and a low net debt-to-equity ratio. A substantial order book provides clear forward visibility and a solid foundation for continued future expansion and profitability.

Experienced Leadership and Management Team

The company is guided by promoters and a senior management team with deep, decades-long expertise in engineering, fabrication, finance, and infrastructure. Their collective industry knowledge enables effective strategic planning, anticipation of market trends, and superior operational execution. This experienced leadership is fundamental to driving the company’s sustained growth and market responsiveness

More About Steel Infra Solutions Company Limited

Steel Infra Solutions Company Limited (SISCOL) is an integrated structural steel solutions provider in India, specializing in design, engineering, fabrication, and erection for large-scale infrastructure projects. According to a CRISIL Report, SISCOL ranked among the top three Indian fabricators in Fiscal 2025 based on tonnage of structural steel delivered.

Capabilities and Offerings

The company provides a comprehensive suite of services covering:

- End-to-end design and engineering

- Procurement and manufacturing

- Fabrication, erection, and project management

Its solutions cater to a wide range of sectors including refineries, power plants, steel plants, airports, high-rise buildings, metro and railway structures, bridges, hospitals, hotels, warehouses, data centres, and sports infrastructure.

Track Record and Growth

Since its inception in Fiscal 2018, SISCOL has executed 187 structural steel projects, delivering over 261,000 metric tonnes of fabricated steel. Revenues from operations grew at a CAGR of 11.49% over three fiscal years, reaching ₹6,360.99 million in Fiscal 2025. Fabricated steel volumes grew at a CAGR of 19.32% during the same period.

Manufacturing Strength

- Six manufacturing units across Bhilai, Vadodara, and Hyderabad with a cumulative capacity of 100,000 MT per annum as of March 2025

- Planned capacity addition of 15,000 MT in Vadodara by Fiscal 2027

- In-house design team of 71 engineers and 335 technical professionals across offices in Bengaluru, Hyderabad, Chennai, and Bhilai

Market Position and Opportunities

According to CRISIL, India’s structural steel fabrication market is projected to grow at a CAGR of 11–12% between Fiscal 2025 and Fiscal 2030, driven by demand from high-rise buildings, metro rail, logistics, data centres, renewable energy, and defence. SISCOL is strategically positioned to leverage this demand through its integrated delivery model.

Customers and Projects

SISCOL has delivered marquee projects such as the Adani Power Plant in Raipur, Jewar International Airport in Noida, the International Hockey Stadium in Rourkela, and multiple metro structures in Chennai and Pune. Its customer base includes leading names such as Adani, Arcelor Mittal Nippon Steel, L&T, Tata Projects, Shapoorji Pallonji, and Technip Energies.

Leadership

The company is led by Chairman and Managing Director Mr. Ravikant Uppal, Whole-time Director and CFO Mr. Rajagopal Kannabiran, and Executive Director Mr. Y Swamy Reddy, supported by an experienced management team with decades of domain expertise.

Industry Outlook

India’s structural steel sector is on a robust growth trajectory, underpinned by rapid infrastructure expansion and urbanization.

Overall Industry Growth

- Structural steel fabrication market in India is valued at approximately USD 6.19 billion in 2025, expected to reach USD 9.80 billion by 2031, at a CAGR of 7.8%.

- Another estimate indicates India’s broader metal fabrication segment is set to grow from USD 1.49 billion in 2024 to USD 2.69 billion by 2035, at a CAGR of around 5.5%.

- The Indian steel market overall is projected to grow at a 6.2% CAGR from 2025 to 2033, targeting 256.7 million tons by 2033.

- Domestic steel demand is estimated to grow 9–10% in FY25, with long-term forecast placing demand growth around 5–7.3% per annum.

Growth Drivers

- Government initiatives—Make in India, smart cities, affordable housing, and green infrastructure—are fueling demand for structural steel and pre-engineered buildings (PEBs).

- Key demand sectors include metro rail systems, data centres, industrial complexes, logistics, power and renewable energy, and defence infrastructure.

- India’s steel production is set to scale from 180 to 300 million tons by 2030, driven by local steelmaking capacity expansion.

