- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Vidya Wires IPO

IPO Details

03 Dec 25

05 Dec 25

₹14,976

288

₹48 to ₹52

NSE, BSE

₹300.01 Cr

10 Dec 25

Vidya Wires IPO Timeline

Bidding Start

03 Dec 25

Bidding Ends

05 Dec 25

Allotment Finalisation

08 Dec 25

Refund Initiation

09 Dec 25

Demat Transfer

09 Dec 25

Listing

10 Dec 25

Vidya Wires Limited

Established in 1981, Vidya Wires Ltd. has grown to become the fourth-largest manufacturer in India’s copper and aluminum wire industry by installed capacity. The company offers an extensive range of copper and aluminum wire products, including enameled copper wires, paper-covered wires and strips, bare annealed wires, and copper tapes. Operating three manufacturing units and a warehousing facility, its production capacity utilization increased from 65.80% in Fiscal 2022 to 89.98% by September 2024, with a 26.99% rise in production volumes over three fiscal years.

Vidya Wires Limited IPO Overview

The Vidya Wires IPO is a book-built issue worth ₹300.01 crores, comprising a fresh issue of 5.27 crore shares aggregating to ₹274.00 crores and an offer for sale of 0.50 crore shares totaling ₹26.01 crores. The IPO will open for subscription on December 3, 2025, and close on December 5, 2025, with allotment expected to be finalized on December 8, 2025. The shares are proposed to list on BSE and NSE, with a tentative listing date of December 10, 2025. The IPO has a price band of ₹48.00 to ₹52.00 per share, with a lot size of 288 shares. For retail investors, the minimum investment is ₹14,976 based on the upper price, while small non-institutional investors (sNII) can invest in 14 lots (4,032 shares) amounting to ₹2,09,664, and big non-institutional investors (bNII) can subscribe to 67 lots (19,296 shares) for ₹10,03,392. Pantomath Capital Advisors Pvt. Ltd. is acting as the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar for the issue.

Check Vidya Wire IPO DRHP for detailed information

Vidya Wires IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹300.01 Cr (₹274 Cr Fresh + ₹26.01 Cr OFS) |

| Fresh Issue | ₹274.00 Cr (5.27 crore shares) |

| IPO Dates | 03 December 2025 to 05 December 2025 |

| Price Bands | ₹48 to ₹52 per share |

| Lot Size | 288 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 16,00,00,000 shares |

| Shareholding post -issue | 21,26,92,307 shares |

Vidya Wires Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 288 | 14,976 |

| Retail (Max) | 13 | 3,744 | 1,94,688 |

| S-HNI (Min) | 14 | 4,032 | 2,09,664 |

| S-HNI (Max) | 66 | 19,008 | 9,88,416 |

| B-HNI (Min) | 67 | 19,296 | 10,03,392 |

Vidya Wires Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Vidya Wires Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | Pre IPO 2.55 |

| Price/Earnings (P/E) Ratio | Pre IPO 20.36 |

| Return on Net Worth (RoNW) | 24.57% |

| ROE | 24.57% |

| Price to Book Value | 6.62 |

| Return on Capital Employed (ROCE) | 19.72% |

| EBITDA Margin | 4.32% |

| PAT Margin | 2.74% |

| Debt to Equity Ratio | 0.88 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements for setting up new project in the subsidiary viz. ALCU | 1,400 |

| Repayment/prepayment, in full or part, of all or certain outstanding borrowings availed by the company | 1,000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

