- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Vishvaraj Environment IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Vishvaraj Environment IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Vishvaraj Environment Limited

Vishvaraj Environment is a leading water utility and wastewater management company, specialising in recycling treated sewage water for industrial use. It offers comprehensive solutions, including Water Treatment Plants, Sewage Treatment Plants, industrial water reuse, and distribution networks, operating under PPP, HAM, EPC, and O&M models. As of March 31, 2025, it supplies 240 MLD of treated water through two PPP projects, has 300 MLD under development, an order book of ₹160,113.44 million, and AUM of ₹66,779 million, with projects in 30 cities. Upcoming initiatives include a 486 MLD STP in Nashik and irrigation and 201 MW solar projects under PM-Kusum.

Vishvaraj Environment Limited IPO Overview

Vishvaraj Environment Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on 29 September 2025 to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Building Issue worth ₹2,250.00 crore, comprising a fresh issue of shares worth ₹1,250.00 crore and an Offer for Sale (OFS) of ₹1,000.00 crore. The company’s equity shares are proposed to be listed on the NSE and BSE. JM Financial Ltd. has been appointed as the book running lead manager, while MUFG Intime India Pvt. Ltd. will act as the registrar for the issue. Key details such as the IPO dates, price band, and lot size are yet to be announced.

The IPO will issue shares with a face value of ₹5 each, under a fresh capital-cum-offer for sale structure, aggregating up to ₹2,250.00 crore. The fresh issue will raise ₹1,250.00 crore, while the OFS will account for ₹1,000.00 crore. The issue will follow a bookbuilding process, and the pre-issue shareholding of Vishvaraj Environment Ltd. stands at 35,50,00,000 shares. The promoters of the company include Arun Hanumandas Lakhani, Vandana Arun Lakhani, Sarang Arun Lakhanee, Sidhaartha Arun Lakhanee, and Premier Financial Services Pvt. Ltd., who currently hold 100% of the company’s equity. Post-IPO promoter holding details are yet to be disclosed. For further information, the Vishvaraj Environment IPO DRHP can be referred to

Vishvaraj Environment Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹2250 crore |

| Fresh Issue | ₹1250 crore |

| Offer for Sale (OFS) | ₹1000 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 35,50,00,000 shares |

| Shareholding post-issue | TBA |

Vishvaraj Environment IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Vishvaraj Environment Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Vishvaraj Environment Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹18.62 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 36.59% |

| Net Asset Value (NAV) | ₹50.89 |

| Return on Equity (RoE) | 39.80% |

| Return on Capital Employed (RoCE) | 24.04% |

| EBITDA Margin | 24.11% |

| PAT Margin | 14.95% |

| Debt to Equity Ratio | 0.98 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in Subsidiaries, in the form of debt or equity for repayment/ prepayment, as applicable of borrowings, in full or in part, of all or a portion of certain outstanding borrowings availed by certain subsidiaries. | 5450 |

| Funding of capital expenditure through investment in our subsidiary, Nagpur Waste Water Management Private Limited to build phase-3 of a UF RO Technology-Based Advanced Water Treatment Plant for supply of 300 MLD water. (“Project A”) | 1785 |

| Funding of capital expenditure through investment in our subsidiary, Bhusawal Waste Water Management Private Limited to Design, Build, Finance, Operate and Transfer (“DBFOT”) framework for execution of a 60 MLD STP and a 80 MLD Tertiary Treatment RO (TTRO) plant. (“Project B”) | 1127.7 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

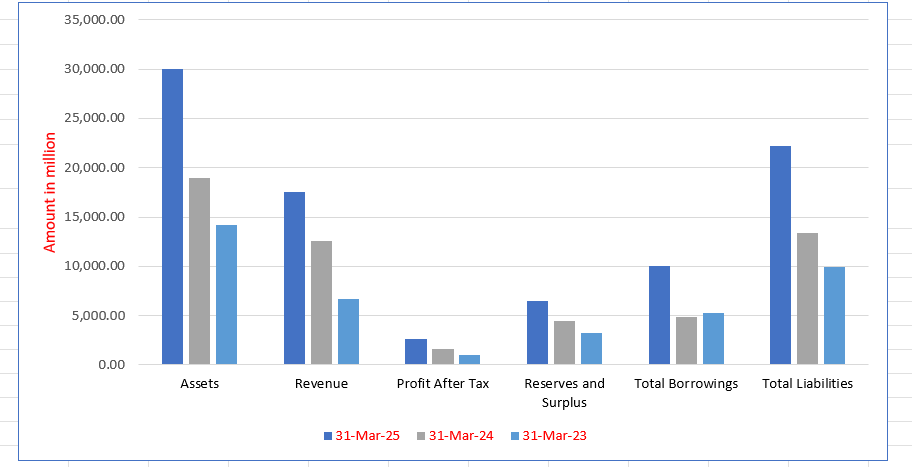

Vishvaraj Environment Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 30,045.62 | 18,923.85 | 14,240.51 |

