- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sterlite Electric IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sterlite Electric IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sterlite Electric Limited

Sterlite Electric Ltd. manufactures capital goods and provides system integration solutions for the power transmission and distribution (T&D) sector. The company operates in four segments: overhead conductors, power cables, optical ground wire (OPGW), and master system integration (MSI) services. Its products include various conductors and medium to extra-high voltage cables up to 220kV, along with fibre-integrated, high-ampacity cables. MSI services focus on grid upgrades. Between April 2022 and March 2025, Sterlite Electric supplied solutions to over 70 countries and operates manufacturing units in Odisha, Dadra and Nagar Haveli, and Uttarakhand.

Sterlite Electric Limited IPO Overview

Sterlite Electric Ltd. has submitted its Draft Red Herring Prospectus (DRHP) to SEBI on 29 September 2025, signalling its intent to raise funds through an Initial Public Offering (IPO). The IPO is structured as a Book Build Issue for a total of 1.56 crore equity shares, comprising a fresh issue of up to 0.78 crore shares and an Offer for Sale (OFS) of up to 0.78 crore shares. The company plans to list its shares on both the NSE and BSE. While the registrar for the issue has been appointed as MUFG Intime India Pvt. Ltd., the book running lead manager has not yet been declared. Key IPO details, including the dates, price band, and lot size, are yet to be announced.

The shares have a face value of ₹2 each, with the total issue size amounting to 1,55,89,174 shares. Of these, 77,93,371 shares will be issued as fresh capital, and 77,95,803 shares will be offered for sale. The IPO will follow the book-building route. Post-issue, the total shareholding is expected to increase from 12,57,49,724 to 14,10,66,858 shares. Promoters of Sterlite Electric Ltd. include Anil Agarwal and Twin Star Overseas Limited, who currently hold 62.69% of the company’s shares prior to the IPO. The DRHP outlines the company’s plan to raise capital while also providing an opportunity for existing shareholders to partially divest their holdings. For more detailed information, the Sterlite Electric IPO DRHP can be referred to.

Sterlite Electric Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.56 crore equity shares |

| Fresh Issue | 0.78 crore equity shares |

| Offer for Sale (OFS) | 0.78 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 12,57,49,724 shares |

| Shareholding post-issue | 14,10,66,858 shares |

Sterlite Electric IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sterlite Electric Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Sterlite Electric Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹12.70 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.35% |

| Net Asset Value (NAV) | ₹117.85 |

| Return on Equity (RoE) | 13.23% |

| Return on Capital Employed (RoCE) | 28.30% |

| EBITDA Margin | 10.87% |

| PAT Margin | 3.66% |

| Debt to Equity Ratio | 0.23 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/prepayment, in full or part, of all or certain outstanding borrowings availed by the Company | 3500 |

| Funding of capital expenditure requirements for expansion through purchase of plant, machineries and equipment by the Company | 2526 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

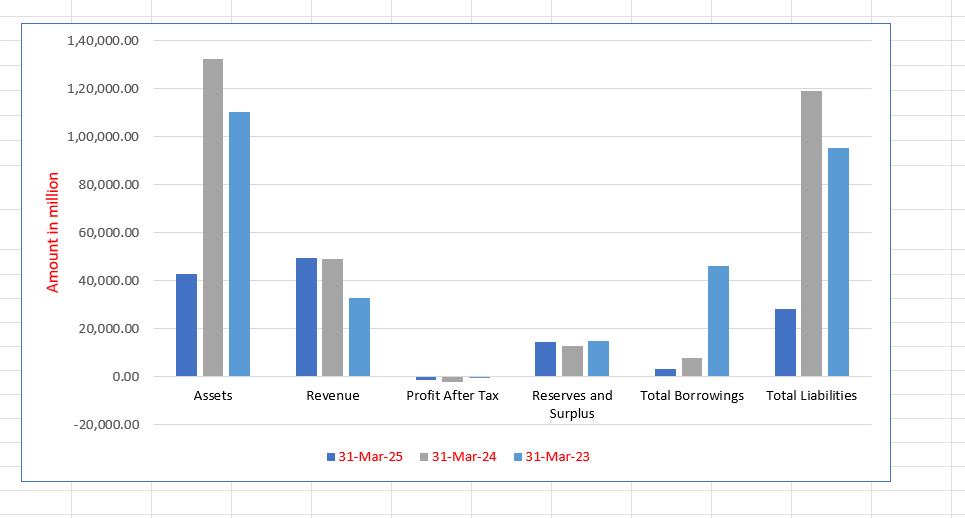

Sterlite Electric Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 42,591.02 | 132,298.70 | 110,362.76 |

