- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Technocraft Ventures IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Technocraft Ventures IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Technocraft Ventures Limited

Technocraft Ventures Ltd., established on October 21, 1998, is a public infrastructure development company specialising in turnkey Engineering, Procurement, and Construction (EPC) projects. Operating mainly in northern India, including Uttar Pradesh, Uttarakhand, Rajasthan, and Delhi, it serves state governments and government agencies. The company delivers projects across water and wastewater infrastructure, roads and highways, urban infrastructure, power distribution, and trenchless and micro-tunnelling works. With 170 full-time employees, including 76 engineers as of June 30, 2025, Technocraft is recognised for its extensive EPC capabilities and successful execution of high-value infrastructure projects

Technocraft Ventures Limited IPO Overview

Technocraft Ventures Ltd. is launching an IPO through a Book Building process for 1.19 crore equity shares, comprising a fresh issue of up to 0.95 crore shares and an Offer for Sale (OFS) of up to 0.24 crore shares. The shares are proposed to be listed on NSE and BSE. Khambatta Securities Ltd. is the book running lead manager, while Bigshare Services Pvt. Ltd. acts as the registrar. Key details such as IPO dates, price band, and lot size are yet to be announced. The IPO will raise fresh capital and provide an exit route through the OFS, increasing total shares from 3.01 crore pre-issue to 3.96 crore post-issue, with promoters including Sanjay Tyagi, Rekha Tyagi, Kartikey Tyagi, Kartikey Constructions (Partnership Firm), and Sanjay Tyagi HUF.

Technocraft Ventures Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.19 crore equity shares |

| Fresh Issue | 0.95 crore equity shares

|

| Offer for Sale (OFS) | 0.24 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,01,01,200 shares |

| Shareholding post-issue | 3,96,06,200 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Technocraft Ventures Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Technocraft Ventures Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹9.37 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 23.51% |

| Net Asset Value (NAV) | ₹39.86 |

| Return on Equity (RoE) | 23.51% |

| Return on Capital Employed (RoCE) | 22.35% |

| EBITDA Margin | 17.24% |

| PAT Margin | 10.09% |

| Debt to Equity Ratio | 0.73 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements of the Company | 1380 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

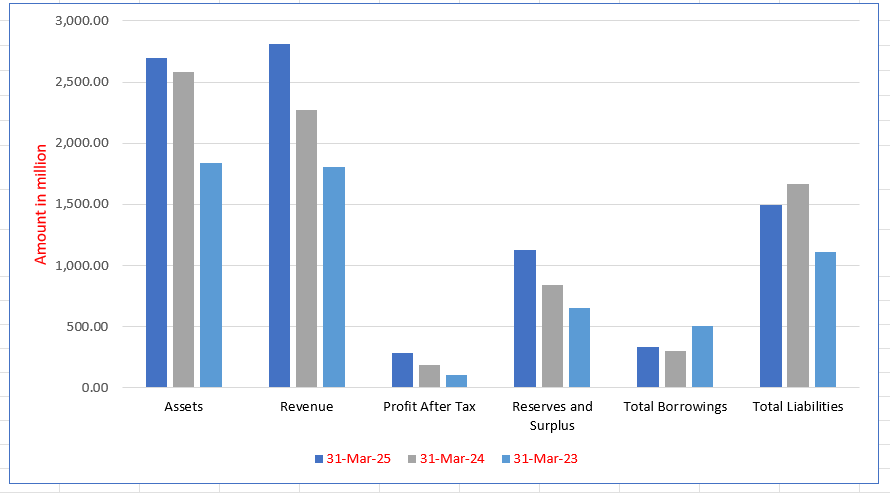

Technocraft Ventures Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,697.37 | 2,580.46 | 1,834.89 |

| Revenue | 2,810.04 | 2,272.98 | 1,805.44 |

| Profit After Tax | 282.04 | 190.54 | 108.06 |

| Reserves and Surplus | 1,124.57 | 842.53 | 652.09 |

| Total Borrowings | 334.70 | 300.81 | 508.04 |

| Total Liabilities | 1,497.55 | 1,662.68 | 1,107.55 |

Financial Status of Technocraft Ventures Limited

SWOT Analysis of Technocraft Ventures IPO

Strength and Opportunities

- Established track record in executing large-scale EPC projects.

