- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Urban Company IPO

₹14,210/145 shares

Minimum Investment

IPO Details

10 Sep 25

12 Sep 25

₹14,210

145

₹98 to ₹103

NSE, BSE

₹1,900 Cr

17 Sep 25

Urban Company IPO Timeline

Bidding Start

10 Sep 25

Bidding Ends

12 Sep 25

Allotment Finalisation

15 Sep 25

Refund Initiation

16 Sep 25

Demat Transfer

16 Sep 25

Listing

17 Sep 25

Urban Company Limited

Urban Company is a technology-driven, full-stack online services marketplace offering quality-focused solutions across home and beauty categories. The platform allows consumers to conveniently book services such as cleaning, pest control, plumbing, carpentry, appliance repair, painting, skincare, grooming, and massage therapy. These services are delivered by trained, independent professionals at the customer’s convenience. The company remains committed to delivering a standardised, reliable, and high-quality service experience. Urban Company currently operates with over 48,000 active service professionals, serving more than 13 million consumers across 59 cities and 4 countries.

Urban Company Limited IPO Overview

Urban Co. is set to raise ₹1,900 crore through a book-built IPO, comprising a fresh issue of 4.58 crore shares worth ₹472 crore and an offer-for-sale of 13.86 crore shares worth ₹1,428 crore. The IPO opens for subscription on 10 September 2025 and closes on 12 September 2025, with allotment expected by 15 September 2025. The shares will list on BSE and NSE, with a tentative listing date of 17 September 2025.

The price band is fixed between ₹98 and ₹103 per share. The retail investor lot size is 145 shares, requiring a minimum investment of ₹14,935 (at the upper price). For non-institutional investors (NII), the lot size is 14 lots (2,030 shares) with an investment of ₹2,09,090, while qualified institutional buyers (QIB) must apply for 67 lots (9,715 shares), amounting to ₹10,00,645.

Kotak Mahindra Capital Company Ltd. is the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar for the issue.

Urban Company Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹429 crore (aggregating to 4,58,25,242 shares)

Offer for Sale (OFS): ₹1471 crore (aggregating to 13,86,40,776 shares) |

| IPO Dates | 10 Sept 2025 to 12 Sept 2025 |

| Price Bands | ₹98 to ₹103 per share |

| Lot Size | 145 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 48,97,67,500 shares |

| Shareholding post -issue | 1,39,00,53,450 shares |

Important Dates

| Activity | Date |

| IPO Open Date | 10 September 2025 |

| IPO Close Date | 12 September 2025 |

| Tentative Allotment | 15 September 2025 |

| Initiation of Refunds | 16 September 2025 |

| Credit of Shares to Demat | 16 September 2025 |

| Tentative Listing Date | 17 September 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 145 | ₹14,935 |

| Retail (Max) | 13 | 1,885 | ₹1,94,155 |

| S-HNI (Min) | 14 | 2,030 | ₹2,09,090 |

| S-HNI (Max) | 66 | 9,570 | ₹9,85,710 |

| B-HNI (Min) | 67 | 9,715 | ₹10,00,645 |

Urban Company Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (0.66) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (7.18%) |

| Net Asset Value (NAV) | 9.31 |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | (4.64%) |

| PAT Margin | – |

| Debt to Equity Ratio |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Expenditure for new technology development and cloud infrastructure | 1900 |

| Expenditure for lease payments for our offices | 700 |

| Expenditure towards marketing activities | 800 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

