- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Tata Capital IPO

IPO Details

06 Oct 25

08 Oct 25

₹14,260

46

₹310 to ₹326

NSE, BSE

₹15,511.87 Cr

13 Oct 25

Tata Capital IPO Timeline

Bidding Start

06 Oct 25

Bidding Ends

08 Oct 25

Allotment Finalisation

09 Oct 25

Refund Initiation

10 Oct 25

Demat Transfer

10 Oct 25

Listing

13 Oct 25

Tata Capital IPO Overview

Tata Capital IPO Live Updates

Tata Capital IPO Day 3 Subscription Status (as of 03:18 p.m. October 8)

As of 3:18 p.m. on October 8, 2025, the Tata Capital IPO was subscribed 1.80 times overall, showing strong traction across all investor categories on the final day of bidding.

Subscription Status (as of 3:18 p.m.)

| Category | Shares Offered | Shares Bid For | Subscription |

|---|---|---|---|

| Qualified Institutional Buyers (QIBs) | 9,49,24,856 | 29,09,07,220 | 3.06× |

| Non-Institutional Investors (NIIs) | 7,11,93,642 | 13,34,75,348 | 1.87× |

| Retail Individual Investors (RIIs) | 16,61,18,498 | 17,21,59,876 | 1.04× |

| Employees | 12,00,000 | 33,32,930 | 2.78× |

| Total | 33,34,36,996 | 59,98,75,374 | 1.80× |

Tata Capital IPO Day 2 Subscription Status

As of 5:00 p.m. on October 7, 2025, the Tata Capital IPO recorded a strong close to Day 2, with overall subscription reaching 75% across investor categories, marking continued momentum ahead of the final day of bidding.

- QIBs: 86% subscribed with bids for 8.14 crore shares, driven by a mix of FIIs (3.49 crore), domestic institutions (2.45 crore), and mutual funds (1.84 crore).

- NIIs: 76% subscribed, supported by sharp interest in the ₹2–10 lakh category, which is now fully subscribed at 1.05×, while the ₹10 lakh+ bracket stands at 61%.

- Retail Investors: 67% subscribed with 11.20 crore shares bid, including 9.17 crore cut-off bids, indicating strong retail appetite.

- Employee Quota: The most oversubscribed segment, at 1.95×, with bids for 23.36 lakh shares against 12 lakh offered.

In total, bids have been placed for 24.96 crore shares against the 33.34 crore shares available, with cumulative demand highest at the ₹310 floor price (25.05 crore shares) and 9.36 crore bids at the cut-off level, showing robust participation across price points.

The IPO, priced at ₹310–₹326 per share, will close for subscription on Wednesday, October 8, 2025, with strong institutional inflows expected on the final day.

Tata Capital IPO Day 1 Subscription Status

The Tata Capital IPO was subscribed 0.39 times overall on the first day, with varying interest across investor categories:

| Investor Category | Subscription (x) | Shares Offered | Shares Bid For | Amount (₹ Cr.) |

|---|---|---|---|---|

| Anchor Investors | 1.00 | 14,23,87,284 | 14,23,87,284 | 4,641.83 |

| QIB (Ex-Anchor) | 0.52 | 9,49,24,856 | 4,93,98,848 | 1,610.40 |

| Non-Institutional Buyers | 0.29 | 7,11,93,642 | 2,03,77,218 | 664.30 |

| • bNII (Above ₹10L) | 0.19 | 4,74,62,428 | 89,06,842 | 290.36 |

| • sNII (Below ₹10L) | 0.48 | 2,37,31,214 | 1,14,70,376 | 373.93 |

| Retail Investors | 0.35 | 16,61,18,498 | 5,79,62,576 | 1,889.58 |

| Employees | 1.10 | 12,00,000 | 13,20,246 | 43.04 |

| Total | 0.39 | 33,34,36,996 | 12,90,58,888 | 4,207.32 |

Incorporated in 2007, Tata Capital Limited (TCL) is a diversified financial services company and a subsidiary of Tata Sons Private Limited. Operating as a non-banking financial company (NBFC) in India, TCL offers a broad range of financial products and services to retail, corporate, and institutional clients. Its offerings include consumer loans such as personal, home, auto, education, and loans against property; commercial finance for businesses; wealth management; investment banking; private equity; and cleantech finance. Headquartered in Mumbai, TCL has over 723 branches nationwide.

