- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Different Types of Derivatives Market in India

By HDFC SKY | Updated at: Oct 1, 2025 05:23 PM IST

Derivatives are financial contracts whose value is derived from an underlying asset like stocks, commodities, currencies, or interest rates. They are widely used for hedging risks, speculating on price movements or leveraging positions. There are several types of derivatives, each serving a unique purpose in the financial markets. Understanding these types helps investors manage risk and optimise returns effectively.

What Are Derivatives?

Derivatives are financial instruments whose value is based on the price of an underlying asset such as stocks, commodities, currencies or indices. They are used for hedging risk, speculating on price movements and gaining market exposure without owning the actual asset. Common types include futures, options, forwards and swaps.

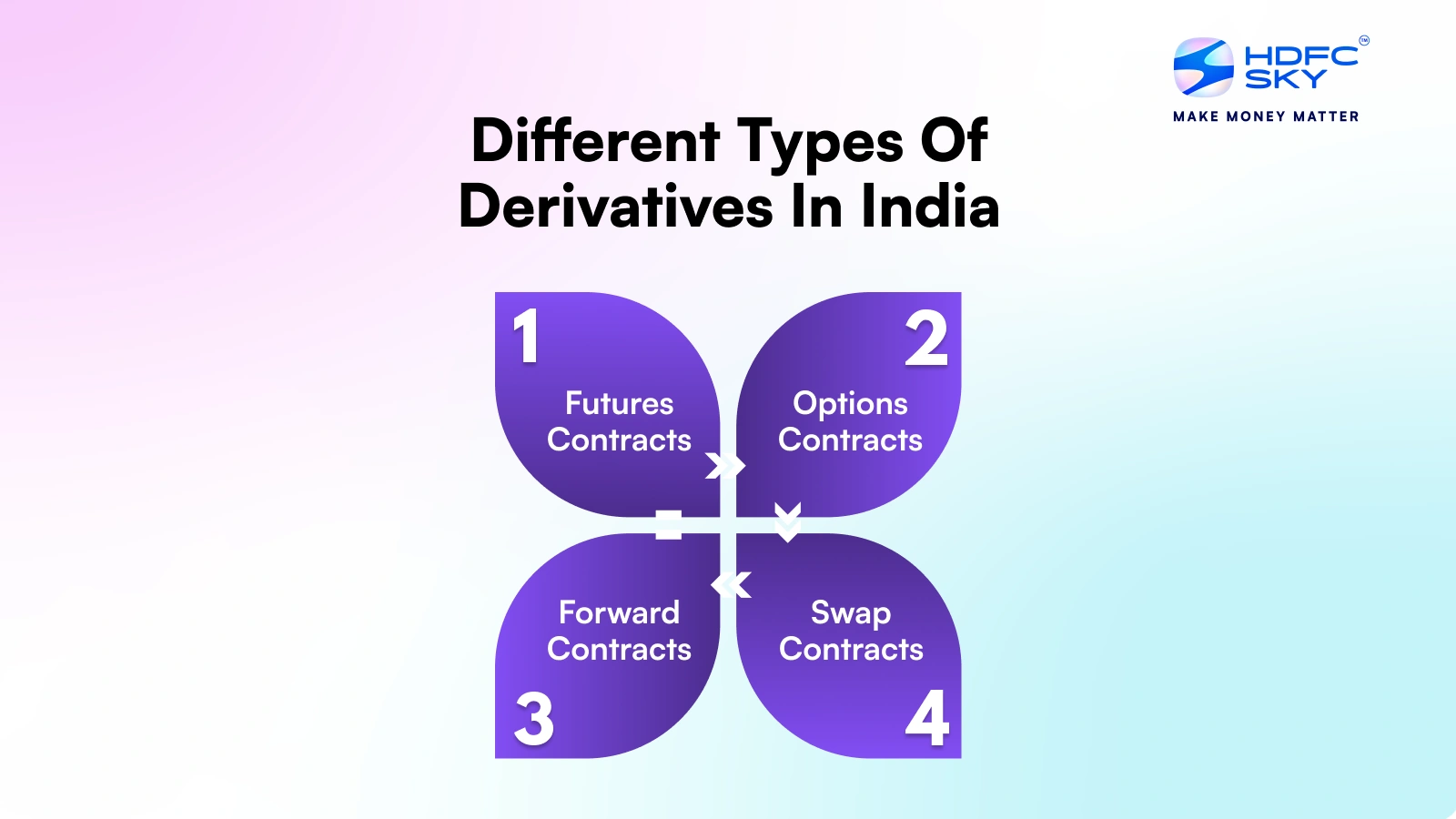

Different Types of Derivatives with Examples

The four types of derivatives find extensive usage in India. They are futures, options, forward, and swap contracts. Investors, traders and companies use all these types of derivatives for different purposes. Derivative contracts can be standardised and traded on exchanges or customised and traded over the counter.

1. Futures Contracts

Futures contracts are contracts to buy or sell an asset on a certain date at a predetermined price. They are sold and bought in India at exchanges such as NSE and MCX. They are standardised meaning that the whole market applies the same rules. Futures are found in shares, commodities and currencies. If you execute a futures contract, you have to buy or sell the asset when the contract expires, regardless of what the market price is then. This protects you from price fluctuations but you can also lose money if the market goes against you.

Futures contracts are a popular type of derivative market in India. Future trades are settled through a clearing corporation (like NCLL or ICCL in India), which acts as a counterparty to both buyer and seller, mitigating default risk. Both buyers and sellers must deposit an initial margin and maintain it through daily Mark-to-Market (MTM) adjustments. In India index futures are cash-settled, while stock futures may result in physical delivery if held till expiry.