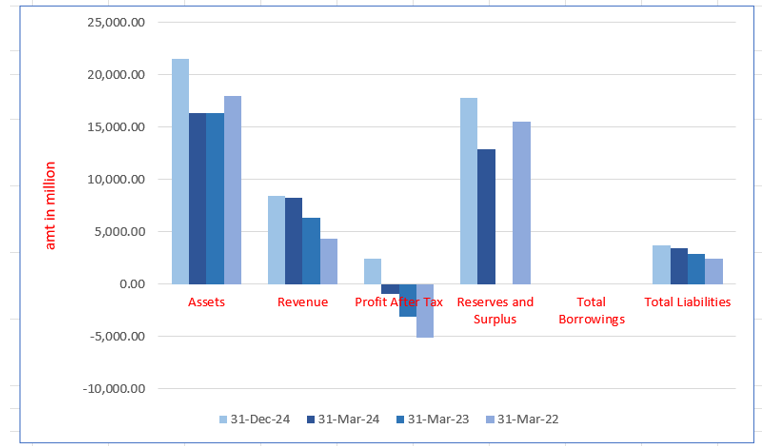

Urban Company Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 21,509.49 | 16,386.46 | 16,312.20 | 17,940.01 |

| Revenue | 8460.16 | 8280.18 | 6365.97 | 4375.75 |

| Profit After Tax | 2425.97 | (927.72) | (3124.84) | (5141.45) |

| Reserves and Surplus | 17,812.61 | 12,926.41 | 13.394.62 | 15,514.34 |

| Total Borrowings | – | – | – | – |

| Total Liabilities | 3696.68 | 3460.05 | 2917.58 | 2426.07 |

Financial Status of Urban Company Limited

SWOT Analysis of Urban Company IPO

Strength and Opportunities

- Extensive service portfolio covering over 100 categories, including beauty, wellness, and home repairs.

- User-friendly digital platform accessible via app and website, ensuring seamless customer experience.

- Strong customer base with over 5 million served by 2024, indicating market acceptance.

- Emphasis on quality through rigorous professional vetting and standardized procedures.

- Expansion into emerging service categories like pet care and elderly care, tapping into new markets.

- Geographic expansion into Tier-2 and Tier-3 cities, leveraging untapped demand.

- Growth in international markets, building on successes in the UAE and Singapore.

- Technological expertise with seamless app experience and advanced algorithms for matching customers with professionals.

- Strong brand recognition in the market, enhancing customer trust and loyalty.

Risks and Threats

- Limited penetration in rural and semi-urban markets, restricting growth potential.

- Trust barriers among some Indian consumers regarding online service platforms.

- Challenges in maintaining consistent service quality due to variability in professional performance.

- Dependence on service providers may cause inconsistency in user experience.

- High competition from local service providers and other aggregators, leading to price wars.

- Potential quality control issues as the network of service professionals expands beyond 110,000.

- Government regulations and policy changes could impact operations and profitability.

- Economic downturns may reduce spending on non-essential services, affecting demand.

- Changing consumer preferences towards DIY approaches or new service models.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Urban Company Limited

Urban Company Limited IPO Strengths

Multi-Category, Hyperlocal, Home Services Marketplace Benefits from Network Effects

Urban Company Limited operates a hyperlocal platform structured into over 12,000 service micro-markets, optimised for minimal travel and faster fulfilment. Each micro-market, defined by demand density and service type, enhances efficiency and consumer satisfaction. This model strengthens network effects, boosts referrals, drives service expansion, and raises professional earnings—30–40% higher than non-platform peers—while increasing consumer lifetime value and order frequency.

Established Brand Trusted by Consumers

Urban Company Limited prioritizes trust, quality, and timely service, earning high consumer ratings averaging above 4.7 out of 5. With 13.26 million unique consumers served and strong network effects, the platform drives brand loyalty, repeat usage, and expanding service adoption, reflected in consistent growth in consumer retention and increasing spend across multiple service categories.

Improved Quality of Service Professionals Through Training and Tools

Urban Company Limited enhances service quality via extensive in-house training and access to quality tools and consumables. With 214 trainers and 220+ classrooms, professionals are upskilled and mentored. Genuine products are barcode-tracked for authenticity. Service professionals retain over 70% earnings, incentivizing higher order volumes and long-term platform engagement.

Robust Technology Platform Powering Growth and Empowerment

Urban Company Limited leverages a unified technology stack with AI, ML, and GenAI to optimize service fulfilment, real-time resource allocation, and personalized consumer experiences. Its platform empowers service professionals through onboarding, training, financial tools, and quality checks, fostering efficiency, quality, and community across hyperlocal service micro-markets nationwide.

