- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Vishal Nirmiti IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Vishal Nirmiti IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Vishal Nirmiti Limited

Incorporated in 1994, Vishal Nirmiti Limited (formerly Sejal Farms Private Limited) is a civil engineering and construction company specialising in Pre-Stressed Concrete (PSC) sleepers, pre-cast and pre-stressed concrete products, and fabrication of Mild Steel (MS) pipes, liners, and penstock pipes for Pumped Storage Projects. The company also provides EPC services for railway infrastructure, irrigation, and industrial projects across India. With ISO 9001:2015-certified facilities in Maharashtra, Madhya Pradesh, Gujarat, and Himachal Pradesh, and operations in several states, the firm is backed by promoters with over 40 years of industry expertise.

Vishal Nirmiti Limited IPO Overview

Vishal Nirmiti Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is a Book-Build Issue comprising a fresh issue of ₹125 crore and an offer for sale (OFS) of up to 0.15 crore equity shares. The company’s shares are proposed to be listed on both the BSE and NSE. While the book-running lead manager is yet to be announced, MUFG Intime India Pvt. Ltd. has been appointed as the registrar. Details such as IPO dates, price band, and lot size are pending. The company’s pre-issue shareholding stands at 1.98 crore shares, with promoter holding at 73.42%.

Vishal Nirmiti Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹125 crore |

| Offer for Sale (OFS) | 0.15 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,98,00,000 shares |

| Shareholding post-issue | TBA |

Vishal Nirmiti IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Vishal Nirmiti Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Vishal Nirmiti Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹11.94 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 47.63% |

| Net Asset Value (NAV) | ₹30.87 |

| Return on Equity (RoE) | 47.21% |

| Return on Capital Employ3ed (RoCE) | 30.32% |

| EBITDA Margin | 14.59% |

| PAT Margin | 7.42% |

| Debt to Equity Ratio | 1.43 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding Working Capital Requirements | 650 |

| Repayment and/ or pre-payment, in part or full of term loans | 200 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

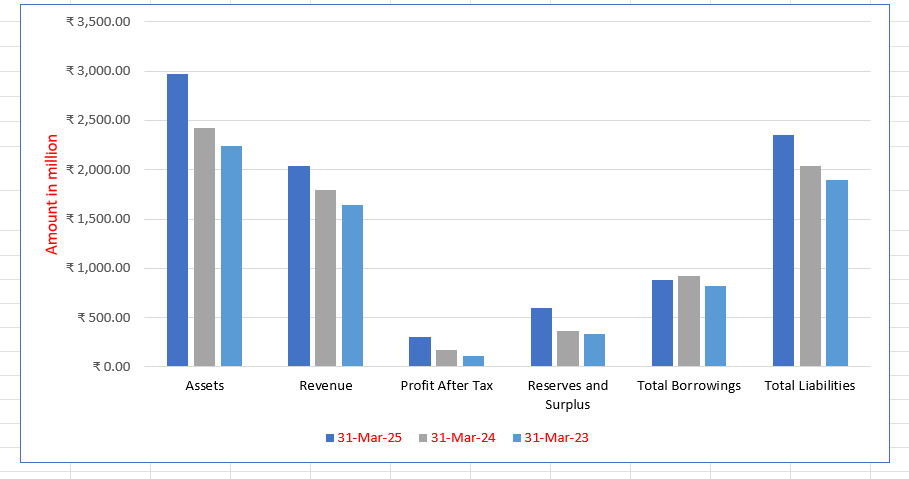

Vishal Nirmiti Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | ₹2,966.10 | ₹2,420.38 | ₹2,245.05 |

| Revenue | ₹2,041.10 | ₹1,794.18 | ₹1,645.34 |

| Profit After Tax | ₹299.00 | ₹176.00 | ₹112.00 |

| Reserves and Surplus | ₹597.62 | ₹367.63 | ₹332.00 |

| Total Borrowings | ₹882.52 | ₹917.53 | ₹821.51 |

| Total Liabilities | ₹2,350.48 | ₹2,034.74 | ₹1,895.04 |

Financial Status of Vishal Nirmiti Limited

SWOT Analysis of Vishal Nirmiti IPO

Strength and Opportunities

- Established track record in manufacturing PSC sleepers for railways.

