- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Supreet Chemicals IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Supreet Chemicals IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Supreet Chemicals Limited

Supreet Chemicals is a specialty chemical intermediates manufacturer, focusing on complex chemistries and multi-step processes. Its products are grouped into Aromatic Amines and Sulphonamides, Amino Phenols, and other specialties. In Fiscal 2025, it offered 135 products, with 74 involving up to five-step processes and 61 requiring six to fifteen steps. Serving 215 customers, including 27 global clients, its portfolio caters to industries such as textiles, pharmaceuticals, performance chemicals, and agrochemicals. With three facilities in Vapi, Gujarat, it operates 6,962 MTPA capacity, planning expansion to 12,985 MTPA.

Supreet Chemicals Limited IPO Overview

Supreet Chemicals Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 5, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a book-building issue with a total size of ₹499 crore, consisting entirely of a fresh issue of shares, without any offer-for-sale component. The company has proposed to list its equity shares on both NSE and BSE. IIFL Capital Services Ltd. is acting as the book-running lead manager, while MUFG Intime India Pvt. Ltd. has been appointed as the registrar. Key details such as IPO opening and closing dates, price band, and lot size are yet to be disclosed. Investors can refer to the Supreet Chemicals IPO DRHP for further details.

As per the DRHP, the equity shares carry a face value of ₹2 each, with the total issue size aggregating up to ₹499 crore. This will be a book-building IPO, and the company’s pre-issue shareholding stands at 6,35,19,000 equity shares. The promoters of Supreet Chemicals Ltd. are Harjindersingh Jaswant Singh Sarna, Narendrakaur H. Sarna, and Manjeetsingh Gurbirsingh Sarna. Their collective promoter holding before the issue is 81.26%, which will be diluted post-issue

Supreet Chemicals Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹499 crore |

| Fresh Issue | ₹499 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 6,35,19,000 shares |

| Shareholding post-issue | TBA |

Supreet Chemicals IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Supreet Chemicals Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Supreet Chemicals Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.17 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 24.51% |

| Net Asset Value (NAV) | ₹37.35 |

| Return on Equity (RoE) | 24.51% |

| Return on Capital Employed (RoCE) | 19.61% |

| EBITDA Margin | 21.63% |

| PAT Margin | 14.06% |

| Debt to Equity Ratio | 0.85 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Financing the capital expenditure requirements of our Company towards Manufacturing Facility 4 (“Proposed Greenfield Project”) | 3100 |

| Repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by our Company | 650 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

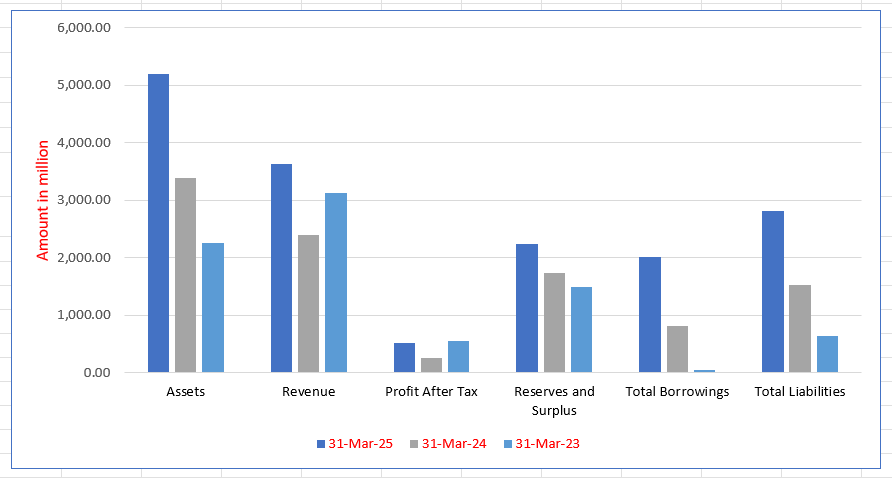

Supreet Chemicals Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,191.48 | 3,387.58 | 2,260.93 |

| Revenue | 3,625.47 | 2,397.56 | 3,127.41 |

| Profit After Tax | 519.18 | 255.94 | 563.41 |

| Reserves and Surplus | 2,245.09 | 1,737.75 | 1,494.57 |

| Total Borrowings | 2,007.03 | 808.94 | 46.60 |

| Total Liabilities | 2,819.35 | 1,522.79 | 639.32 |

Financial Status of Supreet Chemicals Limited

SWOT Analysis of Supreet Chemicals IPO

Strength and Opportunities

- Specialty chemical intermediate expertise in complex chemistries and multi‐step unit operations.

- Over 30 years of manufacturing experience since 1992.

- Strong product portfolio including MCA, Sulphonamides, NAPSA, amino phenols etc.

- Backward integration strategy to ensure better control over key inputs.

- Good domestic raw material sourcing reduces import dependency risk.

- Facilities strategically located in Vapi with rail, road, port connectivity.

- Strong certifications (e.g. ISO, GMP etc.) and compliance focus.