Tata Capital Limited IPO Overview

Tata Capital Ltd. is launching a book-built IPO worth ₹15,511.87 crore, comprising a fresh issue of 21 crore shares aggregating to ₹6,846 crore and an offer for sale (OFS) of 26.58 crore shares amounting to ₹8,665.87 crore. The issue will open for subscription on 6 October 2025 and close on 8 October 2025, with allotments expected to be finalised on 9 October 2025. The company’s shares are scheduled to list on the BSE and NSE on a tentative date of 13 October 2025.

The price band for the IPO has been fixed at ₹310 to ₹326 per share, with a lot size of 46 shares. For retail investors, the minimum investment required at the upper price band amounts to ₹14,996. For non-institutional investors (NIIs), the application size differs: sNII (small non-institutional investors) require a minimum of 14 lots (644 shares) worth ₹2,09,944, while bNII (big non-institutional investors) require 67 lots (3,082 shares) worth ₹10,04,732. Kotak Mahindra Capital Co. Ltd. is serving as the book-running lead manager for the issue, while MUFG Intime India Pvt. Ltd. is acting as the registrar..

Tata Capital Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 47,58,24,280 shares (aggregating up to ₹15,511.87 Cr Cr) |

| Fresh Issue | 21,00,00,000 shares (aggregating up to ₹6846 Cr) |

| Offer for Sale (OFS) | 26,58,24,280 shares of ₹10 (aggregating up to ₹8665.87 Cr) |

| IPO Dates | 6 October 2025 to 8 October 2025 |

| Price Bands | ₹310 to ₹326 per share |

| Lot Size | 46 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,03,48,69,037 shares |

| Shareholding post-issue | 4,03,48,69,037 shares |

Tata Capital IPO Lots

| Category | Lots | Shares | Amount |

| Retail (Min) | 1 | 46 | ₹14,996 |

| Retail (Max) | 13 | 598 | ₹1,94,948 |

| S-HNI (Min) | 14 | 644 | ₹2,09,944 |

| S-HNI (Max) | 66 | 3,036 | ₹9,89,736 |

| B-HNI (Min) | 67 | 3,082 | ₹10,04,732 |

Tata Capital Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Tata Capital Limited IPO Valuation Overviewf

| KPI | Value |

| Earnings Per Share (EPS) | ₹9.3 |

| Return on Net Worth (RoNW) | 11.2% |

| Net Asset Value (NAV) | ₹79.5 |

| Return on Equity (RoE) | 11.04% |

| Return on Capital Employed (RoCE) | 8.26% |

| EBITDA Margin | 71.83% |

| PAT Margin | 12.91% |

| Debt to Equity Ratio | 6.60 |

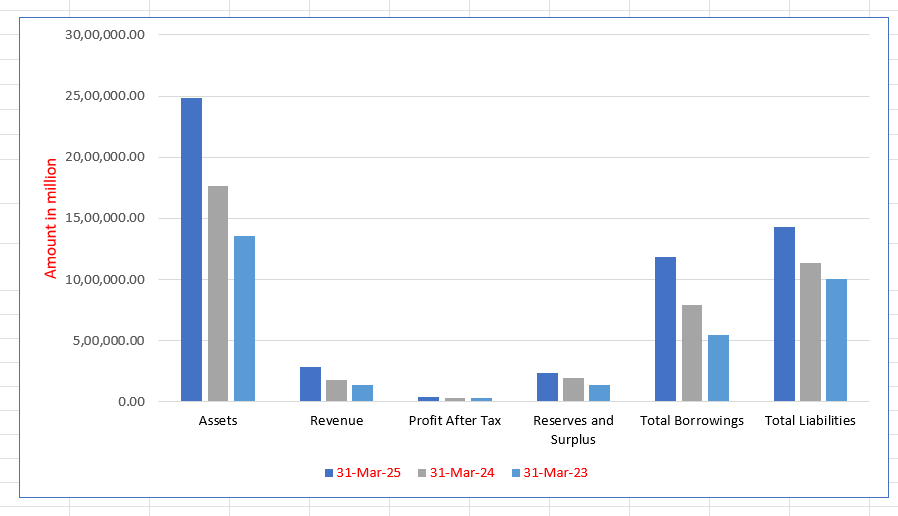

Tata Capital Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,484,650.1 | 1,766,939.8 | 1,356,261.0 |

| Revenue | 283,698.7 | 181,983.8 | 136,374.9 |

| Profit After Tax | 36,550.2 | 33,269.6 | 29,457.7 |

| Reserves and Surplus | 234,586.1 | 197,140.8 | 137,611.4 |

| Total Borrowings | 1,186,204.0 | 791,428.8 | 549,341.3 |

| Total Liabilities | 1,431,942.0 | 1,131,799.0 | 1,006,649.6 |

Financial Status of Tata Capital Limited

SWOT Analysis of Tata Capital IPO

Strength and Opportunities

- Backed by the trusted Tata brand, enhancing credibility and customer trust.

- Diverse product portfolio encompassing consumer loans, wealth management, and commercial finance.

- Strong digital infrastructure, facilitating seamless online transactions and customer engagement.

- Robust financial performance with consistent growth in assets under management and profitability.

- Expansion into cleantech finance, aligning with global sustainability trends.

- Strategic partnerships enhancing product offerings and market reach.

- Focus on MSME lending, tapping into a significant and underserved market segment.

- Emphasis on customer-centric services, improving satisfaction and retention rates.

- Commitment to innovation and technology adoption, staying ahead in a competitive market.

Risks and Threats

- Limited global presence, primarily operating within India.

- High dependence on Tata Sons, making it vulnerable to any negative developments within the parent company.

- Exposure to regulatory changes in the Indian financial sector, which could impact operations.

- Intense competition from both traditional banks and emerging fintech companies.

- Potential asset quality risks due to rapid expansion and increased lending activities.

- Vulnerability to economic downturns affecting loan repayment rates and overall financial stability.

- Operational challenges in managing a vast and diverse portfolio across various sectors.

- Potential cybersecurity threats due to increased digital operations and data handling.

- Fluctuations in interest rates impacting loan demand and profitability.

Tata Capital IPO Live News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Tata Capital Limited IPO

Tata Capital Limited IPO Strengths

Legacy and Strength of the Tata Group

Tata Capital Limited is the flagship financial services company of the Tata Group, one of India’s most distinguished business conglomerates with a legacy spanning over 150 years. Backed by Tata Sons Private Limited, the group operates across 10 diverse sectors, including automotive, technology, steel, and financial services, with a global footprint in over 100 countries. The Tata Group’s strong brand equity, diversified presence, and financial stability provide Tata Capital with a competitive advantage, reinforced by equity infusions of ₹89.7 billion since inception.

Leading Market Position with Comprehensive Lending Solutions

Tata Capital is India’s third-largest diversified NBFC, with a Total Gross Loan portfolio of ₹2,265.5 billion as of March 31, 2025. It offers over 25 lending products catering to salaried individuals, self-employed professionals, SMEs, and corporates, with loan sizes ranging from ₹10,000 to over ₹1 billion. The company maintains a well-diversified portfolio, with no single product contributing more than 20% of total loans, ensuring balanced risk distribution and sustained profitability across economic cycles.

Omni-Channel Distribution Network for Enhanced Reach

Tata Capital operates an extensive omni-channel distribution model, comprising 1,496 branches across 1,102 locations in India, supported by over 30,000 DSAs, 400+ OEMs, and 8,000+ dealers. Its digital platforms, including mobile apps with 21 million downloads, facilitate seamless customer onboarding and servicing. This ‘phygital’ approach optimizes reach, enhances customer engagement, and enables efficient loan sourcing in both urban and underpenetrated markets.

Robust Risk Management and Stable Asset Quality

The company maintains strong asset quality, with Gross Stage 3 Loans at 1.5% and Net Stage 3 Loans at 0.5% as of March 31, 2025. Its prudent risk culture, advanced underwriting models, and AI-driven collections mechanisms ensure minimal credit risk. A multi-layered risk framework, supported by data analytics and stringent credit policies, enables Tata Capital to sustain low delinquency rates and high provision coverage (65.8%), reinforcing its financial resilience.

Technology-Driven Operations for Superior Customer Experience

Digital and analytics form the core of Tata Capital’s operations, enhancing efficiency across loan origination, underwriting, and collections. Over 97.8% of customers are onboarded digitally, while AI-powered tools streamline credit assessments and collections (98.6% digital collections). The company leverages 400+ APIs, 350+ RPA processes, and GenAI for automation, ensuring seamless service delivery and operational scalability.

Highest Credit Ratings and Diverse Funding Profile

Tata Capital holds the highest domestic credit ratings (“AAA/Stable” from CRISIL, ICRA, CARE, and India Ratings) and an international BBB rating (S&P and Fitch). This enables access to diversified funding sources, including banks, mutual funds, and international investors, with no single lender contributing over 10% of borrowings. Its maiden $400 million overseas bond issuance in 2025 further strengthens its liquidity profile.

Consistent Financial Performance and Profitability

With a profitable track record since 2007, Tata Capital has demonstrated resilient growth, achieving a 37.3% CAGR in Total Gross Loans (FY23-FY25) and a 10% CAGR in Profit After Tax. Its Return on Equity (14.2%) and Return on Assets (2.1%) reflect efficient capital utilization, supported by a well-diversified loan book and disciplined risk management.