Example: Buying Nifty futures for next month’s expiry.

2. Options Contracts

Options contracts give you the right but not the obligation, to buy or sell an asset at a specified price within a specified time. There are two primary types: call options (option to buy) and put options (option to sell). You pay a premium for the right. If the market price is unfavourable to you, you can allow the contract to expire and lose only the premium. Options are traded on stocks and indices in India. Options are versatile and can help you avoid large losses. Options are used by many for speculation or to earn additional income. Options are an integral part of financial derivative types.

Example: Buying a call option on Reliance stock.

3. Forward Contracts

Forward contracts are private bilateral contracts between two parties. They are contracts that bind one to buy or sell an asset on a future date at a fixed price. The contracts are not exchanged on an exchange. They are tailored to suit, hence the terms are negotiable depending on the circumstances. In India forward contracts are prevalent for commodities such as crops or metals. Because they are private contracts, there is always a risk that one party will fail to fulfil the obligation. Forwards are suitable for those who desire flexibility and customised terms.

Example: A wheat farmer enters a forward contract with a mill to sell wheat in 3 months.

4. Swap Contracts

Swap contracts are contracts where two entities exchange cash flows or other financial instruments. Large corporations and banks in India predominantly utilise swaps. They can, for instance, exchange interest payments or foreign exchange. Swaps facilitate risk management of something such as shifting interest rates or foreign exchange rates of currency. These are not exchanged on an exchange. Rather they are private contracts. Swaps are a more sophisticated derivative form and are not preferred by small investors. But they are a crucial part of the financial system.

Example: Interest rate swap between a fixed-rate and floating-rate loan.

How to Trade in the Derivatives Market?

Derivatives trading involves speculating or hedging based on an asset’s future price. It requires a trading account, market knowledge and risk management.

- Open a Trading & Demat Account: Register with a SEBI-registered broker who offers derivatives trading.

- Complete KYC: Submit PAN, Aadhaar, bank details and income proof (as derivatives are high-risk instruments).

- Choose the Derivative Instrument: Select from futures, options, etc., based on your strategy.

- Select the Underlying Asset: Decide whether to trade in stocks, indices, commodities or currencies.

- Analyse the Market: Use technical and fundamental analysis to forecast price movements.

- Place the Trade: Enter buy or sell orders through your trading platform.

- Monitor & Exit: Track your positions and square off or roll over before expiry.

Participants in a Derivatives Market

The derivatives market consists of various participants, each with different objectives and risk appetites:

- Hedgers: Use derivatives to protect against price fluctuations in the underlying asset.

- Speculators: Aim to profit from price movements by taking calculated risks.

- Arbitrageurs: Exploit price differences between markets for risk-free profit.

- Margin Traders: Trade with borrowed funds to increase exposure and potential returns.

- Investors: Use derivatives to diversify portfolios or enhance returns.

Advantages of Derivative Trading

Derivative trading offers powerful tools for hedging risk, leveraging capital and enhancing portfolio returns. It’s widely used by traders, investors and institutions.

- Risk Management: Helps hedge against price fluctuations in underlying assets.

- Leverage: Requires a smaller capital outlay for larger market exposure.

- Liquidity: Popular derivatives like index options/futures are highly liquid.

- Price Determination: Reflects market sentiment, aiding in efficient pricing.

- Diversification: Offers exposure to various assets (stocks, commodities, currencies, etc.).

Disadvantages of Derivatives Trading

Derivatives trading involves high risk due to leverage and market volatility. It’s complex and may lead to significant losses if not managed carefully.

- High Risk: Leverage can amplify both profits and losses.

- Complexity: Requires deep understanding of instruments and strategies.

- Market Volatility: Sudden price swings can lead to heavy losses.

- Liquidity Risk: Some contracts may be hard to exit at desired prices.

- Counterparty Risk: Especially in over-the-counter (OTC) derivatives, there’s a chance of default.

Conclusion

The types of derivatives in India futures, options, forwards and swaps provide ample opportunities to hedge and potentially profit. Every derivative and its form has its characteristics, risks and applications. Indian investors utilise these contracts to hedge, speculate, and diversify.

The sale and purchase of derivative contracts require caution, research and a clear understanding of the market. Utilised wisely, types of financial derivatives can help you achieve your investment objectives.

Related Articles

FAQs on Types of Derivatives

Who takes part in the derivatives market?

The key players of the Indian derivatives market are hedgers, speculators, arbitrageurs, and market makers. Hedgers attempt to hedge, speculators attempt to make a profit, arbitrageurs exploit price discrepancies, and market makers supply liquidity for smooth transactions.

How are derivatives regulated?

SEBI, RBI, and the Forward Markets Commission regulate derivatives in India. SEBI regulates exchange-traded financial derivatives, RBI regulates currency contracts and over-the-counter derivatives, and the Forward Markets Commission regulates commodity derivatives. SEBI revises rules from time to time to limit risks and conduct fair trade.

How Do Derivatives Work?

Derivatives are agreements whose value is determined by a commodity underlying, such as shares or commodities. The agreement states the selling and buying price and date. Investors utilise the agreements to hedge, speculate, or earn money from price fluctuations without possessing the asset.

Why do Investors Enter into Derivative Contracts?

Investors use derivative contracts to hedge against price risks, speculate to earn profits, diversify portfolios, or leverage for larger positions. Derivatives are also used for price discovery and management of cash flow risks and are beneficial for individuals as well as businesses.