- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Vikran Engineering IPO

₹13,616/148 shares

Minimum Investment

IPO Details

26 Aug 25

29 Aug 25

₹13,616

148

₹92 to ₹97

NSE, BSE

₹772 Cr

03 Sep 25

Vikran Engineering IPO Timeline

Bidding Start

26 Aug 25

Bidding Ends

29 Aug 25

Allotment Finalisation

01 Sep 25

Refund Initiation

02 Sep 25

Demat Transfer

02 Sep 25

Listing

03 Sep 25

Vikran Engineering Limited

Incorporated in 2008, Vikran Engineering Limited is an EPC company engaged in power transmission, water infrastructure, railway, and solar energy projects. The company undertakes underground water distribution, surface water extraction, overhead tanks, and distribution networks, while also specialising in extra-high voltage substations up to 400kV. By June 30, 2025, it had executed 45 projects across 14 states worth ₹19,199.17 million and maintained an order book of ₹24,424.39 million from 44 ongoing projects. Key government clients include NTPC, Power Grid, and state utilities.

Vikran Engineering Limited IPO Overview

Vikran Engineering Limited is coming up with a book-built IPO worth ₹772.00 crore, comprising a fresh issue of 7.43 crore shares amounting to ₹721.00 crore and an offer for sale of 0.53 crore shares valued at ₹51.00 crore. The issue will open for subscription on 26 August 2025 and close on 29 August 2025. The basis of allotment is likely to be finalised on 1 September 2025, with a tentative listing date set for 3 September 2025 on both BSE and NSE. The IPO price band has been fixed between ₹92 and ₹97 per share, with a lot size of 148 shares. Retail investors can participate with a minimum investment of ₹13,616, while small non-institutional investors (sNII) need to bid for at least 14 lots (2,072 shares) amounting to ₹2,00,984, and big non-institutional investors (bNII) must bid for 70 lots (10,360 shares) worth ₹10,04,920. Pantomath Capital Advisors Pvt. Ltd. is acting as the book-running lead manager for the issue, and Bigshare Services Pvt. Ltd. is the registrar.

Vikran Engineering Limited IPO Details

| Particulars | Details |

| IPO Date | 26 August 2025 to 29 August 2025 |

| Listing Date | 3 September 2025 |

| Face Value | ₹1 per share |

| Issue Price Band | ₹92 to ₹97 per share |

| Lot Size | 148 Shares |

| Total Issue Size | 7,95,87,627 shares (aggregating up to ₹772.00 Cr) |

| Fresh Issue | 7,43,29,896 shares (aggregating up to ₹721.00 Cr) |

| Offer for Sale | 52,57,731 shares (aggregating up to ₹51.00 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 18,35,81,130 shares |

| Share Holding Post Issue | 25,79,11,026 shares |

Vikran Engineering Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Vikran Engineering Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 148 | ₹14,356 |

| Retail (Max) | 13 | 1,924 | ₹1,86,628 |

| S-HNI (Min) | 14 | 2,072 | ₹2,00,984 |

| S-HNI (Max) | 69 | 10,212 | ₹9,90,564 |

| B-HNI (Min) | 70 | 10,360 | ₹10,04,920 |

Vikran Engineering Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 81.78% |

| Post-Issue | [To be updated post equity dilution] |

Vikran Engineering Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | Pre IPO: ₹4.24, Post IPO: ₹3.02 |