Experienced Leadership and Strong Governance

Tata Capital is led by a seasoned management team with deep expertise in financial services, supported by an independent board overseeing governance. The company fosters a culture of innovation and employee development, earning the “Great Place To Work” certification for three consecutive years (2023-2025). This talent-driven approach ensures sustained growth and operational excellence

More About Tata Capital Limited

Tata Capital Limited (TCL) is the flagship financial services company of the Tata Group and a subsidiary of Tata Sons Private Limited, the promoter and holding company of the group. With a legacy spanning over 150 years, the Tata Group operates across diverse sectors including automotive, technology, steel, financial services, aerospace, defence, consumer, and retail. The Tata brand has been recognised as India’s most valuable brand according to the Brand Finance India 100 2025 report.

According to CRISIL, Tata Capital is the third largest diversified non-banking financial company (NBFC) in India, with total gross loans of ₹2,265.5 billion as of March 31, 2025, growing at a CAGR of 37.3% from March 2023. The company has consistently maintained strong asset quality, with a Gross Stage 3 Loans Ratio of 1.9%, Net Stage 3 Loans Ratio of 0.8%, and a Provision Coverage Ratio of 58.5%. Excluding TMFL, the ratios stood at 1.5%, 0.5%, and 65.8%, respectively.

Lending Operations

Since 2007, Tata Capital has served over 7 million customers through more than 25 lending products targeting salaried and self-employed individuals, entrepreneurs, SMEs, and corporates. Retail and SME customers accounted for 88.5% of total gross loans as of March 2025. The loan portfolio is highly granular, with over 99% of accounts below ₹10 million and 79% secured.

Tata Capital operates an omni-channel distribution model with 1,496 branches across 27 states and union territories, supplemented by digital platforms, direct selling agents, OEMs, dealers, and digital partners. Its ‘phygital’ strategy integrates physical and digital channels to deliver a superior customer experience.

Business Verticals

- Retail Finance: Personal, home, business, vehicle, education, and microfinance loans, contributing 62.3% of total gross loans.

- SME Finance: Equipment finance, term loans, supply chain finance, and cleantech/infrastructure loans, contributing 26.2%.

- Corporate Finance: Large business loans including cleantech and infrastructure finance, contributing 11.5%.

Technology & Risk Management

Advanced digital tools support the entire customer lifecycle. Tata Capital uses ML-powered collection models, digital underwriting integrated with credit bureaus, and predictive analytics to maintain low credit costs of 0.9% of average total net loans (excluding TMFL).

Merger with TMFL

The merger with Tata Motors Finance Limited (TMFL) strengthened Tata Capital’s vehicle finance portfolio, expanding its reach across commercial and passenger vehicles. TMFL contributed significantly to commercial vehicle, car, and supply chain finance portfolios, enhancing Tata Capital’s position as a full-stack vehicle finance provider and enabling access to a market valued at ₹18.4 trillion.

Governance & Non-Lending Businesses

Tata Capital is led by an experienced management team supported by a six-member Board, including four independent directors. Its non-lending businesses include third-party product distribution, wealth management, and private equity focused on growth, healthcare, and thematic funds such as decarbonization and innovation

Industry Outlook

Growth Prospects and Market Dynamics

- The Indian NBFC sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 14–16% from FY25 to FY28, driven by strong demand in housing finance, auto loans, credit cards, and personal loans.

- Retail assets, which accounted for 58% of overall NBFC credit in December 2024, have been key growth drivers, with a CAGR of 23% during FY2023–FY2024. A moderation to 16–18% CAGR is expected during FY2025–FY2026 due to a high base.

- The microfinance sector has experienced a contraction, with the portfolio declining to ₹3.59 lakh crore as of June 2025, reflecting a cautious approach among lenders.

Key Growth Drivers

- Digital transformation and technological advancements have enabled NBFCs to offer alternative financing options, especially to MSMEs, enhancing financial inclusion.

- The government’s push towards infrastructure development and rural recovery is expected to drive growth in the NBFC sector in the second half of FY26.

- The easing of regulatory norms and repo rate cuts may improve margins and credit availability, supporting NBFC growth.

Challenges and Considerations

- A slowdown in bank lending to NBFCs, with outstanding loans declining by ₹25,512 crore to ₹16.1 lakh crore in April 2025, indicates tightening financial conditions.

- The microfinance sector’s contraction and cautious lending practices may impact financial inclusion efforts.

Tata Capital’s Position and Strategic Focus

- Tata Capital, as a diversified NBFC, is well-positioned to leverage growth in retail and SME segments, aligning with industry trends.

