- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Things to keep in mind before starting stock market trading

By HDFC SKY | Updated at: Apr 8, 2025 02:56 PM IST

Summary

Trading in the stock market can be a tricky business. So, before you step into the arena, you must be aware of the risks involved. It’s best to start by reading and talking to people who know the trade.

You must approach stock trading like any other business. Don’t go rushing into it in the hope of making immediate and huge returns. You have to spend a considerable number of hours patiently researching and studying trends if you hope to make serious money in the market. It’s a full-time job, and at best a part-time one involving several hours. The chances of making any real money are slim if you treat it like a hobby. Understand that there are no certainties in trading, only probabilities.

Before you get started, you should get a fix on your trading philosophy. You need to decide whether you want to do short-term trading or long-term value investing; both have their pluses and minuses. Day trading means taking positions in a number of stocks in large volumes, and squaring these off by the end of the day. To be successful at this kind of trading, you need to have quick reflexes, the ability to think on your feet, absorb information quickly, and act almost intuitively.

Long-term trading, on the other hand, involves a buy-and-hold strategy. This needs a more patient understanding of a stock, its future potential, the market it is in, the state of the economy, and so on. If you’re patient and willing to wait, this is a strategy made for you.

Here are certain facts you need to understand before you start trading:

Don’t get carried away by sentiment

This is something you must be wary about. Of course, markets are affected by sentiment, but you should not get carried away by the prevailing tide. Remember, by the time it comes to your attention, it could have already lost momentum and could well be beginning to turn in a different direction.

Keep your trading capital intact

When you begin trading, you set out with a certain amount of money as trading capital, which you use to buy and sell stocks. You have to ensure that this capital remains intact over time. Of course, you will suffer some trading losses, but you have to keep these losses within bounds, and not go for excessive speculation. Once you begin eroding your capital, you would be entering dangerous waters.

Don’t go broke

It is also important to ensure that your trading capital is expendable, that is, even if you were to lose your entire trading capital that should not make a significant dent in the living standards of you and your family. Do not, for example, use the money you have stashed away for your children’s education, medical emergencies or other contingencies. Taking huge loans to finance your trading is a definite NO. There are risks involved in stock trading and it is important for you to not lose sight of them.

Keep it small

Don’t look for large gains while trading in shares. You are more likely to make money if you trade in a large number of stocks, making small gains from each. Of course, don’t forget to discount brokerage charges and short-term capital gains (STCG) tax while buying and selling. These can account for a big chunk of your gains!

Look at Futures and Options (F&O)

You don’t have to look at just shares while trading in the stock market. Derivatives like Futures and Options (F&O) are also an excellent way of benefiting from movements in share prices and have become very popular in the past few years. Sure, F&O is a little more complicated than trading in shares, but it enables you to leverage and make gains with little capital of your own. Some experts feel there is more risk in F&O, but others feel they’re no worse than trading in stocks, if done right.

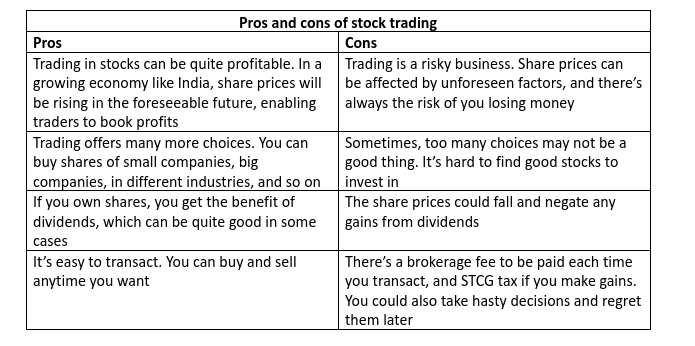

Pros and cons

Here are some of the pros and cons of stock trading:

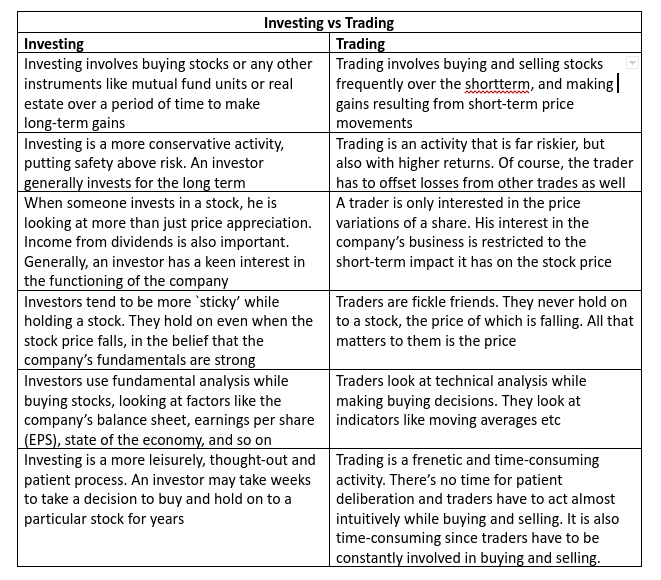

Investing vs Trading

The aim of both trading and investing is the same – to enhance your wealth. The differences lie in the way investors and traders go about conducting this mode of business. Here are some of the differences: