- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Tempsens Instruments IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Tempsens Instruments IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Tempsens Instruments India Limited

Incorporated in 1990, Tempsens Instruments (India) Limited is a leading thermal engineering and specialised cable manufacturer, offering customised temperature sensing and electrical heating solutions. The company holds around a 10% market share in India’s temperature sensor segment by revenue as of March 31, 2025. Its diverse portfolio includes temperature sensing solutions such as thermocouples, RTDs, infrared pyrometers, and furnace monitoring cameras; electrical heating solutions including immersion, process, and cartridge heaters; and specialised cables like control, power, instrumentation, and thermocouple cables.

Tempsens Instruments India Limited IPO Overview

Tempsens Instruments (India) Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, proposing to raise capital through an Initial Public Offer (IPO). The IPO is structured as a Book Build Issue, comprising a fresh issue worth ₹118.00 crores and an offer for sale (OFS) of up to 1.79 crore equity shares. The company plans to list its equity shares on both the NSE and BSE. ICICI Securities Ltd. has been appointed as the Book Running Lead Manager, while Kfin Technologies Ltd. will serve as the registrar for the issue. Key details such as IPO opening and closing dates, price band, and lot size are yet to be announced.

According to the DRHP, the face value of each share is ₹4, and the issue type will be a Bookbuilding IPO. The sale will include a combination of fresh capital and an offer for sale. Before the issue, the company has a total of 8,06,66,025 equity shares. The IPO filing with SEBI took place on September 29, 2025. The promoters of Tempsens Instruments (India) Ltd. are Virendra Prakash Rathi, Vinay Rathi, and Pratap Singh Talesara, who collectively hold 82% of the company’s shares prior to the issue. Details regarding the post-issue promoter shareholding will be disclosed later. For comprehensive information, investors can refer to the Tempsens Instruments (India) Ltd. IPO DRHP.

Tempsens Instruments India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹118 crore |

| Offer for Sale (OFS) | 1.79 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹4 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,06,66,025 shares |

| Shareholding post-issue | TBA |

Tempsens Instruments IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Tempsens Instruments India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Tempsens Instruments India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹7.51 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 14.06% |

| Net Asset Value (NAV) | ₹53.33 |

| Return on Equity (RoE) | 14.08% |

| Return on Capital Employed (RoCE) | 23.08% |

| EBITDA Margin | 25.45% |

| PAT Margin | 16.36% |

| Debt to Equity Ratio | 0.16 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding certain capital expenditure of the Company towards the (i) electrical heating solutions; and (ii) specialized cable solutions | |

| Pre-payment or scheduled re-payment, in full or in part, of certain outstanding borrowings availed by the Company | |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

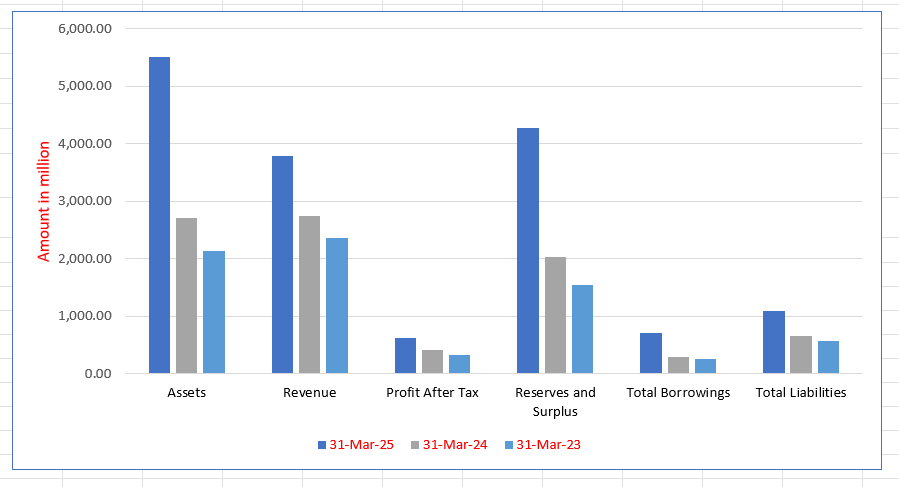

Tempsens Instruments India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,512.82 | 2,711.44 | 2,136.10 |

