- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

TruAlt Bioenergy IPO

₹14,160/30 shares

Minimum Investment

IPO Details

25 Sep 25

29 Sep 25

₹14,160

30

₹472 to ₹496

NSE, BSE

₹839.28 Cr

03 Oct 25

TruAlt Bioenergy IPO Timeline

Bidding Start

25 Sep 25

Bidding Ends

29 Sep 25

Allotment Finalisation

30 Sep 25

Refund Initiation

01 Oct 25

Demat Transfer

01 Oct 25

Listing

03 Oct 25

Trualt Bioenergy Limited

Trualt Bioenergy Limited, established in 2021, is one of India’s leading biofuel producers, with a strong focus on ethanol. With an installed capacity of 2,000 KLPD, it holds a 3.6% market share in ethanol production as of Fiscal 2025. Its operations also cover compressed biogas through subsidiary Leafinity, which runs a 10.20 TPD plant. Backed by MoUs with global firms, the company manages five distillery units in Karnataka and plans expansion into second-generation ethanol, sustainable aviation fuel, MVL, and allied biochemicals.

Trualt Bioenergy Limited IPO Overview

Trualt Bioenergy IPO is a book-built issue consisting of a fresh issue worth ₹750 crore along with an offer for sale of 0.18 crore shares. The subscription will open on September 25, 2025, and close on September 29, 2025. Allotment is likely to be finalised on September 30, 2025, with shares scheduled to list on BSE and NSE by October 3, 2025. The IPO price band has been set at ₹[.] to ₹[.] per share, with Dam Capital Advisors Ltd. acting as lead manager and Bigshare Services Pvt. Ltd. as registrar.

Trualt Bioenergy Limited IPO Details

| Particulars | Details |

| IPO Date | 25 September 2025 to 29 September 2025 |

| Listing Date | 3 October 2025 (tentative) |

| Face Value | ₹10 per share |

| Issue Price Band | ₹[.] to ₹[.] per share |

| Lot Size | [To be updated] |

| Total Issue Size | Fresh Issue: ₹750 Cr + OFS: 18,00,000 shares |

| Fresh Issue | ₹750.00 Crores |

| Offer for Sale | 18,00,000 shares (₹[.] Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 7,06,31,624 shares |

| Share Holding Post Issue | [.] shares |

Trualt Bioenergy Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Offer |

| Retail | Not less than 35% of the Offer |

| NII (HNI) | Not less than 15% of the Offer |

Trualt Bioenergy Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 88.20% |

| Post-Issue | [.] |

Trualt Bioenergy Limited IPO Valuation Overview

| KPI | Value |

| EPS (Pre IPO) | ₹20.94 |

| P/E Ratio | TBD |

| RoNW | 19.07% |

| ROE | 28.27% |

| ROCE | 10.88% |

| NAV | ₹108.87 |

| PAT Margin | 7.69% |

| EBITDA Margin | 16.20% |

| Debt to Equity Ratio | 2.02 |

Objectives of the Proceeds

- Capex towards setting up multi-feed stock operations at Unit 4 (300 KLPD): ₹150.68 Cr

- Funding working capital requirements to support ethanol and CBG operations: ₹425 Cr

- General corporate purposes to strengthen overall business operations and expansion

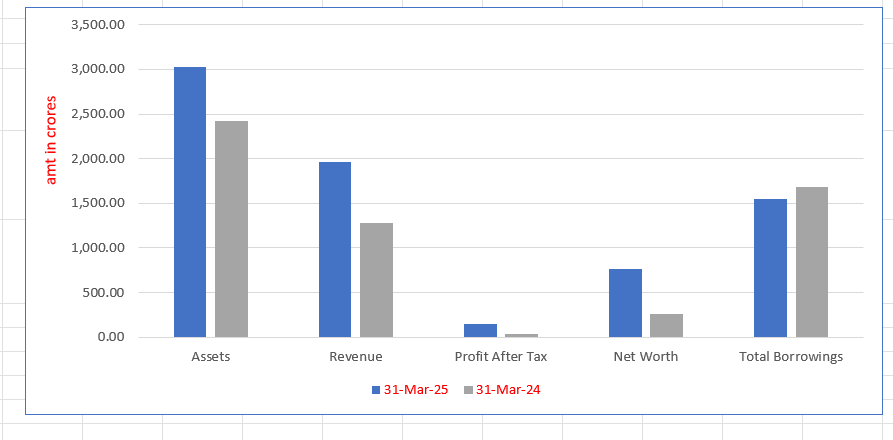

Key Financials (₹ in Crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 |

| Assets | 3,029.73 | 2,419.08 |

| Revenue | 1,968.53 | 1,280.19 |

| Profit After Tax | 146.64 | 31.81 |

| Net Worth | 769.00 | 264.61 |

| Total Borrowings | 1,549.68 | 1,684.68 |

SWOT Analysis of TruAlt Bioenergy IPO

Strength and Opportunities

- Largest ethanol production capacity in India ensures scale advantages.

- Diversified operations across ethanol, CBG, and upcoming sustainable fuels.

- Strategic MoUs with global energy companies for expansion.

- Strong revenue and PAT growth, with increasing demand visibility.

Risks and Threats

- High debt-equity ratio indicates financial risk exposure.

- Regulatory changes in ethanol blending policies may impact growth.

- Dependence on molasses and grain feedstocks creates supply risk.

- Competition from established sugar and ethanol producers.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About TruAlt Bioenergy Limited IPO

TruAlt Bioenergy IPO Strengths

- Holds largest installed ethanol production capacity in India, ensuring consistent scalability and industry dominance.

- Operates an integrated resource management system, optimising ethanol and CBG production for sustainable growth.

- Infrastructure strategically located, supported by technological innovation and focus on sustainability practices.

- Positioned to leverage strong ethanol demand from blending programmes and future aviation fuel requirements.

- Maintains long-term customer relationships with a growing domestic and global demand pipeline.

- Experienced promoters and management team with proven expertise in energy and manufacturing.

Peer Group Comparison (As on March 31, 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) |

| TruAlt Bioenergy | 20.94 | 20.94 | 108.87 | — | 19.07 |

| Peer Group | |||||

| Balrampur Chini Mills | 21.65 | 21.57 | 187.99 | 23.89 | 11.51 |

| Triveni Engineering & Industries | 10.88 | 10.88 | 144.34 | 33.07 | 7.66 |

| Dalmia Bharat Sugar & Industries | 47.78 | 47.78 | 399.62 | 7.75 | 11.96 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Trualt Bioenergy IPO

How can I apply for Trualt Bioenergy Limited IPO?

You can apply via HDFCSky using UPI-based ASBA for a seamless application process.

What is the price band of Trualt Bioenergy Limited IPO?

The IPO price band is yet to be announced and will be updated soon.

When will Trualt Bioenergy Limited IPO shares get listed?

The shares are expected to be listed on BSE and NSE on 3 October 2025.

What is the minimum investment required in Trualt Bioenergy Limited IPO?

The minimum investment depends on the lot size, which will be announced shortly.