- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Veritas Finance IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Veritas Finance IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Veritas Finance Limited

Veritas Finance Limited (Veritas) is committed to addressing the financial requirements of India’s micro, small, and medium enterprises (MSMEs), a sector that remains largely underserved despite numerous initiatives. Operated by professionals with extensive experience in the financial services industry, the company strives to simplify credit accessibility for this segment, positively impacting millions engaged in informal activities that contribute to nation-building. A Non-Banking Finance Company registered with the Reserve Bank of India, Veritas Finance holds a loan book of ₹6,517 crores, with a presence across 424 branches (excluding 70 service centres) and a customer base of 1,95,243 as of September 30, 2024.

Veritas Finance Limited IPO Overview

Veritas Finance IPO is a bookbuilding issue of ₹2,800.00 crore, comprising a fresh issue of ₹600.00 crore and an offer for sale of ₹2,200.00 crore. The IPO dates, allotment date, and price bands are yet to be announced. ICICI Securities Ltd, HDFC Bank Ltd, Jefferies India Pvt Ltd, Kotak Mahindra Capital Company Ltd, and Nuvama Wealth Management Ltd are the book-running lead managers, while KFin Technologies Ltd is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹10 per share. As per the Draft Red Herring Prospectus (DRHP), the total issue size, lot size, and exact price band details are yet to be disclosed. The company’s pre-issue shareholding stands at 13,12,81,209 shares. The DRHP was filed with SEBI on January 21, 2025.

Veritas Finance Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹600 crore

Offer for Sale (OFS): ₹2200 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 13,12,81,209 shares |

| Shareholding post -issue | TBA |

Veritas Finance IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Veritas Finance Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Veritas Finance Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 19.04 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.27% |

| Net Asset Value (NAV) | 182.68 |

| Return on Equity | 12.27% |

| Return on Capital Employed (ROCE) | 27.36% |

| EBITDA Margin | 59.49% |

| PAT Margin | 22.05% |

| Debt to Equity Ratio | 1.72 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Augmenting our capital base to meet future business requirements of our Company toward lending | TBD |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

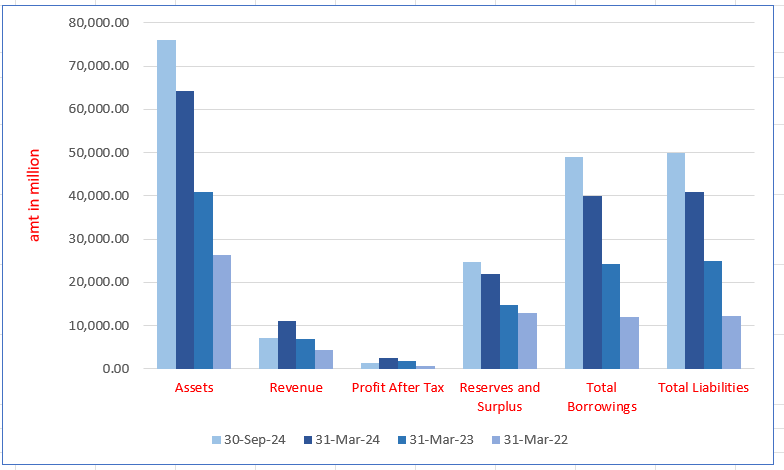

Veritas Finance Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 76,056.60 | 64,215.93 | 40,862.81 | 26,424.74 |

| Revenue | 7168.54 | 11,112.03 | 6802.31 | 4420.85 |

| Profit After Tax | 1331.08 | 2450.52 | 1764.04 | 754.04 |

| Reserves and Surplus | 24,792.93 | 22,020.35 | 14,770.34 | 12,944.68 |

| Total Borrowings | 48,894.18 | 39,958.07 | 24,253.24 | 11956.52 |

| Total Liabilities | 49,950.09 | 40,920.39 | 24,950.24 | 12,344.27 |

Financial Status of Veritas Finance Limited

SWOT Analysis of Veritas Finance IPO

Strength and Opportunities

- Extensive branch network enhances accessibility for MSMEs in semi-urban and rural areas.

- Diverse product offerings cater to various financing needs of the MSME sector.