| Revenue | 49,557.60 | 49,178.94 | 32,786.46 |

| Profit After Tax | (1,563.35) | (2,168.75) | (327.32) |

| Reserves and Surplus | 14,596.63 | 12,929.77 | 14,940.01 |

| Total Borrowings | 3,272.21 | 7,705.27 | 46,113.47 |

| Total Liabilities | 28,252.32 | 118,970.90 | 95,269.99 |

Financial Status of Sterlite Electric Limited

SWOT Analysis of Sterlite Electric IPO

Strength and Opportunities

- Strong presence in power T&D segment across conductors, cables and MSI services.

- Wide product portfolio including ACSR, composite core, ACCC, high voltage cables up to 220 kV.

- Global export footprint supplying to 70+ countries, enhancing diversification.

- Manufacturing bases in strategic locations (Odisha, Dadra & Nagar Haveli, Uttarakhand) enabling scale.

- Growing demand in India for grid modernisation and T&D upgrades offers major growth opportunity.

- Opportunity to benefit from India’s powerinfrastructure push (e.g., rural electrification, renewables interface).

- Ability to integrate system solutions (MSI) adds value beyond products and strengthens customer relationships.

- Technological advancements in conductor and cable materials open avenues for premium products.

- Exporting to diverse geographies (USA, Brazil, UAE etc) supports global growth potential.

Risks and Threats

- High dependence on large infrastructure orders which can be delayed.

- Capitalintensive manufacturing leads to fixed cost burden.

- Exposure to global market volatility and foreign exchange risk.

- Promptale regulatory and environmental compliance challenges across sites.

- Highly competitive market with price pressure from both domestic and international players.

- Rawmaterial cost inflation and supplychain disruptions could squeeze margins.

- Dependence on a few major customers/projects could lead to revenue concentration risk.

- Regulatory changes, policy shifts or delays in approvals may impact project timelines and profitability.

- Foreign trade barriers, geopolitical risks or shipping/logistics bottlenecks may hinder operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sterlite Electric Limited

Sterlite Electric Limited IPO Strengths

Broad Product Portfolio and Strong Order Book

Sterlite Electric Limited leverages an extensive product portfolio, including overhead conductors, power cables, OPGW, and MSI services, to offer solutions for power transmission and grid modernization projects. The company’s diverse, customized, and standard offerings address various voltage requirements, supported by a strong order book that reflects significant market demand and the firm’s robust business spread across key sectors.

Strategic Facilities and Value Chain Control

The company maintains a competitive edge through strategically located manufacturing facilities across India, which ensures supply-chain cost efficiency and rapid delivery times. This geographic advantage, coupled with end-to-end control over the value chain—from in-house design to finished goods—and continuous R&D and technological capabilities, significantly enhances product quality and operational efficiency.

Marquee Global and Domestic Customer Relationships

Sterlite Electric Limited has established long-standing relationships, often averaging over five years, with marquee global and domestic customers across multiple sectors, including utilities, infrastructure, and renewable energy. This stability is built on the firm’s commitment to quality, timely delivery, and a competitive value proposition, resulting in a diversified customer base with no single customer dependency exceeding 15.0% of revenue.

Positioning to Capitalize on Power Sector Growth

The company is well-positioned to capitalize on the substantial growth in the Indian and global power sectors, driven by rising energy demand, urbanization, and ambitious renewable energy targets. Its comprehensive product range in the expanding cables and conductors market, coupled with advanced manufacturing and R&D, allows it to effectively cater to the increasing demand for grid modernization and transmission infrastructure projects.

Strong Parentage and Power Sector Heritage

Benefiting from the strong parentage of the Vedanta Group, Sterlite Electric Limited draws on a rich power sector lineage and deep understanding of the Power T&D value chain. This heritage and extensive network provide a foundation for strategic alliances, enhanced credibility, and accumulated expertise, which is leveraged to drive innovation and excellence in specialized power products and transmission services.

Experienced Board and Qualified Management

The company is guided by an experienced Board of Directors and a qualified senior management team with diverse expertise in finance, operations, engineering, and technology. Their collective industry knowledge and proven leadership provide a strong basis for sustained growth, effective decision-making, and seizing market opportunities, ensuring the firm continues to innovate and meet customer demands efficiently.

