- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sudeep Pharma IPO

₹14,075/25 shares

Minimum Investment

IPO Details

21 Nov 25

25 Nov 25

₹14,075

25

₹563 to ₹593

NSE, BSE

₹895 Cr

28 Nov 25

Sudeep Pharma IPO Timeline

Bidding Start

21 Nov 25

Bidding Ends

25 Nov 25

Allotment Finalisation

26 Nov 25

Refund Initiation

27 Nov 25

Demat Transfer

27 Nov 25

Listing

28 Nov 25

Sudeep Pharma IPO

Founded in 1989, Sudeep Pharma Limited manufactures pharmaceutical excipients, food-grade minerals, and specialty nutrition ingredients, catering to over 100 countries. It operates six manufacturing units with a total production capacity of 50,000 MT, producing minerals like calcium, magnesium, zinc, potassium, sodium, and iron. The company offers over 200 products to clients across the pharmaceutical, food, and nutrition industries. Backed by strong R&D with in-house labs and pilot-scale facilities, Sudeep Pharma’s product portfolio includes Pharmaceutical, Food and Nutrition Business, Specialty Ingredients Business, and Triturates.

Sudeep Pharma Limited IPO Overview

Sudeep Pharma is launching an IPO through a book-building process, aiming to raise ₹895.00 crores. The issue comprises a fresh issue of 0.16 crore shares worth ₹95.00 crores and an offer for sale of 1.35 crore shares aggregating ₹800.00 crores. The IPO opens for subscription on November 21, 2025, and closes on November 25, 2025, with the allotment expected to be finalized on November 26, 2025. Sudeep Pharma shares are set to list on both BSE and NSE, with a tentative listing date of November 28, 2025.

The price band is fixed between ₹563.00 and ₹593.00 per share, and the minimum application lot size is 25 shares, requiring a retail investment of ₹14,825 at the upper price. For non-institutional investors (NII), the minimum lot is 14 lots (350 shares) amounting to ₹2,07,550, while for high-value investors (HNI), the minimum is 68 lots (1,700 shares), amounting to ₹10,08,100. ICICI Securities Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar of the issue.

Sudeep Pharma Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹95 crore

Offer for Sale (OFS): 1.01 crore shares |

| IPO Dates | November 21, 2025 to November 25, 2025 |

| Price Bands | ₹563 to ₹593 per share |

| Lot Size | 25 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 11,13,46,602 shares |

| Shareholding post -issue | 11,29,48,626 shares |

Sudeep Pharma IPO Timeline

| Event | Date |

| IPO Open Date | Fri, Nov 21, 2025 |

| IPO Close Date | Tue, Nov 25, 2025 |

| Tentative Allotment | Wed, Nov 26, 2025 |

| Initiation of Refunds | Thu, Nov 27, 2025 |

| Credit of Shares to Demat | Thu, Nov 27, 2025 |

| Tentative Listing Date | Fri, Nov 28, 2025 |

Sudeep Pharma IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 25 | ₹14,825 |

| Retail (Max) | 13 | 325 | ₹1,92,725 |

| S-HNI (Min) | 14 | 350 | ₹2,07,550 |

| S-HNI (Max) | 67 | 1,675 | ₹9,93,275 |

| B-HNI (Min) | 68 | 1,700 | ₹10,08,100 |

Sudeep Pharma Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sudeep Pharma Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 12.27 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 37.08% |

| Net Asset Value (NAV) | 33.09 |

| Return on Equity (RoE) | 37.40% |

| Return on Capital Employed (RoCE) | 41.18% |

| EBITDA Margin | 40.88% |

| PAT Margin | 28.99% |

| Debt to Equity Ratio | 0.19 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure towards procurement of machinery for the production line located at Nandesari Facility I | 758.14 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