| Revenue | 17,587.11 | 12,554.41 | 6,699.92 |

| Profit After Tax | 2,662.69 | 1,657.86 | 960.58 |

| Reserves and Surplus | 6,516.37 | 4,476.83 | 3,252.86 |

| Total Borrowings | 10,009.98 | 4,901.59 | 5,305.88 |

| Total Liabilities | 22,224.05 | 13,364.62 | 9,939.15 |

Financial Status of Vishvaraj Environment Limited

SWOT Analysis of Vishvaraj Environment IPO

Strength and Opportunities

- Established track record in water and wastewater treatment across India.

- Strong alignment with government sustainability and ESG goals supporting long-term growth.

- Healthy order book ensuring stable revenue visibility over the medium term.

- Diversified business models such as PPP, HAM, EPC, and O&M providing flexibility.

- Expanding national footprint and growing demand for treated sewage water reuse.

- Opportunity to scale renewable and solar energy projects alongside core operations.

- Potential to leverage ESG credentials to attract institutional investors and partnerships.

- Rising industrial demand for recycled water creating new market avenues.

- Recognition through national and international awards enhancing brand credibility.

Risks and Threats

- Heavy reliance on tender-based project awards, which adds unpredictability.

- Working-capital intensive operations due to large contracts and delayed receivables.

- Under-construction project risks, including cost overruns and execution delays.

- Dependence on government and municipal clients with moderate credit profiles.

- Highly competitive and fragmented sector putting pressure on profit margins.

- Regulatory and policy delays can slow project implementation.

- Geographic spread and operational complexity may challenge management efficiency.

- Macroeconomic factors like rising interest rates could increase financing costs.

- Environmental and operational risks such as water-quality failures could affect reputation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Vishvaraj Environment Limited

Vishvaraj Environment Limited IPO Strengths

Leading Developer and Industry Pioneer

Vishvaraj Environment Limited is a leading developer in water utility and wastewater management, strategically focused on the profitable reuse of treated sewage water for industrial use, a market with significant tailwinds. The company has a substantial Order Book of ₹160,113.44 million and a large operational and under-construction portfolio, including India’s first large-scale sewage water reuse Public-Private Partnership (PPP) project.

Asset Ownership with Predictable Cash Flows

The company adopts an asset ownership model with a focus on securing long-term concessions (up to 33 years) under PPP and Hybrid Annuity Model (HAM) frameworks. This strategy, combined with O&M service contracts, ensures predictable, annuity-like cash flows and long-term financial stability. It minimizes counter-party risk by primarily engaging with strong urban local, state, and central government entities.

Integrated End-to-End Execution Capabilities

Vishvaraj Environment possesses demonstrated end-to-end execution capabilities, managing projects from financial closure and design through in-house EPC and O&M. This integrated approach allows control over quality, timelines, and costs, enabling the company to retain project margins. They employ a technology-agnostic approach, utilizing advanced treatments like Ultrafiltration and Reverse Osmosis for complex wastewater reuse.

Substantial and Diversified Order Book

The firm maintains a substantial and well-diversified Order Book of ₹160,113.44 million, spread across multiple business models and project types, including wastewater reuse, water supply, and renewables. This large, high-value backlog provides a strong revenue visibility (9.10x revenue from operations as of March 31, 2025) and positions the company effectively to capitalize on the growing demand for water infrastructure.

Consistent Operational and Financial Performance

Vishvaraj Environment has a consistent track record of operational and financial performance, driven by focused growth, strategic bidding, and efficient project execution. The company maintains a strong financial position characterized by significant total equity and favorable credit ratings (CRISIL A/Stable for long-term borrowings), complemented by initiatives like using surety bonds to optimize capital structure and improve working capital.

More About Vishvaraj Environment Limited

Vishvaraj Environment Limited (VEL) stands as a leading developer of water-utility and wastewater-management projects in India, with a sharp focus on recycling treated sewage water for industrial use. According to external reports, as of 31 March 2025, VEL held an order book of ₹ 160,113.44 million and managed assets (AUM) worth ₹ 66,779.00 million. The company’s core services span the entire water cycle value chain: constructing and operating Water Treatment Plants (WTPs), Sewage Treatment Plants (STPs), industrial water-reuse projects and water-distribution networks.