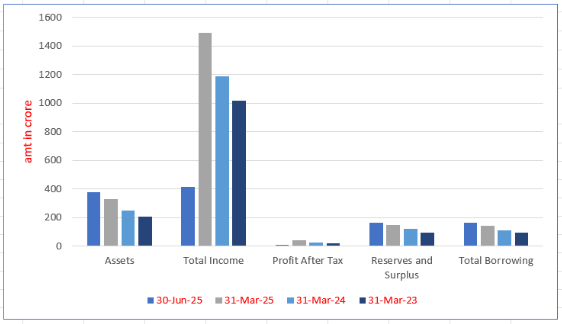

Vidya Wires Limited Financials (in million)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 376.93 | 331.33 | 247.84 | 209.08 |

| Total Income | 413.09 | 1,491.45 | 1,188.49 | 1,015.72 |

| Profit After Tax | 12.06 | 40.87 | 25.68 | 21.53 |

| Reserves and Surplus | 162.37 | 150.36 | 121.54 | 95.86 |

| Total Borrowings | 162.75 | 145.63 | 109.71 | 97.11 |

Financial Status of Vidya Wires Limited

SWOT Analysis of Vidya Wires IPO

Strength and Opportunities

- Over four decades of industry experience, establishing a strong market presence and reputation.

- Diverse product portfolio, including enameled copper wires, paper-covered wires, and bare annealed wires, catering to various customer needs.

- Strong relationships with reputed clients like Adani Wilmar Limited and Schneider Electric Infrastructure Limited, ensuring consistent demand.

- Strategic location in Anand, Gujarat, providing logistical advantages near major sea ports like Hazira and Mundra for efficient export activities.

- Commitment to sustainability, with over 26% of power sourced from renewable energy, enhancing corporate responsibility.

- Accredited with ISO 9001:2015, ISO 45001:2018, and ISO 14001:2015 certifications, ensuring adherence to international quality standards.

- Expansion plans through subsidiary ALCU Industries Private Limited aim to increase installed capacity, supporting future growth.

- Efficient working capital management, with gross current assets of 63 days as of March 31, 2024, reflecting operational efficiency.

- UL-approved company exporting enameled copper and aluminum wires to the USA, expanding international market reach.

- Robust financial risk profile with improved gearing and TOLTNW ratios, supported by steady accretion to reserves.

Risks and Threats

- Operates in a highly competitive market with significant presence of unorganized players, limiting pricing power.

- Susceptibility to fluctuations in raw material prices, especially copper, which can impact profitability.

- Moderate operating margins due to limited value addition and intense competition in the industry.

- Exposure to the cyclical nature of end-user industries such as power transmission and automotive sectors.

- Dependence on a few key customers for a significant portion of revenue, leading to potential concentration risks.

- Potential challenges in maintaining efficient working capital management due to rising copper prices, increasing reliance on working capital limits.

- Vulnerability to regulatory changes in environmental and quality standards, necessitating continuous compliance efforts.

- Exposure to foreign exchange fluctuations due to export activities, which may affect profitability if not adequately hedged.

- Challenges in maintaining and upgrading technology to stay competitive in a rapidly evolving industry landscape.

- Potential risks associated with large debt-funded capital expenditures, which could impact the financial risk profile if not managed prudently.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Vidya Wires Limited IPO

Vidya Wires Limited, established in 1981, has emerged as one of the largest manufacturers of winding and conductivity products. The company offers a comprehensive range of precision-engineered solutions for critical industries.

- Product Portfolio:

- Enameled Copper Rectangular Strips

- Paper Insulated Copper Conductors

- Copper Busbars

- Winding Wires

- PV Ribbon and Aluminum Paper Covered Strips

- Used in energy generation, transmission, electric motors, clean energy, and electric mobility

- Key Features:

- Products designed for conductivity, durability, and thermal efficiency

- Integral to high-performance applications where reliability is critical

Market Position and Expansion Plans

Vidya Wires holds a strong position in the Indian market and is set to expand its capabilities to further enhance its market share.

- Industry Ranking:

- 4th largest manufacturer in the industry

- 5.9% market share of installed capacity in FY24 (India)

- Expansion Plans:

- Current capacity: 19,680 MT per annum

- Proposed expansion to 37,680 MT per annum at Narsanda, Gujarat

- Focus on diversifying product range via new manufacturing unit (ALCU Industries Private Limited)

Sustainability and Quality Assurance

The company integrates sustainability and quality practices to ensure the highest standards in its operations.