| Revenue | 3,785.26 | 2,748.10 | 2,369.43 |

| Profit After Tax | 625.55 | 409.19 | 332.33 |

| Reserves and Surplus | 4,272.45 | 2,029.76 | 1,548.78 |

| Total Borrowings | 718.35 | 301.31 | 264.52 |

| Total Liabilities | 1,096.03 | 663.39 | 568.83 |

Financial Status of Tempsens Instruments India Limited

SWOT Analysis of Tempsens Instruments IPO

Strength and Opportunities

- Strong backward-integrated manufacturing capability controlling processes from alloy melting to calibration.

- Established global footprint with manufacturing units in India and abroad, exporting to over 75 countries.

- Comprehensive product portfolio across temperature sensing, electrical heating, and specialised cables.

- Serves diverse industries including metal, petrochemical, defence, power, and glass sectors.

- Strong brand credibility supported by multiple certifications for industrial applications.

- Opportunity to benefit from “Make in India” initiatives promoting domestic manufacturing.

- Rising demand for sensors, heating solutions, and specialised cables driven by Industry 4.0 and automation.

- Expansion potential in emerging markets through strategic partnerships and joint ventures.

- Increasing replacement and aftermarket demand from heavy-industry customers.

Risks and Threats

- High working capital intensity due to long receivables and inventories.

- Intense competition in export markets with relatively low entry barriers.

- Exposure to raw-material cost fluctuations that can impact profit margins.

- Dependence on cyclical industries such as steel, cement, and oil & gas.

- Moderate export growth limited by local presence requirements in foreign markets.

- Regulatory and compliance risks across multiple product categories and geographies.

- Threat from low-cost imports and substitute products affecting pricing power.

- Scalability challenges if expansion or acquisitions are financed through high leverage.

- Customer concentration risk as top clients contribute a major portion of revenue.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Tempsens Instruments India Limited

Tempsens Instruments India Limited IPO Strengths

Market Leadership and Indigenisation Focus

Tempsens Instruments India Limited is the largest manufacturer of both contact and non-contact temperature sensors in India by revenue, holding approximately a 10% market share in the temperature sensor segment for Fiscal 2025 (Source: F&S Report). The company is also a top manufacturer of electrical heaters, with a strong focus on indigenisation creating high market entry barriers.

Extensive Customized Thermal Solutions

The company offers one of the most extensive portfolios of customized thermal engineering solutions in India and globally (Source: F&S Report). Each product is niche and custom-built on a make-to-order basis, requiring detailed engineering and design. This rigorous approach is crucial for complex, critical industrial applications, supporting high customer retention.

High Entry Barriers from Strict Certifications

Obtaining product certifications for Tempsens’ specialised and high-stakes engineered products involves strict criteria and extended qualification periods (Source: F&S Report). These demanding approval processes, including in-depth testing and field trials, create high entry barriers for prospective competitors. This enhances customer loyalty and creates cross-selling opportunities.

Diversified Business Model and Global Reach

Tempsens operates a resilient, diversified model across temperature sensing, electrical heating, and specialised cables, with a balanced revenue mix between Project/OEM (69.16% in Fiscal 2025) and MRO (30.84% in Fiscal 2025) business. The company has an extensive export footprint, with sales to over 75 countries, mitigating sectoral and regional risk.

Established R&D and Integrated Operations

The company maintains a strong R&D focus, supported by a dedicated team of 59 employees as of March 31, 2025, enabling customised, critical solutions. Operations feature backward integration for full production control and digital traceability for rigorous quality assurance. This integrated setup provides a significant competitive advantage.

Experienced, Multi-Generational Leadership

Tempsens is led by a multi-generational team including its Promoters and supported by an experienced management team. Key managerial personnel and Senior Management have an average association of 15 years, as of March 31, 2025. This continuity in vision and deep industry expertise drives long-term business growth.