- Experienced management team with rich expertise in the financial services industry.

- Strong focus on ethical and transparent business practices builds customer trust.

- Recognition and awards enhance the company's reputation and credibility.

- Significant capital infusion from investors supports growth and expansion plans.

- Commitment to financial inclusion aligns with national economic development goals.

- High customer satisfaction levels contribute to client retention and positive word-of-mouth.

- Robust risk management framework ensures prudent lending practices and portfolio quality.

- Continuous expansion into new markets offers potential for increased market share.

- Adoption of digital initiatives enhances operational efficiency and customer experience.

Risks and Threats

- High reliance on debt financing increases financial risk and interest obligations.

- Operating in a highly competitive market with numerous financial service providers.

- Exposure to credit risk due to lending to underserved MSME segments.

- Vulnerability to economic downturns affecting the repayment capacity of MSME clients.

- Regulatory changes in the financial sector could impact operational flexibility.

- Fluctuations in interest rates may affect profitability and cost of funds.

- Dependence on external funding sources may lead to liquidity constraints during tight market conditions.

- Technological disruptions in the financial services industry may require continuous investment in digital infrastructure.

- Geographical concentration in certain regions may expose the company to localized economic challenges.

- Limited brand recognition compared to larger, more established financial institutions.

- Potential challenges in maintaining asset quality amidst rapid loan book growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Veritas Finance Limited IPO

More About Veritas Finance Limited

Established in 2015, Veritas Finance Limited is a non-deposit-taking, non-banking financial company (NBFC) registered with the Reserve Bank of India (RBI). Classified as an ‘NBFC-Middle Layer’ under RBI’s scale-based regulations, it has made significant strides in addressing the credit needs of underserved sectors in India.

Key Business Focus

Veritas Finance primarily caters to micro, small, and medium enterprises (MSMEs) and self-employed individuals. Over time, the company has diversified, expanding its offerings to include:

- Small business loans

- Home loans

- Used commercial vehicle loans

As of September 30, 2024, Veritas Finance had a total loan book (AUM) of ₹65,172.17 million. The company has been the fastest-growing NBFC in terms of AUM growth from 2022 to 2024, with a compounded annual growth rate (CAGR) of 61.76%, according to CRISIL MI&A.

Addressing the MSME Credit Gap

India’s MSME credit demand is estimated to be ₹138 trillion, with only 25% being met through formal financing channels. There exists a potential MSME credit gap of ₹32.5 trillion, which presents a significant opportunity for financial institutions like Veritas Finance.

- MSME Credit Growth: The MSME credit market is growing at a CAGR of 15.8%, expected to rise at 17-19% CAGR from 2024 to 2027 (Source: CRISIL MI&A Report).

- Housing Finance Growth: Similarly, the housing finance market is expanding, with a CAGR of 13.6% from FY 2019 to 2024, expected to continue growing at 13-15% CAGR from FY 2024 to 2027.

Diverse Product Offering

Veritas Finance offers a range of products designed to meet the varied needs of its customer base:

- Rural Business Loans: Aimed at supporting business expansion and home construction, these loans primarily serve borrowers in rural and semi-urban regions. They carry an average yield of 22.83%.

- Affordable Home Loans: Tailored for low-income self-employed and salaried individuals, these loans target Tier-1 and Tier-2 cities and have an average yield of 16.63%.

- Used Commercial Vehicle Loans: Secured by the vehicle, these loans are designed for small transportation operators and agriculture businesses, with an average yield of 19.25%.

- Working Capital Loans: Unsecured loans for MSMEs, with an average ticket size of ₹0.18 million and an average yield of 27.03%.

Geographical Reach and Distribution Network

With a branch network of 424 across 10 states and one union territory, Veritas Finance has a strong presence in Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, and West Bengal, which together contribute to 88.58% of its total AUM. The company has grown its presence from 8 states in 2022 to 10 states in 2024.

Customer Base and Growth

Veritas Finance has disbursed loans to over 195,000 borrowers, with a CAGR of 56.68% in its borrower base from 2022 to 2024. The company relies on a combination of in-house lead generation and direct selling agents to source loans.

Credit Evaluation and Risk Management

Veritas Finance uses a proprietary scorecard model for assessing creditworthiness, focusing on income-earning capacity, asset documentation, and cash flows. This model goes beyond traditional credit scores, enabling a more holistic assessment of borrowers, especially in underserved regions.

Industry Outlook

Overview and Growth Prospects of the NBFC Sector in India

Non-Banking Financial Companies (NBFCs) play a crucial role in India’s financial landscape, complementing banks by catering to underbanked regions and customers without formal credit histories. The sector has seen significant growth, with NBFC credit expected to grow at 15-17% between FY 2024 and FY 2027, driven by retail and MSME loans. Retail credit, constituting 48% of NBFC portfolios, is projected to grow at 14-16%, while MSME and infrastructure finance will also see strong growth. Technological adoption and deeper market penetration, particularly in rural and semi-urban areas, will drive financial inclusion and continue the sector’s expansion.

MSME Credit in India: Growth Outlook and Future Drivers

Overview of the MSME Sector in India

- Contribution to GDP: MSMEs contribute approximately 29% to India’s GDP.

- Employment Impact: As of December 2024, 57 million MSMEs employ around 241.4 million people.

- Geographic Distribution: MSMEs are spread across rural and urban areas, with Maharashtra, Tamil Nadu, and Uttar Pradesh having the highest concentrations of MSMEs.

MSME Sector’s Contribution and Future Growth

- Current Contribution to GDP: In FY2022, MSMEs accounted for 29.2% of India’s GDP.

- Projected Growth: The government’s aim is for MSMEs to contribute 40-50% of GDP by FY2030.

- Exports: MSMEs are responsible for 45.7% of India’s exports as of FY2024.

Behavioral Shifts in MSMEs

- Formalization: Approximately 38% of MSMEs are registered under the Udyam system, which facilitates access to government schemes.

- Government Initiatives: Increased registration on platforms like Udyam Portal and GeM has contributed to a rise in formal MSME credit access.

Credit Gap in the MSME Sector

- Current Credit Gap: The MSME credit gap was estimated at ₹58.4 trillion in 2017, which has grown to approximately ₹103 trillion by FY2024.

- Formal Financing: Only 25% of MSME credit demand is met through formal channels, with the rest sourced informally.

MSME Credit Demand Projections

- Estimated Credit Demand (FY2024): Approximately ₹138 trillion, with 25% met by formal financing.

- Potential Credit Gap: The gap to be addressed by formal sources is estimated at ₹32.5 trillion in FY2024.

- Future Growth: The MSME credit portfolio is expected to grow at a CAGR of 17-19% from FY2024 to FY2027.

Key Drivers for MSME Credit Growth

- Credit Gap in the MSME Segment

- Over 15% of India’s 70 million MSMEs have access to formal credit.

- High-risk perceptions and delivery costs have limited the reach of traditional financial institutions to this segment.

- As the sector grows, there is significant untapped potential for financial institutions.

- Increased Data Availability and Transparency

- Digitalization of MSMEs is creating vast data points that can improve credit assessment processes.

- Increased transparency through platforms like GST and demonetization has accelerated the formalization of the economy.

- These data points will allow for better underwriting and tailored credit offerings.

- Faster Credit Processing

- Advancements in big data analytics, e-KYC (via Aadhar), and automated loan processing have reduced the turnaround time (TAT) for loan approvals.

- Flexible repayment options and real-time digital payments systems have further improved accessibility.

- Growth in Branch Networks

- There is an ongoing trend of expanding branch networks by MSME lenders, especially in rural and semi-urban areas.

- A broader branch network will lead to increased credit penetration and further MSME loan growth.

- Entry of New Lenders and Partnerships

- New players are entering the MSME lending space, leveraging digital platforms and automated systems to provide faster credit solutions.

- Traditional lenders are also forming partnerships to cross-sell products and tap into the MSME sector more effectively.

Future Outlook for MSME Credit in India

- Credit Growth: Overall MSME credit is expected to grow by 22% in FY2024, with a further 17-19% annual growth forecasted through FY2027.

- Increased Access: As digital initiatives and government policies continue to evolve, the credit gap is expected to narrow, with more MSMEs gaining access to formal financing channels.

- Expansion of Digital Platforms: Technology is playing a pivotal role in creating faster, more efficient lending systems that will empower more MSMEs to participate in the formal credit ecosystem.

Overview of Secured MSME Portfolio

- Projected Growth: The overall secured MSME portfolio outstanding is projected to grow by 16-18% from FY2024 to FY2027.

- Growth of Secured MSME Loans:

- The secured MSME loan segment has experienced significant growth, with a compound annual growth rate (CAGR) of approximately 16% from FY2019 to FY2024.

- As of FY2024, CRISIL MI&A estimates the outstanding value of secured MSME loans provided by banks and NBFCs at ₹10.3 trillion.

- Market Growth Drivers:

- Branch Network Expansion: Increased lender presence and geographic expansion.

- Government Initiatives: Programs like GST and Udyam have boosted the formalisation of the MSME segment.

- Data Availability: Better data accessibility for lenders, especially NBFCs.

Market Share & Lender Dynamics

- Market Share by Lender Type (As of September 2024):

- NBFCs (including HFCs, NBFC-Fintech) hold 38% of the overall secured MSME portfolio outstanding.

- Growth Trend:

- The MSME portfolio of NBFCs has grown at a faster rate compared to the broader MSME market.

Potential Market for Residential Property-Backed Secured MSME Lending

- Market Size:

- The potential market for secured MSME lending for ticket sizes less than ₹0.5 million is estimated at ₹22 trillion.

Unsecured Business Loans in India

- Market Growth: The unsecured business loan portfolio grew at a CAGR of ~16.3% from FY2019-2024, reaching ₹7,840 billion by H1 FY2025.

- Future Growth: Expected to grow at a CAGR of 18-20% till FY2027, driven by increased financial penetration and government initiatives.

- Key Growth Factors:

- Higher interest margins, technology adoption, regulatory support, and financial inclusion.

- Key Risks:

- Increased risk due to lack of collateral, leading to higher defaults.

Housing Finance Industry Outlook

- Shortage: India faces a housing shortage of ~100 million units, with demand for ₹50-60 trillion in housing loans to address the gap.

- Mortgage-to-GDP Ratio: Expected to grow from 12.3% in FY2023 to 16% by FY2025.

- Growth Drivers:

- Rising urbanisation, per capita income, and government support.

- Increasing demand for independent houses and urban housing.

- Growing number of nuclear families and preference for formal credit.

Growth Outlook for Commercial Vehicle Financing in India (FY24-FY27)

- Sales Growth: The commercial vehicle (CV) market saw a 34% growth in FY23, with LCV and M&HCV sales reaching ~277,000 and ~168,000 in H1 FY25, despite a slight dip in FY24.

- Key Growth Drivers:

- Industrial Growth: Strong industrial performance with GDP growing at ~7%, supporting the CV sector.

- Increased Freight Rates: Boost in freight demand and improved transporter profitability driving CV sales.

- Rural Consumption: Surge in rural demand contributing to increased LCV sales.

- Future Outlook: Commercial vehicle financing is expected to grow at a CAGR of 11-13% from FY24 to FY27, reaching ₹7.0-7.2 trillion.

How Will Veritas Finance Limited Benefit?

- Tapping into MSME Credit Gap

Veritas Finance can leverage the significant MSME credit gap of ₹32.5 trillion, as formal financing covers only 25% of credit demand. With MSME credit growing at 17-19% CAGR, Veritas is poised to address this gap by expanding its reach and offerings to underserved MSMEs.

- Expanding Housing Finance Market

With the housing finance market projected to grow at a 13-15% CAGR, Veritas Finance’s affordable home loans can benefit from the expanding demand for home loans. The company’s focus on low-income self-employed individuals positions it well in this fast-growing market segment.

- Geographical Expansion

Veritas Finance’s strong presence in 10 states, especially in underserved rural and semi-urban regions, positions the company to capture a larger market share in MSME and housing finance. As it expands further, it will benefit from deeper market penetration and increased loan disbursements.

- Diversified Product Offering

Veritas Finance offers a diverse range of products, including rural business loans, affordable home loans, and used commercial vehicle loans. This product diversification allows the company to address the varying financial needs of micro, small, and medium enterprises, ensuring sustainable growth and profitability.