- Strong relationships with government agencies and municipal corporations.

- Diverse project portfolio across water, wastewater, roads, urban infrastructure, and power sectors.

- Participation in government initiatives like AMRUT and Jal Jeevan Mission.

- Proven ability to secure and execute large-value projects.

- Experienced management team with over two decades in the construction industry.

- Focus on sustainable and environmentally friendly infrastructure solutions.

- Expansion opportunities in untapped regional markets.

- Growing demand for infrastructure development in line with urbanization trends.

Risks and Threats

- Concentrated order book with significant exposure to specific regions and clients.

- Working capital-intensive operations leading to high utilization of working capital limits.

- Exposure to raw material price fluctuations due to absence of price escalation clauses in contracts.

- Intense competition in the construction industry from numerous small and medium-sized players.

- Regulatory challenges and delays in project approvals affecting timelines.

- Potential delays in project execution due to logistical and operational challenges.

- Vulnerability to economic downturns affecting government spending on infrastructure.

- Risks associated with geopolitical factors impacting project locations.

- Fluctuations in interest rates affecting financing costs for projects.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Technocraft Ventures Limited

Technocraft Ventures Limited IPO Strengths

Diversified EPC Capabilities

Technocraft Ventures Limited has strong engineering, procurement, and construction (EPC) capabilities across multiple infrastructure sectors, including water supply, sewerage networks, and power systems. The company provides end-to-end project delivery, from engineering design to commissioning. This diversification allows it to undertake complex projects under major government schemes like Namami Gange and Jal Jeevan Mission.

Execution Capabilities and Financial Growth

The company demonstrates its execution capabilities through its successful completion of high-value government and multilateral projects. Its proficiency in managing large-scale, technically complex projects is reflected in its robust financial performance, with consistent growth in revenue, EBITDA, and Profit After Tax over the past three fiscal years, showcasing a strong track record of operational and financial success.

In-House Engineering and Technological Adaptation

The company’s in-house engineering team of 76 professionals provides a strong foundation for its project execution. This team integrates advanced technologies, such as micro-tunnelling and trenchless pipeline installation, to minimize disruption in urban areas. The use of digital tools and engineering software enhances precision, efficiency, and timely delivery of technically complex projects, showcasing a commitment to innovation.

Consistent Revenue Growth and Strengthening Profitability

Technocraft Ventures has shown consistent growth in revenue and profitability over the last three financial years. Revenue from operations grew from ₹1,786.91 million in FY 2023 to ₹2,795.64 million in FY 2025, a CAGR of approximately 16.09%. Profit After Tax (PAT) also increased significantly, reflecting the company’s ability to scale operations efficiently while improving its bottom line.

Regulatory-Approved Electrical Works Capabilities

The company holds ‘Class A’ Electrical Contractor’s Licenses from the Electrical Inspectorate Department of Rajasthan and Uttarakhand, which are among the highest certifications for executing high-tension (HT) and extra high-tension (EHT) electrical projects. These licenses allow the company to independently undertake critical electrical infrastructure works, such as substations and transmission lines, diversifying its revenue streams.

Promoter-Led Business

Technocraft Ventures is led by its Managing Director, Mr. Sanjay Tyagi, who has over 35 years of experience in the infrastructure sector. His extensive background in government contracting and public works has been crucial in expanding the company’s operational footprint and securing mandates under major government schemes. This promoter-led structure ensures strong execution capabilities and industry expertise.

Robust Order Book

As of June 30, 2025, Technocraft Ventures has a robust order book with 14 projects and 5 O&M projects, totaling ₹6,656.44 million and ₹201.60 million, respectively. This consistent growth in the order book is a testament to the company’s ability to successfully bid for and win new projects. The company’s strong reputation for quality and timely delivery has contributed to its continued success.

More About Technocraft Ventures Limited

Technocraft Ventures Limited is a multidisciplinary public infrastructure development company specialising in turnkey Engineering, Procurement, and Construction (EPC) projects. The company operates across multiple infrastructure segments, including wastewater treatment, operation and maintenance of public utilities, water supply schemes, electrical transmission and distribution networks, substation construction, road and highway works, micro-tunnelling, and urban development. Its projects are primarily executed for state governments and government agencies across northern India, including Uttar Pradesh, Uttarakhand, Rajasthan, and the National Capital Territory of Delhi.

