- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Tenneco Clean Air India IPO

IPO Details

12 Nov 25

14 Nov 25

₹13,986

37

₹378 to ₹397

NSE, BSE

₹3,600 Cr

19 Nov 25

Tenneco Clean Air India IPO Timeline

Bidding Start

12 Nov 25

Bidding Ends

14 Nov 25

Allotment Finalisation

17 Nov 25

Refund Initiation

18 Nov 25

Demat Transfer

18 Nov 25

Listing

19 Nov 25

Tenneco Clean Air India Limited

Tenneco Clean Air India Limited, a subsidiary of global leader Tenneco Inc., specialises in designing and manufacturing emission control technologies for light and commercial vehicles. Operating under the Clean Air division, it provides catalytic converters, diesel particulate filters, mufflers, and exhaust pipes, enabling OEMs to meet Bharat Stage VI norms. With 12 strategically located manufacturing facilities across seven states and one union territory, the company supports OEMs and Tier 1 customers, emphasising sustainability, innovation, and regulatory compliance through advanced R&D and engineering capabilities.

Tenneco Clean Air India Limited IPO Overview

The Tenneco Clean Air IPO is a book-built issue worth ₹3,600 crore, comprising an offer for sale of 9.07 crore shares. The subscription for the IPO opens on November 12, 2025, and closes on November 14, 2025. The basis of allotment is expected to be finalised on November 17, 2025, while the shares are scheduled to be listed on the BSE and NSE on November 19, 2025.

The price band for the IPO is fixed between ₹378 and ₹397 per share, with a lot size of 37 shares. For retail investors, the minimum investment stands at ₹14,689 for one lot at the upper price band. The small HNI (sNII) category requires a minimum application of 14 lots (518 shares) worth ₹2,05,646, while the big HNI (bNII) category begins with 69 lots (2,553 shares) amounting to ₹10,13,541. JM Financial Ltd. serves as the book running lead manager, and MUFG Intime India Pvt. Ltd. acts as the registrar for the issue.

Tenneco Clean Air India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹3600 crore |

| Fresh Issue | NA |

| Offer for Sale (OFS) | ₹3600 crore |

| IPO Dates | 12 November 2025 to 14 November 2025 |

| Price Bands | ₹378 to ₹397 |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 40,36,04,309 shares |

| Shareholding post -issue | 40,36,04,309 shares |

Tenneco Clean Air India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 37 | ₹14,689 |

| Retail (Max) | 13 | 481 | ₹1,90,957 |

| S-HNI (Min) | 14 | 518 | ₹2,05,646 |

| S-HNI (Max) | 68 | 2,516 | ₹9,98,852 |

| B-HNI (Min) | 69 | 2,553 | ₹10,13,541 |

Tenneco Clean Air India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Tenneco Clean Air India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹13.68 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 46.65% |

| Net Asset Value (NAV) | ₹31.10 |

| Return on Equity (RoE) | 42.65% |

| Return on Capital Employed (RoCE) | 56.78% |

| EBITDA Margin | 16.67% |

| PAT Margin | 11.31% |

| Debt to Equity Ratio | 0.17 |

Objectives of the IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

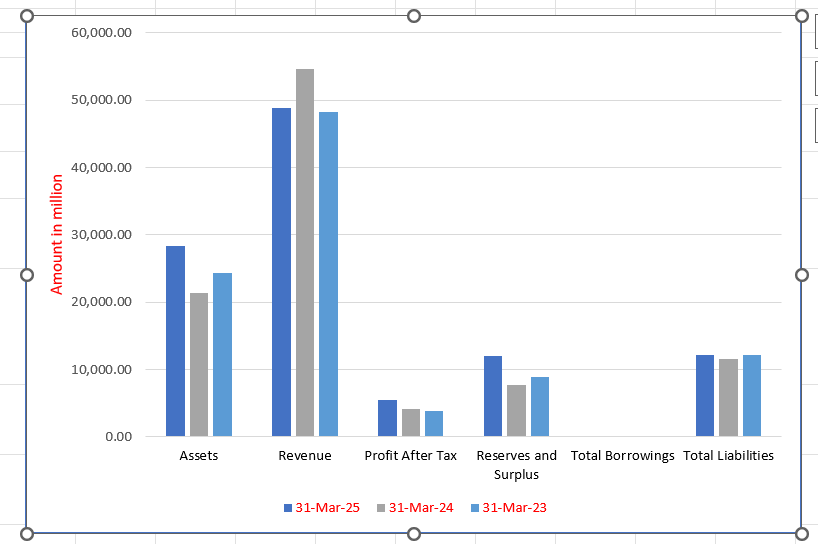

Tenneco Clean Air India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 28,315.84 | 21,362.62 | 24,296.49 |