- Sustainability Focus:

- 26% of power sourced from renewable energy (solar and windmill)

- Certifications:

- ISO 9001:2015 (Quality Management System)

- ISO 45001:2018 (Occupational Health & Safety)

- ISO 14001:2015 (Environmental Management System)

Customer Base and Revenue Distribution

Vidya Wires serves a broad customer base, with a significant presence in both domestic and international markets.

- Customer Base:

- Over 370 customers in total, including 40+ international clients

- Notable Clients:

- Adani Wilmar Limited

- Schneider Electric

- Suzlon Energy

- Revenue Distribution:

- Significant revenue from repeat customers (96% of total revenue in FY24)

- Majority of revenue from Gujarat and Maharashtra

Future Prospects and Product Diversification

Vidya Wires is committed to growth and diversification, introducing new products to meet evolving customer needs.

- Proposed Product Additions:

- Copper Foils, Copper Components, Solar Cables

- Enameled Aluminium Winding Wires, Multi Paper Covered Copper Conductors

- Focus:

- Strengthen market position through product innovation and global expansion

Industry Outlook

The copper and aluminum wire manufacturing industry plays a vital role across multiple sectors such as electrical power transmission, construction, automotive, and renewable energy. This sector in India and globally is expanding rapidly due to increased infrastructure development, urbanization, and a surge in renewable energy projects.

Market Size and Growth

- India Wires and Cables Market:

- The Indian market was valued at approximately INR 1,083.71 billion in 2023.

- It is expected to grow at a CAGR of 14.5% from 2024 to 2032, reaching around INR 3,655.81 billion by 2032.

- Global Aluminum Wire Market:

- The market was valued at USD 33.93 billion in 2024.

- It is projected to grow at a CAGR of 6.1% from 2025 to 2030.

- Global Aluminum Wire Market (Alternative Source):

- Valued at USD 32.5 billion in 2018, the market is anticipated to reach USD 69.1 billion by 2033.

- This represents a growth CAGR of 5.8% from 2024 to 2033.

Key Drivers of Growth

- Infrastructure Development: Ongoing projects such as metro railways, smart grids, and urbanization will continue to drive the demand for wires and cables in India and globally.

- Renewable Energy Expansion: With the global shift towards renewable energy sources like solar and wind power, the demand for high-quality aluminum wires for efficient power transmission is growing.

- Automotive Industry Trends: The electric vehicle (EV) revolution is creating a higher need for lightweight, efficient wiring solutions, particularly favoring aluminum over copper.

Future Outlook

- The Indian market for wires and cables is set to continue its robust growth, projected to expand at a CAGR of 14.5% from 2024 to 2032.

- The global aluminum wire market is expected to grow steadily, benefiting from trends such as the shift towards cleaner energy and the automotive sector’s electrification.

Enameled Aluminum Winding Wires

- Market Demand & Growth:

- The demand for enameled aluminum winding wires is growing due to their use in electric motors, transformers, and other electrical equipment.

- CAGR: The global market for winding wires is expected to grow at a CAGR of 7.5% from 2024 to 2030.

- Growth Drivers:

- Increased demand for electric motors in the automotive and consumer appliance sectors.

- Rising adoption of renewable energy technologies such as wind power, which require efficient wiring.

- Future Outlook:

- The market is expected to expand as the shift to electric vehicles (EVs) and renewable energy grows.

Enameled Aluminum Rectangular Strips

- Market Demand & Growth:

- The increasing use of aluminum in the manufacturing of high-efficiency motors, transformers, and other components is boosting demand for rectangular strips.

- CAGR: Expected to grow at a rate of 6% annually in India from 2024 to 2032.

- Growth Drivers:

- Shift to lightweight materials in automotive and electrical components.

- Strong demand in the construction and renewable energy sectors.

- Future Outlook:

- Expected to see robust growth in the EV and energy sectors.