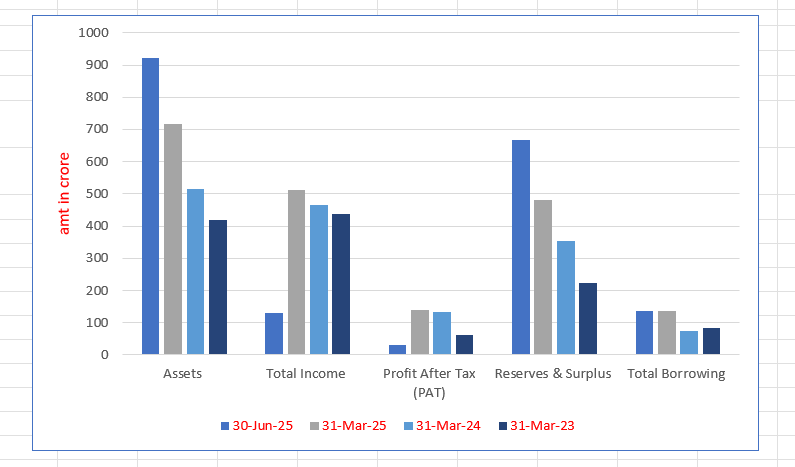

Sudeep Pharma Limited Financials (in million)

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 922.26 | 717.17 | 513.87 | 420.11 |

| Total Income | 130.08 | 511.33 | 465.38 | 438.26 |

| Profit After Tax (PAT) | 31.27 | 138.69 | 133.15 | 62.32 |

| Reserves & Surplus | 668.52 | 481.11 | 354.59 | 221.88 |

| Total Borrowing | 135.97 | 135.25 | 75.03 | 82.26 |

Financial Status of Sudeep Pharma Limited

SWOT Analysis of Sudeep Pharma IPO

Strength and Opportunities

- Established since 1989 with strong legacy in quality ingredients.

- Wide global reach, serving 100+ countries.

- Six manufacturing units with 50,000 MT capacity.

- Diverse portfolio covering pharma, nutraceuticals, food sectors.

- Over 200 products across various industries.

- Robust inhouse R&D and pilotscale labs.

- Ability to tailor mineral ingredients (calcium, zinc, etc.)

- Growing demand for specialty nutrition ingredients worldwide.

- Opportunity to expand specialty ingredients and triturates lines.

Risks and Threats

- Limited publicly disclosed financial transparency.

- High dependence on rawmaterial price fluctuations.

- Concentrated production at a few sites increases risk.

- Potential regulatory compliance complexity in multiple markets.

- Intense global competition from larger chemical players.

- Innovation pace may lag larger multinationals.

- Vulnerability to import/export tariff and trade barriers.

- Currency exposure in international markets.

- Scalability challenges amid operational growth.

Sudeep Pharma IPO

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sudeep Pharma Limited IPO

Sudeep Pharma Limited IPO Strengths

Market Leadership with a Diversified Product Portfolio in a High-Barrier Industry

Sudeep Pharma Limited is a leading manufacturer of pharmaceutical, food, nutrition, and specialty ingredients in India, with a strong focus on mineral-based products and iron phosphate. Backed by a diverse portfolio of over 100 products and regulatory-accredited facilities, the company thrives in high-barrier industries through innovation, customer-centricity, and technological advancement

Distinguished Global Customer Base with Long-Standing Relationships

Sudeep Pharma Limited serves over 1,100 customers globally, including 40+ blue-chip multinationals and 14 Fortune 500 companies, as of December 31, 2024. With average top-client relationships spanning over seven years, the company’s enduring customer trust is driven by regulatory compliance, consistent quality, and deep presence across pharmaceutical, food, nutrition, and FMCG sectors

Well-Equipped and Regulatory-Compliant Manufacturing Facilities

Sudeep Pharma Limited operates three advanced manufacturing facilities in Vadodara with 12 production lines and a total annual capacity of 65,579 MT, as of December 31, 2024. Backed by 36 global accreditations, proprietary technologies, and USFDA approval, the company ensures consistent quality, regulatory compliance, and capacity expansion to meet growing global demand

Strong Research and Development Capabilities

Sudeep Pharma Limited’s innovation-driven R&D facility, staffed by 37 experts, has led over 300 projects and commercialised 106 products as of December 31, 2024. With advanced technologies and proprietary processes like encapsulation and liposomal delivery, the company addresses complex formulation challenges, enhances bioavailability, and drives product development across pharmaceutical and nutrition sectors.

