- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Understanding key economic concepts -- growth and inflation

By HDFC SKY | Updated at: Apr 4, 2025 11:14 AM IST

Let’s begin this chapter by understanding the concept of growth. For this, we first need to know what Gross Domestic Product (GDP) means. In simple terms, the GDP is the total value of goods and services produced in a country in a year. To explain this concept in a simpler way, imagine that a country produces only one product – wheat. The country produces 100kgs of wheat in a year, for which consumers pay Rs 10 per kg. So, the total GDP of the country will be 100 x 10 = Rs 1,000.

Growth rate is the percentage at which the GDP grows year on year. To continue with the previous example, if the country produces 110kgs of wheat the next year and sells it for the same Rs 10 per kg, GDP would be calculated as Rs 1,100. So, the GDP growth of the country can be calculated with the formula:

Growth = ((GDP in year 2 – GDP in year 1) / GDP in year 1)) x 100

In the above example, the GDP growth rate works out to be 10%. This growth rate is what determines the overall economic health of a country, along with the potential direction in which the country is going.

Now that we know what GDP is, the next question is – how do we calculate it?

GDP = Consumer spending + Investments by businesses + Govt. Spending + Net Exports

- Consumer spending includes all the spending done by consumers in an economy such as buying food, clothes, etc.

- Investments by businesses are predominantly capital expenditures. For example, when a company buys land to set up a new factory.

- Government spending includes infrastructure spending on roads, bridges along with welfare spendings such as subsidies and schemes.

- Net Exports is the difference between the exports and imports of a country.

The objective of governments world over is to sustain good GDP growth over the medium and long term, through favourable policies and stability. They also have to continue to develop the country simultaneously, which means spending money in a number of areas such as infrastructure, defence, etc. This leads to more private players entering the country due to its growth opportunities and future prospects, leading to something known as the multiplier effect i.e., the government gets a multiple of their spending added to the overall GDP. For example, India plans to invest $100 billion into the semiconductor space, over the next 5 years, to make India the global hub for chips. This will bring more private players into the space, due to the government support available, and will likely increase India’s overall GDP by a multiple of the total amount invested.

Inflation

Now let’s go back to our initial example of one country one product. In the second year, we assumed that the country’s wheat output increased from 100 kg to 110 kg, thus increasing GDP. However, what if we increased the price by Re 1, while keeping the output constant. In this case too, the GDP would be Rs 1100 (100kg * 11). However, in this example, the growth was achieved not by an increase in production but by rising prices. This rise in price is known as inflation.

GDP growth occurs through a combination of production increases and price rises, to ensure demand for products & services continue to grow, while maintaining a certain target inflation level. This is a job for Central Banks all over the world and is a lot harder to maintain than it sounds. There is a very delicate balance that needs to be maintained to ensure that people continue to buy things, while also ensuring it doesn’t hurt their pockets too much while doing so.

For example, suppose you love a certain brand of chocolate. You bought a box 6 months ago for Rs 800. You went to the store today, and it was priced at Rs 1200, a whopping 50% increase. Now, you have a choice to make. Do you think the chocolates are worth the additional 50%? Chances are, they’re not. You’ll either find a competing brand within your budget or (worse) you won’t buy chocolate at all. The first scenario will lead to reduced sales for your preferred brand causing them to drop their prices to try and boost sales, which may hurt their profitability, but ensure survival. However, the second option is what is more problematic as it could lead to deflation.

Deflation is the opposite of inflation where prices gradually reduce over time due to lack of economic growth. This causes people to defer their purchases to a future date as the future price is expected to be lower than the current price, causing demand to fall further. Deflation is a slippery slope that governments and central banks actively try and avoid.