More About Tempsens Instruments India Limited

Founded in 1990, Tempsens Instruments (India) Limited stands as one of India’s foremost thermal engineering and specialised cable manufacturers. The company focuses on designing and producing customised temperature sensing and electrical heating solutions, along with specialised cables. Each product is tailored to meet unique technical requirements across industries. Backed by strong technical expertise and customer collaboration, Tempsens effectively addresses complex thermal management and cable challenges while ensuring timely, high-quality delivery through its robust sales and operations teams.

Industry Leadership

According to the F&S Report, Tempsens is India’s largest manufacturer of contact and non-contact temperature sensors by revenue, holding around a 10% market share in the temperature sensor segment as of March 31, 2025. It is also the only Indian manufacturer of non-contact temperature sensors with an 18% market share, reflecting its technological leadership. The company has successfully indigenised non-contact sensor development, reducing dependence on foreign suppliers. Tempsens is among the few Indian manufacturers offering advanced conductor solutions and ranks among India’s largest producers of electrical heaters and fibre optic temperature sensors.

Diverse Product Portfolio

Tempsens’ offerings are categorised under three verticals:

- Temperature Sensing Solutions: Include thermocouples, resistance temperature detectors (RTDs), infrared pyrometers, furnace monitoring cameras, temperature gauges, fibre optic sensors, and calibrators. These ensure process stability, safety, and precision in industries like steel, power, defence, and pharmaceuticals.

- Electrical Heating Solutions: Comprise immersion, process, tubular, cartridge, and flexible heaters designed to maintain accurate heating in critical sectors such as oil and gas, energy, and aerospace.

- Specialised Cables: Encompass low-voltage, instrumentation, thermocouple, and nickel-alloy cables engineered for reliable performance in harsh industrial conditions.

Business Model and Market Reach

Tempsens’ two-pronged approach combines Project/OEM and MRO (Maintenance, Repair, and Operations) segments—balancing long-term project orders with stable recurring business. With a customer base exceeding 345 clients across 75 countries, the company has diversified its revenue streams and reduced dependence on any single sector or customer. Supported by 11 manufacturing units worldwide and a strong R&D framework, Tempsens continues to drive innovation, maintain quality, and expand its global presence through joint ventures and acquisitions.

Industry Outlook

India’s temperature sensing, electrical heating, and specialised cable industry is set for steady expansion, driven by rapid industrialisation, automation, and infrastructure development. For companies like Tempsens Instruments (India) Limited, operating across these verticals, the market offers strong long-term growth potential.

Temperature Sensing & Instrumentation

- The Indian industrial sensors and transmitters market is valued at around USD 1.39 billion in 2025 and is projected to reach approximately USD 2.18 billion by 2030, growing at a CAGR of 9.3%.

- Globally, the temperature sensors market is expected to expand from USD 6.72 billion in 2023 to nearly USD 10 billion by 2030, at a CAGR of about 6%.

- Key drivers include the adoption of Industry 4.0 technologies, predictive maintenance systems, and higher automation in industries such as metals, power, oil and gas, glass, and defence.

Specialised Cables & Wires

- The Indian wires and cables industry, valued at USD 9.3 billion in 2024, is projected to grow to around USD 17 billion by 2032, registering a CAGR of 7.9–9%.

- Expansion in renewable energy, smart grid infrastructure, and electrification initiatives are major growth enablers.

- Rising demand for high-performance instrumentation and thermocouple cables across manufacturing and process industries further fuels sector growth.

Electrical Heating & Thermal Solutions

- Demand for electrical heating systems is increasing across oil and gas, petrochemical, defence, and process manufacturing industries.

- Growth is supported by industrial modernisation, decarbonisation efforts, and energy-efficient heating requirements.

- Integration of smart sensors and automation in thermal systems enhances precision and process efficiency.

Key Growth Drivers

- “Make in India” initiatives encouraging local production of sensors, heaters, and cables.

- Rapid infrastructure growth across steel, power, defence, and aerospace sectors.

