- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

The stock market ecosystem

By HDFC SKY | Updated at: May 13, 2025 05:04 PM IST

Summary

As you know by now, a stock market is a place where you can buy or sell stocks of a public company (a company that has been listed on any stock exchange). But how does the stock market work?

Like any other market, the stock market has multiple participants with specific roles to ensure its smooth functioning. This includes regulators, traders, and financial intermediaries, among others. Let’s look at how all the participants work in tandem to make the market efficient.

The equity market in India comprises two big exchanges – BSE (formerly Bombay Stock Exchange) and the National Stock Exchange (NSE). As discussed earlier, BSE’s benchmark S&P BSE Sensex index tracks 30 stocks while the NSE’s benchmark index CNX Nifty tracks 50 stocks. Investors have the option to invest in stocks through either of the exchanges. BSE and NSE also have several other indices that are based on sectors, themes, or market capitalisation.

Market participants are individuals and corporations transacting in the equity market. These include retail investors, domestic institutional investors (DIIs), foreign institutional investors (FIIs), asset management companies (AMCs), non-resident Indians (NRIs), among others.

Now let’s understand the roles of each of the participants in the smooth functioning of the stock market.

Regulators

Just like the Reserve Bank of India (RBI) regulates the country’s banking system, the Securities and Exchange Board of India (SEBI) governs the stock market to ensure seamless functioning and to protect the interest of all parties involved.

The primary objectives of SEBI are to control the activities of stock exchanges, safeguard the rights of shareholders and guarantee the security of their investment. SEBI acts as a watchdog to ensure the stock market is free of malpractices.

Financial intermediaries

Several other entities collectively work to ensure the market functions efficiently. Since buyers and sellers do not physically meet to buy or sell stocks, these entities work as the link between them. All financial intermediaries operate under the guidelines prescribed by SEBI.

In India, there are four primary financial intermediaries in the stock market. Let’s look at each of them in detail and the services they offer.