- Strong promoter experience of over three decades in the infrastructure industry.

- High entry barriers due to specialised manufacturing approvals and certifications.

- Diverse product mix including PSC sleepers, MS pipes, and civil engineering services enabling cross-segment growth.

- Strong potential to grow with rising national investments in railways and infrastructure.

- Opportunity to expand in fabrication and hydro-mechanical projects for diversification.

- Scope to leverage government initiatives promoting domestic manufacturing and localisation.

- Healthy order book visibility ensuring stable future revenue streams.

- Certified manufacturing plants with proven quality control and repeat client orders.

Risks and Threats

- High customer concentration, with majority revenue dependent on a few major clients.

- Working-capital intensive operations with high inventory requirements.

- Profit margins vulnerable to fluctuations in raw material prices such as cement and steel.

- Revenue exposed to cyclic trends in rail infrastructure and government project approvals.

- Moderate financial risk profile and variable profitability in past years.

- Large contract execution and delayed payments may affect liquidity.

- Stiff competition from multiple approved vendors in the railway and EPC segments.

- Policy or regulatory changes in public sector tendering could impact order flow.

- Supply chain disruptions or material shortages may increase production costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Vishal Nirmiti Limited

Vishal Nirmiti Limited IPO Strengths

Established Financial Resilience and Profitability

Vishal Nirmiti Limited possesses a robust financial track record, demonstrating consistent revenue growth and strong profitability. This financial strength is validated by audited statements and a healthy cash flow. The company’s resilience provides the capacity to adapt to market changes and execute large-scale contracts confidently, ensuring long-term stability and reliability for its partners and projects.

Integrated and Client-Centric Business Model

The company’s business model focuses on building long-term client relationships through transparent communication and on-time delivery. It manages the complete project lifecycle in-house, minimizing third-party reliance for superior cost, quality, and timeline control. Strategic vendor partnerships and modern management tools ensure efficient resource utilization and consistent operational excellence across all projects.

Diversified Portfolio for Risk Mitigation

Vishal Nirmiti maintains a strategically diversified presence across PSC sleepers, MS pipes, construction services, and infrastructure projects. This diversification creates multiple, resilient revenue streams, reducing dependence on any single sector. It enhances the company’s agility, enables effective risk management, and allows it to offer integrated, end-to-end solutions to a broad client base.

Pan-India Execution Capability

The company demonstrates a proven ability to successfully execute projects across diverse geographies and terrains. Supported by multiple manufacturing facilities and a flexible operational strategy, Vishal Nirmiti can scale quickly into new regions. This geographical flexibility minimizes logistics costs and delivery times for clients, establishing the firm as a reliable, nationwide partner.

Specialized Expertise in Sleeper Manufacturing

Vishal Nirmiti has deep expertise in manufacturing a wide range of precision-engineered sleeper types, including mono-block, twin-block, and turnout sleepers. By integrating optimized production, in-house quality control, and certified personnel, the company delivers high volumes of critical railway components at competitive costs, meeting the stringent demands of national rail infrastructure.

Efficient MS Pipe Production System

The company’s MS pipe business model is designed for cost-efficiency, high output, and consistent quality. It leverages modern production processes, robust supply chain management, and strategic plant locations. Bulk procurement and embedded quality control at every stage enable Vishal Nirmiti to deliver high-quality products with speed and cost competitiveness for various infrastructure and industrial applications.

End-to-End Infrastructure Project Mastery

Vishal Nirmiti is capable of handling the full lifecycle of complex infrastructure projects, from feasibility and design to construction and commissioning. Its strong in-house technical team, comprising civil, mechanical, and structural engineering expertise, ensures projects are delivered on time, on budget, and to the highest quality standards, meeting all regulatory and client expectations.