- Focus on Unsecured Loans

With its working capital loans for MSMEs, Veritas Finance taps into the high-demand unsecured loan market. These loans cater to small businesses, with an average ticket size of ₹0.18 million, providing a steady revenue stream driven by higher yields and growing MSME demand.

- Use of Technology in Credit Assessment

By using a proprietary scorecard model that evaluates income-earning capacity, asset documentation, and cash flows, Veritas Finance can better assess creditworthiness in underserved regions. This advanced risk management model increases the company’s ability to make more accurate, reliable lending decisions.

- Strong Loan Book Growth

Veritas Finance’s impressive CAGR of 61.76% in loan book growth from 2022 to 2024 highlights its ability to scale rapidly. The company’s strong AUM growth provides a solid foundation for future expansion and ensures that it remains competitive in a dynamic market.

- Expanding Borrower Base

With a 56.68% CAGR in its borrower base, Veritas Finance has shown exceptional customer acquisition growth. As it continues to increase its customer base, the company is well-positioned to benefit from a growing loan book and greater market influence.

- Strategic Partnerships and Collaboration

Veritas Finance’s partnerships with local agents and its in-house lead generation model will facilitate faster loan disbursement and enhanced customer acquisition. By strengthening these collaborations, the company can further streamline operations and increase its outreach to underserved areas.

- Improved Risk Management Practices

By focusing on a comprehensive credit assessment model, Veritas Finance is better equipped to manage risks and reduce defaults. This ensures higher loan recovery rates, mitigates credit risk, and boosts the company’s financial stability in the long term.

Peer Group Comparison

| Name of the Company | Total Income (₹ in million) | Face Value (₹) | P/E | P/B | EPS (Basic) (₹) | RoNW (%) | NAV

(₹) |

| Veritas Finance Limited | 11,174.93 | 10 | TBA | 19.04 | 18.86 | 12.27% | 182.68 |

| Five Star Business Finance | 21,951.01 | 1 | 22.98 | 3.67 | 28.64 | 17.59% | 177.68 |

| SBFC Finance Limited | 10,199.20 | 10 | 36.21 | 3.22 | 2.35 | 10.13% | 25.87 |

| Aavas Financiers Limited | 20,206.93 | 10 | 26.31 | 3.42 | 62.03 | 13.96% | 476.79 |

| Aptus Value Housing Finance India | 14,168.45 | 2 | 22.20 | 3.59 | 12.27 | 14.75% | 75.52 |

| Cholamandalam Investment and Finance | 194,198.70 | 2 | 29.82 | 5.25 | 41.17 | NA | 233.26 |

| Sundaram Finance Limited | 72,855.00 | 10 | 34.33 | 4.49 | 130.31 | NA | 997.10 |

Key Insights

- Total Income: Veritas Finance reported ₹11,174.93 million in total income, which positions it well among peers. However, it trails behind larger players like Five Star Business Finance with ₹21,951.01 million and Cholamandalam Investment with ₹194,198.70 million, reflecting its smaller scale.

- Face Value: Veritas Finance has a face value of ₹10 per share, which is common among the listed peers. Five Star Business Finance has a much lower face value of ₹1, indicating a more flexible capital structure. SBFC Finance also maintains ₹10 per share face value.

- P/E (Price-to-Earnings Ratio): Veritas Finance has yet to disclose its P/E ratio. Five Star Business Finance has a P/E of 22.98, indicating market confidence. SBFC Finance leads with a high P/E of 36.21, reflecting investor expectations, while Aavas Financiers and Aptus are positioned between.

- P/B (Price-to-Book Ratio): Veritas Finance boasts a P/B ratio of 19.04, which is relatively high, indicating a strong market value compared to its book value. Five Star Business Finance has a lower ratio of 3.67, indicating a more conservative market valuation. SBFC Finance follows with 3.22.

- EPS (Basic): Veritas Finance has a basic EPS of ₹18.86, which is quite strong. Five Star Business Finance leads with an impressive ₹28.64. SBFC Finance shows a lower EPS of ₹2.35, reflecting weaker profitability, while Aavas Financiers and Aptus display solid earnings.