Stockbrokers

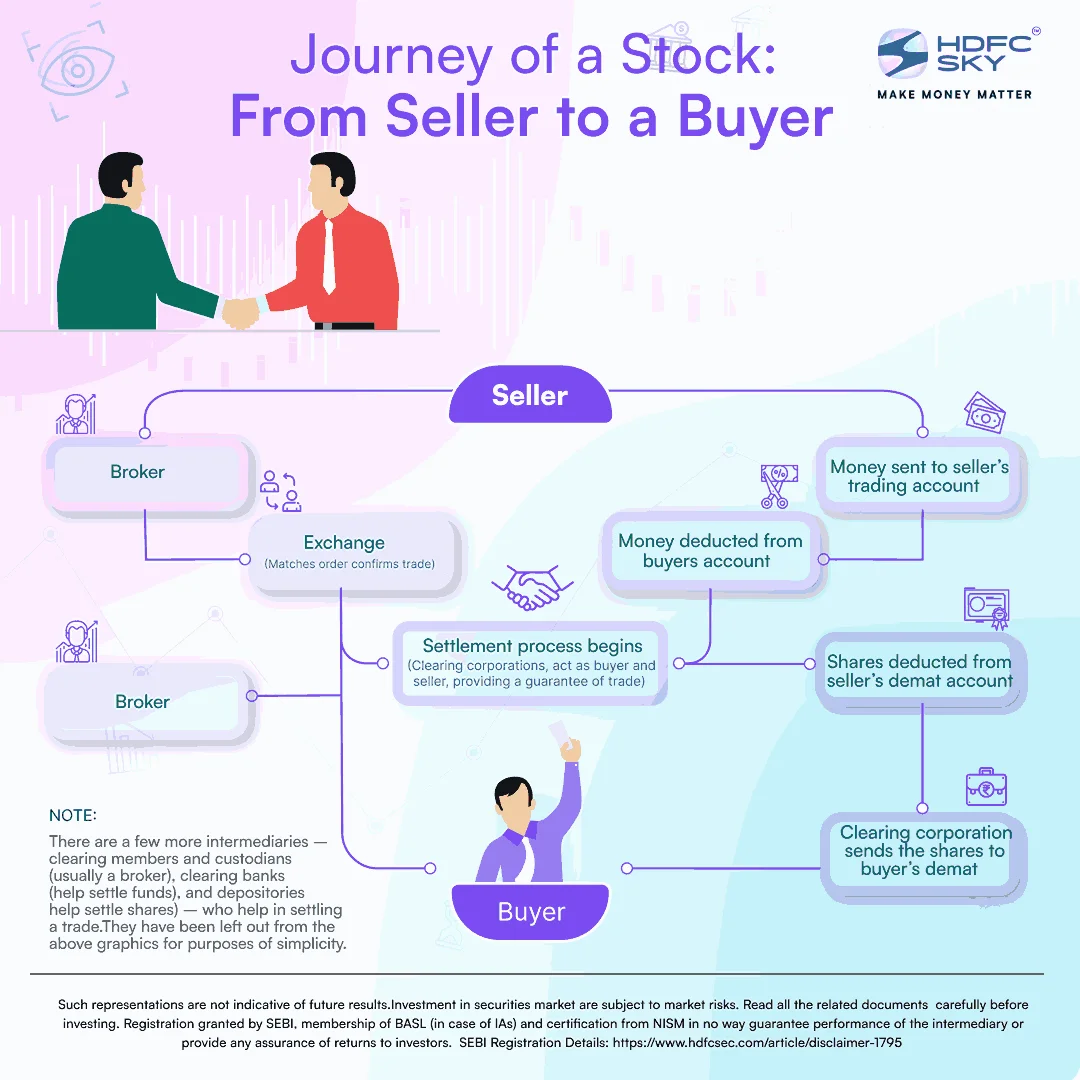

Just like your bank works as an intermediary when you want to transfer money from your account to someone, you need an intermediary when you want to buy or sell shares on a stock exchange. This is where stockbrokers come in.

Stockbrokers are trading members of the stock exchange and hold a stockbroking licence. They operate under the guidelines prescribed by SEBI and act as agents to market participants, assisting them in buying and selling stocks. For this, they charge a commission known as brokerage.

With increased competition in the space, most brokerages today also offer a plethora of other services. These include an interface (both online and offline) for trading, proper financial statements (income statement, ledger) and contract notes of all transactions as well as advisory.

Depository and Depository Participants

Since stocks are not tangible, you need a share certificate to prove ownership. Earlier, companies issued share certificates in a paper format to their shareholders. The onus to produce these certificates to claim their rights as shareholders of the company was on the investor. But like with other crucial documents, paper share certificates were susceptible to damage or even loss if not stored properly. It was also cumbersome for companies

to issue and maintain paper certificates.

To overcome these issues, share certificates were converted into digital form in the 1990s. These digital certificates are required to be stored in dematerialised or Demat accounts to be held with the depositary.

India has two major depositories – the National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL).

But just like you cannot buy or sell stocks directly on an exchange, you cannot open a Demat account directly with the depositories. This is where depository participants come in.

A depository participant acts as an agent of depositaries. So, a new investor needs to open a Demat account with a depository participant. Shares purchased by you are held in that account with the depository participant, but you remain the sole beneficial owner of the shares.

Typically, banks, financial institutions and broking firms act as depository participants. But you don’t have to deal with these intermediaries for trading in stocks. Your trading account, Demat account and bank account are all interlinked. Meaning if you sell a stock, it will automatically get debited from your Demat account and the money will be also credited automatically at settlement.

Banks

Investing involves money and therefore, banks play a key role in the stock market. Your bank account facilitates the money transfers required to buy these shares. You can link multiple bank accounts to your trading account, but the account must be in your name.

But it is important to note that only a bank account that has been opened in your name can be used to link to a trading account. Any other bank account that is in the name of a family member or friend cannot be used to buy stocks.

Clearing corporations

Clearing corporations play an important role in ensuring there is no default in the capital markets.

Clearing corporations act as a middleman between buyers and sellers. Let’s say you want to buy 100 shares of Tata Motors at Rs 400 and another investor A wants to sell 100 shares of Tata Motors at Rs 400. The clearing corporation will take the shares from A and give them to you. It does this for all transactions in the market, acting as a buyer to every seller and a seller to every buyer.

It also acts as a guarantor, making sure that the buyer does not default on the payment and the seller does not default on his obligation to deliver the shares.

In India, the National Security Clearing Corporation Ltd and Indian Clearing Corporation are wholly owned subsidiaries of NSE and BSE, respectively.