More About Vishal Nirmiti Limited

Vishal Nirmiti Limited is recognised for its expertise in on-site fabrication of Mild Steel (MS) pipes, especially large-diameter pipes, through automatic longitudinal submerged arc welding. This approach minimises transportation and logistics costs, ensuring efficiency and precision. With over two decades of industry experience, the company has successfully fabricated more than 10,00,000 metric tonnes of MS pipes to date.

Its manufacturing capabilities extend beyond fabrication to include anti-corrosive and protective coatings such as sandblasting, painting, cement mortar lining, and guniting. The company primarily produces hot-rolled MS pipes in circular shapes up to 7,500 mm diameter and 3 mm to 36 mm thickness, serving diverse sectors including infrastructure, hydropower, lift irrigation, and water supply projects.

Service Verticals

Sub-Contracting Services

Vishal Nirmiti Limited executes sub-contracting projects for renowned infrastructure and construction firms such as Samruddhi Industries, Kalpataru Projects International Limited, and Raj Infrastructure Development (India) Pvt. Ltd. These projects include the manufacturing of pre-cast elements, prestressed products, and MS liners for major civil, irrigation, and infrastructure developments. The company also produces precast concrete noise barriers and cable ducts for the Mumbai–Ahmedabad High-Speed Rail Corridor.

Power Generation through Windmills

As part of its renewable energy initiatives, Vishal Nirmiti operates wind turbine generators (WTGs) in Maharashtra. Power generated from these assets is sold to electricity distribution companies under long-term power purchase agreements, contributing to sustainable revenue.

Scrap Sale and Leasing Activities

The company systematically disposes of scrap generated during production, selling it to third-party recyclers, which enhances efficiency and adds supplementary income. Additionally, under a Build-Operate-Transfer (BoT) model with the Solapur Municipal Corporation, it leases commercial office units and earns rental income.

Revenue Distribution

For FY 2025, Vishal Nirmiti derived 76.18% of its revenue from manufacturing and 23.82% from services. Its top five customers, including Indian Railways, Larsen & Toubro, Samruddhi Industries, and Kalpataru Projects, consistently contributed over 85% of total revenue, showcasing strong client relationships and recurring business opportunities.

Industry Outlook

The Indian steel pipes market reached approximately 13.56 million tons in 2024, and it is projected to grow to about 27.76 million tons by 2033, representing a CAGR of around 7.65% during 2025-2033. Concurrently, the broader steel pipes & tubes market in India is estimated at USD 32.88 billion in 2023 and expected to grow at a CAGR of about 6.43% to reach USD 37.69 billion by 2030.

Growth Drivers

- Infrastructure investment (railways, highways, water supply, irrigation) fuels demand for large-diameter welded and welded-fabricated pipes.

- Growth of oil & gas, pipelines, petrochemicals, and industrial projects creates demand for seamless and high-strength welded steel pipes.

- Urbanisation and renewable energy deployment (hydro power, wind) expand requirements for water supply, pump-storage, and large MS/liner pipe fabrication.

- Government focus on “Make in India”, import-substitution, local fabrication and manufacturing gives domestic manufacturers a competitive edge.

Relevant Product Segments

For companies manufacturing mild steel (MS) pipes, large diameter liners, PP (pre-stressed) concrete products and fabrication services:

- The MS pipes segment in India is set for strong growth owing to large diameter, heavy-walled applications in hydro-mechanical, irrigation and civil engineering.

- The seamless/welded pipe segments for oil & gas and water-transport functions are expected to grow at moderate to strong rates, derived from the overall pipe market CAGR above.

Outlook Summary

The Indian steel pipes & tubes industry presents a favourable growth outlook with double-digit volume expansion (volume CAGR ~7.6%) and strong value growth (~6-7% CAGR) through the remainder of the decade. For firms engaged in large-diameter MS pipes, fabrication, water/irrigation and infrastructure segments, the tailwinds are especially strong. As infrastructure, power, rail and water-project investments scale, companies positioned across fabrication plus heavy steel-pipe supply chains stand to benefit significantly.