- RoNW: Veritas Finance has a return on net worth (RoNW) of 12.27%, which is good, but Five Star Business Finance and Aavas Financiers perform better with RoNW of 17.59% and 13.96%, respectively. SBFC Finance shows a relatively lower RoNW of 10.13%.

- NAV: Veritas Finance has a NAV of ₹182.68, suggesting a solid underlying value per share. Five Star Business Finance has a similar NAV of ₹177.68. Aavas Financiers leads with ₹476.79, reflecting its higher asset backing, while Sundaram Finance shows ₹997.10.

Veritas Finance Limited IPO Strengths

- Diversified and Secure Loan Portfolio with Rapid Growth

Veritas Finance Limited has developed a diversified, granular portfolio of secured loans, primarily targeting MSMEs and self-employed individuals in rural and semi-urban markets. The company offers a variety of loan products, including home loans, vehicle finance, and working capital loans, with over 90% of its Loans (AUM) secured. The company’s focus on underserved and under-banked borrowers has allowed it to achieve rapid growth, with a CAGR of 61.76%, reaching ₹57,237.87 million by March 2024.

- Extensive and Efficient Branch Network Across Rural and Semi-Urban Areas

The company operates a widespread distribution network of 424 branches in 10 states and one union territory, primarily serving rural and semi-urban regions. This network, supported by a ‘hub and spoke’ model, enables Veritas Finance to provide last-mile coverage and tailor its products to local markets. The in-house lead generation strategy further strengthens its ability to reach new customers, and the company has strategically co-located new businesses at existing branches to enhance service delivery and growth.

- Data-Driven Credit Assessment and Robust Risk Management

Veritas Finance Limited uses a combination of proprietary tools and advanced technologies to assess borrower creditworthiness. Their “triple AAA” filter evaluates asset creation, attitude, and income, while their AI-driven underwriting models analyze 409 data points for an accurate risk assessment. This approach allows them to maintain low loan-to-value ratios and a high-quality portfolio, with a strong focus on financial inclusion and proactive risk management strategies.

- Diversified & Cost-Effective Funding Sources

Veritas Finance Limited has established a diversified and cost-effective funding profile, utilizing a broad network of 36 lenders and 11 debt security holders, including leading banks and private investors. Their disciplined asset-liability management allows access to capital at competitive rates, enabling sustainable growth. With a strong credit rating and a high proportion of borrowings from private and public sector banks, the company optimizes borrowing costs, positioning itself for continued expansion.

- Experienced Management & Strategic Leadership

Veritas Finance Limited is led by a highly experienced management team, with over 25 years of expertise in financial services. The leadership, guided by a distinguished Board, includes seasoned professionals in various business sectors. Their strategic guidance, supported by marquee investors such as Norwest Venture Partners and British International Investment plc, enhances corporate governance and drives the company’s growth. Specialized business heads with over 15 years of experience ensure effective expansion into new markets and business lines

Key Insights from Financial Performance

- Assets: As of 30th September 2024, Veritas Finance Limited’s assets amounted to ₹76,056.60 million, reflecting a significant increase from ₹64,215.93 million in March 2024. The asset growth over the years indicates the company’s strong financial performance and expansion, especially when compared to ₹26,424.74 million in March 2022.

- Revenue: The company’s revenue for the period ending 30th September 2024 was ₹7,168.54 million, down from ₹11,112.03 million in March 2024. Despite the decline in the most recent quarter, the revenue has increased considerably from ₹4,420.85 million in March 2022, indicating overall growth.

- Profit After Tax: Veritas Finance Limited’s Profit After Tax (PAT) for September 2024 stood at ₹1,331.08 million, lower than ₹2,450.52 million in March 2024. However, the profit shows growth from ₹754.04 million in March 2022, reflecting improving profitability over the years.

- Reserves and Surplus: The company’s reserves and surplus grew to ₹24,792.93 million as of 30th September 2024, from ₹22,020.35 million in March 2024. This increase signals robust retained earnings and a growing financial buffer, improving from ₹12,944.68 million in March 2022.

- Total Borrowings: Veritas Finance Limited’s total borrowings as of September 2024 were ₹48,894.18 million, an increase from ₹39,958.07 million in March 2024. This growth in borrowings over the years, up from ₹11,956.52 million in March 2022, reflects increased financing to support the company’s expansion.

