- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Studds Accessories IPO

₹13,925/25 shares

Minimum Investment

IPO Details

30 Oct 25

03 Nov 25

₹13,925

25

₹557 to ₹585

NSE, BSE

₹455.49 Cr

07 Nov 25

Studds Accessories IPO Timeline

Bidding Start

30 Oct 25

Bidding Ends

03 Nov 25

Allotment Finalisation

04 Nov 25

Refund Initiation

06 Nov 25

Demat Transfer

06 Nov 25

Listing

07 Nov 25

Studds Accessories Limited

Studds began its journey in 1983, starting from a humble garage setup where its first helmet was manufactured. Over the decades, the company has grown into a global brand with advanced facilities capable of producing 9.04 million helmets annually. Through continuous innovation and dedication to rider safety, Studds has earned widespread customer trust. It became India’s leading helmet brand by revenue in Fiscal 2023 and the world’s largest by volume in Fiscal 2024. Today, Studds exports to over 70 countries, known for its safety, quality, and unwavering customer commitment

Studds Accessories Limited IPO Overview

Studds Accessories Ltd. IPO is a book-built issue worth ₹455.49 crores. The entire issue is an offer for sale (OFS) comprising 0.78 crore equity shares, aggregating to ₹455.49 crores. The IPO will open for subscription on October 30, 2025, and close on November 3, 2025. The basis of allotment is expected to be finalised on November 4, 2025, while refunds and credit of shares to demat accounts will take place on November 6, 2025. The shares are expected to be listed on both the BSE and NSE with a tentative listing date of November 7, 2025.

The price band for the issue is set between ₹557 and ₹585 per share, and the lot size is 25 shares per application. A retail investor can apply for a minimum of one lot (25 shares) with an investment of ₹14,625 at the upper price band. For small non-institutional investors (sNII), the minimum application size is 14 lots (350 shares) worth ₹2,04,750, while big non-institutional investors (bNII) must apply for at least 69 lots (1,725 shares), amounting to ₹10,09,125.IIFL Capital Services Ltd. is the book-running lead manager for the issue, and MUFG Intime India Pvt. Ltd. will act as the registrar.

Studds Accessories Limited Upcoming IPO Details

| Particulars | Details |

| IPO Date | October 30, 2025 to November 3, 2025 |

| Listing Date | November 7, 2025 (Tentative) |

| Face Value | ₹5 per share |

| Issue Price Band | ₹557 to ₹585 per share |

| Lot Size | 25 Shares |

| Sale Type | Offer For Sale |

| Total Issue Size | 77,86,120 shares (aggregating up to ₹455.49 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Shareholding Pre-Issue | 3,93,53,400 shares |

| Shareholding Post-Issue | 3,93,53,400 shares |

Studds Accessories IPO Important Dates

| Event | Date |

| IPO Open Date | Thu, Oct 30, 2025 |

| IPO Close Date | Mon, Nov 3, 2025 |

| Tentative Allotment | Tue, Nov 4, 2025 |

| Initiation of Refunds | Thu, Nov 6, 2025 |

| Credit of Shares to Demat | Thu, Nov 6, 2025 |

| Tentative Listing Date | Fri, Nov 7, 2025 |

Studds Accessories IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 25 | ₹14,625 |

| Retail (Max) | 13 | 325 | ₹1,90,125 |

| S-HNI (Min) | 14 | 350 | ₹2,04,750 |

| S-HNI (Max) | 68 | 1,700 | ₹9,94,500 |

| B-HNI (Min) | 69 | 1,725 | ₹10,09,125 |

Studds Accessories Limited IPO Reservation

| Investor Category | Shares Offered |

| Retail Shares Offered | 50% of the Net Issue |

| NII (HNI) Shares Offered | 50% of the Net Issue |

Studds Accessories Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 14.54 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 14.77% |