| Revenue | 48,904.30 | 54,676.12 | 48,273.68 |

| Profit After Tax | 5,531.43 | 4,167.87 | 3,810.43 |

| Reserves and Surplus | 12,063.66 | 7,659.33 | 8,946.29 |

| Total Borrowings | – | – | 139.72 |

| Total Liabilities | 12,192.17 | 11,549.15 | 12,201.95 |

Financial Status of Tenneco Clean Air India Limited

SWOT Analysis of Tenneco Clean Air India IPO

Strength and Opportunities

- Strong brand recognition in emission control systems.

- Advanced aftertreatment technologies meeting global emission standards

- Integration with Tenneco's global R&D initiatives

- Strategic partnerships with original equipment manufacturers (OEMs)

- Diverse product portfolio catering to various vehicle segments

- Expansion into emerging markets with growing automotive sectors

- Commitment to sustainability and environmental responsibility

- Investment in energy recycling technologies to enhance vehicle efficiency

- Focus on innovation to stay ahead in the competitive market.

Risks and Threats

- High capital expenditure for R&D and manufacturing

- Exposure to fluctuations in automotive industry demand

- Regulatory compliance challenges across diverse markets

- Intense competition from local and international players

- Vulnerability to supply chain disruptions

- Dependence on the performance of the parent company's other divisions

- Potential impact of global economic downturns on sales

- Risks associated with technological obsolescence

- Challenges in adapting to rapidly changing automotive trends.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Tenneco Clean Air India Limited

Tenneco Clean Air India Limited IPO Strengths

Market Leadership and Strong Customer Relationships

Tenneco Clean Air India Limited holds a commanding market position as a leading supplier of automotive components in India. The company leads the market in shock absorbers and struts for passenger vehicles and holds significant market share for clean air solutions in various segments. Its strong, long-standing relationships with 119 diverse customers, including all top OEMs, enable sustained growth.

Strategic Portfolio and Diversified Revenue Streams

The company’s strategically diversified portfolio includes proprietary products and solutions for multiple industry sub-segments, such as exhaust aftertreatment systems, bearings, and advanced suspension systems. By also generating revenue from the aftermarket and exports, the company effectively mitigates risks from domestic automotive downturns and ensures stable financial performance.

Innovation Driven by Global R&D Collaboration

Tenneco Clean Air India Limited maintains an innovation-focused approach by leveraging its two R&D technical centers in India and the extensive global R&D initiatives of the Tenneco Group. This enables the company to develop and localize proprietary, customized, and cost-effective products, such as BS6-compliant solutions and India’s first electronic suspension system for Mahindra.

Flexible and Automated Manufacturing with a Localized Supply Chain

The company’s robust manufacturing footprint consists of 12 strategically located plants across India, supported by a highly localized supply chain. These facilities incorporate advanced automation, robotics, and quality control systems to ensure high efficiency, product quality, and a defect rate of less than two parts per million.

Strong Financial Performance

Tenneco Clean Air India Limited has demonstrated strong financial performance with consistent growth and improved margins. In Fiscal 2025, the company achieved a profit of ₹5,531.43 million, a CAGR of 20.48% over three years. Its financial metrics, including a superior return on equity and return on capital employed, outperform the peer average.

Experienced Leadership and Skilled Workforce

The company is guided by a qualified and experienced board of directors and a professional management team with decades of industry expertise. The leadership is supported by a dedicated and technically qualified workforce, which receives continuous training to stay updated with the latest manufacturing technologies, ensuring continuity and excellence in operations.

More About Tenneco Clean Air India Limited

Tenneco Clean Air India Limited is part of the Tenneco Group, a U.S.-headquartered global Tier I automotive component supplier. The Tenneco Group reported revenue of US$16,777 million in 2024 (Source: CRISIL). Established in 1979 at Parwanoo, India, the company designs, manufactures, and supplies technology-intensive Clean Air, Powertrain, and Advanced Ride Technologies solutions for both domestic and export markets.

Business Divisions

Clean Air & Powertrain Solutions:

- Clean Air Solutions: Exhaust after-treatment systems, including catalytic converters, mufflers, and exhaust pipes.