- Increasing export potential backed by global certifications and quality compliance.

- Rising automation and digital monitoring creating demand for advanced thermal management systems.

Outlook Summary

Overall, the industry segments served by Tempsens are projected to grow at 8–9% CAGR over the next five years. With India becoming a manufacturing hub for advanced sensing and thermal technologies, the company operates in a sector poised for sustained expansion driven by industrial automation, localisation, and innovation.

How Will Tempsens Instruments India Limited Benefit

- Tempsens Instruments (India) Limited is well-positioned to capitalise on the rapid growth of India’s temperature sensing and specialised cable markets, both projected to expand at 8–9% CAGR.

- Its strong expertise in thermal engineering and in-house manufacturing enables it to meet rising domestic and global demand for precision temperature and heating solutions.

- The company’s established presence across metals, power, and defence sectors aligns with India’s infrastructure and industrial automation boom.

- Increasing adoption of Industry 4.0 and predictive maintenance systems enhances demand for Tempsens’ advanced sensors and monitoring instruments.

- Expansion of renewable and smart grid projects drives need for high-performance instrumentation and thermocouple cables.

- Government support through “Make in India” promotes local sourcing, reducing dependence on imports and improving margins.

- Growing export opportunities and global certifications strengthen Tempsens’ competitive edge in international markets.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Tempsens Instruments India Limited

Accelerate Product Commercialisation

The company leverages its R&D expertise and strategic technological partnerships, such as the Pyrosens-Micro-Epsilon joint venture, to accelerate the launch of new, commercially viable solutions. Key focus areas include new pyrometers, fibre optic sensors, and solutions for high-growth sectors like battery energy storage and green hydrogen.

Scale Established Product Lines

Tempsens aims to scale and optimise its established core product lines, including process heating, conductor solutions, and infrared technology. The strategy involves expanding production capacity, automating key manufacturing processes, and strengthening global distribution to capitalise on surging market demand, particularly for electric heaters.

Global Expansion and Export Growth

The company’s strategy is to enhance its global footprint by increasing export sales and establishing a stronger presence in key international markets, including Europe and North America. This involves pursuing long-term contracts, obtaining international certifications, and leveraging a network of subsidiaries and joint ventures.

Organic and Inorganic Growth

Tempsens pursues a balanced growth strategy of organic expansion and disciplined inorganic initiatives. Organically, it optimises operations and broadens its portfolio. Inorganically, it seeks mergers, acquisitions, and technology-focused joint ventures to extend its geographic reach and access new client segments globally.

Optimise Efficiency and Capacity

The company is committed to improving operational efficiency and strategically expanding its manufacturing capacity for specialized cable and electrical heating solutions. This is achieved through process optimisation, adopting advanced technologies, and deepening its backward integration to ensure cost-efficient operations and higher product consistency.

Expand Recurring MRO Business

Tempsens focuses on expanding its MRO (Maintenance, Repair, and Operations) business and further diversifying its industry presence. This strategic shift aims to create stable, annuity-style revenue streams by targeting recurring demand for replacement products in core sectors like metals, power, and petrochemicals, enhancing business resilience.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Tempsens Instruments India Limited IPO

How can I apply for Tempsens Instruments India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Tempsens Instruments (India) Limited IPO?

Tempsens Instruments (India) Limited is launching an IPO through a book-built issue comprising fresh shares and an offer for sale.

How much will Tempsens Instruments (India) Limited raise through its IPO?

The company aims to raise ₹118 crore through a fresh issue along with an offer for sale of 1.79 crore shares.

On which exchanges will Tempsens Instruments (India) Limited be listed?

The equity shares of Tempsens Instruments (India) Limited are proposed to be listed on both NSE and BSE.

Who are the lead manager and registrar for the Tempsens Instruments (India) Limited IPO?

ICICI Securities Limited is the book-running lead manager, and Kfin Technologies Limited is the registrar to the issue.

How will the IPO proceeds be utilised by Tempsens Instruments (India) Limited?

Proceeds will fund capital expenditure, repayment of borrowings, and support general corporate purposes.