Experienced Promoters and Senior Management Team

Sudeep Pharma Limited is guided by Promoter and Managing Director Sujit Jaysukh Bhayani, with 34 years of industry experience, and Promoter Shanil Sujit Bhayani, with nine years of strategic leadership. Supported by a seasoned senior management team, the company benefits from deep operational, financial, and technical expertise, ensuring sustained growth and strategic execution.

More About Sudeep Pharma Limited

Sudeep Pharma Limited is a technology-driven manufacturer of excipients and specialty ingredients for the pharmaceutical, food, and nutrition industries. Since its establishment in 1989, the company has expanded significantly and now exports to over 100 countries. With a combined annual manufacturing capacity of 65,579 MT, Sudeep Pharma is one of the largest producers of food-grade iron phosphate globally.

Technological Capabilities

The company leverages in-house technologies like:

- Encapsulation

- Spray drying

- Granulation

- Liposomal preparations

- Trituration and blending

These processes ensure innovation, efficiency, and product reliability.

International Presence

Sudeep Pharma has a global footprint across:

- North and South America

- Europe and the UK

- Middle East and Africa

- Asia-Pacific

Dedicated regional sales offices and third-party stocking agreements enhance customer proximity and service.

Certifications and Compliance

One of the manufacturing units is USFDA-approved. The company holds:

- CEP and EU written confirmation for calcium carbonate as API

- Certifications from WHO-GMP, ISO, BRC, EXCiPACT, GAIN, and WFP

- Kosher and Halal certifications

Business Verticals

Pharmaceutical, Food & Nutrition

Offers mineral-based ingredients like calcium, iron, magnesium, zinc, and sodium used in:

- Pharmaceutical formulations

- Infant and clinical nutrition

- Fortified foods and supplements

Specialty Ingredients (via SNPL)

Focuses on customized solutions, including:

- Micronutrient premixes

- Liposomal and encapsulated ingredients

- Granulated and spray-dried formats. Used across FMCG, dairy, beverages, and bakery applications.

Customer Base and Relationships

Sudeep Pharma serves over 1,100 clients, including Pfizer, Danone, Aurobindo, and Mankind Pharma. Approximately 80% of revenue is generated from repeat customers, with average relationships spanning 7+ years.

Leadership and Recognition

Led by Sujit Jaysukh Bhayani and Shanil Sujit Bhayani, the company has received accolades like:

- Global Indian MSME of the Year – 2023

- India’s Fastest Growing MSME – 2024

Their focus remains on innovation, global expansion, and delivering safe, high-quality mineral ingredients.

Industry Outlook

Indian Pharmaceutical Excipients Market

India’s market for pharmaceutical excipients and biopharmaceutical excipients is projected to expand steadily:

- The Indian biopharmaceutical excipients segment was valued at USD 124.5 million in 2023 and is expected to reach USD 197.9 million by 2030, at a CAGR of 6.8%.

- Globally, pharmaceutical excipients were estimated at USD 8.82 billion in 2024 and are expected to grow at a CAGR of approximately 5.75–6.6% through 2034 to reach USD 15–20 billion.

Growth Drivers

- Rising demand for solid oral dosage forms and generic drugs.

- Advancements in formulation technologies that improve bioavailability and shelf life.

Indian Specialty Food Ingredients & Nutraceuticals Market

This segment includes functional minerals, premixes, and encapsulated or spray-dried formats relevant to Sudeep Pharma’s nutrition-focused portfolio.

- The Indian specialty food ingredients market was valued at USD 7.94 billion in 2022 and is projected to reach USD 12.68 billion by 2030, with a 6% CAGR.

- The broader food ingredients market in India stood at approximately USD 1.15 billion in 2024 and is expected to reach USD 1.93 billion by 2032, growing at 6.7% CAGR.

- The Indian nutraceuticals market, including vitamin-mineral premixes, was valued at USD 8 billion in 2024 and is forecast to reach USD 21.48 billion by 2033, at an 11.6% CAGR.

Key Growth Drivers

- Increased health awareness and focus on preventive healthcare.

- Rising demand for clean-label, fortified, and functional food products.

- Growth in plant-based and fortified dairy, beverage, and bakery applications.

Industry Overview & Key Figures

- India’s pharmaceutical industry was valued at USD 50 billion in 2023–24 and is expected to reach USD 130 billion by 2030.