- Total Liabilities: Total liabilities stood at ₹49,950.09 million in September 2024, up from ₹40,920.39 million in March 2024. The steady increase in liabilities, from ₹12,344.27 million in March 2022, aligns with the company’s growing borrowings and financial obligations to fuel growth.

Other Financial Details

- Finance Costs: For the six-month period ending September 30, 2024, finance costs stood at ₹2,245.58 million, showing a decrease compared to ₹3,144.16 million in March 2024. This indicates a reduction in borrowing-related expenses over time.

- Fees and Commission Expense: The fees and commission expenses for the six months ended September 30, 2024, amounted to ₹8.61 million, significantly lower than ₹43.52 million in March 2024, reflecting a reduction in transaction-based expenses.

- Impairment on Financial Instruments: Impairment on financial instruments for September 2024 reached ₹644.33 million, lower than ₹901.66 million in March 2024. This indicates improved asset quality and lower provisions for doubtful assets.

- Employee Benefits Expenses: These expenses decreased to ₹1,986.33 million for the six months ending September 30, 2024, compared to ₹2,916.10 million in March 2024, reflecting cost optimization and potentially reduced headcount or compensation adjustments.

- Depreciation and Amortization: These expenses stood at ₹142.03 million for the six months ending September 30, 2024, a decrease from ₹235.63 million in March 2024, likely due to changes in asset valuation or disposal.

Key Strategies for Veritas Finance Limited

- Growing Rural Business Loans

Veritas Finance continues to focus on small business owners and self-employed individuals in urban and rural markets. They leverage a micro-market approach, using technology and proprietary credit assessment models to penetrate underserved markets. Their goal is to address the growing MSME credit gap, with a particular emphasis on increasing market penetration and improving efficiency.

- Diversifying Loan Portfolio

Veritas Finance aims to diversify its loan portfolio by expanding into new business lines, including home and vehicle finance. Their strategic focus is on low-risk loans targeting low to middle-income individuals. With significant growth potential in retail credit markets, particularly in Tier 2 and Tier 3 cities, the company plans to capitalize on evolving demand and market dynamics.

- Deepening Market Presence

Veritas Finance seeks to deepen its presence in existing markets and expand into new geographies. By leveraging its established branch network, the company focuses on maintaining balanced growth. The aim is to offer home loans and used vehicle loans in existing branches while selectively expanding the branch network, especially in rural and semi-urban markets.

- Diversifying Funding Sources

Veritas Finance is committed to diversifying its funding sources, optimizing borrowing costs, and maintaining a favorable asset-liability management position. The company prioritizes long-term borrowing, which ensures financial stability and mitigates liquidity risks. With an emphasis on maintaining low borrowing costs, Veritas aims to expand its credit rating and secure stable funding to support sustained growth.

- Investing in Technology

Veritas Finance is focused on leveraging technology to improve operational efficiency and enhance customer experience. They invest in upgrading IT infrastructure, automating processes, and using artificial intelligence to enhance underwriting and fraud detection. With a focus on seamless mobile sourcing, digitized document execution, and AI-driven risk assessment, the company aims to increase productivity and customer satisfaction.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Veritas Finance

What is the size and structure of Veritas Finance Limited's IPO?

The IPO is expected to raise around ₹2,800 crore, comprising a ₹600 crore fresh issue and a ₹2,200 crore offer for sale by existing shareholders.

When is the Veritas Finance Limited IPO expected to open?

The IPO is anticipated to open in the first week of May 2025.

What is the price band for the Veritas Finance Limited IPO?

The price band for the IPO has not been announced yet.

How can investors apply for the Veritas Finance Limited IPO?

Investors can apply online using UPI or ASBA through their bank accounts.

What is the expected listing date for Veritas Finance Limited's shares?

The listing date has not been specified yet.

Who are the lead managers for the Veritas Finance Limited IPO?

The lead managers include HDFC Bank Limited, ICICI Securities Limited, Jefferies India Private Limited, Kotak Mahindra Capital Company Limited, and Nuvama Wealth Management Limited.