Product-Specific Trends

- Pre-engineered buildings and components are gaining traction due to faster construction cycles, cost efficiency, and sustainability advantages.

- Fabrication of heavy and light structural steel sections for construction, industrial, and infrastructure projects remains a key sub-segment

How Will Steel Infra Solutions Company Limited Benefit

- Rising infrastructure investments and urbanisation will boost demand for structural steel, directly creating growth opportunities for SISCOL’s fabrication and steel solutions.

- Expanding adoption of pre-engineered buildings will favour SISCOL’s expertise in manufacturing customised PEB components, enabling faster project execution.

- Government-backed initiatives like Smart Cities, affordable housing, and Make in India will open large-scale projects where SISCOL can supply both heavy and light structural steel sections.

- Growing sectors such as metro rail, logistics hubs, data centres, renewable energy, and defence infrastructure will require advanced fabrication, aligning with SISCOL’s core capabilities.

- Increasing steel production capacity across India ensures raw material availability, supporting SISCOL’s cost-efficient operations and scalability.

- Sustainability trends and preference for eco-friendly construction will strengthen demand for steel structures, positioning SISCOL as a partner for green infrastructure projects.

Peer Group Comparison

| Name of the Company | Total Revenue

(₹ in million) |

Face Value

(₹) |

P/E (Diluted Basis) | EPS (₹) | RoNW (%) | NAV (₹) |

| Steel Infra Solutions Company Limited | 6,393.50 | 10 | TBD | 8.12 | 15.16% | 53.54 |

| Peer Group | ||||||

| Atmaco Co Ltd | 2,902.78 | 10.00 | 28.38 | 7.80 | 15.15% | 51.45 |

| Everest Industries Limited | 17,374.70 | 10.00 | -240.79 | -2.28 | -0.78% | 291.47 |

| Pennar Industries | 32,632.70 | 5.00 | 28.27 | 8.84 | 11.95% | 74.08 |

| Interarch Building Products | 14,744.70 | 10.00 | 33.81 | 68.51 | 14.35% | 451.57 |

Key Strategies for Steel Infra Solutions Company Limited

Expansion and Capitalizing on Industry Tailwinds

Steel Infra Solutions Company Limited is expanding its facilities to capitalize on strong industry growth. The company plans to grow its presence in South and West Indian markets by leveraging its new Vadodara and Hyderabad facilities. Additional capacity is also being added to the Vadodara facility.

Improving Export Revenue

Steel Infra Solutions Company Limited is increasing its export revenue by leveraging existing international relationships with PMC companies. The company is focusing on global projects, particularly in the Middle East, Africa, and Southeast Asia, while also expanding its design and engineering services to international clients.

Diversifying into Value-Added Products

Steel Infra Solutions Company Limited is exploring a strategic expansion into value-added fabricated steel products. This includes targeting the defense, power, and logistics sectors by manufacturing defense technologies, large power transformer tanks, and shipping containers, which diversifies its business beyond its core offerings.

Focus on Cost Optimization and Operational Efficiency

Steel Infra Solutions Company Limited is dedicated to continuous cost optimization and improving operational efficiency. The company uses an integrated, in-house approach to manufacturing. It plans to adopt new technologies, such as automation and robotics, to enhance its production speed, quality, and cost-effectiveness.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Steel Infra Solutions Company Limited IPO

How can I apply for Steel Infra Solutions Company Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the IPO size of Steel Infra Solutions Company Limited?

The IPO size is ₹96.00 crores fresh issue and 1.42 crore equity shares under OFS.

When was the DRHP filed for Steel Infra Solutions IPO?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 28, 2025.

Where will Steel Infra Solutions IPO shares be listed?

The equity shares are proposed to be listed on both NSE and BSE mainboard platforms.

What is the primary purpose of Steel Infra Solutions IPO proceeds?

Funds will support capacity expansion, working capital needs, and general corporate purposes.

Who are the key intermediaries managing Steel Infra Solutions IPO?

DAM Capital Advisors Ltd. is the BRLM and MUFG Intime India Pvt. Ltd. is the registrar.