- The country accounts for 20% of global generic drug volume and 50% of the global vaccine supply.

- The Indian active pharmaceutical ingredients (API) market was approximately USD 10.8 billion in 2024 and is forecast to grow at a CAGR of 7.7% to reach USD 16.9 billion by 2030.

How Will Sudeep Pharma Limited Benefit

- Sudeep Pharma’s strong presence in excipients positions it to benefit from the rising global and domestic demand for solid oral dosage forms and generics.

- Its in-house technologies in spray drying, granulation, and encapsulation align with the industry’s shift towards advanced drug delivery systems.

- The company’s diverse mineral-based portfolio supports growing demand in India’s nutraceuticals and functional food segments.

- With certifications like USFDA and CEP, Sudeep Pharma is well-equipped to serve expanding regulated markets.

- Its leadership in iron phosphate and calcium carbonate production meets the rising need for fortified and clean-label ingredients.

- Global footprint across 100+ countries ensures access to high-growth regions in Asia-Pacific, the Middle East, and Latin America.

- Regional sales offices and stocking agreements enhance responsiveness to local market needs.

- Strong client relationships and repeat business reduce customer acquisition costs amid increasing competition.

- Strategic focus on R&D supports development of bioavailable and shelf-stable ingredient systems

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Sudeep Pharma Limited

Expand into High-Growth Businesses

Sudeep Pharma Limited is expanding into next-generation sectors through its subsidiary SAMPL, which is establishing a facility to manufacture battery-grade iron phosphate for electric vehicles. By leveraging its existing infrastructure and eco-friendly processes, the company targets growth in energy storage and electric mobility solutions.

Expand Market Reach through Growth Initiatives

Sudeep Pharma Limited is enhancing global presence by leveraging USFDA-approved facilities, scaling exports, and shifting from distributor-led to direct access models. Investments in warehousing, technical teams, and cross-selling strategies enable the company to deepen customer relationships across the United States, Europe, and emerging markets.

Capitalize on Public Health Fortification Initiatives

Sudeep Pharma Limited aims to support government-led food fortification programmes across India, Africa, and Southeast Asia. Leveraging its expertise in micronutrient premixes and formulation capabilities, the company contributes to global nutrition goals while expanding market presence in regions demanding large-scale health interventions.

Develop Customised Solutions and Strategic Partnerships

Sudeep Pharma Limited focuses on creating customised food minerals and innovative delivery formats. By forming international alliances, adopting localised strategies, and enhancing market responsiveness, the company builds agility and brand strength, with established distribution across Europe to serve customer-specific requirements more efficiently.

Pursue Inorganic Growth through Strategic Acquisitions

Sudeep Pharma Limited pursues inorganic growth through disciplined acquisitions, such as its majority stake in NSS, a European manufacturer of critical care and infant nutrition blends. This integration enhances product offerings, customer access, and cross-selling opportunities, supporting long-term revenue growth in global markets.

Enhance Manufacturing Capabilities

Sudeep Pharma Limited is establishing a new facility in Nandesari, Gujarat, to boost excipient production and meet global demand. By incorporating automation and scaling capacity, the company strengthens its position as a cost-effective supplier, ready to capitalise on the growing trend of global outsourcing to India.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sudeep Pharma Limited IPO

How can I apply for Sudeep Pharma Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Sudeep Pharma Limited’s IPO?

Sudeep Pharma IPO is a book build issue of ₹895.00 crores. The issue is a combination of fresh issue of 0.16 crore shares aggregating to ₹95.00 crores and offer for sale of 1.35 crore shares aggregating to ₹800.00 crores.

Who are the lead managers handling the IPO?

ICICI Securities Limited and IIFL Capital Services Limited are acting as the book-running lead managers.

What will the fresh issue proceeds be used for?

Around ₹75.8 crore will be used to procure machinery at the Nandesari Facility, with the rest for corporate use.

On which exchanges will the IPO be listed?

The IPO is proposed to be listed on both BSE and NSE through the book-building route.

Who is the registrar for the IPO?

MUFG Intime India Pvt Ltd (via Link Intime) is appointed as the official registrar for the IPO.