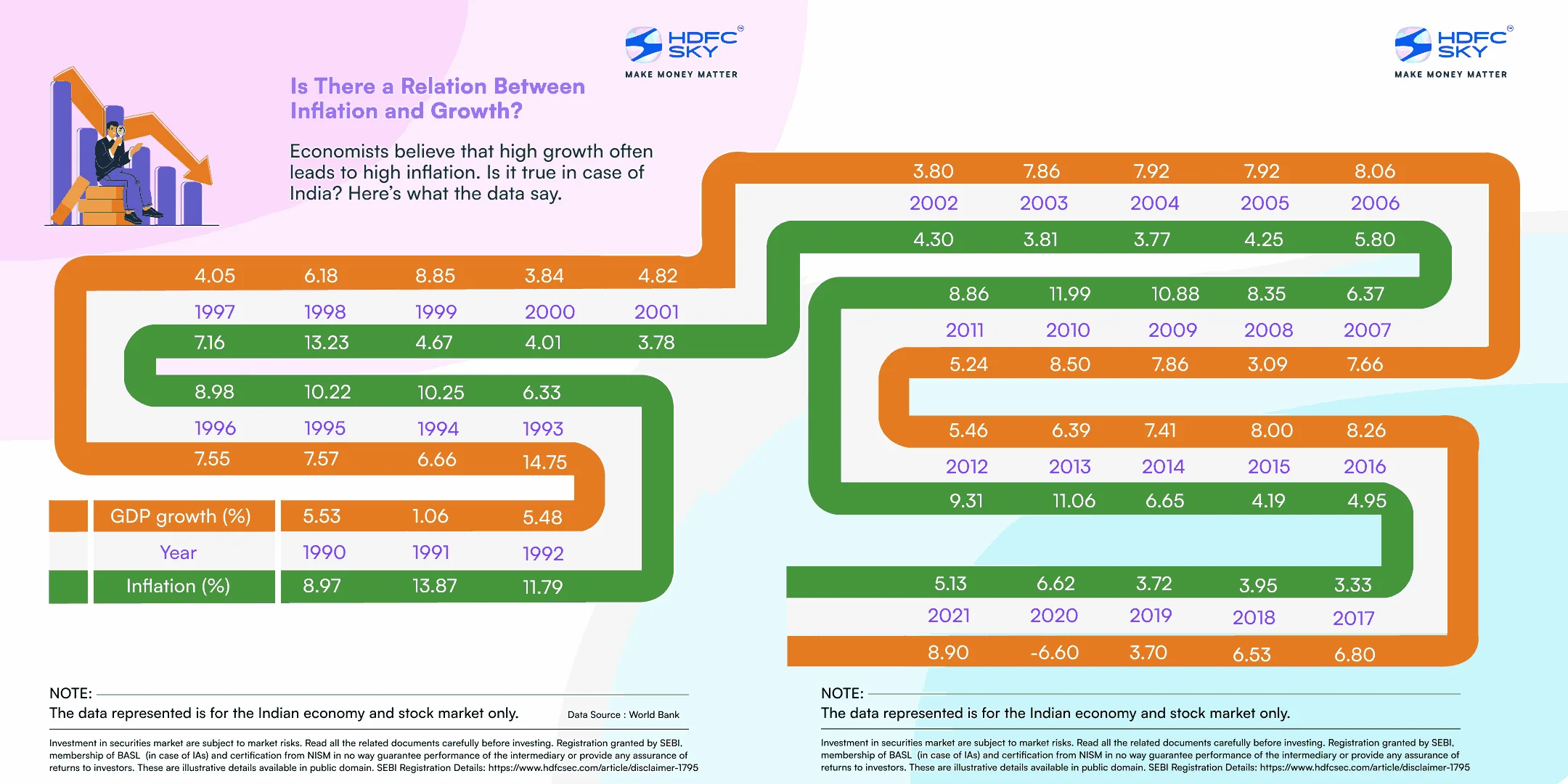

So, what is the sweet spot? A growth rate which is high and achievable and an inflation rate which is low enough to help demand to keep growing, but not too low to ensure people defer their purchases. India’s growth targets are usually in the 7-10% range historically, while having a target inflation of 4%, which shows a real growth rate of 3-6% per year.