- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

UKB Electronics IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

UKB Electronics Limited

UKB Electronics Limited is an integrated EMS provider offering product design, prototyping, and manufacturing of electronic and electrical products. It serves leading OEMs, including multinational corporations and Fortune 500 companies like LG, Panasonic, Carrier Midea, Haier, and IFB. Its portfolio spans home appliances, consumer electronics, PCB assemblies, and strategic electronics across aerospace, defence, automotive (e-mobility), industrial automation, and renewable energy. The company also develops e-mobility charging solutions and specialised cables. With 11 facilities nationwide, it exports to 17+ countries, including the US, Mexico, South Korea, and Singapore.

UKB Electronics Limited IPO Overview

UKB Electronics Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 1, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is a book-built issue worth ₹800 crore, comprising a fresh issue of ₹400 crore and an offer for sale (OFS) of ₹400 crore. The equity shares are proposed to be listed on both NSE and BSE. While the book-running lead manager is yet to be announced, Kfin Technologies Ltd. has been appointed as the registrar of the issue. Details such as IPO dates, price band, and lot size are yet to be disclosed. As per the DRHP, the face value of each share is set at ₹2, and the total issue size aggregates up to ₹800 crore, split equally between fresh issue and OFS. The IPO will be a book-building issue, and the company’s pre-issue shareholding stands at 29,46,60,000 shares. Promoters of UKB Electronics include Manoj Tayal, Vinay Kumar Tayal, Manik Tayal, and Pradeep Kumar Tayal, who collectively hold 99.95% of the company’s shares before the issue.

UKB Electronics Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹800 crore |

| Fresh Issue | ₹400 crore |

| Offer for Sale (OFS) | ₹400 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 29,46,60,000 shares |

| Shareholding post-issue | TBA |

UKB Electronics IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

UKB Electronics Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

UKB Electronics Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.56 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 22.52% |

| Net Asset Value (NAV) | ₹6.94 |

| Return on Equity (RoE) | 20.60% |

| Return on Capital Employed (RoCE) | 27.78% |

| EBITDA Margin | 12.31% |

| PAT Margin | 5.82% |

| Debt to Equity Ratio | 1.14 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Pre-payment or re-payment, in full or in part, of certain outstanding borrowings availed by the Company | 2212.76 |

| Purchase of plant and machinery for our existing Manufacturing Facilities | 805.79 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

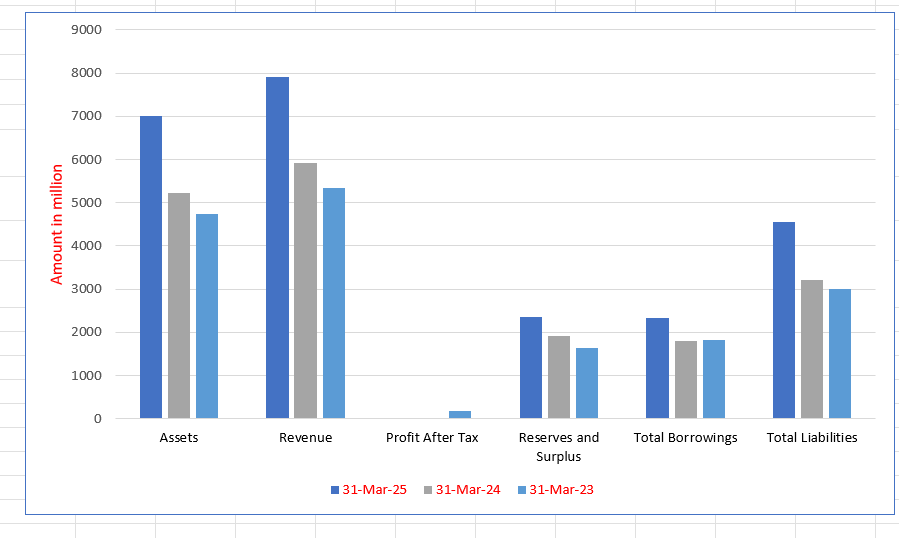

UKB Electronics Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 7018.01 | 5218.16 | 4748.97 |

