- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Difference Between Stock SIP and Mutual Fund SIP: Benefits & Limitations of Stock vs Mutual Fund SIP

By HDFC SKY | Updated at: Jul 28, 2025 11:14 AM IST

Summary

Stock SIP vs Mutual Fund SIP Comparison – Key Differences & Investment Insights

- Investment Mechanism:

- Stock SIP: Direct investment in individual company shares at regular intervals.

- Mutual Fund SIP: Investment in a diversified portfolio managed by professionals.

- Control & Customization:

- Stock SIPs allow investors full control over stock selection and allocation.

- Mutual Fund SIPs offer limited control but provide diversification and fund manager expertise.

- Risk Factor:

- Stock SIPs carry higher risk due to exposure to specific stocks.

- Mutual Fund SIPs mitigate risk through asset diversification.

- Returns Potential:

- Stock SIPs may deliver higher returns if stocks perform well but with greater volatility.

- Mutual Fund SIPs offer more stable returns aligned with market trends and fund category.

- Costs & Fees:

- Stock SIPs may incur brokerage charges.

- Mutual Fund SIPs may involve expense ratios and exit loads.

- Investor Suitability:

- Stock SIPs suit experienced investors comfortable with equity markets.

- Mutual Fund SIPs are ideal for beginners and those seeking managed exposure.

Stock SIP and Mutual Fund SIP are two of the most popular ways to invest. However, while being similar in some respects, there are some differences between both which the investors need to understand.

Let us understand the difference between Stock SIP and Mutual Fund SIP in detail.

What is Stock SIP?

A Stock SIP (Systematic Investment Plan) involves investing a fixed amount regularly in specific stocks. This approach enables investors to gradually build a portfolio of individual stocks while averaging the purchase price over time.

For example, if you invest ₹5,000 monthly in Stock X, you buy more shares when the price is low and fewer when it’s high, benefiting from rupee cost averaging.

Key Features of SIP in share market:

- Direct ownership of individual stocks.

- Flexibility to choose and modify the portfolio.

- Higher potential returns are tied to stock performance.

- Requires market knowledge and active monitoring.

To understand how periodic investments can help manage this, use the SIP Calculator.

What is a Mutual Fund SIP?

If you are wondering – “what is sip in Mutual Fund.” Well, a Mutual Fund SIP allows you to invest a fixed amount regularly into a mutual fund scheme. This approach pools your money with other investors to create a diversified portfolio managed by professional fund managers.

When you invest in a mutual fund SIP, professional fund managers invest your money across different companies, industries, or asset classes to optimize returns.

Mutual funds themselves involve professional management, where experts make investment decisions for you.

For instance, investing ₹5,000 monthly in a diversified equity mutual fund spreads your investment across multiple companies, industries, or asset classes. Use the Mutual Funds Return Calculator to assess potential returns on such investments.

Key Features of Mutual Fund SIP:

- Diversified investment across securities.

- Managed by professional fund managers.

- Ideal for investors with limited market knowledge.

- Reduces the impact of individual stock performance.