Innovation and Product Development Excellence

Urban Company Limited leads in product innovation, introducing industry-first tools like the foam jet pump, roll-on wax, and ‘Co-Pilot’ diagnostic. Collaborating with OEMs, it develops professional-grade kits and launched smart ‘Native’ water purifiers and electronic door locks, enhancing service quality, efficiency, and consumer convenience across its platform nationwide.

Scale and Technology Driving Profitability

Urban Company Limited’s scalable platform and unified technology have enabled over 85 million completed service orders since 2014. Expanding across cities and categories, it consistently grows its consumer base and spending, driving operational efficiencies and improving adjusted EBITDA margins from -22.49% in 2022 to 3.83% in 2024, strengthening profitability.

Strong Leadership with Experienced Promoters and Board

Urban Company Limited is led by three promoters—Abhiraj Singh Bhal, Varun Khaitan, and Raghav Chandra—each with over a decade of industry experience. Supported by a skilled management team and independent directors, the company benefits from strategic governance, strong operational leadership, and deep expertise to drive sustained growth and market leadership.

More About Urban Company Limited

Urban Company Limited operates a technology-led, full-stack online services marketplace catering to quality-driven home and beauty solutions. By 31 December 2024, the company had a presence in 59 cities across India, UAE, Singapore, and KSA, with 48 cities in India alone.

Diverse Service Portfolio

Urban Company enables consumers to seamlessly access a broad range of home and personal services, such as:

- Cleaning, pest control, painting

- Appliance servicing and repairs

- Electrician, plumbing, and carpentry work

- Beauty and wellness services including skincare, hair grooming, and massage therapy

All services are delivered at the customer’s convenience by independent, background-verified professionals.

Expanding Offerings under the ‘Native’ Brand

In Fiscals 2023 and 2024, Urban Company introduced:

- Water purifiers (2023)

- Electronic door locks (2024)

These are sold under the proprietary brand ‘Native’, available both in India and abroad.

Empowering Service Professionals

Urban Company supports its service professionals with:

- Comprehensive in-house training

- Access to tools, technology, SOPs, and consumables

- Financing, insurance, and branding aid

This model enhances service delivery quality while helping professionals earn 30–40% more than non-platform peers (Redseer Report 2024).

- 48,169 average monthly active professionals (9M FY2024)

Technology at the Core

The platform uses technology for:

- Efficient service discovery

- Micro-market demand-supply matching

- On-job assistance for professionals

- Integrated ordering of tools and consumables

This data-driven model improves consumer experience and service consistency.

Focus on Consumer Excellence

Urban Company prioritises:

- Trust, quality, and convenience

- Average consumer rating: 4.82/5 (9M FY2024)

- Feedback analysis and retraining based on consumer comments

- Growth driven by repeat users

Revenue Streams

Urban Company’s earnings are generated from:

- Service facilitation via its platform

- Sales of consumables and tools to professionals

- Sales of Native-branded products to consumers

International Expansion and Joint Venture

- Services offered in UAE, Singapore, and KSA

- Transitioned to a joint venture model in KSA from January 1, 2025

Market Leadership

According to Redseer, Urban Company was the leading online full-stack home and beauty platform in India (NTV-based) in 9M FY2024.

India’s home services market has a TAM of $59.2 billion (2024) expected to grow to $97.4 billion by 2029, driven by urbanisation and busier lifestyles.

Industry Outlook

India’s home services and smart living sectors are poised for significant growth, driven by urbanization, rising disposable incomes, and increasing digital adoption.

Home Services Market

- Market Size & Growth: The Indian home services market, encompassing cleaning, repairs, beauty, and wellness services, is projected to grow at a CAGR of 10–11%, reaching approximately USD 97.4 billion by 2029 from USD 59.2 billion in 2024.

- Growth Drivers:

- Rapid urbanization and the expansion of real estate developments.

- Increased demand for professional services in tier 2 and tier 3 cities.

- Rising disposable incomes leading to higher spending on home improvement and maintenance.