- IPO filing (INR 4.99B fresh issue) gives opportunity for raising growth capital.

- Growing demand in specialty chemical sector offers expansion scope.

- Export opportunities in niche intermediates for pharmaceuticals and agrochemicals.

Risks and Threats

- Revenue decline: operating revenue dropped ~22–25% in FY 2023-24.

- Sharp drop in EBITDA (~48%) and Net Profit (~57%) in latest reported year.

- High volatility in raw material costs globally.

- Dependence on shorter‐term supplier contracts – less stability in supply chains.

- Low margins: negative or shrinking operating/margin returns.

- Rising debt / borrowings — large jump in borrowings reported.

- Return on Equity and Return on Capital Employed are negative, indicating capital inefficiency.

- Exposure to regulatory and environmental compliance risks in chemical operations.

- Intense competition in domestic and global chemical markets.

- Currency fluctuations affecting export realisations and input costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Supreet Chemicals Limited

Supreet Chemicals Limited IPO Strengths

Expertise in Complex Chemical Processes

Supreet Chemicals Limited possesses expertise in handling over 15 complex chemistries and up to 15 multi-step unit operations. This capability, built through years of operational experience, allows it to optimize raw materials, enhance yields, and increase cost competitiveness for a wide range of end-products and applications.

Extensive and Diversified Product Portfolio

The company has consistently expanded its commercialized product portfolio from 102 products in Fiscal 2023 to 135 in Fiscal 2025. This diversification, coupled with a robust pipeline of 107 development-stage products, limits dependence on any single product and mitigates risks associated with different industry business cycles.

Diversified End-Use Industry Exposure

Supreet’s products serve various end-use industries, including textiles, pharmaceuticals, performance chemicals, and personal care. This diversified exposure reduces reliance on any single sector, enhances resilience against sector-specific downturns, and ensures long-term stability for its business model.

Diversified and Long-Standing Customer Base

The company benefits from a well-diversified customer base, supplying to 215 customers in Fiscal 2025. It has developed long-standing relationships with key customers due to consistent product quality and reliable supply, which mitigates concentration risks and provides stability to its revenue profile.

Integrated Manufacturing and Capacity Expansion

Supreet operates three integrated manufacturing facilities in Vapi, Gujarat, with an aggregate capacity of 6,962 MTPA. Its track record of timely capacity additions and adoption of modern technology supports productivity and efficiency, with plans to further expand capacity to 12,985 MTPA.

Experienced Leadership and Management Team

The company is led by an experienced promoter and management team with extensive industry experience. This team’s depth and diversity enable Supreet to anticipate market trends, manage operations, maintain customer relationships, and respond effectively to changes in the market.

More About Supreet Chemicals Limited

Supreet Chemicals Limited is a leading manufacturer of specialty chemical intermediates, renowned for its expertise in handling complex chemistries and multi-step production processes. The company’s advanced capabilities enable it to serve a diverse range of end-use industries, including textiles, pharmaceuticals, performance chemicals, personal care, and agro-chemicals.

- Core Competencies: Masters over 15 complex chemistries and up to 15 multi-step unit operations, a rare capability that distinguishes it from competitors who typically specialize in only a few.

- Product Portfolio: Its business is categorized into three key product families, which have shown significant growth:

- Aromatic Amines and Sulphonamides: Contributed 36.1% (₹1,308.1 million) to Fiscal 2025 revenue.

- Amino Phenols: Contributed 15.8% (₹571.5 million) to Fiscal 2025 revenue.

- Other Specialties: A rapidly growing segment, contributing 36.5% (₹1,322.7 million) to Fiscal 2025 revenue.

Operational and Manufacturing Strength

Supreet Chemicals has consistently expanded and complexified its product offerings. The number of products involving six to 15 multi-step processes grew from 41 in Fiscal 2023 to 61 in Fiscal 2025.

- Manufacturing Facilities: Operates three functionally integrated facilities in Vapi, Gujarat, with a combined installed capacity of 6,962 MTPA and a capacity utilization of 74.3% in Fiscal 2025.

- Expansion Plans: Is currently undertaking a significant expansion to nearly double its capacity to 12,985 MTPA.

- Certifications: Its facilities are ISO 9001:2015 (Quality) and ISO 14001:2015 (Environmental) certified.

Customer Base and Business Model

The company has built strong, established relationships with a large customer base, serving 215 customers in Fiscal 2025 across India and 14 global countries.

- Key Clients: Includes major names such as Archroma, BASF, IPCA Laboratories, Sudarshan Chemicals, and Anupam Rasayan.

- Diversified Revenue Streams: In addition to direct sales, it employs a contract manufacturing model, which contributed ₹109.3 million (3.0%) to revenue in Fiscal 2025. This strategy helps optimize capacity utilization and deepen client partnerships

Industry Outlook

The Indian specialty chemicals market was valued at around USD 63–65 billion in 2024 and is projected to reach nearly USD 90–96 billion by 2033–34, growing at a CAGR of 3.8–4.5%. Some sub-segments are expected to grow much faster, at 10–12% annually, due to increasing domestic and export demand. Specialty chemicals account for about one-fourth of India’s total chemicals and petrochemicals industry, highlighting their strategic importance.