- Powertrain Solutions: Engine bearings, sealing systems, spark plugs, and ignition coils under the Champion brand.

Advanced Ride Technologies:

- Shock absorbers, struts, and suspension systems under the Monroe brand for ICE and electric vehicles.

Market Position

- Largest Clean Air supplier to Indian commercial truck OEMs (60% market share).

- Among top two suppliers to Indian off-highway OEMs (42% share).

- Top four supplier to passenger vehicle OEMs (20% share).

- Largest supplier of shock absorbers/struts to Indian PV OEMs (48% share).

Manufacturing & R&D

Tenneco Clean Air India operates 12 manufacturing facilities across seven states and one union territory, including seven Clean Air & Powertrain and five Advanced Ride Technologies plants. Facilities feature process automation, robotic welding, and adhere to IATF 16949, ISO 45001, and ISO 14001 standards.

The company runs two R&D technical centers in India, collaborating with 39 global Tenneco engineering centers to develop localized, cost-efficient solutions. Notable innovations include BS6-compliant products and advanced hydraulic rebound systems.

Customers & Partnerships

In Fiscal 2025, Tenneco served 119 customers, including all top seven PV and top five CT OEMs in India. Long-standing relationships average 19.2 years with top 10 customers, ensuring strong customer stickiness and program continuity.

Performance & Recognition

Fiscal 2025 highlights include revenue of ₹48,904.30 million, VAR of ₹43,801.21 million, EBITDA margin of 16.67%, PAT margin of 11.31%, and ROCE of 56.78%. The company has received numerous awards from global OEMs for innovation, quality, and operational excellence, reflecting its commitment to high standards.

Supply Chain & Sustainability

Tenneco Clean Air India maintains a localized, efficient supply chain with over 91% of raw materials sourced domestically, leveraging global procurement practices, just-in-time planning, and shared manufacturing assets to optimize cost and responsiveness.

Industry Outlook

Market Size & Growth Trends

The Indian automotive component industry reached a turnover of ₹6.73 lakh crore (approximately $80.2 billion) in FY2025, registering a 9.6% year-on-year growth. Over the past five years, the industry has nearly doubled in size, reflecting a compound annual growth rate (CAGR) of 14%. Looking ahead, the sector is expected to grow at a CAGR of 7–9% in FY2026, supported by continued demand from two-wheelers and passenger vehicles.

Key Growth Drivers

- Domestic Demand: Rising middle-class incomes and increasing vehicle ownership are boosting domestic sales.

- Export Growth: Exports reached nearly $23 billion in FY2025, reflecting India’s growing competitiveness in global markets.

- Technological Advancements: Adoption of smart manufacturing, electric vehicle components, and advanced driver assistance systems (ADAS) is driving innovation.

- Policy Support: Government initiatives such as the Automotive Mission Plan and Free Trade Agreements provide incentives and support industry expansion.

Sectoral Highlights

- Two-Wheelers & Passenger Vehicles: These segments account for nearly half of the industry’s revenue, with strong demand for utility and passenger vehicles.

- Commercial Vehicles & Tractors: Moderate growth in these segments (~17% share) supports steady industry expansion.

- Electric Vehicle Components: Growing EV adoption is encouraging domestic production of critical components like rare earth magnets.

How Will Tenneco Clean Air India Limited Benefit

- Tenneco Clean Air India Limited will benefit from rising domestic vehicle demand, expanding its Clean Air and Powertrain solutions sales.

- Strong export growth positions the company to supply global markets with technology-intensive components.

- Technological advancements, including EV adoption and advanced suspension systems, create new opportunities for Advanced Ride Technologies.

- Long-standing relationships with top OEMs ensure continued program awards and customer stickiness.

- Localized manufacturing and R&D enable cost-efficient production and faster time-to-market for BS6-compliant and EV-ready products.

- High market shares in commercial trucks, off-highway vehicles, and passenger vehicles strengthen competitive positioning.

- Efficient supply chain management and domestic sourcing optimize costs and improve responsiveness to changing market demand.

- Recognition for quality, innovation, and operational excellence enhances brand credibility and supports long-term partnerships.