| Price/Earnings (P/E) Ratio | Pre IPO: 22.88x, Post IPO: 32.15x |

| Return on Net Worth (RoNW) | 16.63% |

| Net Asset Value (NAV) | ₹25.49 per share |

| Return on Equity | 16.63% |

| Return on Capital Employed (ROCE) | 23.34% |

| EBITDA Margin | 17.50% |

| PAT Margin | 8.44% |

| Debt to Equity Ratio | 0.58 |

Objectives of the Proceeds

- Funding working capital requirements of the company – ₹541.00 crore

- General corporate purposes – balance amount of proceeds

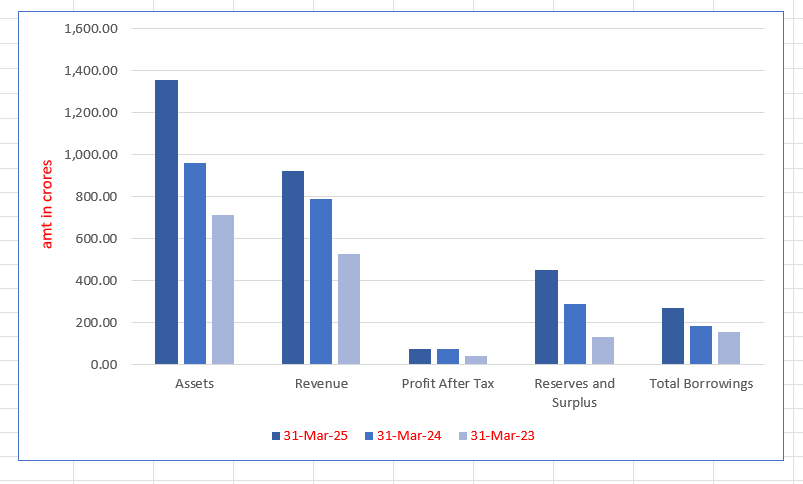

Key Financials (in ₹ crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,354.68 | 959.79 | 712.47 |

| Revenue | 922.36 | 791.44 | 529.18 |

| Profit After Tax | 77.82 | 74.83 | 42.84 |

| Reserves and Surplus | 449.52 | 290.95 | 130.85 |

| Total Borrowings | 272.94 | 183.39 | 154.92 |

SWOT Analysis of Vikran Engineering IPO

Strength and Opportunities

- Strong EPC presence in power, water, railways, and solar projects.

- Diversified order book across multiple infrastructure sectors and states

- Experienced promoters and proven track record in timely execution

- Expanding solar energy EPC presence tapping into renewable growth

Risks and Threats

- High dependence on government contracts for revenue stability

- Execution delays due to regulatory approvals and land issues

- Fluctuations in raw material costs impacting profitability

- Competitive bidding pressures in EPC industry reducing margins

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Vikran Engineering Limited

Vikran Engineering Limited IPO Strengths

- Among the rapidly expanding EPC companies, recognised for timely execution in power transmission, distribution, and water infrastructure projects.

- Maintains a well-diversified order book across multiple verticals, supported by stable growth and consistent financial performance.

- Operates on an asset-light business model, enabling scalability, cost efficiency, and effective utilisation of resources.

- Strong in-house technical expertise with advanced engineering capabilities, ensuring strict process control and reliable quality assurance.

- Guided by experienced promoters and a skilled management team, possessing extensive domain knowledge and industry insights.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Vikran Engineering Ltd. | 4.35 | 4.35 | 25.49 | 32.15 | 16.63 | — |

| Peer Group | ||||||

| Bajel Projects Limited | 1.34 | 1.34 | 57.63 | 158.75 | 2.32 | 3.72 |

| Kalpataru Projects International Ltd. | 35.53 | 35.53 | 378.80 | 34.68 | 8.77 | 3.26 |

| Techno Electric & Engg. Co. Ltd. | 37.19 | 37.19 | 321.55 | 40.17 | 11.31 | 4.65 |

| SPML Infra Limited | 7.61 | 7.61 | 107.43 | 36.79 | 6.22 | 2.61 |

| KEC International Limited | 21.80 | 21.80 | 200.88 | 35.71 | 10.67 | 3.89 |

| Transrail Lighting Limited | 25.72 | 25.72 | 140.11 | 30.73 | 17.36 | 5.64 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Vikran Engineering Limited IPO

How can I apply for Vikran Engineering Limited IPO?

You can apply for Vikran Engineering IPO through HDFC SKY using UPI-based ASBA payment method.

What is the minimum investment required in Vikran Engineering IPO?

Retail investors need to invest at least ₹14,356 for one lot of 148 shares.

When will Vikran Engineering IPO allotment be finalised?

The IPO allotment for Vikran Engineering is expected to be finalised on 1 September 2025.

On which exchanges will Vikran Engineering IPO list?

The equity shares of Vikran Engineering Limited will be listed on both NSE and BSE.