- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Virupaksha Organics IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Virupaksha Organics IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Virupaksha Organics Limited IPO

Virupaksha Organics is a research-driven Indian pharmaceutical company engaged in manufacturing active pharmaceutical ingredients (APIs), key starting materials (KSMs), and intermediates. It also provides contract development and manufacturing (CDMO) services to global pharma companies. As of March 31, 2025, the company offers 54 products across multiple therapeutic areas and serves over 550 customers in more than 100 countries. Supported by six manufacturing units in Telangana and Karnataka, it employs advanced technologies to ensure high-quality, safe, and reliable pharmaceutical production.

Virupaksha Organics Limited IPO Overview

Virupaksha Organics Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offer (IPO). The proposed IPO is a Book Build Issue amounting to ₹740.00 crores, consisting entirely of a fresh issue of equity shares, with no offer-for-sale component. The company plans to list its equity shares on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Axis Capital Ltd. has been appointed as the Book Running Lead Manager for the issue, while Kfin Technologies Ltd. will act as the registrar. Details such as IPO opening and closing dates, price bands, and lot size are yet to be disclosed. Investors can refer to the Virupaksha Organics IPO DRHP for comprehensive information.

The IPO will have a face value of ₹10 per share, with the issue structured as a Bookbuilding IPO. The total issue size will comprise fresh shares aggregating up to ₹740.00 crores, and the company’s equity shares will be listed on both BSE and NSE upon completion. Before the issue, Virupaksha Organics Ltd. had a total of 6,15,31,937 equity shares. The company filed its DRHP with SEBI on September 29, 2025.

The promoters of Virupaksha Organics Ltd. include Chandra Mouliswar Reddy Gangavaram, Balasubba Reddy Mamilla, Chandrasekhar Reddy Gangavaram, Vedavathi Gangavaram, Kondapalli Sandeep Reddy, Kotla Suraj Reddy, Mamilla Nagarjun Reddy, Gangavaram Sri Lakshmi, and G. Sri Vidya. The promoters collectively held 59.84% of the company’s equity shares prior to the IPO. The promoter holding post-issue will be updated once the final share allocation is completed.

Virupaksha Organics Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹740 crore |

| Fresh Issue | ₹740 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 6,15,31,937 shares |

| Shareholding post-issue | TBA |

Virupaksha Organics IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Virupaksha Organics Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Virupaksha Organics Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹13.17 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 17.25% |

| Net Asset Value (NAV) | ₹111.25 |

| Return on Equity (RoE) | 21.51% |

| Return on Capital Employed (RoCE) | 19.12% |

| EBITDA Margin | 17.77% |

| PAT Margin | 9.70% |

| Debt to Equity Ratio | 0.58 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirement for capacity expansion at the Expansion Units | 3600 |

| Prepayment of all or a portion of certain outstanding borrowings availed by our Company | 1950 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

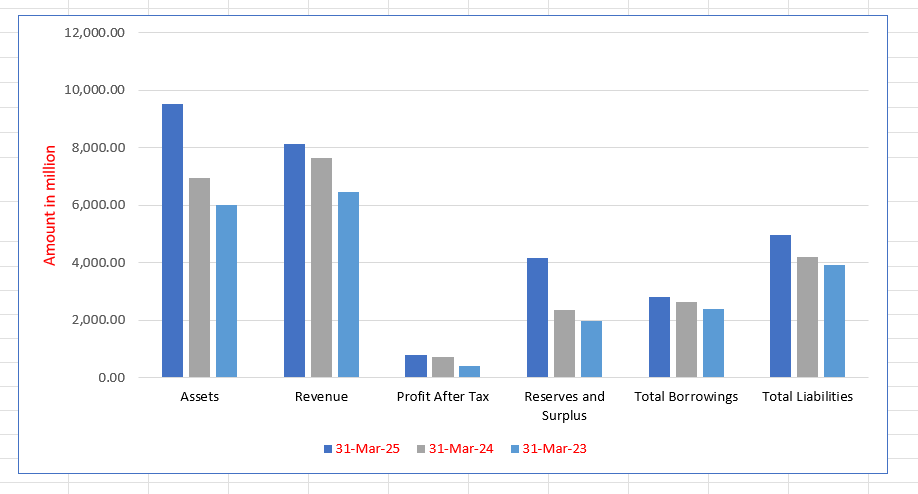

Virupaksha Organics Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 9,524.81 | 6,966.94 | 6,017.64 |