- Integration with Tenneco Group’s global R&D and technical resources accelerates innovation and product development for Indian and export markets.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue

(₹ million) |

EPS (₹) | NAV (₹) | PE Ration | RoNW (%) |

| Tenneco Clean Air India Limited | 10 | 48,904.30 | 13.68 | 31.10 | [•]## | 46.65% |

| Peer Groups | ||||||

| Bosch Ltd | 103 | 1,80,874.00 | 683.25 | 4,683.48 | 46.21 | 15.56% |

| Timken India Ltd | 10 | 31,478.10 | 59.48 | 378.21 | 54.61 | 17.00% |

| SKF India Ltd | 10 | 49,199.00 | 114.50 | 525.50 | 40.20 | 21.43% |

| ZF Commercial Vehicle Control System India Ltd | 51 | 38,309.63 | 242.90 | 1,694.75 | 53.71 | 15.35% |

| Sharda Motor Industries Ltd | 2 | 28,365.71 | 109.71 | 369.92 | 16.92 | 30.46% |

| Gabriel India Ltd | 15 | 40,633.81 | 17.05 | 82.38 | 34.73 | 22.42% |

| Uno Minda Ltd | 2 | 1,67,746.10 | 16.42 (Basic) / 16.37 (Diluted) | 99.75 | 64.51 | 17.66% |

| Sona BLW Precision Forgings Ltd | 10 | 35,460.21 | 9.92 | 288.38 | 48.12 | 14.76% |

Key Strategies for Tenneco Clean Air India Limited

Capturing Market Opportunities from Stricter Emission Standards

Tenneco Clean Air India Limited leverages tightening global and Indian emission regulations, including BS7, CAFE, TREM V, and CPCB standards. By engaging OEMs early and adapting global technologies to local requirements, the company aims to increase demand, enhance CPV, and strengthen its Clean Air Solutions market position.

Capitalising on Premiumisation, SUVs, EVs, and Hybrids

The company targets opportunities from rising premium vehicle, SUV, EV, and hybrid sales, delivering high-performance engines and modular exhaust systems. Advanced technologies optimise efficiency, weight, and emissions compliance, while suspension innovations and adaptive solutions enhance ride quality, addressing evolving customer preferences and increasing CPV.

Enhancing Competitiveness through Strategic Localisation

Tenneco Clean Air India Limited focuses on localising global products, reducing logistics costs, import duties, and supply chain risks. By manufacturing critical Advanced Ride Technologies components, IROX bearings, and ceramic spark plugs locally, the company improves margins, expands OEM share of wallet, and captures growth in under-penetrated markets.

Positioning India as a Global Export Hub

The company leverages India’s cost advantages, strategic location, and manufacturing capabilities to serve global Tenneco Group and third-party OEM customers. By exporting high-quality components, enhancing vertical integration, and exploring new adjacent products, Tenneco aims to increase export revenues while maintaining global quality standards.

Focus on R&D and Innovation

Tenneco Clean Air India Limited invests in R&D to develop advanced Clean Air, Powertrain, and suspension technologies. The company addresses regulatory trends, premiumisation, hybridisation, and alternative fuels, adapting global innovations to local needs, improving fuel efficiency, emissions reduction, and driving market differentiation through cutting-edge products.

Leveraging Cross-Divisional Efficiencies and Opportunities

By consolidating Clean Air, Powertrain, and Advanced Ride Technologies divisions, Tenneco maximises cross-selling opportunities, utilises shared suppliers, standardised processes, and P3/OSE methodologies. The company targets unserved programs, expands customer relationships, and drives revenue growth while maintaining operational efficiency and competitive pricing across business lines.

Enhancing Operational Efficiencies for Sustained Profitability

Tenneco Clean Air India Limited focuses on cost optimisation across materials, manufacturing, labour, and indirect functions. Through P3 operating systems, inventory optimisation, vendor-managed models, and strategic supplier partnerships, the company improves margins, cash flow, and production capacity while supporting growth aligned with technological advancements.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Tenneco Clean Air India Limited IPO

How can I apply for Tenneco Clean Air India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of Tenneco Clean Air India IPO?

The IPO is a Book Build Offer for sale, aggregating up to ₹3,600 crores.

Where will Tenneco Clean Air India shares be listed?

The equity shares are proposed to be listed on NSE and BSE on 19 November 2025

Who are the lead managers and registrar for the IPO?

JM Financial Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

What is the shareholding pattern before and after the IPO?

Pre-IPO promoter holding is 100%, with 40,36,04,309 shares; post-IPO dilution is yet to be determined.

How is the IPO quota divided among investors?

QIBs: max 50%, Retail: min 35%, Non-Institutional Investors: min 15% of the offer.