| Revenue | 7904.05 | 5927.39 | 5333.28 |

| Profit After Tax | 4,60.18 | 2,67.48 | 191.77 |

| Reserves and Surplus | 2365.41 | 1906.41 | 1638.94 |

| Total Borrowings | 2338.23 | 1807.27 | 1829.92 |

| Total Liabilities | 4554.38 | 3213.53 | 3011.71 |

Financial Status of UKB Electronics Limited

SWOT Analysis of UKB Electronics IPO

Strength and Opportunities

- Extensive manufacturing footprint with 11 plants across India and a workforce of 3,500+ associates

- Long-standing reputation—over two decades of experience in electronics manufacturing

- Broad product portfolio: PCBs, wiring harnesses, EV charging solutions, flexible cords, remote controls, power cords

- Strong quality credentials: IATF 16949, ISO 9001, ISO 14001, ISO 45001 certifications

- Wide industry coverage: consumer electronics, EV & automotive, defence, aerospace, industrial sectors

- In-house advanced manufacturing capabilities: SMT lines, E-beam cross-linking, Niehoff fine-wire drawing

- Global compliance approvals (UL, CE, BIS, ETL, IEC, etc.) boost export potential

- Strategic move: recently filed DRHP to raise up to ₹800 crore through IPO, supporting expansion

- Multiple manufacturing units support Just-In-Time delivery and inter-facility backup

- Growing demand for EV and renewable energy components presents growth path

Risks and Threats

- Heavy reliance on manufacturing in India may expose the company to regional disruptions and logistical risks

- Limited public information on financials or global expansion strategy may reduce investor confidence

- Intense competition from global EMS providers could pressure margins

- Dependence on certifications and compliance; failure to update standards could hinder competitiveness

- Exposure to cyclical demand in EV or defence sectors may lead to revenue volatility

- High capital expenditure for maintaining cutting-edge equipment can strain finances

- Export market complexity and regulatory shifts (e.g., trade tariffs) pose risks

- IPO markets are volatile — market downturns could delay capital raising or dilute valuation

- Supply chain disruptions (global or local) could still impact production continuity

- Regulatory or technological shifts (e.g., changes in EV standards) could require rapid adaptation

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About UKB Electronics Limited

UKB Electronics Limited IPO Strengths

Diverse Product Portfolio and Market Reach

UKB Electronics Limited possesses a diverse product portfolio that includes electronic distribution systems, appliance cord assemblies, remote controls, and specialty cables. This allows them to serve both B2B and B2C markets and a wide range of industries, such as home appliances, strategic electronics, and mass transportation, effectively de-risking their business model.

Strategic Integration and Capabilities

The company is an integrated EMS manufacturer with end-to-end product development capabilities. Their backward integration ensures consistency and reliability by managing processes from design to manufacturing. They possess capabilities in mould designing, wire and cable designing, and printed circuit board assembly, enabling them to maintain high quality and offer comprehensive solutions to customers.

Robust Manufacturing and Quality Control

UKB Electronics operates 11 strategically located manufacturing facilities and is equipped with advanced imported machinery, including automated production lines. They also have an in-house design center and a testing laboratory with E-beam radiation infrastructure approved by the Atomic Energy Regulatory Board. This ensures the production of high-quality, durable components and allows for rigorous testing.

Strong Customer Base and Market Positioning

The company serves a broad array of customers, with a significant number in both the home appliances and consumer electronics and strategic electronics sectors. They have established a strong presence in the market, supported by their long-standing relationships with global OEMs and Fortune 500 companies. This strong customer base and market position are key to their customer retention and growth.

Extensive Promoter Experience and Market Leadership

UKB Electronics has a well-established market position, largely due to the promoters’ over two decades of experience in the electrical and electronics industry. Their deep expertise has been instrumental in the company becoming a leading manufacturer of electronic components, particularly in the consumer durables and white goods segments. This wealth of experience provides a significant competitive advantage.

