- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Transline Technologies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

TBA

TBA

TBA

Transline Technologies Limited

Transline Technologies, incorporated in 2001, is a specialised technology-solutions provider focusing on integrated security, surveillance, biometric authentication, and AI-driven software platforms. The company earns revenue from system integration contracts, SaaS subscriptions, hardware and software sales, and technical services. Its proprietary SaaS platforms—StorePulse, CamStore, and CheckCam—are offered as standalone cloud solutions or within turnkey deployments for government agencies, PSUs, smart city authorities, and private enterprises. As of FY 2025, Transline served 296 customers with an order book of ₹1,986.86 million, and its 461 employees support diverse operations, IT infrastructure, and services, with revenue mainly from video surveillance, IT infrastructure, biometric solutions, and technical services.

Transline Technologies Limited IPO Overview

Transline Technologies Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on August 14, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Building issue, consisting entirely of an offer for sale of up to 1.62 crore equity shares. The shares are proposed to be listed on the NSE and BSE, with Bigshare Services Pvt. Ltd. appointed as the registrar, while the book running lead manager is yet to be declared. Key details such as IPO dates, price bands, and lot size are pending announcement. The promoters of the company are Arun Gupta, Amita Gupta, Drishti Gupta, and RKG Enterprises Private Limited. Pre-IPO shareholding stands at 70.81%, remaining unchanged post-issue, with a face value of ₹2 per share and a total issue size of 1.62 crore shares.

Transline Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.62 crore shares |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 1.62 crore shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Transline Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Transline Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.44 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 36.86% |

| Net Asset Value (NAV) | ₹19.91 |

| Return on Equity (RoE) | 36.86% |

| Return on Capital Employed (RoCE) | 53.37% |

| EBITDA Margin | 21.39% |

| PAT Margin | 13% |

| Debt to Equity Ratio | 0.48 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

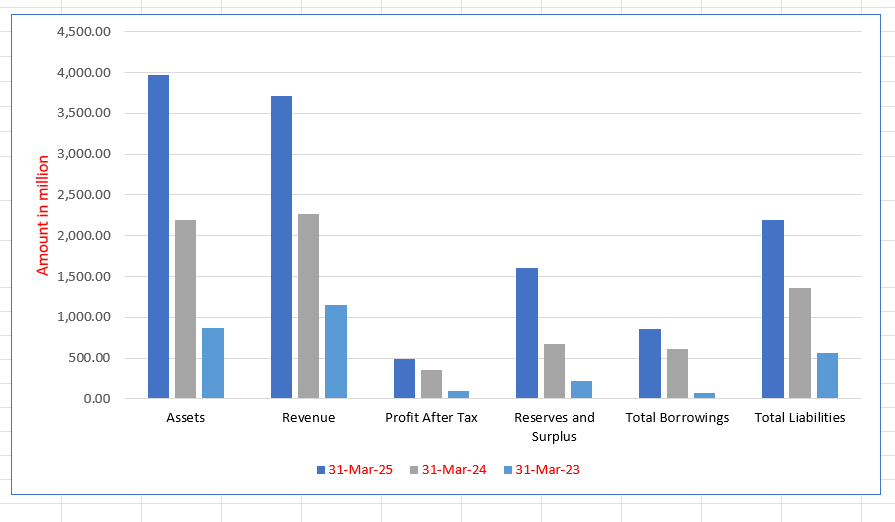

Transline Technologies Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,974.74 | 2,194.99 | 867.17 |

| Revenue | 3,719.07 | 2,263.38 | 1,154.89 |

| Profit After Tax | 483.33 | 354.67 | 98.75 |

| Reserves and Surplus | 1,606.25 | 674.89 | 224.77 |

| Total Borrowings | 860.85 | 606.82 | 69.03 |

| Total Liabilities | 2,189.14 | 1,358.01 | 566.72 |

Financial Status of Transline Technologies Limited

SWOT Analysis of Transline Technologies IPO

Strength and Opportunities

- Established in 2001 with over 24 years of experience.

- Diverse revenue streams: system integration, SaaS, hardware/software sales, and technical services.

- Proprietary AI-driven software platforms: StorePulse, CamStore, and CheckCam.

- Strong customer base across various sectors, including government agencies, PSUs, smart city authorities, and private enterprises.

- Robust order book with confirmed projects at various stages of execution.

- Significant presence in key Indian cities: New Delhi, Navi Mumbai, and Hyderabad.

- ISO certifications (ISO 9001:2015, ISO 14001:2015, ISO/IEC 27001:2013) ensuring quality and security standards.

- Continuous innovation and development of new products to meet market demands.

- Expansion of headquarters in New Delhi to accommodate growing operations.

Risks and Threats

- High dependence on government and PSU contracts.

- Limited international presence, focusing primarily on the Indian market.

- Intense competition in the surveillance and biometric technology sector.

- Vulnerability to policy changes and regulatory shifts in the Indian market.

- Potential challenges in scaling operations due to resource constraints.

- Exposure to economic fluctuations affecting public sector spending.

- Dependency on a limited number of key clients for a substantial portion of revenue.

- Risks associated with technological obsolescence and the need for constant upgrades.

- Challenges in maintaining consistent profit margins amidst rising operational costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Transline Technologies Limited

Transline Technologies Limited IPO Strengths

Leading India’s Digital Surveillance and Biometrics Market

Transline Technologies is a prominent player in India’s video surveillance, biometrics, and IoT sectors. With over two decades of experience, the company specializes in advanced, integrated solutions that enhance safety and operational efficiency. Their focus on technology and customized solutions has positioned them as a leader in these high-growth markets.

Diversified and Resilient Customer Base

The company has cultivated long-standing relationships with a diverse clientele, including government departments, public sector undertakings, and private enterprises. This wide-ranging customer base, spanning sectors like IT, railways, and manufacturing, highlights the adaptability of their solutions. Serving a broad array of industries helps mitigate market risk and ensures steady demand.

Strong R&D and Proprietary Technology

Transline Technologies has a dedicated in-house R&D team that develops proprietary software solutions. These include AI-powered video analytics, real-time video compression tools, and centralized attendance systems. The company protects its intellectual property with numerous trademark, copyright, and patent applications, reinforcing its competitive edge and commitment to innovation.

Robust Financial Performance and Growth

The company demonstrates a strong financial track record, with revenue from operations growing at a CAGR of 80.44% between fiscal years 2023 and 2025. This growth is supported by increased profitability, improved EBITDA margins, and a prudent capital structure. The company’s solid financial health reflects its operational efficiency and ability to manage growth effectively.

Experienced Leadership and Management

Transline Technologies is led by an experienced promoter and a seasoned management team with deep industry knowledge. Their collective expertise in technology, operations, and business development has been critical to the company’s success. The leadership’s strategic vision has enabled the company to anticipate market trends, manage growth, and build strong client relationships.

More About Transline Technologies Limited

Transline Technologies Limited is a specialised technology solutions provider focusing on integrated security and surveillance systems, biometric authentication platforms, and AI-driven software products. The company generates revenue through multiple streams, including project-based system integration contracts, SaaS subscriptions, hardware and software sales, and technical services such as annual maintenance and managed support.

Proprietary Solutions

Transline has developed a portfolio of proprietary software tools:

- StorePulse: AI-powered video analytics platform

- CamStore: Real-time video compression and storage optimisation solution

- CheckCam: CCTV network health monitoring system

These solutions are available as standalone cloud-deployed SaaS products or as part of turnkey system deployments.

Clientele and Sectors

The company serves a diverse customer base, including government agencies, PSUs, smart city authorities, educational institutions, and private enterprises in transportation, retail, logistics, and telecommunications.

Leadership and Workforce

Founded and led by Promoter and Managing Director Arun Gupta, who has over 23 years of experience in technology and IT services, Transline initially focused on IT infrastructure and surveillance solutions. Under his leadership, the company expanded into biometric systems, IoT-based smart infrastructure, and AI-enhanced security applications. As of March 31, 2025, Transline employs 461 personnel across project management, engineering, product development, client delivery, and technical support.

Revenue Breakdown (Fiscal 2025)

- Video Surveillance: ₹1,344.02 million (36.22%) – high-definition IP cameras, AI analytics, facial recognition, command and control centres, IoT monitoring

- Biometric Solutions: ₹657.31 million (17.71%) – Aadhaar-enabled iris, fingerprint, palm vein, and facial recognition systems

- IT Infrastructure: ₹980.59 million (26.43%) – enterprise data centres, communication networks, secure IT environments

- Services: ₹703.48 million (18.96%) – technical manpower, field support, annual maintenance contracts

- SaaS Platforms: ₹25.38 million (0.68%) – StorePulse, CamStore, CheckCam subscription-based offerings

Key Projects and Capabilities

- Implementing a large-scale Integrated Command and Control Centre across 151 railway stations, enabling real-time CCTV monitoring in 8+ states.

- Executed a centralised digital identification infrastructure project supplying 2,200+ biometric kits and associated computing devices for law enforcement agencies.

- Order book of ₹1,986.86 million as of March 31, 2025, encompassing installation, commissioning, training, and post-implementation support.

R&D and Innovation

Transline’s R&D team of 23 members drives innovation in AI analytics, IoT integration, cloud monitoring, and advanced user interfaces, supporting recurring-revenue SaaS streams and enhancing interoperability of surveillance solutions.

Industry Outlook

The Indian security and surveillance industry is experiencing significant growth, driven by increasing security concerns, urbanization, and technological advancements. The sector encompasses various domains, including video surveillance, biometric authentication, and integrated security solutions.

Market Segments and Growth Projections

Video Surveillance

- Market Size & Growth: Valued at USD 2,026.6 million in 2024, the Indian video surveillance market is projected to reach USD 5,260.3 million by 2030, reflecting a CAGR of 17.2% from 2025 to 2030.

- Key Drivers: Government initiatives like the Smart Cities Mission, increasing urbanization, and rising security concerns are fueling demand for advanced surveillance systems.

AI in Video Surveillance

- Market Size & Growth: The AI in video surveillance market is expected to grow from USD 4.74 billion in 2025 to USD 12.46 billion by 2030, at a CAGR of 21.3% .

- Technological Advancements: Integration of AI technologies such as facial recognition, anomaly detection, and predictive analytics is enhancing the effectiveness of surveillance systems.

Biometric Authentication

- Market Size & Growth: The biometric authentication market in India is anticipated to grow from USD 2.92 billion in 2024 to USD 5.92 billion by 2032, at a CAGR of 9.2% .

- Applications: Biometric systems are increasingly adopted in sectors like banking, government services, and healthcare for secure identity verification and access control.

Industry Drivers

- Government Initiatives: Programs like the Smart Cities Mission and Digital India are promoting the adoption of advanced security technologies.

- Urbanization: Rapid urban growth necessitates enhanced security infrastructure to ensure public safety.

- Technological Advancements: Continuous innovations in AI, IoT, and cloud computing are transforming the security landscape.

- Regulatory Support: Policies encouraging the use of indigenous and secure surveillance equipment are boosting domestic manufacturing and reducing dependency on foreign suppliers.

How Will Transline Technologies Limited Benefit

- Transline can leverage the rapid expansion of the Indian video surveillance market, projected to reach USD 5,260.3 million by 2030, to increase deployment of its AI-driven solutions.

- Its proprietary AI-powered platforms, StorePulse and CheckCam, position the company to meet rising demand for intelligent surveillance, anomaly detection, and predictive analytics.

- With the biometric authentication market expected to grow to USD 5.92 billion by 2032, Transline’s Aadhaar-enabled and multi-modal authentication systems can capture increasing government and enterprise demand.

- Recurring subscription-based SaaS offerings enable Transline to benefit from the shift towards cloud-deployed surveillance and analytics solutions.

- Established experience in large-scale government contracts allows the company to participate in Smart Cities, Digital India, and law enforcement initiatives.

- Continuous R&D enhances the product portfolio, ensuring differentiation and sustained relevance in a technologically evolving market.

- Modular offerings combining hardware, software, and services allow Transline to address diverse sector-specific requirements efficiently.

Peer Group Comparison

| Name of the Company | Revenue

(₹ million) |

Face Value

(₹) |

P/E | EPS (₹) | RoNW (%) | NAV

(₹ ) |

| Transline Technologies Limited | 3,710.78 | 2 | -5.44 | 5.44 | 19.91 | |

| Nelco Limited | 3,048.70 | 10 | 21.58 | 4.18 | 7.58% | 56.05 |

| Peer Groups | ||||||

| Orient Technologies Ltd | 8,395.30 | 10 | 24.86 | 12.85 | 19.98% | 79.17 |

| Allied Digital Services Ltd | 8,070.70 | 5 | 31.27 | 4.98 | 5.44% | 106.73 |

Key Strategies for Transline Technologies Limited

One-Stop Surveillance and Security Solutions

Transline aims to be the preferred provider of end-to-end security solutions, integrating AI, IoT, biometrics, and analytics. Its offerings empower clients to monitor, manage, and optimize environments, delivering actionable insights, operational efficiency, and robust safety ecosystems across retail, manufacturing, and government sectors.

Expansion in Government and B2G Projects

Leveraging its expertise in surveillance, biometrics, and IoT, Transline focuses on public sector engagements. It addresses smart city infrastructure, public safety, and national development, deploying proprietary software to enhance decision-making, operational efficiency, and reliability across government, PSU, and critical infrastructure projects.

SaaS Adoption and Global Scalability

By transitioning to cloud-based SaaS platforms like StorePulse, CamStore, and CheckCam, Transline can provide scalable solutions with predictable revenue streams, continuous updates, and improved customer engagement, serving both enterprises and governments while supporting recurring subscriptions and higher-margin contracts.

Marketing, Branding, and Geographic Expansion

Transline plans to strengthen brand presence through targeted campaigns, digital marketing, trade shows, and thought leadership. Expansion targets include Tier-I and Tier-II Indian cities and international markets, leveraging partnerships, alliances, and localized support to grow visibility and market penetration.

Strategic Partnerships and Alliances

The company collaborates with technology providers, cloud vendors, IoT integrators, POS platforms, and global OEMs. These alliances enable secure, scalable, and industry-specific solutions, enhancing product capabilities while facilitating domestic and international market expansion.

Innovation, R&D, and AI Integration

Transline’s R&D team drives AI-powered analytics, predictive maintenance, anomaly detection, and real-time monitoring. Continuous innovation strengthens proprietary offerings, transforms surveillance into actionable intelligence, and ensures the company remains at the forefront of emerging technologies.

Industry-Specific Digital Transformation

By integrating surveillance, biometrics, hardware, and digital solutions, Transline provides consulting and system integration services. Focus industries include education, finance, and manufacturing, enabling secure, efficient, and scalable operations while supporting hybrid IT, automation, and real-time analytics for operational optimization.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Transline Technologies Limited IPO

How can I apply for Transline Technologies Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What type of IPO is Transline Technologies planning?

It is a Book Building IPO consisting entirely of an Offer for Sale of up to 1.62 crore shares.

Who are the promoters of the company?

The promoters are Arun Gupta, Amita Gupta, Drishti Gupta, and RKG Enterprises Private Limited.

Will the company receive any funds from this IPO?

No, the entire proceeds from the IPO will go to the selling shareholders; the company will not receive funds.

On which stock exchanges will the shares be listed?

The equity shares are proposed to be listed on NSE and BSE.