| Revenue | 8,117.09 | 7,659.91 | 6,448.39 |

| Profit After Tax | 787.14 | 736.82 | 430.90 |

| Reserves and Surplus | 4,155.98 | 2,378.66 | 1,972.32 |

| Total Borrowings | 2,822.32 | 2,643.49 | 2,408.47 |

| Total Liabilities | 4,958.61 | 4,213.80 | 3,920.52 |

Financial Status of Virupaksha Organics Limited

SWOT Analysis of Virupaksha Organics IPO

Strength and Opportunities

- Strong technical expertise and infrastructure in API and intermediate manufacturing.

- Diversified product portfolio covering APIs, intermediates, and CDMO services.

- Established export footprint across more than 100 countries and major global markets.

- Growing domestic API demand supports expansion potential in India.

- Opportunity to expand CDMO services as pharma outsourcing rises globally.

- Potential to increase filings and approvals (DMFs) to access regulated markets.

- Scope for capacity expansion leveraging existing manufacturing units in Telangana and Karnataka.

- Trend towards pharma reshoring and supply-chain diversification may benefit the business.

- Ability to leverage advanced technologies like flow chemistry, NMR, and IR for quality assurance.

Risks and Threats

- Relatively modest scale compared to global CDMO giants, limiting large contract wins.

- Heavy reliance on capital-intensive manufacturing assets increases fixed cost risks.

- Exposure to regulatory risk in sensitive markets like USFDA and EU compliance.

- Price pressure and margin erosion risk in generic API markets.

- Supply chain disruptions and raw material cost volatility could impact margins.

- Currency fluctuations and export duties could reduce competitiveness.

- Intense competition from other Indian and Chinese API and intermediate producers.

- Environmental and governance regulations may impose higher compliance costs.

- Dependence on a limited number of large customers could pose concentration risk.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Virupaksha Organics Limited

Virupaksha Organics Limited IPO Strengths

Extensive Product Portfolio Aligned with Industry Growth

Virupaksha Organics Limited boasts a comprehensive portfolio of 54 products, including 23 APIs and 31 intermediates, focusing on high-volume therapeutic areas like anti-histamines and analgesics. This diverse offering, including key products such as Fexofenadine $\text{HCl}$ and Tapentadol $\text{HCl}$, effectively positions the company to capitalize on strong industry tailwinds in the global and Indian pharmaceutical and API markets.

Diversified Global Customer Base and Enduring Relationships

The company has cultivated long-standing relationships with over 550 customers across more than 100 countries, including marquee multinational pharmaceutical firms. This diversified global base benefits from high customer retention, which is driven by the complex regulatory requirements for changing API suppliers. A significant portion of Virupaksha’s revenue is generated from customers with relationships spanning more than five years.

Robust Manufacturing and Advanced Research & Development (R&D)

Virupaksha Organics operates six manufacturing units equipped with 223 reactors, enabling large-scale commercial production and custom synthesis (CDMO). The facilities have secured multiple international regulatory approvals (e.g., USFDA, PMDA). The company’s R&D team, comprising 61 personnel, drives product development and process optimization, supported by advanced technologies like flow chemistry for enhanced efficiency.

Experienced and Qualified Leadership Team

The company is led by experienced promoters and a seasoned senior management team with extensive knowledge in the pharmaceutical sector. Key individuals, including the Managing Director and Whole-Time Directors, possess over two decades of industry experience. This expertise has been crucial in successfully scaling operations, building brand recognition, and fostering long-term customer relationships, providing a competitive edge.

More About Virupaksha Organics Limited

Virupaksha Organics Limited is a research and development–driven Indian pharmaceutical company engaged in the manufacture of active pharmaceutical ingredients (APIs), key starting materials (KSMs), and intermediates. With an operating revenue CAGR of 12.2% between FY 2023 and FY 2025, the company has outperformed many peers in the sector. Its growth is powered by robust R&D capabilities, stringent regulatory compliance, and global-quality manufacturing practices.