Project Execution and Operations

- Tender-Based Model: Technocraft executes projects mostly under tender-based contracts awarded by state agencies, public works departments, urban local bodies, and other government entities.

- Dedicated Site Teams: The company maintains strong on-ground presence through dedicated teams aligned with each project’s geographical and technical requirements.

History and Milestones

Incorporated in 1998, Technocraft began operations in Uttar Pradesh with residential and road construction projects. Initial work on planned housing colonies, sector-level layouts, and road strengthening under PWD and National Highways programs laid the foundation for diversification into water, wastewater, and public utility infrastructure.

Key achievements include:

- 2007: Annual turnover exceeded ₹450 million.

- 2009: Entered wastewater treatment via a strategic partnership with M/s Ultratech Engineers.

- 2012–2013: Diversified into power distribution, securing contracts valued at ₹891.4 million and annual turnover crossing ₹1,000 million.

- 2016: Acquired Ultratech Engineers’ ongoing business, enhancing wastewater treatment capabilities.

- 2017: Entered multilateral-funded projects with an ADB-funded sewerage project in Udaipur.

- 2023–2025: Annual turnover reached over ₹2,700 million, with awards in AMRUT 2.0 and PWD road projects.

Core Services

Water & Wastewater Infrastructure

- EPC of water supply schemes, sewerage networks, STPs/WWTPs, reservoirs, and transmission mains

- Long-term O&M of STPs, WSSPs, and sewer networks

Roads and Highways

- EPC of road and highway projects

Urban Infrastructure

- Sector-level planning and residential buildings

Power Distribution

- Electrification schemes, substations, transmission lines

Trenchless & Micro-Tunnelling Works

- Pipeline installation in high-density zones with minimal surface disruption

Leadership

Under Managing Director Mr. Sanjay Tyagi, who joined in 2007, Technocraft strategically diversified into specialised EPC segments, strengthened technical capabilities, and expanded operations across complex government and multilateral-funded projects, ensuring high standards of project execution and long-term sustainability.

Industry Outlook

The Indian infrastructure sector is poised for robust growth, driven by substantial government investments and strategic initiatives aimed at enhancing connectivity, urban development, and sustainability. The sector encompasses various domains, including road construction, wastewater treatment, power distribution, and urban infrastructure development.

Key Market Segments

Roads and Highways

- Market Size & Growth: Valued at USD 152.19 billion in 2024, the road construction market is projected to reach USD 341.31 billion by 2033, reflecting a CAGR of 10.20% .

- Government Initiatives: The Bharatmala Pariyojana program aims to construct 83,677 kilometers of roads by 2025, addressing critical connectivity gaps and promoting regional economic growth .

Water and Wastewater Treatment

- Market Size & Growth: The wastewater treatment market was valued at USD 5.141 billion in 2022, with expectations of continued growth driven by urbanization and industrialization .

- Regulatory Support: Government-backed programs emphasize wastewater treatment, sewage management, and the rejuvenation of water bodies, further supporting market expansion .

Power Distribution

- Market Dynamics: The power distribution sector is experiencing significant investments to enhance grid infrastructure and meet the growing energy demands of urban and rural areas.

- Future Outlook: Continued investments in renewable energy sources and smart grid technologies are expected to drive the sector’s growth.

Urban Infrastructure

- Market Trends: There’s a growing emphasis on sustainable urban development, with investments in smart cities, public transportation, and green building initiatives.

- Growth Drivers: Urbanization, increased disposable incomes, and government policies promoting sustainable development are key factors propelling this segment.

Growth Drivers

- Government Investments: Substantial allocations in national budgets for infrastructure development.

- Urbanization: Rapid urban growth necessitating enhanced infrastructure.

- Private Sector Participation: Increased involvement through public-private partnerships.

- Technological Advancements: Adoption of smart infrastructure solutions and sustainable practices.

How Will Technocraft Ventures Limited Benefit

- Technocraft Ventures Limited can leverage the expanding road construction market, securing large-scale EPC contracts under programs like Bharatmala Pariyojana.

- Growth in wastewater treatment and government-backed urban water projects offers opportunities for new contracts and long-term O&M engagements.