| Net Asset Value (NAV) | 98.44 |

| Return on Equity | 14.77% |

| Return on Capital Employed (ROCE) | 18.98% |

| EBITDA Margin | 17.05% |

| PAT Margin | 10.82% |

| Debt to Equity Ratio | (0.07) |

Objectives of the IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

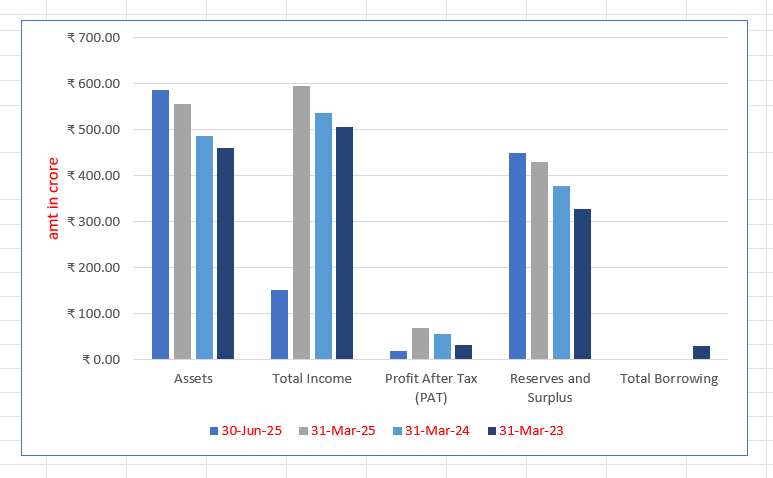

Studds Accessories Limited Financials (in crore)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | ₹586.61 | ₹556.71 | ₹485.56 | ₹461.07 |

| Total Income | ₹152.01 | ₹595.89 | ₹535.84 | ₹506.48 |

| Profit After Tax (PAT) | ₹20.25 | ₹69.64 | ₹57.23 | ₹33.15 |

| Reserves and Surplus | ₹450.09 | ₹429.80 | ₹377.57 | ₹328.18 |

| Total Borrowing | ₹2.91 | ₹2.91 | ₹0.61 | ₹30.58 |

Financial Status of Studds Accessories Limited

SWOT Analysis of Studds Accessories IPO

Strength and Opportunities

- Global leader in helmet manufacturing with a 25.66% market share in India.

- Exports to over 70 countries, enhancing international presence.

- Diverse product portfolio including helmets, jackets, gloves, and more.

- Strong OEM partnerships with brands like Honda and Yamaha.

- Continuous innovation with 16 new product launches in the last 3 years.

- Robust dealer network with over 385 dealers and 7 exclusive brand outlets.

- Strong financial growth with increasing revenue and profitability.

- Largest manufacturing capacity in the domestic organized segment.

- Plans to expand product offerings to include more riding gear and accessories.

Risks and Threats

- Dependence on two-wheeler sales; any downturn affects demand.

- All manufacturing facilities located in Faridabad, posing geographic risk.

- Intense competition from both domestic and international brands.

- Fluctuating raw material costs impacting profit margins.

- Limited market penetration in rural areas due to road safety awareness.

- Potential delays in IPO listing affecting capital expansion plans.

- Regulatory changes in safety standards requiring continuous adaptation.

- Economic slowdowns can adversely affect discretionary spending on accessories.

- Dependence on specific suppliers for key components may pose supply chain risks.

Live Studds Accessories IPO News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Studds Accessories Limited

Studds Accessories Limited IPO Strengths

- Largest Domestic Player of Two-Wheeler Helmets

Studds Accessories Limited is India’s largest two-wheeler helmet manufacturer by revenue in FY23 and the global leader by volume in 2024. With nearly five decades of experience, a 9.04 million unit capacity, and strong brands like Studds and SMK, the company blends innovation, safety, and aspirational design.

- Wide Design and Product Catalogue Across Price Points Catering to Diverse Consumer Requirements

Studds Accessories Limited offers a comprehensive range of over 240 helmet designs and 15,060 SKUs across segments, fulfilling both mass commuter and premium customer needs. Its brands, Studds and SMK, are strategically positioned with diverse pricing and features, ensuring relevance across markets, styles, and performance expectations.