Product Portfolio and Market Presence

As of March 31, 2025, Virupaksha Organics offered 54 products, including 23 APIs and 31 intermediates. These products cater to diverse therapeutic areas such as:

- Anti-histamines, anti-fungals, and anti-diabetics

- Analgesics, anti-depressants, and anti-asthmatics

- Anti-tussives, anti-anginals, and anti-ulceratives

The company serves over 550 customers across more than 100 countries, including long-standing relationships with multinational pharmaceutical firms in the US, Europe, and Japan. It has filed 25 Drug Master Files (DMFs) globally, with 11 filed with the USFDA.

Manufacturing and Technological Edge

Virupaksha Organics operates six manufacturing units in Telangana and Karnataka, equipped with 223 reactors of 988 KL total capacity. The company employs advanced technologies like flow chemistry, VapourTech reactors, infrared spectroscopy, NMR, mass spectrometry, and x-ray diffraction to ensure product safety, purity, and consistency.

R&D and Quality Certifications

Its R&D unit in Telangana is led by a team of 61 professionals under Dr. Shankar Reddy, a pharmaceutical expert with over 28 years of experience. The company’s facilities have received certifications from USFDA, WHO-GMP, PMDA, and EU-GMP, along with ISO and EcoVadis Bronze sustainability ratings.

Strategic Acquisitions

In December 2024, Virupaksha Organics acquired Progenerics Pharma Private Limited, enhancing its formulation development capabilities. Later, in June 2025, it acquired a 55.37% stake in Oxygenta Pharmaceutical Limited, expanding production by an additional 280 KL.

Leadership and Vision

Led by Managing Director Chandra Mouliswar Reddy Gangavaram, who has over 24 years of industry experience, the management continues to drive organic and inorganic growth, strengthen global presence, and reinforce Virupaksha Organics’ position as a trusted pharmaceutical manufacturer.

Industry Outlook

The Indian active pharmaceutical ingredient (API) market is estimated at around USD 14.18 billion in 2025 and is projected to reach approximately USD 21.46 billion by 2030, reflecting a compound annual growth rate (CAGR) of about 8.3–8.5% over the period. Broadly, the Indian pharmaceutical sector is expected to expand from USD 50–58 billion in 2024 to about USD 130 billion by 2030.

Key Growth Drivers

- The government’s emphasis on self-reliance in APIs and KSMs through production-linked incentive (PLI) schemes and bulk-drug parks continues to drive expansion.

- Global supply-chain diversification: many Western pharmaceutical companies are reducing dependency on China and sourcing APIs from India, benefiting domestic manufacturers.

- Rising domestic demand for generic medicines and an increasing burden of chronic diseases have boosted the need for APIs in segments such as anti-diabetics, anti-fungals, and analgesics.

- Enhanced R&D investments and technological advancements in synthesis, flow chemistry, and green manufacturing are promoting efficiency and sustainability.

Product-Segment Spotlight: APIs, KSMs & Intermediates

Within the pharmaceutical industry, APIs remain the dominant growth segment, accounting for over 70% of India’s pharmaceutical manufacturing market. Merchant (contract or outsourced) API and intermediate manufacturing is expected to grow at nearly 9–10% CAGR through 2030, indicating robust outsourcing potential.

Intermediates and key starting materials (KSMs) are also gaining prominence as companies pursue vertical integration to secure raw material supply and strengthen profitability. India is gradually reducing dependence on imports, particularly from China, by expanding local production capacity and R&D.

Outlook & Strategic Implications

India’s API and intermediate manufacturing sector stands at a pivotal stage, supported by favourable government policies, rising global outsourcing, and increasing domestic pharmaceutical consumption. However, as competition intensifies, success will depend on regulatory compliance, cost efficiency, and value-added CDMO capabilities.

How Will Virupaksha Organics Limited Benefit

- Virupaksha Organics Limited is well positioned to capitalise on India’s growing API and intermediate market, projected to expand at an 8–10% CAGR.

- Its strong R&D focus and technologically advanced manufacturing enable efficient production of high-value APIs and KSMs that meet global regulatory standards.

- With six modern facilities and over 988 KL reactor capacity, the company can scale operations to meet increasing global outsourcing demand.

- The government’s PLI scheme and reduced import dependency align with Virupaksha’s domestic production strengths, improving cost competitiveness.

- Its diversified product portfolio across therapeutic segments such as anti-diabetics, anti-fungals, and anti-histamines ensures stable revenue streams amid rising healthcare needs.