- The surge in e-commerce platforms facilitating easy access to home services.

Smart Home Devices & Automation

- Smart Home Devices: The market for smart home devices in India, including smart locks, lighting, and environmental appliances like air and water purifiers, is expected to grow significantly, driven by increased internet penetration and consumer awareness.

- Home Automation Systems:

- Market Size & Growth: Valued at USD 3.56 billion in 2024, the home automation market is anticipated to reach USD 13.64 billion by 2033, growing at a CAGR of 16.1%.

- Key Trends:

- Integration of AI and IoT technologies enhancing user experience.

- Growing preference for energy-efficient and sustainable smart home solutions.

- Government initiatives promoting smart cities and digital infrastructure.

Implications for Urban Company

Urban Company’s diverse service offerings align well with these industry trends. The company’s expansion into smart products under the ‘Native’ brand, such as water purifiers and electronic door locks, positions it to capitalize on the growing demand for smart home solutions. Additionally, its technology-driven platform caters to the increasing preference for convenient and reliable home services

How Will Urban Company Limited Benefit

- Urban Company is well-positioned to capitalise on India’s booming home services market, expected to reach USD 97.4 billion by 2029, with its extensive presence across 48 Indian cities.

- Rising demand in tier 2 and 3 cities aligns with its focus on accessible, tech-enabled services.

- The launch of ‘Native’ products like water purifiers and smart locks supports its entry into the growing smart home segment, valued at USD 13.64 billion by 2033.

- AI and IoT trends favour Urban Company’s technology-first model, enhancing personalisation and reliability.

- Repeat usage and high consumer ratings (4.82/5) indicate strong customer loyalty and trust.

- Empowerment of over 48,000 active professionals increases service availability and maintains quality.

- Its international expansion and KSA joint venture open new revenue streams and market visibility.

- Government initiatives promoting smart living and digital infrastructure further reinforce the company’s strategic direction.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Urban Company Limited

Enhancing Consumer Retention and Spend

Urban Company aims to boost consumer retention by improving service quality through training and smaller micro-markets, reducing travel time, and lowering prices. To increase consumer spend, it focuses on personalized targeting, expanding granular service categories, and promoting new offerings to encourage trials and growth.

Expanding Consumer Base and Market Reach

By December 2024, Urban Company served 13.26 million consumers, with half added since 2022. It aims to grow by enhancing services and brand presence in existing cities, expanding offerings in the UAE and KSA, and entering new Indian cities with rising demand in the top 200 urban markets.

Innovative Expansion of Products and Services

Urban Company actively explores large underserved markets to address consumer needs by launching new products like water purifiers and electronic door locks under its Native brand. It has expanded home services with small painting projects and wall panel décor, introduced cleaning subscription pilots, and launched InstaHelp for rapid service delivery, enhancing convenience and affordability.

Invest in Technology to Enhance Efficiency and Experience

Urban Company continues investing in technology to boost consumer satisfaction, improve service professional efficiency, and reduce costs. It leverages AI for better service matching, post-service support, image recognition, and workflow assistance. The company also plans to hire industry experts to strengthen growth, streamline onboarding, and improve service quality monitoring.

Quicker Fulfilment of Services

Urban Company prioritizes real-time availability of service professionals by creating smaller micro-markets to reduce travel time and using data to optimize staffing. It focuses on new service categories where faster fulfilment boosts consumer preference, responding to growing demand for quick services post-COVID.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Urban Company Limited IPO

How can I apply for Urban Company Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the Urban Company IPO open?

The IPO open date is 10 Sept 2025, with closing date on 12 Sept 2025

What is the total issue size of the Urban Company IPO?

The total issue size is ₹1,900 crore, including fresh issue and offer for sale.

On which stock exchanges will Urban Company list?

Urban Company will list on the BSE and NSE stock exchanges.

What is the face value of Urban Company shares in the IPO?

The face value of shares in the IPO is ₹10 per share.

Who are the lead managers for the Urban Company IPO?

Kotak Mahindra, Morgan Stanley, Goldman Sachs, and JM Financial are the lead managers.