Global Presence and Strategic Certifications

The company operates globally, with a presence in over 14 countries and multiple international certifications, including UL and TUV marks. This allows them to supply major OEMs and other international clients, highlighting their adherence to global quality and safety standards. Their ability to export to diverse markets further solidifies their reputation for reliability and quality.

Focus on Innovation and Technology

UKB Electronics prioritizes innovation, supported by a dedicated R&D team that continuously researches and develops new solutions. The company’s unique capability is its 3.0 MeV Electron Beam Machine, which is used to manufacture advanced EBXL wires and cables. This commitment to leveraging cutting-edge technology ensures that their products not only meet but exceed customer expectations.

More About UKB Electronics Limited

UKB Electronics Limited emerges as a distinguished innovator and electronic manufacturing services (EMS) provider in India. With over two decades of expertise, the company is committed to delivering precision-engineered solutions that span design, prototyping, and full-scale manufacturing.

Core Strengths

- End-to-End Manufacturing: UKB Electronics delivers comprehensive EMS offerings—from initial design and prototyping to PCB assembly and product delivery.

- Product Diversity: Its product portfolio includes printed circuit boards (PCBs), electronic assemblies, PCBA units, remote controls, specialized wiring harnesses, power cords, EV charging solutions, and IT hardware components.

- Accreditations: The company maintains robust quality and safety standards, holding certifications such as IATF 16949, ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018.

Geographic Reach

The company extends its services across more than 11 locations within India and has established global partnerships, enabling it to serve a diverse, worldwide clientele.

Industry Engagement

It operates across multiple key sectors, including:

- Consumer Electronics – supplying components for home and kitchen appliances

- Automotive & EV – delivering electronic solutions for electric vehicles and related systems

- Strategic Electronics – serving defence, aerospace, railways, marine, and nuclear industries

- Industrial Infrastructure – supporting renewable energy, wind power, telecom, automation, oil and gas, building & construction, and transmission & distribution.

Vision & Ethos

UKB Electronics projects itself as a “partner in advanced Electronic Manufacturing Services,” aligning with its slogan, “From Design to Delivery, Experience Excellence.” The company champions excellence, innovation, precision, and sustainable practices in all facets of its operations.

Leadership & Culture

Guided by a leadership team that embodies passion and forward-thinking innovation, UKB Electronics is driven toward a technology-enabled future marked by continuous improvement.

Industry Outlook

India’s Electronics Manufacturing Services (EMS) sector was valued at approximately USD 61.85 billion in 2024 and is projected to surge to USD 348 billion by 2031, reflecting an impressive CAGR of around 28%. Some conservative estimates suggest the EMS market could cross USD 100 billion by 2035 with a CAGR of about 6%. The broader electronics manufacturing sector, including system design, is expected to touch USD 300 billion by 2026.

Key Growth Drivers

- Government push through ‘Make in India’ and PLI schemes, which incentivise domestic production, especially in mobiles, IT hardware, and components.

- Consumer electronics demand, led by smartphones, laptops, and IT devices, driven by rising disposable incomes and a growing middle-class population.

- Expansion of EV electronics, industrial automation, semiconductors, and strategic electronics such as defence and aerospace.

- Strong focus on localisation of supply chains and ecosystem development to reduce import dependency.

Outlook for Specific Products

- PCBAs and electronic components such as lithium-ion cells, camera modules, displays, and wiring harnesses are expected to see rapid expansion, with projected growth of nearly 30% CAGR, reaching an estimated USD 139 billion by 2030.

- The components ecosystem is emerging as one of the fastest-growing sub-segments, forming the backbone for consumer electronics, automotive, and strategic industries.

How Will UKB Electronics Limited Benefit

- UKB Electronics Limited is well-positioned to capitalise on India’s EMS industry, which is expected to grow at a CAGR of nearly 28% by 2031.

- Rising demand for PCBAs, wiring harnesses, and electronic assemblies directly aligns with the company’s core manufacturing expertise.

- Expansion of EV electronics and automotive components offers opportunities for UKB to strengthen its footprint in emerging mobility solutions.