- Advanced Manufacturing and D&D Capabilities with Vertically Integrated Operations

Studds Accessories Limited operates a fully vertically integrated model, controlling the entire product journey from design to sales. With four advanced ISO-certified manufacturing facilities and a strong D&D team, the company leverages automation, in-house moulding, and smart technologies to ensure superior quality, faster time-to-market, and enhanced cost-efficiency.

- Strong Pan-India and Global Presence Backed by Robust Distribution and Quality Certifications

Studds Accessories Limited has built a vast and efficient distribution network spanning 348 active distributors across India and operations in over 70 countries. Its strong sales channels—comprising distributors, OEMs, EBOs, e-commerce, and government institutions—are supported by global quality certifications and trusted customer relationships across diverse markets.

- Capital-Efficient and Sustainable Business Model

The company operates a scalable, capital-efficient model leveraging strong brand recall, integrated operations, and an extensive distribution network. This approach minimises advertising costs, reduces expenses, and enables efficient expansion. Backed by effective working capital management, the business has achieved consistent revenue and profit growth from 2022 to 2024.

More About Studds Accessories Limited

Studds Accessories Limited stands as the largest two-wheeler helmet player in India by revenue for Fiscal 2023 and the world’s largest by volume in Calendar Year 2024 (Source: CARE Report). With nearly five decades of manufacturing experience, the company has establisheda strong reputation in the helmet industry.

Manufacturing Capacity and Sales

The company operates multiple manufacturing facilities in Faridabad, India, with a combined annualized capacity of 9.04 million units. In Fiscal 2024, Studds sold approximately 7.10 million helmets.

Brand Portfolio and Global Presence

- Studds Brand: Founded in 1975, this brand targets the mass and mid-market segments within India, offering helmets priced between ₹895 to ₹3,895. In Fiscal 2024, Studds helmets accounted for 6.87 million units sold globally.

- SMK Brand: Launched in 2016, SMK caters to the premium motorcycle segment in India and certain international markets. These helmets, priced between ₹3,000 to ₹12,800, focus on comfort with multiple shell sizes and sold 0.16 million units globally in Fiscal 2024.

- White Label Production: The company manufactures helmets for brands such as Daytona and O’Neal, serving markets in the United States, Europe, and Australia.

Studds and SMK helmets are marketed across more than 70 countries, with key export regions including the Americas, Asia (excluding India), Europe, and others.

Commitment to Safety and Innovation

Safety is at the core of Studds’ product philosophy, with products complying with certifications such as ISO 9001:2015, ISO 14001:2015, IS 4151:2015 (BIS), and ECE 22.06. The company’s design team of 75 employees focuses on integrating advanced safety features, comfort, and technology such as Bluetooth and helmet wear detection systems.

Distribution and Partnerships

Studds maintains a robust distributor network of 348 active distributors in India and collaborations with prominent motorcycle OEMs like Honda, Hero MotoCorp, Suzuki, Royal Enfield, and Yamaha. Products are available through exclusive brand outlets, e-commerce, quick-commerce platforms, and their official website.

Leadership

The company benefits from the leadership of Chairman and Managing Director Madhu Bhushan Khurana, with nearly 40 years of industry experience, and Managing Director Sidhartha Bhushan Khurana, who has been instrumental in strategic and operational growth since 1998.

Industry Outlook

Two-Wheeler Helmet Market: Robust Growth Ahead

- Market Size & Growth: Valued at USD 2.12 billion in 2024, the Indian two-wheeler helmet market is projected to reach USD 3.08 billion by 2030, growing at a CAGR of 6.48%.

- Segment Insights:

- Full-face helmets: Dominated revenue in 2024.

- Open-face helmets: Expected to register the fastest growth during the forecast period.

- Growth Drivers:

- Government regulations mandating helmet use.

- Increasing road safety awareness.

- Rising two-wheeler sales in urban and rural areas.

Two-Wheeler Accessories Market: Expanding Horizons

- Market Size & Growth: The Indian two-wheeler accessories market reached USD 380 million in 2024 and is expected to grow at a CAGR of 3.4% to reach USD 500 million by 2033

- Key Trends:

- Growing demand for performance parts and premium safety gear.

- Increasing consumer interest in customization and aesthetic enhancements.

Strategic Outlook

The convergence of regulatory support, consumer awareness, and technological advancements positions the Indian two-wheeler helmet and accessories industry for sustained growth. Companies focusing on innovation, quality, and compliance are well-placed to capitalize on emerging opportunities in this dynamic market.

How Will Studds Accessories Limited Benefit

- Studds Accessories Limited is poised to benefit significantly from the growing helmet and accessories market in India.

- As the largest two-wheeler helmet player by revenue and global volume leader, it is well-positioned to capture expanding demand.

- Its manufacturing capacity of 9.04 million units and 7.10 million helmets sold in FY24 ensures readiness for increased consumption.

- With strong brand portfolios—Studds for mass and mid-market, SMK for premium—Studds addresses varied consumer segments.

- Its global footprint in over 70 countries supports revenue diversification and export growth.

- Advanced in-house design and safety certifications align with rising safety awareness and regulatory compliance.

- Integration of technology like Bluetooth and helmet detection enhances product appeal.

- Its partnerships with major OEMs like Hero, Honda, and Royal Enfield strengthen its distribution ecosystem.

- Widespread availability through exclusive outlets, online, and quick-commerce platforms boosts reach.

- Veteran leadership and nearly five decades of experience position the company to capitalise on future growth trends.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Studds Accessories Limited

- Expand and Strengthen Production Capacity with Vertical Integration

Studds Accessories Limited leverages nearly five decades of expertise and advanced automated facilities to scale production capacity. With multiple manufacturing units, including a new facility under construction, they integrate cutting-edge robotics and IoT for efficiency, ensuring high-quality helmets at competitive costs to meet growing global demand.

- Strategic Expansion into New Markets and Geographies

The company plans to grow its global footprint by strengthening presence in North America, South America, and ASEAN regions. Through acquisitions like Bikerz US Inc. and a planned European subsidiary with direct distribution and warehousing, Studds aims to enhance market reach and streamline international operations.

- Enhance Premium Helmet Offerings under Studds and SMK Brands

Studds aims to broaden its premium helmet portfolio by expanding the SMK brand internationally and launching premium products under the Studds brand at competitive price points. This strategy targets rising demand fueled by premium motorcycle sales and growing consumer income, increasing market share globally.

- Diversify Product Portfolio with Niche and Lifestyle Offerings

The company intends to expand beyond helmets by developing niche products such as bicycle helmets, luggage, and apparel. Studds plans to enter aspirational product segments targeting niche consumers, leveraging its manufacturing capabilities to increase product diversity and improve margins through lifestyle-oriented offerings.

- Strengthen Domestic Online Sales and Digital Infrastructure

Studds focuses on growing its online presence by expanding sales via e-commerce platforms and its website. The company invests in digital infrastructure to integrate online and offline channels seamlessly, aiming to enhance customer experience and consider launching a dedicated mobile app for improved shopping engagement.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Studds Accessories Limited IPO

How can I apply for Studds Accessories Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the structure of the Studds Accessories IPO?

The IPO is entirely an Offer for Sale (OFS) of up to 77.9 lakh equity shares.

Will Studds Accessories receive any proceeds from the IPO?

No, as it’s a complete OFS, proceeds will go to the selling shareholders, not the company.

Who are the lead managers for the Studds Accessories IPO?

IIFL Capital Services and ICICI Securities are the lead managers for the IPO.

On which stock exchanges will the shares be listed?

The shares are proposed to be listed on both BSE and NSE.

When is the expected listing date for the IPO?

The listing is anticipatedto list on 7 November 2025, subject to regulatory approvals