Enameled Copper Rectangular Wires for EV Motors

- Market Demand & Growth:

- As EV adoption increases, so does the demand for specialized copper wires used in electric motor windings.

- CAGR: The global market for copper wire in EV motors is forecasted to grow by 10.5% CAGR from 2024 to 2030.

- Growth Drivers:

- Surge in EV production, particularly in India’s fast-growing electric vehicle sector.

- Regulatory push for cleaner and more efficient transportation solutions.

- Future Outlook:

- Continued expansion in line with India’s electric mobility push.

Enameled Copper Winding Wires/Magnet Wires

- Market Demand & Growth:

- Enameled copper wires are widely used in the manufacturing of electric motors, transformers, and inductive components.

- CAGR: Expected to grow at 6.9% CAGR in India from 2024 to 2030.

- Growth Drivers:

- Strong demand from the renewable energy and automotive industries.

- Increasing applications in power generation and industrial machinery.

- Future Outlook:

- Growth driven by renewable energy projects and the electric vehicle revolution.

Fibre Glass Covered Copper/Aluminium Conductors

- Market Demand & Growth:

- Widely used for power transmission and distribution.

- CAGR: Projected to grow at 7.2% CAGR from 2024 to 2032.

- Growth Drivers:

- Rising energy demand and infrastructure development.

- Expansion of smart grids and renewable energy installations.

- Future Outlook:

- Continual growth as India invests in infrastructure and smart grids.

Paper Insulated Copper/Aluminium Conductors

- Market Demand & Growth:

- These conductors are essential in transformer and power transmission applications.

- CAGR: Projected to expand at 8.4% CAGR in the next 5 years in India.

- Growth Drivers:

- Growth in the power and energy sectors, particularly in transformer manufacturing.

- Development of high-efficiency power grids.

- Future Outlook:

- Further expansion as renewable energy sources increase demand for high-quality conductors.

Continuously Transposed Conductors (CTC)

- Market Demand & Growth:

- CTCs are extensively used in the power generation and transmission sectors.

- CAGR: Estimated CAGR of 6% from 2024 to 2030 for the Indian market.

- Growth Drivers:

- Increased transmission line efficiency and demand for high-power transmission solutions.

- Investment in high-efficiency power transmission networks.

- Future Outlook:

- Growth tied to infrastructure developments in India and globally.

Solar Cables

- Market Demand & Growth:

- With the increasing adoption of solar energy, demand for high-quality solar cables has surged.

- CAGR: The global market for solar cables is projected to grow by 8.5% CAGR from 2024 to 2030.

- Growth Drivers:

- Increased government investments in solar power.

- Expansion of solar farms and residential solar installations.

- Future Outlook:

- The growth of the solar sector in India, particularly with government targets for renewable energy.

Copper Foils and Copper Components

- Market Demand & Growth:

- Used in electronics, automotive, and energy sectors.

- CAGR: Copper foil and components are expected to grow at a CAGR of 5.4% globally between 2024 and 2030.

- Growth Drivers:

- The growing demand for lightweight, conductive materials in EVs and electronics.

- Increased use of copper foils in solar energy panels.

- Future Outlook:

- Continued demand in sectors that require high conductivity and energy efficiency

How Will Vidya Wires Limited Benefit?

- Expansion into High-Demand Sectors

Vidya Wires Limited benefits from the increasing demand for high-performance components like enameled copper strips and paper insulated conductors. As electric mobility, renewable energy, and power transmission sectors expand, Vidya Wires offers critical products that enhance energy efficiency and support evolving industry demands.

- Strategic Manufacturing Expansion

The company’s planned expansion of its manufacturing capacity will allow Vidya Wires to meet the growing demand in diverse sectors, including automotive and renewable energy. By increasing production capacity, Vidya Wires will cater to the expanding needs of infrastructure projects, clean energy, and electric mobility applications.

- Strong Sustainability Practices

Vidya Wires benefits from its sustainability initiatives, sourcing 26% of its energy from renewable sources. This focus on eco-friendly operations aligns with global trends toward sustainability, boosting its reputation among environmentally conscious clients. It also ensures compliance with regulations, enhancing long-term competitiveness and market appeal.

- Product Quality and Reliability

Vidya Wires’ commitment to product quality, backed by ISO certifications and rigorous testing, ensures its products’ durability and efficiency. By supplying essential components like copper busbars and PV ribbons, the company supports industries that demand high reliability, such as energy generation, automotive, and clean energy sectors.

- Diverse Customer Base and Revenue Stability

Vidya Wires’ diverse customer base, with over 370 clients globally, supports revenue stability through repeat business. With 96% of its revenue from returning clients, Vidya Wires maintains a strong foothold in critical industries, ensuring long-term relationships and sustained growth as demand for its products increases.

- Market Position and Competitive Advantage

With a 5.9% market share and ranking as the 4th largest manufacturer in India, Vidya Wires benefits from its competitive advantage in the market. As infrastructure, renewable energy, and electric vehicle sectors continue to grow, Vidya Wires is well-positioned to expand its reach and market influence.

- Global Expansion and Product Diversification

Vidya Wires is strategically diversifying its product portfolio with offerings like copper foils and solar cables. The company’s plans for global expansion allow it to tap into new markets, benefiting from the increasing demand for innovative solutions in clean energy, automotive, and power transmission industries worldwide.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ Million) | EPS (₹) | NAV (₹) | P/E Ratio | RoNW (%) |

| Vidya wires Limited | 1.00 | 11,860.73 | 1.61 | 7.85 | [●] | 20.47 |

| Peer Group | ||||||

| Precision Wires India Limited | 1.00 | 33,016.91 | 4.08 | 28.35 | 38.68 | 14.39 |

| Ram Ratna Wires Limited | 5.00 | 29,832.48 | 11.88 | 98.20 | 44.85 | 12.64 |

Key Insights

- Revenue Comparison: Vidya Wires Limited reported a revenue of ₹11,860.73 million, significantly lower than its peers. Precision Wires India Limited and Ram Ratna Wires Limited posted revenues of ₹33,016.91 million and ₹29,832.48 million, respectively. This indicates that Vidya Wires has a smaller market presence and scale compared to its competitors.

- Earnings Per Share (EPS): Vidya Wires Limited recorded an EPS of ₹1.61, which is notably lower than Precision Wires’ ₹4.08 and Ram Ratna Wires’ ₹11.88. A lower EPS suggests that Vidya Wires generates comparatively lower profits per share, impacting investor returns and overall profitability.

- Net Asset Value (NAV) Per Share: With a NAV of ₹7.85, Vidya Wires Limited has a significantly lower asset value per share compared to Precision Wires at ₹28.35 and Ram Ratna Wires at ₹98.20. This suggests that Vidya Wires has a smaller asset base and lower intrinsic value for shareholders.

- Price-to-Earnings (P/E) Ratio: The P/E ratio for Vidya Wires Limited is undisclosed, while Precision Wires and Ram Ratna Wires have P/E ratios of 38.68 and 44.85, respectively. A high P/E ratio typically reflects strong investor confidence, whereas an undisclosed value makes valuation comparisons difficult.

- Return on Net Worth (RoNW): Vidya Wires Limited has a RoNW of 20.47%, outperforming Precision Wires at 14.39% and Ram Ratna Wires at 12.64%. This indicates that Vidya Wires is generating better returns on shareholder equity, suggesting efficient capital utilization despite lower revenue and EPS.

Vidya Wires Limited IPO Strengths

- Among the top 5 manufacturers in its industry in India

Vidya Wires Limited ranks as the 4th largest manufacturer in its sector based on installed capacity, with 19,680 MT per annum. With proposed expansion, the company is poised to become the 3rd largest. It holds a market share of 5.9% for FY24, expected to increase to 11.3% post-expansion, strengthening its position as a key player in the industry.

- De-risked business model with a wide customer base, diversified portfolio of products, and multiple end-user industries:

Vidya Wires Limited has a diverse customer base, with over 370 customers globally, including more than 40 international clients. The company has reduced reliance on individual customers, with none contributing more than 9% of annual revenue, thereby mitigating risks associated with market volatility and ensuring stable revenue streams.

- Backward integration for quality control and sustainability initiatives

The company manufactures 35%-40% of its copper rods in-house, ensuring consistency and quality control. It operates with ISO 9001:2015, ISO 45001:2018, and ISO 14001:2015 certifications. Vidya Wires Limited also integrates sustainability into its operations, sourcing renewable energy and adopting energy-efficient technologies, contributing to environmental responsibility while reducing operational costs.

- Strategically located operating facilities

The company’s manufacturing facilities in Anand, Gujarat, offer access to major sea ports, facilitating efficient import and export of materials. This strategic location supports its strong presence in the western region of India and allows Vidya Wires Limited to capitalize on regional demand, particularly in Gujarat and Maharashtra, which contribute significantly to the company’s revenue and production.

- Diversified customer base with longstanding relationships

Vidya Wires Limited has built strong, long-term relationships with its customers and suppliers over decades, ensuring steady business and repeat orders. With over 96% of revenue derived from repeat customers, the company enjoys a reliable customer base that contributes to its stability and growth in both domestic and international markets.

- Continuous financial performance

Vidya Wires Limited has consistently demonstrated strong financial performance with impressive CAGR growth in EBITDA and PAT. It is one of the most working capital-efficient companies, surpassing peers in fixed assets turnover, inventory turnover, and other financial metrics. The company has maintained profitability for over 40 years and continues to show growth in net worth.

Key Insights from Financial Performance

- Assets: Assets have increased to 3,276.55 million in Sept 2024 from 2,478.41 million in March 2024. This indicates significant growth in assets, showing improved financial health and resource accumulation, which can support long-term operational stability and business expansion.

- Revenue: Revenue has decreased from 11,860.73 million in March 2024 to 7,544.42 million in Sept 2024. This decline signifies a reduction in income generation, potentially due to lower sales or other external market challenges affecting the company’s revenue streams during this period.

- Profit After Tax: PAT dropped to 174.69 million in Sept 2024, from 256.93 million in March 2024. This decline reflects a decrease in profitability, possibly due to reduced revenue or higher costs impacting the company’s ability to sustain profit margins.

- Reserves and Surplus: This grew to 1,389.74 million in Sept 2024 from 1,215.38 million in March 2024. This increase demonstrates a strengthening of the company’s financial position, with more retained earnings and reinvestment to support future growth and expansion.

- Total Borrowings: Total borrowings increased to 1,615.09 million in Sept 2024, from 1,097.11 million in March 2024. This uptick indicates an increase in financial leverage, suggesting the company has taken on more debt to fund operations or business activities during this period.

- Total Liabilities: Total liabilities rose to 1,846.81 million in Sept 2024, compared to 1,223.03 million in March 2024. This increase reflects higher financial obligations, which could impact the company’s future cash flow, requiring effective management of liabilities to maintain solvency.

Other Financial Details

- Cost of Materials Consumed: The cost of materials consumed decreased to ₹7,140.94 million in September 2024 from ₹11,023.09 million in March 2024. This indicates a reduction in material costs compared to the previous periods, reflecting potential cost-cutting or lower production levels.

- Manufacturing Expense and Erection Charges: These charges amounted to ₹118.48 million in September 2024, down from ₹203.86 million in March 2024. This decrease indicates cost-saving measures or reduced manufacturing activities during the latest period compared to previous fiscal years.

- Employee Benefit Expense: These expenses dropped to ₹43.95 million in September 2024, compared to ₹60.34 million in March 2024. This reduction could reflect workforce adjustments, wage cuts, or lower staff-related costs during the six months.