More About Sterlite Electric Limited

Sterlite Electric Limited is a leading manufacturer of capital goods and provider of system integration solutions, specialising in the power transmission and distribution (Power T&D) industry. Serving both domestic and international markets, the company offers a wide range of overhead conductors, power cables, optical ground wire (OPGW), and master system integration (MSI) services. As part of the Vedanta Group, Sterlite Electric leverages its heritage to deliver comprehensive solutions across the Power T&D value chain, from generation to transmission and distribution.

The company’s lineage traces back to 2006 as the power conductor division of Sterlite Technologies Limited, with the grid business commencing in 2010. In 2016, the divisions were demerged to form Sterlite Power Transmission Limited (now Sterlite Electric Limited), focusing on power products and transmission-related manufacturing. By 2024, the infrastructure business was transferred to Sterlite Grid 5 Limited, allowing Sterlite Electric to concentrate on manufacturing overhead conductors, cables, and specialised EPC services with a long-term global vision.

Business Segments

Overhead Conductors and OPGW

Sterlite Electric manufactures a diverse range of conductors, including HPC, ACSR, STER-AL59 alloy, composite core, ACCC, ACSS, and GAP type conductors. The company held a 15% share of the Indian power conductors market in Fiscal 2025 and 25–28% in the high-ampacity and AL59 segment. Patented ACCC and GAP technologies enable solutions for challenging terrains and urban distribution corridors. The company also produces OPGW and accessories such as tension assemblies and vibration dampers. The closing order book for overhead conductors and OPGW was ₹53,890 million as of March 31, 2025.

Power Cables

Sterlite Electric manufactures medium, high, and extra-high voltage cables (66–220 kV), fibre-integrated cables, and high-ampacity cables. The company recently introduced LTDC solar cables and medium voltage covered conductors (MVCC), with plans to produce solar array cables. Integrated EPC solutions and advanced cable monitoring further strengthen the offering. The closing order book for power cables was ₹15,290 million.

MSI Services

The company provides grid uprate and upgrade solutions to enhance capacity, reliability, and efficiency of existing transmission lines. The closing order book for MSI services stood at ₹5,310 million.

Manufacturing and R&D

Sterlite Electric operates four strategically located manufacturing facilities in Jharsuguda, Piparia, Rakholi, and Haridwar, with annual installed capacities of 117,195 metric tonnes for conductors, 2,400 km for cables, and 21,000 km for OPGW. A strong R&D focus drives product innovation, including fibre-integrated and high-ampacity cables, ensuring efficiency, reliability, and compliance with industry standards.

Global Reach and Market Position

The company has served customers in over 70 countries, generating international revenue of ₹10,007 million, ₹16,576 million, and ₹11,800 million in Fiscals 2025, 2024, and 2023, respectively. Consistent revenue growth with a CAGR of 22.94% from Fiscal 2023 to 2025 highlights Sterlite Electric’s strong market position, technological expertise, and commitment to quality.

Industry Outlook

The Indian power transmission and distribution (T&D) equipment market is experiencing steady growth. The market reached approximately USD 11.58 billion in 2024 and is projected to grow to USD 21.83 billion by 2033, representing a CAGR of ~6.8% over 202533. Meanwhile, the broader T&D market (equipment, lines, cables) is forecast to grow at a CAGR of ~5.2% from 2025 to 2030, rising from about USD 27.77 billion in 2024 to USD 37.61 billion by 2030.

Within this, the wires and cables segment in India is showing even stronger momentum. One estimate puts the Indian wires & cables market at around USD 21.22 billion in 2025 and forecasts it to reach USD 32.85 billion by 2030, implying a CAGR of approximately 9.1%. The Indian insulated metallic wires and cables demand is expected to grow at around 6.4% CAGR between 202328.

For overhead conductors, the Indian market is estimated to grow at around 9.4% CAGR, driven by electrification and grid expansion.

Key Growth Drivers

- Strong push for renewable energy capacity (solar and wind) mandates expansion of transmission, evacuation and highvoltage infrastructure.

- Government initiatives such as grid modernisation, “One Nation, One Grid”, green energy corridors, rural electrification and smart grid rollout create demand for advanced conductors, cables and system integration.

- Increasing urbanisation, electrification of remote areas and requirement for high performance cables (EHV/HV) and conductors (ACCC, composite core) to reduce losses and enhance capacity.

- Export opportunities as India moves to be a global supplier of wires, cables and conductors, with rising export value.

SegmentSpecific Outlook

- Wires & Cables: Forecast to grow at ~9% CAGR from 2025 to 2030, reaching over USD 30 billion. Demand is driven by HV/EHV cables, solar/renewables evacuation cables, and urban underground network upgrades.