- Increasing power distribution investments allow the company to expand its electrification and substation projects, particularly in northern India.

- The focus on urban infrastructure and smart city initiatives enables Technocraft to undertake sector-level planning and residential development projects.

- Rising government funding and public-private partnership models provide a stable pipeline of tender-based projects, ensuring consistent revenue streams.

- Adoption of technological advancements and sustainable infrastructure practices aligns with the company’s integrated EPC capabilities, enhancing project efficiency and competitiveness.

- Multilateral-funded projects and regulatory support offer the potential to participate in complex, high-value contracts, strengthening technical expertise and market reputation.

- Overall, the sector’s growth drivers position Technocraft to scale operations, diversify services, and achieve sustained financial growth.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ million) | EPS (₹) | NAV (₹) | P/E Ratio | RoNW (%) |

| Technocraft Ventures Limited* | 10 | 2,795.64 | 9.37 | 39.86 | [●] | 23.51 |

| Peer group | ||||||

| EMS Limited | 106 | 9,658.32 | 33.05 | 175.70 | 18.15 | 18.84 |

| VA Tech Wabag Limited | 216 | 32,940.00 | 47.48 | 345.15 | 32.19 | 13.78 |

| Enviro Infra Engineers Limited | 10 | 10,660.56 | 11.76 | 56.66 | 20.87 | 17.81 |

| Denta Water and Infra Solutions Limited | 10 | 2,032.85 | 25.83 | 153.10 | 11.85 | 12.94 |

Key Strategies for Technocraft Ventures Limited

Strategic Expansion of Project Scale

Technocraft Ventures Limited plans to expand the scale of its infrastructure projects, focusing on high-capacity water and wastewater treatment plants. By targeting larger projects, the company aims to reduce competition, enhance profit margins, and improve its pre-qualification status. This strategy aligns with the Indian government’s increasing investment in major infrastructure schemes.

Expanding Geographic Presence

The company intends to expand its geographic footprint beyond its established presence in Northern India. Technocraft Ventures is targeting high-potential states such as Madhya Pradesh, Chhattisgarh, Bihar, Jharkhand, and Odisha. This strategic expansion aims to capitalize on increasing infrastructure demand and mitigate regional risks, ensuring a more resilient and diversified business model.

On-site Renewable Energy Generation

Technocraft Ventures is integrating renewable energy, particularly solar power, into its projects to enhance environmental sustainability and operational efficiency. By installing solar panels at sites, the company aims to reduce dependence on external power grids and lower costs. This initiative aligns with India’s clean energy mandates and positions the company as a responsible infrastructure developer.

Capitalize on Government Initiatives

The company plans to capitalize on key government policy initiatives aimed at addressing urbanization challenges, such as the need for clean water and efficient wastewater management. Technocraft Ventures is actively participating in programs like the Jal Jeevan Mission and AMRUT, leveraging its expertise in STPs and sewerage systems to contribute to national infrastructure development.

Strategic Diversification into High-Growth Sectors

Technocraft Ventures intends to diversify into high-growth sectors that complement its core EPC capabilities. The company is exploring opportunities in renewable energy, solid waste management, and satellite city development. This strategic diversification aligns with national infrastructure goals and is expected to enhance long-term growth by reducing project-specific risks and expanding its service offerings.

Enhancing Core Strengths

The company believes its ability to execute projects effectively is crucial for its continued success. Technocraft Ventures is committed to attracting, retaining, and training qualified personnel. The company provides its staff with continuous training in the latest techniques and technologies, ensuring high-quality workmanship, timely project completion, and a strong competitive edge in the industry.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Technocraft Ventures Limited IPO

How can I apply for Technocraft Ventures Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of Technocraft Ventures IPO?

The IPO comprises 1.19 crore shares, including 0.95 crore fresh issue and 0.24 crore offer for sale.

Where will Technocraft Ventures shares be listed?

The shares are proposed to list on the NSE and BSE mainboards post-IPO.

Who are the lead managers and registrar of the IPO?

Khambatta Securities Ltd. is the lead manager and Bigshare Services Pvt. Ltd. is the registrar.

What is the face value and price band of the IPO?

Face value is ₹10 per share; the issue price band and lot size are yet to be announced.

What will the IPO proceeds be used for?

Funds will primarily support the company’s working capital requirements and general corporate purposes.