- The PLI schemes and localisation push will enable the company to secure more domestic contracts while reducing reliance on imports.

- Growing consumption of consumer electronics and IT hardware ensures consistent demand for UKB’s product lines, from power cords to remote controls.

- Increasing investment in strategic sectors like defence, aerospace, and industrial automation will allow UKB to diversify its client base.

- As the components ecosystem grows, UKB can expand scale, improve margins, and enhance its role as a preferred EMS partner.

Peer Group Comparison

| Name of Company | Revenue (in million) | Face value (₹) | EPS (₹) | NAV (₹) | P/E | RoNW (%) |

| Our Company | 7,872.71 | 2 | 1.56 | 6.94 | N.A. | 22.52% |

| Peer Groups | ||||||

| Kaynes Technology India Limited | 27,217.52 | 10 | 45.40 | 443.83 | 136.53 | 10.32% |

| Avalon Technologies Limited | 10,981.28 | 2 | 9.48 | 92.44 | 89.00 | 10.37% |

| Dixon Technologies (India) Limited | 3,88,601.00 | 2 | 202.58 | 575.82 | 82.26 | 35.53% |

| PG Electroplast Limited | 48,695.32 | 1 | 10.55 | 99.90 | 52.86 | 10.18% |

| Amber Enterprises India Limited | 99,730.16 | 10 | 71.67 | 683.05 | 100.78 | 10.87% |

Key Strategies for UKB Electronics Limited

Expansion of Manufacturing Capacities

UKB Electronics Limited is strategically expanding its manufacturing capabilities by establishing both brownfield and greenfield facilities to meet increasing customer demand. The company plans to invest ₹805.79 million to acquire and install machinery, aiming to enhance operational efficiencies and expand into new sectors like defence and railways.

Deepening Ties with International Clients

The company is focused on transitioning from a domestic supplier to a preferred global partner for its international marquee clients. This strategy involves expanding its product offerings and supplying a broader range of components, including co-developing solutions. The objective is to enhance customer retention, increase wallet share, and strengthen strategic partnerships globally.

Increasing International Exports

UKB Electronics Limited aims to capitalize on the growing international demand for its products. The company is expanding its international sales and marketing infrastructure, leveraging third and fourth-party logistics, and establishing dedicated offices in key markets like the United States and Latin America to boost exports and improve profit margins.

Leveraging Product Development Capabilities

UKB Electronics Limited is leveraging its product development capabilities to capitalize on opportunities in strategic electronics sectors. The company has expanded its offerings in aerospace, defence, and mass transport and is building on this foundation to diversify its product portfolio. The firm aims to be a leading provider of quality products in these sectors.

Strengthening Position in Consumer Electronics

The company is working to deepen its presence in the consumer electronics sector by expanding its product portfolio. The strategy involves introducing new product lines such as LED TV remotes, PCB power controllers, and power adapters. Additionally, UKB Electronics aims to increase the content value per product and establish new manufacturing facilities to support this growth.

Focusing on Box Build Products

As part of its export strategy, the company is enhancing its EMS capabilities to provide comprehensive end-to-end manufacturing solutions. This involves expanding services to encompass the complete assembly and integration of components into a final, ready-to-use product. The company is currently developing box build products, including robotic cleaning machines, air purifiers, and room heaters.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On UKB Electronics Limited IPO

How can I apply for UKB Electronics Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of UKB Electronics Limited IPO?

The IPO is ₹800 crore, including a fresh issue of ₹400 crore and an OFS of ₹400 crore.

Where will UKB Electronics Limited shares be listed?

The equity shares are proposed to be listed on both BSE and NSE mainboard platforms.

What is the purpose of UKB Electronics IPO?

The proceeds will be used for loan repayment, machinery purchase, and general corporate purposes.

Who are the promoters of UKB Electronics Limited?

The promoters are Manoj Tayal, Vinay Kumar Tayal, Manik Tayal, and Pradeep Kumar Tayal.

How did UKB Electronics perform financially in FY 2025?

In FY 2025, the company reported ₹790.41 crore revenue and ₹46.02 crore profit after tax.