- Finance Costs: Finance costs stood at ₹59.01 million in September 2024, significantly lower than ₹109.15 million in March 2024. The decrease in finance costs indicates lower borrowing or improved financial management practices, reducing interest payments.

- Depreciation and Amortization Expense: Depreciation and amortization expenses were ₹14.17 million in September 2024, a decrease from ₹26.96 million in March 2024. This suggests a reduction in asset depreciation or the completion of depreciation cycles for certain assets.

- Other Expenses: Other expenses amounted to ₹48 million in September 2024, lower than ₹80.97 million in March 2024. This decrease indicates a reduction in miscellaneous costs, possibly due to better cost management or lower non-operational expenses during the period.

Key Strategies for Vidya Wires Limited

- Expanding Capacity and Product Portfolio

Vidya Wires Limited plans to expand its manufacturing capacities and product portfolio to meet growing customer demands. By increasing its installed capacity by 18,000 MT, it aims to offer new products like Copper Foils and Solar Cables, enhancing its market share and targeting sectors such as renewable energy and electric vehicles. Post-expansion, the company expects significant growth in market share.

- Focus on Upcoming Sectors like Renewable Energy and EVs

Vidya Wires Limited is strategically focusing on renewable energy and electric vehicles (EVs), industries with rapid growth. As enameled copper wire is essential for EV motors and renewable energy components, the company aims to develop new products like Solar Cables and PV Round Ribbon. This focus supports its goal of capturing a larger share of the renewable energy and EV sectors.

- Expanding Geographical Footprint

Vidya Wires Limited aims to enhance its global presence by expanding exports. With an increased manufacturing capacity, the company plans to raise its export share to 25% by diversifying its customer base and selling a wider range of products internationally. By tapping into new markets and strengthening its existing export channels, the company seeks to capitalize on growing global demand.

- Enhancing Sustainability Initiatives and Efficiency

Vidya Wires Limited is committed to sustainability by incorporating renewable energy sources like solar power in its operations. The company plans to further reduce its carbon footprint by installing energy-efficient machinery in its Proposed Project, contributing to environmental conservation. This aligns with its focus on promoting green technologies, which will drive growth in the copper and aluminum industries.

- Focus on Deleveraging and Financial Flexibility

Vidya Wires Limited intends to reduce its borrowings and improve its debt-to-equity ratio. By utilizing proceeds from the proposed project to repay loans, the company aims to reduce its indebtedness and debt servicing costs. This strategy will enhance financial flexibility, allowing Vidya Wires to raise additional resources for future business development and expansion.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is Vidya Wires Limited's IPO?

Vidya Wires IPO is a book build issue of ₹300.01 crores. The issue is a combination of fresh issue of 5.27 crore shares aggregating to ₹274.00 crores and offer for sale of 0.50 crore shares aggregating to ₹26.01 crores.

What is the purpose of the IPO?

The funds raised from the IPO will be used for capital expenditure in setting up a new project, repaying outstanding borrowings, and meeting general corporate requirements.

Who are the promoters of Vidya Wires Limited?

The promoters of Vidya Wires Limited are Shyamsundar Rathi and Shailesh Rathi, both of whom plan to sell 50 lakh equity shares each in the offer for sale.

What is the retail investor quota in the IPO?

The retail investor quota in the Vidya Wires IPO is set at 35%, with Qualified Institutional Buyers (QIB) allocated 50% and High Net-Worth Individuals (HNI) allocated 15%.

When is the Vidya Wires Limited IPO expected to open?

Vidya Wires IPO opens for subscription on Dec 3, 2025 and closes on Dec 5, 2025. The allotment for the Vidya Wires IPO is expected to be finalized on Dec 8, 2025. Vidya Wires IPO will list on BSE, NSE with a tentative listing date fixed as Dec 10, 2025.

How can investors apply for the IPO?

Investors can apply for the Vidya Wires IPO online using UPI or ASBA through their bank accounts or through authorized brokers during the IPO subscription period.