Growth Drivers

- Expanding end-use sectors such as pharmaceuticals, agrochemicals, textiles, cosmetics, and performance materials.

- “China+1” strategy, where global players diversify sourcing from India for reliability and cost competitiveness.

- Government initiatives supporting import substitution, R&D, and green chemistry adoption.

- Rising demand for high-purity intermediates requiring complex chemistries and multi-step processes.

Outlook for Supreet Chemicals’ Product Segments

- Aromatic Amines: Global demand projected to grow at ~6–6.5% CAGR, with strong use in dyes, pharmaceuticals, and rubber.

- Amino Phenols: Widely applied in pharma and agrochemicals, forecasted CAGR of 6–7% in India.

- Sulphonamides and Specialty Intermediates: Driven by growth in personal care, agrochemicals, and specialty pharma.

- Aroma Chemicals and Allied Segments: Indian market projected to double by 2033, growing at ~8% CAGR.

Key Figures

- Industry Size (2024): ~USD 63–65 billion.

- Projected Size (2033–34): ~USD 90–96 billion.

- CAGR (Overall Specialty Chemicals): 3.8–4.5%.

- CAGR (Key Product Families): 6–8% across aromatic amines, amino phenols, and aroma chemicals.

How Will Supreet Chemicals Limited Benefit

- Positioned to capture growth from India’s expanding specialty chemicals market, projected to reach USD 90–96 billion by 2033–34.

- Expertise in complex chemistries and multi-step processes aligns with rising demand for high-purity intermediates.

- Strong portfolio in aromatic amines, amino phenols, and sulphonamides ensures participation in fast-growing product segments.

- Backward integration and domestic sourcing reduce raw material dependency and improve cost efficiency.

- Capacity expansion from 6,962 MTPA to nearly 13,000 MTPA enables higher scale and revenue potential.

- Long-term relationships with leading global and Indian customers provide stability and recurring demand.

- China+1 strategy opens opportunities to secure export contracts as global firms diversify supply chains.

- Government incentives and regulatory push for import substitution support higher domestic market share.

- Diversified revenue streams, including contract manufacturing, enhance resilience and profitability.

Peer Group Comparison

| Name of the Company | Face Value (₹) | P/E | EPS (Basic) | EPS (Diluted) | RoNW (%) | NAV (₹ per share) |

| Supreet Limited | 2 | [•] | 8.17 | 8.17 | 24.51% | 37.35 |

| Peer Group | ||||||

| Deepak Nitrite Ltd | 2 | 35.40 | 51.12 | 51.12 | 13.69% | 395.06 |

| Aarti Industries Ltd | 5 | 41.33 | 9.13 | 9.12 | 6.07% | 154.62 |

| Atul Ltd | 10 | 38.40 | 164.37 | 164.37 | 9.03% | 1,901.57 |

| Balaji Amines Ltd | 2 | 30.39 | 48.62 | 48.62 | 8.83% | 569.46 |

| Alkyl Amines Chemicals Ltd | 2 | 55.68 | 36.40 | 36.35 | 13.94% | 274.31 |

| Neogen Chemicals Ltd | 10 | 108.95 | 13.20 | 13.20 | 4.49% | 299.24 |

| Rossari Biotech Ltd | 2 | 25.06 | 24.66 | 24.65 | 12.21% | 214.13 |

Key Strategies for Supreet Chemicals Limited

Portfolio Diversification and High-Margin Focus

The company’s strategy is to diversify its product portfolio by developing new, high-margin specialty chemical intermediates. This involves continuous R&D, adopting cleaner technologies, and performing complex, multi-step operations for niche products to improve its overall margin profile and profitability.

Enhancing Technical Competencies

Supreet aims to enhance its competencies by developing more complex processes, including those with up to 20 multi-step operations. This focus on advanced chemistries and processes is intended to optimize raw materials, improve yields, and increase its cost competitiveness in the market.

Increasing Customer Wallet Share

The strategy involves deepening relationships with key customers to increase wallet share. Supreet plans to achieve this by offering more specialized and customized products, expanding into new end-use markets, and leveraging its contract manufacturing model to optimize capacity utilization

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Supreet Chemicals Limited IPO

How can I apply for Supreet Chemicals Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Supreet Chemicals IPO?

The IPO size is ₹499 crore, entirely through fresh issue of equity shares without any offer for sale.

Where will Supreet Chemicals Limited shares be listed?

The company’s equity shares are proposed to be listed on both NSE and BSE after the IPO.

Who are the lead manager and registrar for the IPO?

IIFL Capital Services Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is registrar.

What are the objectives of Supreet Chemicals IPO?

Proceeds will fund a new greenfield manufacturing facility, repay borrowings, and support general corporate purposes.

Has the IPO price band and lot size been announced?

No, the IPO price band and lot size details are yet to be officially announced.