- Overhead Conductors/OPGW: With a CAGR near 9.4% in India, demand is driven by longdistance highvoltage transmission, challenging terrains (river crossings, urban corridors), and emerging technologies (composite core, ACCC).

- T&D Equipment / System Integration (MSI): The overall T&D equipment market growth around ~6%7% provides a favourable backdrop for integrators and grid upgrade players.

How Will Sterlite Electric Limited Benefit

- Sterlite Electric Limited is well-positioned to capitalise on India’s growing demand for power transmission and distribution infrastructure, benefiting from strong industry expansion.

- The company’s wide portfolio of overhead conductors, OPGW, and EHV/HV cables aligns with market growth in renewable energy evacuation and high-capacity transmission projects.

- Its patented ACCC and GAP conductor technologies give a competitive edge for challenging terrains and urban distribution corridors.

- Expansion of smart grids and government initiatives such as “One Nation, One Grid” provide opportunities for Sterlite’s master system integration (MSI) services.

- Rising exports of wires, cables, and conductors enable Sterlite Electric to enhance its global footprint and revenue diversification.

- Technological advancements and R&D capabilities support the development of high-performance products that meet evolving grid and renewable energy requirements.

- Strategic manufacturing locations ensure efficient supply chain and timely delivery to key domestic and international markets.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Total Revenue (₹ million) | P/E | EPS Basic | EPS Diluted | RoNW (%) | NAV (₹ per share) |

| Sterlite Electric Limited | 2.00 | 49,557.60 | N.A. | 12.70 | 12.62 | 12.35 | 117.85 |

| Peer Group | |||||||

| Apar Industries Limited | 10.00 | 185,812.10 | 37.81 | 204.47 | 204.47 | 18.24 | 1,121.17 |

| KEI Industries Limited | 2.00 | 97,358.77 | 50.34 | 75.65 | 75.55 | 12.04 | 605.50 |

| Universal Cables Limited | 10.00 | 24,083.86 | 27.56 | 25.76 | 25.76 | 5.04 | 510.73 |

Key Strategies for Sterlite Electric Limited

Expand International Market Presence

Sterlite Electric Limited plans to deepen and broaden its global footprint by introducing new products, securing new customers, and penetrating new geographies, focusing on the USA and Europe for overhead conductors and the EU, Middle East, and Africa for power cables. This strategy aims to diversify revenue, leverage higher international margins, and mitigate regional economic risks.

Diversify into Allied Power Sectors

The company intends to expand its portfolio into allied sectors by leveraging existing manufacturing and R&D capabilities. This includes adding copper-alloy conductors for railway applications and diversifying power cables into wind, EV, locomotive, and marine segments. They also plan to target data centers and process industries with new intelligent cable offerings.

Focus on Premium Product Diversification

The firm will utilize its R&D and manufacturing expertise to introduce value-added, premium offerings, building on its successful transition to high-performance conductors like ACCC and GAP technology. This strategy, which includes developing Extra High Voltage (EHV) cables and intelligent cables with sensors, is designed to strengthen its competitive edge and improve profit margins.

Increase Capacity and Optimize Efficiency

Sterlite Electric Limited is increasing its manufacturing capabilities by setting up a new power cable facility in Vadodara to manufacture up to 550 kV HVDC/AC cables and expanding existing conductor capacity. The company will also focus on cost leadership through optimized sourcing, increased capacity utilization, and end-to-end digitalization to maximize operational efficiency.

Pursue Inorganic Growth Opportunities

The company plans to selectively pursue strategic joint ventures and acquisitions to accelerate growth, expand end-market opportunities, enter new geographic regions, and enhance technological capabilities. They are exploring opportunities in the line vertical (conductors/cables) and equipment vertical (substations), applying a disciplined approach to target companies based on growth potential and cultural fit.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sterlite Electric Limited IPO

How can I apply for Sterlite Electric Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When did Sterlite Electric file its IPO DRHP?

Sterlite Electric Ltd. filed its Draft Red Herring Prospectus with SEBI on September 29, 2025.

What is the size and type of the IPO?

The IPO is a Book Building Issue of 1.56 crore shares, including fresh issue and offer for sale equally.

Where will Sterlite Electric shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE stock exchanges.

What is the purpose of the IPO proceeds?

Proceeds will be used for debt repayment, capital expenditure for expansion, and general corporate purposes.

How are the shares reserved for investors?

QIBs will get at least 75%, retail investors up to 10%, and non-institutional investors up to 15% of the net offer.