Business Model & Operational Strength

VEL pursues long-term concession agreements and delivers solutions via multiple models including Public-Private Partnerships (PPP), Hybrid Annuity Model (HAM), Engineering, Procurement & Construction (EPC) and Operations & Maintenance (O&M) services. It currently supplies 240 MLD of treated sewage water through two PPP projects and has another 300 MLD under development. The company also features prominently on the global stage, ranked 24th among the world’s top 50 private water operators (by number of people served) and placed 4th among Indian firms in that listing. Furthermore, VEL achieved a revenue-from-operations CAGR of 62.02% from FY2023 to FY2025, positioning it second among its peers in growth terms.

Nationwide & Strategic Project Presence

With operations and under-construction projects across 30 cities in India, VEL works on marquee programmes. Under the National Mission for Clean Ganga, it is executing 13 STPs (177.60 MLD) in Agra, five STPs (192.00 MLD) in Dhanbad and a 35 MLD STP in Maheshtala, Kolkata. It also supplies fresh water to 1,805 villages through over 7,000 km of pipelines under the Jal Jeevan Mission across Uttar Pradesh, Maharashtra and Karnataka. In addition, VEL is undertaking a 300 MLD wastewater-reuse project using ultrafiltration and reverse-osmosis for MAHAGENCO in Maharashtra and a massive irrigation network covering 20,887 hectares of culturable command area (CCA).

Innovation, Track-Record & Renewable Expansion

VEL boasts a proven execution capability: it developed India’s first full-city 24×7 water-supply PPP project in Nagpur in 2011 and followed with India’s first large-scale sewage-water-reuse PPP project (200 MLD) supplying treated effluent to thermal power plants, thus freeing up 190 MLD of fresh water for the city. More recently (June 2025) it won a 486 MLD STP project in Nashik under HAM to ensure a cleaner Godavari River ahead of the 2027 Kumbh Mela. In FY2025 the company also entered the solar-power domain, establishing 201 MW of solar projects across six districts in Maharashtra under the PM-KUSUM scheme.

Strategic Position & Outlook

By operating across EPC, PPP, HAM and O&M, and branching into renewables, VEL has built a diversified revenue model and mitigated single-segment risk. The company’s alignment with national water-security imperatives, its execution expertise and strong order book provide a solid base for growth. With India facing acute water-stress—holding only 4% of the world’s freshwater resources while accounting for 18% of the global population—the need for infrastructure like VEL’s is urgent and increasing. Thus, Vishvaraj Environment is well-positioned to capitalise on the expanding water-and-wastewater market in India, driven by government initiatives such as Har Ghar Jal, AMRUT 2.0 and Namami Gange

Industry Outlook

India’s water and wastewater treatment industry is on a strong growth trajectory, supported by regulatory push, urbanisation, industrialisation and rising scarcity of freshwater. The sector offers robust potential both for water-treatment systems (such as WTPs, STPs, water-distribution and reuse infrastructure) and for wastewater-recycling/re-use solutions (especially industrial reuse, membrane technologies, zero‐liquid‐discharge etc.).

Growth Prospects & Key Figures

- The Indian wastewater-treatment market was valued at USD 9.64 billion in 2024 and is projected to reach USD 18.63 billion by 2033, a CAGR of about 7.6% for 2025-2033.

- The broader Indian water-treatment system market generated revenue of around USD 2,980 million in 2024, and is expected to reach roughly USD 6,905.8 million by 2033, reflecting a CAGR of about 10%.

- For recycling & reuse of treated water in India, the market is expected to grow at a CAGR of about 10.6% between 2025-2030, with industrial‐end-use as the largest driver.

- The industrial water & wastewater infrastructure segment specifically is forecast to expand from USD 2.87 billion in 2024 to approximately USD 4.65 billion by 2030, at a CAGR of ~8.3%.

Growth Drivers

- Government Initiatives: Programmes like Jal Jeevan Mission, AMRUT 2.0, Namami Gange and funding for sewage & reuse create large project pipelines.

- Water Scarcity & Stress: India has only ~4% of world’s freshwater but ~18% of world’s population, making water-treatment, reuse and distribution critical.

- Industrial & Urban Demand: Rapid urbanisation and manufacturing growth raise demand for treated water and wastewater-infrastructure in both municipal and industrial applications.

- Technological Adoption: Use of advanced technologies—membrane filtration (UF/RO), ZLD, smart monitoring, reuse systems—drives growth in higher-value segments.