- Expanding partnerships with multinational firms in the US, EU, and Japan enhance export potential.

- Strategic acquisitions like Progenerics Pharma and Oxygenta Pharmaceutical strengthen formulation and bulk manufacturing capacities, driving long-term growth and market resilience.

Peer Group Comparison

| Name of the Company | Total Revenue (₹ in million) | Face Value (₹) | P/E | EPS (Basic) | EPS (Diluted) | RoNW (%) | NAV (₹ per share) |

| Virupakhsa Organics | 8,117.09 | 10.00 | [●]* | 13.17 | 13.17 | 17.25 | 111.25 |

| Peer Groups | |||||||

| Supriya Lifescience Limited | 6,964.85 | 2.00 | 30.02 | 23.35 | 23.35 | 19.17 | 121.85 |

| Alivus Life Sciences Limited | 23,868.84 | 2.00 | 23.62 | 39.63 | 39.52 | 17.24 | 229.92 |

| Divi’s Laboratories Limited | 93,600.00 | 2.00 | 68.95 | 82.53 | 82.53 | 14.67 | 562.70 |

| Laurus Labs Limited | 55,539.60 | 2.00 | 125.41 | 6.65 | 6.64 | 8.19 | 81.13 |

| Aarti Drugs Limited | 23,870.30 | 10.00 | 25.61 | 18.35 | 18.35 | 12.33 | 149.32 |

| Neuland Laboratories Limited | 14,768.37 | 10.00 | 68.83 | 202.74 | 202.74 | 17.08 | 1,186.90 |

Key Strategies for Virupaksha Organics Limited

Product Portfolio Expansion and Commercialization

The company plans to expand its diverse API and intermediate product portfolio, focusing on high-growth therapeutic areas like anti-inflammatory and anti-diabetic segments. This includes transitioning 10 pipeline products to full-scale commercialization and leveraging the capabilities of Progenerics and Oxygenta to efficiently develop and launch complex, high-value molecules based on market demand.

Global Market Penetration and CDMO Growth

Virupaksha aims to increase its market presence in regulated territories, including the US, Europe, and Japan, by significantly enhancing its DMF filings (currently 25 across various markets). This strategy will broaden global reach, grow the customer base, and reinforce regulatory compliance. Furthermore, the company intends to expand its CDMO business to cater to new international markets.

Strategic Entry into Formulations Market

The strategy involves a foray into the formulations market, leveraging the recent acquisition of Progenerics, a research-based formulation development company. This forward integration will allow the company to offer complex dosage forms and comprehensive pharmaceutical solutions. Utilizing Progenerics’ expertise will also support customers in preparing regulatory dossiers and accelerating market entry.

Capacity Expansion and Business Scaling

To meet increasing demand from an expanded product portfolio and new markets, the company plans to substantially expand its existing manufacturing capacities at Units 1, 2, 4, and 5. By installing additional reactors without acquiring new land, Virupaksha will increase its total reactor volume. ₹ 3,600.00 million from net proceeds will fund this necessary capacity increase.

Integration of Recent Acquisitions for Synergy

The company is focused on integrating the operations of Progenerics and Oxygenta, which were acquired to drive inorganic growth. The goal is to maximize synergies across R&D, supply chain, and customer relations. Leveraging Oxygenta’s 280 KL manufacturing capacity and Progenerics’ formulation expertise will diversify offerings, optimize expenses, and enhance productivity.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Virupaksha Organics IPO

How can I apply for Virupaksha Organics Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When did Virupaksha Organics Limited file its Draft Red Herring Prospectus (DRHP) with SEBI?

Virupaksha Organics Limited filed its DRHP with SEBI on September 29, 2025, to initiate its IPO process.

What is the total size and structure of the Virupaksha Organics IPO?

The IPO is a Book Build Issue worth ₹740 crore, consisting entirely of fresh shares with no offer-for-sale component.

On which stock exchanges will the Virupaksha Organics shares be listed?

The equity shares are proposed to be listed on both BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Who are the lead manager and registrar for the Virupaksha Organics IPO?

Axis Capital Limited is the Book Running Lead Manager, and Kfin Technologies Limited serves as the registrar to the issue.

How will Virupaksha Organics utilise the IPO proceeds?

Funds will be used for capacity expansion (₹360 crore), debt repayment (₹195 crore), and general corporate purposes.