- The company’s focus on digital platforms and ‘phygital’ strategies enhances customer engagement and operational efficiency.

- Strategic mergers, such as the recent integration with Tata Motors Finance Limited, expand Tata Capital’s portfolio, particularly in vehicle finance, aligning with the industry’s growth areas.

How Will Tata Capital Limited Benefit

- Tata Capital Limited can capitalize on the projected NBFC sector growth of 14–16% CAGR by expanding its lending operations across retail, SME, and corporate segments.

- The focus on digital transformation and ‘phygital’ strategies will enhance customer engagement, streamline loan processing, and improve operational efficiency.

- Growth in retail assets and auto finance segments provides opportunities to increase market share, particularly in personal loans, vehicle loans, and housing finance.

- The merger with Tata Motors Finance Limited strengthens its vehicle finance portfolio, enabling access to a larger customer base and a broader product offering.

- Government infrastructure initiatives and rural recovery efforts open avenues for SME and corporate financing, aligning with Tata Capital’s business verticals.

- A diversified borrowing mix and strong credit ratings ensure sustainable funding, supporting portfolio expansion and risk management.

- Advanced analytics and ML-powered collections help maintain low credit costs, preserving asset quality while scaling operations.

- Non-lending businesses, including wealth management and private equity, allow Tata Capital to capture new revenue streams and enhance profitability

Peer Group Comparison

| Name of the Company | Revenue

(₹ in million) |

Face value (₹) | EPS (₹) | RoNW | NAV (per share) (₹) | P/E |

| Company* | 283,127.4 | 10 | 9.3 | 9.3 | 11.2% | 79.5 |

| Bajaj Finance Limited | 696,835.1 | 1 | 26.89 | 26.82 | 17.35% | 155.6 |

| Shriram Finance Limited | 418,344.2 | 2 | 50.82 | 50.75 | 16.83% | 300.3 |

| Cholamandalam Investment and Finance Company Limited | 258,459.8 | 2 | 50.72 | 50.60 | 18.01% | 281.5 |

| L&T Finance Limited | 159,242.4 | 10 | 10.61 | 10.57 | 10.34% | 102.5 |

| Sundaram Finance Limited | 84,856.3 | 10 | 170.53 | 170.53 | 13.74% | 1,187.8 |

| HDB Financial Services Limited | 163,002.8 | 10 | 27.40 | 27.30 | 14.57% | 198.8 |

Key Strategies for Tata Capital Limited

Enhance Products and Distribution Network

Tata Capital Limited aims to continue its growth by strengthening its product offerings and distribution channels. The company is committed to introducing new and innovative products while expanding its physical branch network and digital presence to reach a wider customer base.

Strengthen Risk Management

Tata Capital Limited is focused on maintaining high asset quality by continuously strengthening its risk management framework. The company plans to refine its credit underwriting processes and collections infrastructure, using advanced analytics and data-driven insights to make informed decisions and manage risks effectively.

Leverage Technology and Data Analytics

Tata Capital Limited is dedicated to leveraging technology and data analytics across its lending value chain. The company will continue to invest in advanced technologies like AI and machine learning to enhance operational efficiency, reduce costs, improve the customer experience, and strengthen risk management.

Maintain Financial Stability and Diversify Funding

Tata Capital Limited will maintain its credit ratings and a diversified liability mix to optimize borrowing costs. The company will seek to broaden its funding sources, including long-term debt instruments, to drive business growth and profitability while ensuring prudent asset and liability management to mitigate liquidity risks.

Invest in Employee Talent

Tata Capital Limited recognizes its employees as its most valuable asset and is committed to attracting, training, and retaining top talent. The company aims to foster a culture of innovation and inclusion, offering career development programs and leadership opportunities to promote employee growth, retention, and engagement.

Harness the Merger with TMFL

Tata Capital Limited is leveraging its merger with TMFL to become a full-stack provider of vehicle finance. The company is focused on optimizing the portfolio mix, reducing borrowing costs, strengthening risk management practices, and improving asset quality to drive superior business outcomes.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Tata Capital Limited IPO

How can I apply for Tata Capital Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size and structure of the IPO?

The IPO issue size is ₹15,511.87 Cr, of which ₹6846cr is fresh issue and ₹8665.87 cr is OFS

Where will Tata Capital IPO be listed?

The IPO is proposed to be listed on the BSE and NSE mainboards.

What is the face value and price band of the IPO?

The face value is ₹10 per share; the issue price band and lot size are yet to be announced.

Who are the key managers and registrars of the IPO?

Kotak Mahindra Capital is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar