- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Travel Food Services IPO

₹13,585/13 shares

Minimum Investment

IPO Details

07 Jul 25

09 Jul 25

₹13,585

13

₹1,045 to ₹1,100

NSE, BSE

₹2 Cr

14 Jul 25

Travel Food Services IPO Timeline

Bidding Start

07 Jul 25

Bidding Ends

09 Jul 25

Allotment Finalisation

10 Jul 25

Refund Initiation

11 Jul 25

Demat Transfer

11 Jul 25

Listing

14 Jul 25

Travel Food Services Limited

Travel Food Services (TFS) is a leading player in India’s airport Travel QSR and lounge sector, operating over 350 Travel QSR outlets and 30+ airport lounges across major travel hubs. The company manages 397 Travel QSR outlets, including 335 at 14 airports in India, 30 at two Malaysian airports, and 32 at eight highway locations in India. TFS is dedicated to offering high-quality food and beverages, catering to travelers’ needs, and ensuring their satisfaction.

In the lounge segment, TFS provides premium spaces in airport terminals, accessible to first and business-class passengers, loyalty members, and select credit/debit cardholders. By June 30, 2024, the company had launched 31 lounges in India and Malaysia, with an additional lounge opened in Hong Kong in July 2024. As of Fiscal Year 2024, TFS holds a 24% market share in India’s airport Travel QSR sector and 45% in the airport lounge market.

Travel Food Services Limited IPO Overview

The IPO date for Travel Food Services has not been announced yet. The company plans to raise ₹2,000 crores through the IPO, comprising a fresh issue and an Offer for Sale (OFS) of up to ₹2,000 crores, with a face value of ₹1 per share. The IPO will have a 35% retail quota, 50% for QIBs, and 15% for HNIs, as per the DRHP. The listing will be on the NSE and BSE. Travel Food Services, based in Mumbai, intends to raise these funds to support its growth, with the Kapur Family Trust and SSP Asia Pacific Holdings as major stakeholders.

Travel Food Services Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA |

| Offer for Sale: ₹2000 crore | |

| IPO Dates | 7 July 2025 to 9 July 2025 |

| Price Bands | ₹1045 to ₹1100 per share |

| Lot Size | 13 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 13,16,79,484 shares |

Travel Food Services IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | 7 July 2025 |

| IPO Close Date | 9 July 2025 |

| Basis of Allotment Date | 10 July 2025 |

| Refunds Initiation | 11 July 2025 |

| Credit of Shares to Demat | 11 July 2025 |

| IPO Listing Date | 14 July 2025 |

Travel Food Services IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 13 | ₹14,300 |

| Retail (Max) | 13 | 169 | ₹1,85,900 |

| S-HNI (Min) | 14 | 182 | ₹2,00,000 |

| S-HNI (Max) | 69 | 897 | ₹9,86,700 |

| B-HNI (Min) | 70 | 910 | ₹10,01,000 |

Travel Food Services IPO Lead Managers

| Lead Managers |

| Kotak Mahindra Capital Limited |

| HSBC Securities and Capital Markets (India) Private Limited |

| ICICI Securities Limited |

| Batlivala & Karani Securities India Private Limited |

Travel Food Services Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 21.85 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 36.14% |

| Net Asset Value (NAV) | 60.45 |

| Return on Equity | 36.57% |

| Return on Capital Employed (ROCE) | 49.97% |

| EBITDA Margin | 39.38% |

| PAT Margin | 20.38% |

| Debt to Equity Ratio | 1.03 |

Objectives of the IPO Proceeds

The Promoter Selling Shareholder will be entitled to receive the entire proceeds from the Offer, after deducting the Offer expenses and applicable taxes. The Company will not receive any proceeds from the Offer.

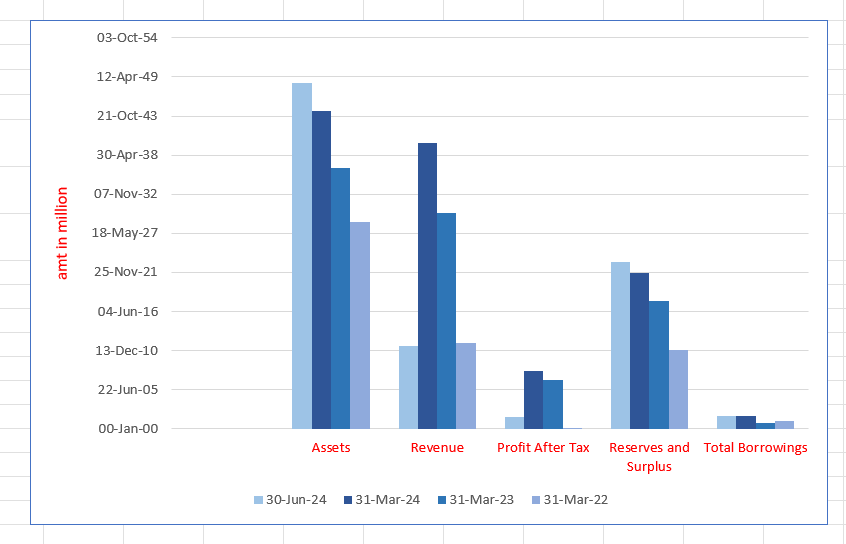

Travel Food Services Limited Financials (in million)

| Particulars | 30 June 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 17,711.57 | 16,233.92 | 13,323.24 | 10,564.92 |

| Revenue | 4252.04 | 14,622.92 | 11,035.82 | 4416.63 |

| Profit After Tax | 595.46 | 2980.17 | 2512.99 | 50.33 |

| Reserves and Surplus | 8525.40 | 7966.97 | 6516.02 | 4058.53 |

| Total Borrowings | 669.70 | 637.81 | 310.52 | 381.67 |

| Total Liabilities | 9018.66 | 8085.13 | 6672.99 | 10564.92 |

Financial Status of Travel Food Services Limited

SWOT Analysis of Travel Food Services IPO

Strength and Opportunities

- Travel Food Services has a strong presence in key metro cities across India, strengthening its market position.

- Its diverse portfolio of international and local brands helps attract a wide range of customers.

- The company has extensive expertise in airport and train food services, which enhances operational efficiency.

- Its strong partnerships with renowned brands like Krispy Kreme and Domino’s increase customer loyalty.

- The company's focus on innovation in food concepts provides a competitive edge.

- Travel Food Services operates in a rapidly growing travel and tourism industry, opening new growth opportunities.

- The presence of experienced local teams helps cater to regional tastes and preferences.

- Its ability to manage food quality and customer experience across multiple locations strengthens brand reputation.

- The company leverages technology for order management, improving customer experience and efficiency.

- Strategic collaborations with airports and railways position the company well for future expansion.

- Focus on sustainability and eco-friendly practices boosts its appeal among environmentally conscious consumers.

Risks and Threats

- Heavy reliance on the aviation sector makes it vulnerable to fluctuations in air travel.

- Limited presence in tier 2 and tier 3 cities may limit growth potential.

- Seasonal demand fluctuations affect the consistency of revenue streams.

- Dependence on third-party logistics for supply chain management poses operational risks.

- The high operational costs of maintaining premium outlets may affect profitability.

- Intense competition from other food service providers in travel hubs may reduce market share.

- Regulatory challenges in different airports and regions could create operational delays.

- The uncertainty in fuel and transport costs can increase operational expenses.

- Economic downturns can affect discretionary spending, impacting revenue from premium services.

- The market's shift toward healthier eating may pose challenges for certain food offerings.

- Security concerns at travel hubs may affect footfall, leading to revenue loss.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Travel Food Services Limited

Travel Food Services Limited IPO Strengths

Leading Player in Travel QSR and Lounge Sectors in Indian Airports

Travel Food Services Limited (TFS) is a dominant player in the Travel QSR and Lounge sectors across Indian airports. As of March 2024, it operated the largest network of Travel QSRs in India, with 313 outlets located in airports. It holds a 24% market share in the Travel QSR sector and a 45% market share in the Lounge sector. TFS’s strategic presence across 14 airports, including major hubs, strengthens its position in capturing future growth opportunities.

Strong Expertise in Airport F&B Operations

Travel Food Services Limited (TFS) has built significant expertise in managing F&B operations in the complex and highly secure airport environment. Over 15 years, it has developed efficient processes for managing security, regulatory compliance, and operational challenges. This includes adapting to stringent food safety regulations and managing 24/7 operations. TFS’s ability to handle large-scale, high-demand airport environments makes it a competitive force in the F&B sector within airports.

Proven Track Record with Long-Term Relationships with Airport Operators:

Travel Food Services Limited (TFS) has established long-term relationships with major airport operators, which support its growth in the Travel QSR and Lounge sectors. It has been operational in key airports like Delhi, Mumbai, and Chennai for over a decade, securing long-term concessions with partners such as DIAL and GMR. TFS’s ability to secure consistent, strategic partnerships allows it to maintain a stable presence in numerous airports across India and Malaysia.

Diversified Portfolio of F&B Brands

Travel Food Services Limited operates a diverse portfolio of partner F&B brands, including international names like KFC, Pizza Hut, and Krispy Kreme, regional Indian brands such as Bikanervala, and in-house brands like Caféccino. With 78 licensed partner brands and 39 in-house brands, this extensive range enables Travel Food Services Limited to cater to both local and international palates, strengthening its competitive position in airport concessions and customer satisfaction.

Deep Understanding of Traveller Preferences

Travel Food Services Limited utilizes technological innovations and local expertise to enhance the travel experience. By offering services such as self-ordering kiosks, mobile ordering, and region-specific menu innovations, Travel Food Services Limited ensures customer convenience and operational efficiency. Its tailored approach, such as introducing live counters and custom packaging, addresses travellers’ needs, elevating the airport dining experience and increasing customer satisfaction.

Experienced Management Team with Strategic Partnerships

Travel Food Services Limited is supported by a seasoned management team with over 23 years of collective experience. The company’s partnership with K Hospitality and SSP further strengthens its operations. K Hospitality’s expertise in the Indian F&B industry and SSP’s global presence enable Travel Food Services Limited to maintain high standards, expand its brand portfolio, and access new opportunities, including international airport concessions and partnerships.

More About Travel Food Services Limited

Travel Food Services Limited is a dominant player in India’s rapidly growing airport travel quick service restaurant (Travel QSR) and lounge sectors, based on revenue in Fiscal 2024, according to the CRISIL Report. The company operates across India and Malaysia, providing a diverse range of food and beverage (F&B) concepts designed to meet the fast-paced demands of travel environments.

Travel QSR Business

- Food and Beverage Portfolio: Travel Food Services Limited operates 397 Travel QSRs, leveraging 117 partner and in-house brands.

- Locations: The majority of these outlets are located in airports, with select locations at highway sites.

- Revenue Leadership: The company holds a 24% market share in India’s Travel QSR sector as of Fiscal 2024.

Lounge Business

- Exclusive Access: Travel Food Services Limited’s lounges cater to first/business class passengers, airline loyalty members, select credit card holders, and members of other loyalty programmes.

- Current Operations: The company operates 31 lounges across India and Malaysia, with a new lounge opened in Hong Kong in July 2024.

- Market Share: It holds a 45% market share in India’s airport lounge sector as of Fiscal 2024.

Strategic Presence

- Major Airports: The company’s services are available in 14 major airports in India and three in Malaysia, including high-traffic airports such as Delhi, Mumbai, and Bengaluru.

- Passenger Traffic: The airports where Travel Food Services Limited operates account for 74% of India’s total air traffic as of Fiscal 2024.

Operational Excellence

- High Retention Rate: Travel Food Services Limited has maintained a 92% contract retention rate since 2009.

- Sector Growth: The Indian airport QSR and lounge sectors have experienced robust growth, with CAGRs of 15% and 26%, respectively, between Fiscal 2019 and 2024.

Strategic Partnerships

- SSP Group: Travel Food Services Limited benefits from its relationship with SSP Group, which operates over 2,900 outlets across 37 countries, enhancing the company’s brand portfolio and operational expertise.

- K Hospitality: With over 50 years of experience in the F&B industry, K Hospitality provides Travel Food Services Limited with valuable expertise, market reputation, and procurement advantages from its extensive supplier network.

Travel QSR Business of Travel Food Services Limited

As of June 30, 2024, Travel Food Services Limitedoperates a diverse portfolio of 397 Travel Quick Service Restaurants (QSRs). These outlets are spread across India, Malaysia, and select highway sites, offering a wide range of food and beverage options tailored to the needs of travellers.

Distribution Across Key Locations

The company operates:

- 335 outlets across 14 airports in India

- 30 outlets across two airports in Malaysia

- 32 outlets at eight highway sites in India

Out of these, 340 outlets are directly managed by the company, while the remaining 57 outlets are operated through its Associates and Joint Ventures.

Focus on Travel-Friendly F&B Formats

Travel Food Services offers a variety of quick service formats specifically designed for the travel environment, including:

- Fast food

- Cafes

- Bakeries

- Food courts

- Bars

These outlets are strategically located to cater to the demand for speed and convenience from travellers. The company works closely with regional Indian and international brand partners to adapt their food and beverage concepts to meet the unique needs of the travel environment.

Brand Portfolio

The company boasts a strong portfolio of 117 F&B brands, comprising both partner brands and in-house brands. Notable names include:

- International Brands: KFC, Pizza Hut, Wagamama, Krispy Kreme

- Regional Indian Brands: Hatti Kaapi, Sangeetha, Bikanervala, Wow Momo

- In-house Brands: JOSHH, Curry Kitchen, Bombay Brasserie

This extensive brand portfolio positions Travel Food Services as a preferred partner for airport operators in India, especially as the Travel QSR sector continues to expand due to rising air travel and increasing disposable income.

Industry Outlook

Market Opportunity for Travel QSR Industry

India’s aviation and travel sectors are undergoing rapid transformation, creating strong growth opportunities for Travel QSRs.

Growth in the Aviation Sector

Demand Drivers:

- Domestic air passenger traffic expected to grow at 8–9% CAGR from FY24 to FY34.

- International traffic projected to rise at 6–8% CAGR in the same period.

- LCCs’ share in domestic traffic increased from 66% in 2016 to 78% in 2024.

- LCCs’ international traffic share rose from 20% in 2016 to 46% in 2024.

Supply Drivers:

- Operational airports to grow from 137 (2024) to 165–185 by FY29 and 185–205 by FY34.

- Indian airlines expected to receive 1,800 new aircraft by FY34.

Travel QSR Market Growth

- Higher dwell times at Indian airports offer more opportunities for food purchases.

- LCC passengers often buy food pre-boarding, increasing QSR demand at airports.

Lounge Industry Potential

- India averages just 0.7 lounges per airport, indicating underpenetration.

- Lounge industry grew at 26% CAGR (FY19–FY24); projected 21–23% CAGR till FY34.

Expansion in Wayside Amenities and Expressways

- NHAI plans 1,000 WSAs to support highway travellers.

- India’s expressway network to rise from 19 (2024) to 55–65 by FY34.

How Will Travel Food Services Limited Benefit?

- Travel Food Services leads India’s QSR and lounge markets with strong airport presence and market share.

- Aviation growth and rising low-cost carriers drive higher footfall, increasing demand at airport food outlets.

- Expansion from 137 to 185 airports by 2029 offers new locations and business opportunities.

- Longer dwell times at Indian airports increase passenger engagement with food and beverage services.

- Lounge segment growth at 21–23% CAGR strengthens company’s future in underpenetrated airport lounge space.

- Global and regional brand partnerships broaden customer appeal across diverse domestic and international airports.

- 92% contract retention since 2009 ensures operational stability and sustained growth in high-traffic locations.

- International operations in Malaysia and Hong Kong increase global visibility and expand future revenue potential.

- 53% revenue from partner brands confirms a balanced, scalable business model with strong industry ties.

- Government infrastructure push opens expansion prospects along expressways and highways for QSR outlet growth.

Peer Group Comparison

| Company Name | Face Value (₹ per share) | Revenue | EPS (₹) | NAV

(₹) |

PE Ratio | RoNW (%) |

| Company (TFS) | 1.00 | 13,963.22 | 21.85 | 60.45 | 36.14 | [•] |

| Jubilant FoodWorks Limited | 2.00 | 56,540.88 | 6.06 | 32.90 | 114.69 | 18.40 |

| Devyani International Limited | 1.00 | 35,563.00 | 0.39 | 8.76 | 432.56 | 4.48 |

| Sapphire Foods India Limited | 2.00 | 25,942.79 | 8.30 | 210.41 | 213.46** | 3.94 |

| Westlife Foodworld Limited | 2.00 | 23,918.10 | 4.44 | 37.72 | 182.92 | 11.77 |

| Restaurant Brands Asia Limited | 10.00 | 24,371.00 | (4.40) | 12.65 | NM5 | (34.78) |

Key Strategies for Travel Food Services Limited

Optimising Product Offerings for LFL Sales Growth

The company seeks to leverage long-term growth trends in India’s air passenger traffic. By understanding customer preferences and regional trends, it aims to enhance its product offerings, streamline menus, and introduce digital ordering systems. This approach focuses on improving service efficiency and convenience and increasing like-for-like sales.

Expanding Presence in Existing and New Markets

The company plans to expand in both domestic and international markets by retaining current airport concessions and securing new ones. Growth strategies include expanding outlets in existing airports, entering new locations, and tapping into the highway and expressway QSR sectors, with a focus on customer experience and strategic international growth.

Leveraging Operational Efficiencies and Scale

The company focuses on optimizing margins through category management, efficient supply chain management, and labour productivity. With strategies like upselling, inventory control, and waste reduction, it aims to drive higher profitability while maintaining operational efficiency and cost-effective service delivery across multiple outlets.

Optimising Capital Expenditure Practices

Capital efficiency is a key focus, with strategies like modular designs, food automation technology, and standardized procurement processes. The company employs strict investment review practices, reverse auctions, and post-project audits to ensure effective capital allocation, maintain cost control, and drive long-term operational efficiency in outlet expansions.

Winning Through People

The company’s “People First” strategy focuses on attracting, retaining, and developing talent through training, employee wellness programs, and fostering an inclusive work environment. Investing in diversity and employee engagement enhances operational performance and ensures long-term workforce stability. Safety, benefits, and career development are prioritized for employee satisfaction and growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Travel Food Services IPO

When will the Travel Food Services IPO open?

The IPO opening and closing dates are 7th July 2025 and 9th July 2025, repsectively

What is the issue size of the Travel Food Services IPO?

The IPO aims to raise ₹2,000 crore, including a fresh issue and an offer for sale, as detailed in the draft red herring prospectus (DRHP).

What is the quota allocation for investors in the IPO?

The retail quota is set at 35%, with 50% reserved for Qualified Institutional Buyers (QIBs) and 15% for High Net Worth Individuals (HNIs).

Where will the Travel Food Services IPO be listed?

The IPO will be listed on India’s leading stock exchanges, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

What is the face value of the shares in the IPO?

Each share in the Travel Food Services IPO has a face value of ₹1, making it accessible to a wide range of investors.

What are the price range and lot size for the IPO?

The price range is ₹1045 to ₹1100 per share and lot size is 13 shares