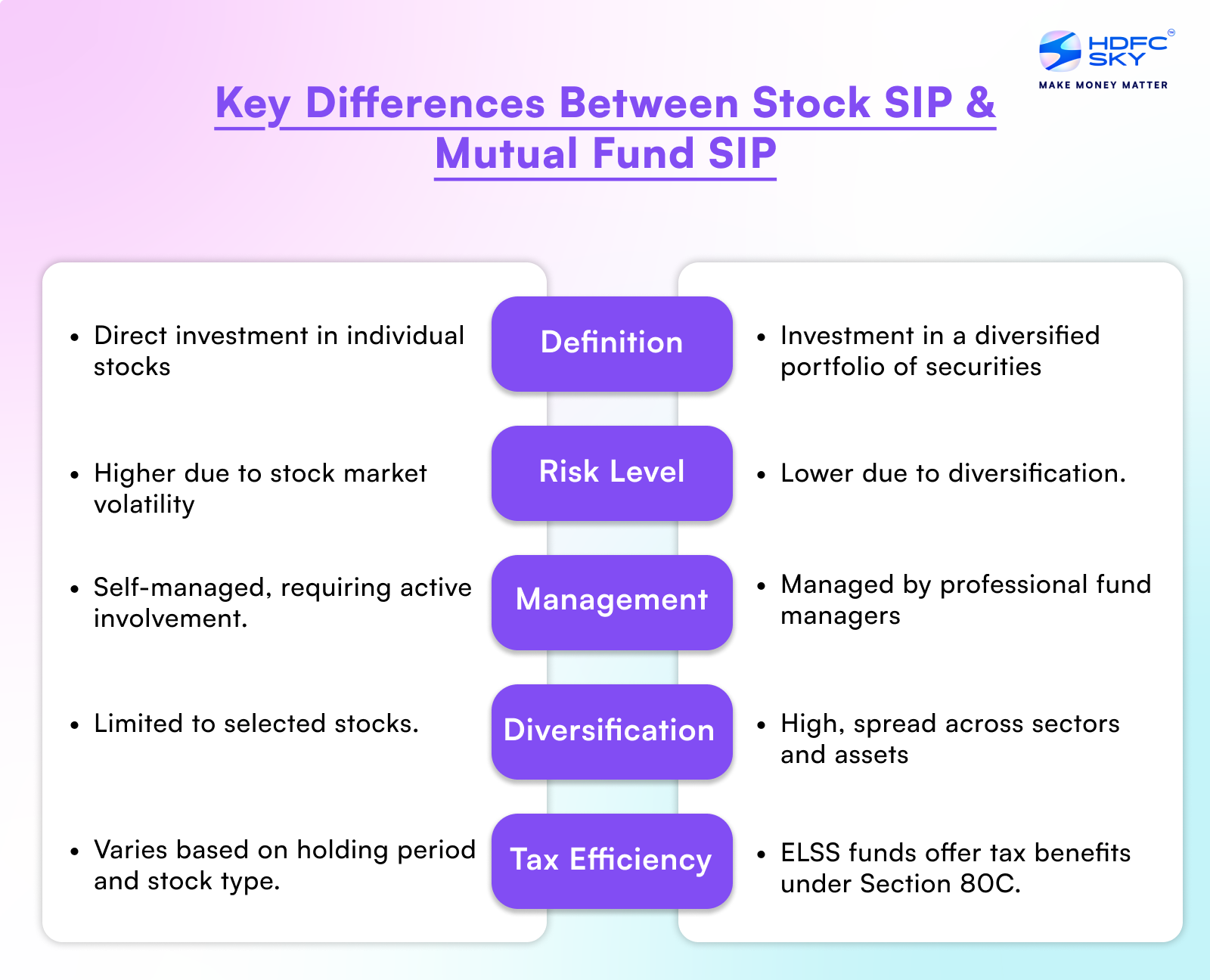

Key Differences Between Stock SIP and Mutual Fund SIP

| SIP in stock vs SIP in mutual fund | ||

| Feature | Stock SIP | Mutual Fund SIP |

| Definition | Direct investment in individual stocks. | Investment in a diversified portfolio of securities. |

| Risk Level | Higher due to stock volatility. | Lower due to diversification. |

| Management | Self-managed; requires active involvement. | Professionally managed by fund managers. |

| Diversification | Limited to selected stocks. | High; spread across various sectors and assets. |

| Tax Efficiency | Depends on the holding period and stock type. | ELSS funds offer tax benefits under Section 80C. |

| Suitability | Best for experienced investors with high-risk tolerance. | Suitable for new and experienced investors alike. |

Factors to Consider Before Choosing Stock SIP

Before starting a stock SIP, consider these factors, just like you would before starting a new business:

- Risk Tolerance: Stock SIPs involve higher risk as prices are subject to market volatility and company performance. Decide if you can handle short-term fluctuations and potential losses before investing.

- Research Requirements: Choosing stocks requires in-depth knowledge of financial statements, market trends, and industry dynamics. Lack of expertise may lead to poor investment decisions.

- Active Monitoring: Stock SIPs demand regular tracking of market movements, news updates, and stock-specific developments. This level of involvement can be time-consuming.

- Long-Term Focus: Investing in Stock SIPs is more suited for long-term goals where you can withstand short-term volatility and benefit from compounding over time.

Benefits of Mutual Fund SIPs

Imagine joining a savings group (chit fund) managed by financial experts:

- Professional Management: Experts handle your investments, making it ideal for those without the time or knowledge to research individual stocks.

- Diversification: Spreads risk across multiple securities, reducing the impact of a poor-performing stock.

- Convenience: Automated investments make SIPs hassle-free.

- Rupee Cost Averaging: Regular investments help mitigate market volatility by buying more units when prices are low and fewer when they are high.

Limitations of Stock SIP & Mutual Fund SIP

Stock SIP Limitations:

- Like putting all eggs in one basket: Investing in one stock means higher risk. If the company performs poorly, you could lose a significant portion of your money.

- Requires constant market monitoring: You constantly need to monitor your stock SIP. Prices can fluctuate, requiring adjustments based on market conditions.

- Higher risk of loss if the chosen company performs poorly: If a company’s stock crashes due to poor performance or a scandal, you could lose a significant portion of your investment.

Mutual Fund SIP Limitations:

- Lower control over investments: Investing in mutual funds is like being part of a joint family decision, where you have limited influence over the choices made.

- Management fees eat into returns: Paying management fees reduces the overall returns you earn.

- Returns might be moderate: Mutual funds tend to offer moderate returns, like choosing a safe route, while direct stock investments can yield higher, but riskier, rewards.

Conclusion

Stock SIP offers more control and potentially higher returns but requires more knowledge and time. Mutual Fund SIP provides professional management and diversification but with moderate returns and less control. You can plan your investments more effectively using the HDFC SIP Calculator.

For beginners or those with limited time, starting with a mutual fund SIP might be wiser. As you gain knowledge and confidence, you could consider adding stock SIPs to your portfolio, creating a balanced investment approach that suits your goals and comfort level.

Related Articles

FAQs on Stock SIP vs Mutual Fund SIP

What are the key benefits of investing in a Stock SIP?

Stock SIPs allow for disciplined investment in individual stocks, offering the potential for higher returns through direct equity ownership. Cost averaging helps mitigate market volatility, and investors enjoy flexibility in choosing and modifying their portfolios.

What are the disadvantages of a Stock SIP?

Stock SIPs involve higher risk due to stock volatility and require constant monitoring. Investors must have a deep understanding of financial markets to make informed decisions, making it less suitable for beginners.

Which SIP is better for long-term wealth creation: Stock SIP or Mutual Fund SIP?

Mutual Fund SIPs are generally better for risk-averse investors due to diversification and professional management. However, Stock SIPs can deliver higher returns for experienced investors.

What are the advantages of a Mutual Fund SIP over a Stock SIP?

Mutual Fund SIPs offer diversification, professional management, and ease of investment. They are less risky and more suitable for beginners or those seeking a hands-off approach.

How do Stock SIPs and Mutual Fund SIPs differ in terms of returns?

Stock SIPs have the potential for higher returns but carry greater risk due to market volatility. Mutual Fund SIPs provide moderate and steady returns, reducing risk through diversification.

What are the costs and fees associated with Stock SIPs and Mutual Fund SIPs?

Stock SIPs involve transaction fees and STT, while Mutual Fund SIPs charge management fees and expense ratios. These costs can impact your overall returns.

How do I decide between a Stock SIP and a Mutual Fund SIP for my portfolio?

Consider your risk appetite, financial goals, and market knowledge. Choose a Stock SIP if you prefer direct equity investment and are comfortable with higher risk. Opt for a Mutual Fund SIP for diversification and professional management.

How to Start Stock SIP in Stocks?

To start a Stock SIP, open a brokerage account, select a stock, choose the SIP amount and frequency, and set up the SIP through your broker’s platform.