How Will Vishal Nirmiti Limited Benefit

- The surge in water supply, irrigation, and hydro power projects will drive higher demand for on-site fabricated MS pipes — a core area of Vishal Nirmiti’s expertise.

- Expanding government infrastructure spending supports recurring contracts from major public and private clients.

- The growth of renewable energy, particularly hydro and wind, enhances opportunities in penstock pipes and related fabrication works.

- Increasing focus on local fabrication under “Make in India” strengthens the company’s competitiveness and contract pipeline.

- Rising industrial activity ensures steady demand for coated and heavy-walled pipes, reinforcing Vishal Nirmiti’s revenue stability and capacity utilisation.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ in million) | EPS (₹) | P/E Ratio | RONW (%) | NAV (₹) |

| Vishal NirmitiLimited | 10 | 31,85.17 | 11.94 | [●] | 47.63 | 30.87 |

| Peer Group | ||||||

| GPT Infraprojects Limited | 10 | 11,880.71 | 6.55 | 17.10 | 14.31 | 42.83 |

| Indian Hume Pipe Company Limited | 10 | 14,912.31 | 105.93 | 3.6 | 40.54 | 261.32 |

Key Strategies for Vishal Nirmiti Limited

Deepen Focus on Current Business Verticals

Vishal Nirmiti Limited (VNL) will concentrate on growing its core manufacturing of PSC sleepers and MS pipes, alongside its services business. The company intends to increase market share and strengthen customer loyalty by improving efficiency, reducing costs, and leveraging its specialization in the rail infrastructure sector and large-diameter MS pipes for irrigation projects.

Maintaining Profitability and Financial Stability

VNL aims to sustain a healthy financial position by ensuring continued profitable growth and financial discipline. The strategy focuses on expanding revenue while protecting margins, maintaining strong cash flow and balance sheet ratios, and prioritizing high-ROI investments. It will avoid over-leveraging and unsustainable growth, emphasizing long-term value creation.

Enhance Automation for Cost Effectiveness

The company is committed to improving cost and operational efficiency by enhancing the automation and mechanization of its internal manufacturing processes. VNL believes investing in automation solutions will lead to higher productivity, lower employee costs, and reduced rework, sustaining a long-term cost advantage in both its manufacturing and construction activities.

Targeted Penetration of New Geographies

VNL plans to expand its market presence into additional states across India, subject to viability and market research. This strategy aims to reduce concentration risk, enhance market reach, and cater to higher demand. The company will establish necessary infrastructure, talent, and compliance to effectively increase its customer base and brand visibility in new high-potential regions.

Innovation and Adoption of Modern Technologies

VNL will strategically invest in innovation and modern technologies to enhance efficiency, productivity, and deliver superior output. The plan includes utilizing spiral welded pipe technology and integrating cutting-edge tools to streamline workflows. This continuous technological upgrade is imperative for maintaining high quality, staying competitive, and reducing time-to-market.

Focus on High-Value and Scalable Projects

The company’s growth strategy is centered on bidding for higher-value projects that offer clear commercial and strategic benefits. VNL intends to leverage its expertise, such as in precast concrete for the High-Speed Rail corridor, by implementing a project evaluation framework to select opportunities with a balance of high reward and low risk for profitability and scalability.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Vishal Nirmiti Limited IPO

How can I apply for Vishal Nirmiti Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the IPO?

The IPO comprises a fresh issue of ₹125 crore and an Offer-for-Sale (OFS) of up to 0.15 crore equity shares.

Where will the shares be listed?

The company proposes listing on both the BSE Limited and the National Stock Exchange of India (NSE).

Who is the registrar for the issue?

The registrar appointed for the IPO is MUFG Intime India Pvt Ltd..

What are the key dates and price band for the IPO?

Key details such as IPO opening/closing dates and the price band are yet to be announced.

What is the company’s promoter holding before the IPO?

Before the IPO, promoter holding stands at 73.42% of the equity share capital.