- Wastewater Reuse Emphasis: Industries and municipalities increasingly target reuse of treated sewage water and industrial effluents to conserve fresh water and comply with discharge norms.

Outlook for Products & Services Relevant to the Company

For companies providing full-cycle solutions such as Water Treatment Plants (WTPs), Sewage Treatment Plants (STPs), industrial water reuse and distribution networks:

- The market for municipal STPs and reuse plants is expanding strongly due to urban sanitation mandates and river-cleaning efforts.

- Industrial water-reuse systems and membrane-based reuse plants (as the company executes) are high-growth sub-segments given ZLD mandates and corporate sustainability goals.

- Water-distribution networks and sewage-pipe infrastructure are driven by rural-supply programmes and urban-network expansion.

- EPC and O&M services linked to large concession projects (PPP/HAM) will see Increasing outsourcing and private-sector participation.

How Will Vishvaraj Environment Limited Benefit

- Vishvaraj Environment Limited (VEL) is well-positioned to capitalise on India’s expanding water and wastewater treatment market, projected to grow at a CAGR of 7.5–11%.

- Its expertise in large-scale WTPs, STPs and wastewater-reuse systems directly aligns with the rising demand for sustainable water infrastructure.

- With a strong presence in PPP and HAM projects, VEL can secure long-term revenue streams from government initiatives like Jal Jeevan Mission and Namami Gange.

- Growing emphasis on treated sewage reuse for industrial applications supports VEL’s core competency in recycling wastewater for power and manufacturing sectors.

- The company’s integrated EPC and O&M capabilities allow it to benefit from increased outsourcing by public authorities.

- Technological adoption in membrane-based treatment and solar-powered systems enhances its competitive edge.

- As ESG-focused investments rise, VEL’s sustainability-driven operations can attract institutional investors seeking impact-based opportunities.

Peer Group Comparison

| Name of Company | Total Revenue (₹ in million) | Face Value (₹) | P/E | EPS (Basic) (₹) | EPS (Diluted) (₹) | RoNW (%) | NAV (₹ per share) |

| Vishvaraj Environment Limited | 17,587.11 | 5.00 | [●] | 18.62 | 18.62 | 36.59% | 50.89 |

| Peer Group | |||||||

| VA Tech Wabag Limited | 32,940.00 | 2.00 | 31.02 | 47.48 | 46.80 | 13.80% | 344.09 |

| ION Exchange India Limited | 27,371.08 | 1.00 | 23.19 | 17.53 | 17.53 | 17.21% | 101.89 |

| Welspun Enterprises Limited | 35,841.00 | 10.00 | 21.45 | 23.61 | 23.30 | 13.87% | 185.97 |

| Enviro Infra Engineers Limited | 10,660.56 | 10.00 | 21.01 | 11.76 | 11.76 | 17.73% | 66.35 |

| EMS Limited | 9,658.32 | 10.00 | 16.48 | 33.05 | 33.05 | 18.81% | 175.70 |

| Vishnu Prakash R Punglia Limited | 12,374.18 | 10.00 | 19.82 | 4.70 | 4.70 | 7.52% | 62.52 |

Key Strategies for Vishvaraj Environment Limited

Prioritize Wastewater Reuse Projects

VEL will intensify its focus on wastewater reuse projects, leveraging its ₹121 billion Order Book in this segment. They will continue developing advanced UF/RO treatment plants to supply treated sewage to industrial customers, such as thermal power plants, significantly reducing their freshwater dependency, while securing bids backed by strong funding agencies.

Scale Irrigation and Maintain Market Leadership

The company plans to maintain its leadership position by capitalizing on the growing water utility and wastewater market, supported by government schemes. VEL will strengthen PPPs for long-term cash flows and actively scale its irrigation business, including bidding for large-scale river-linking projects to improve agricultural water use efficiency across rural India.

Expand Geographic Reach and Pursue Acquisitions

Vishvaraj Environment intends to expand its geographic reach within India and into high-growth international markets, building on its experience in the Maldives. Concurrently, the firm will evaluate inorganic growth opportunities through acquisitions and strategic arrangements to consolidate its market position and enhance its service offerings and execution capabilities.

Modernize Infrastructure with Advanced Technology

The company plans to invest in modernizing its water utility infrastructure by partnering with technology firms. This involves integrating advanced solutions like smart meters, intelligent leak detection, and AI-based asset optimization. This dual approach, leveraging pilots and partnerships, aims to improve operational efficiency, reduce non-revenue water, and enhance real-time decision-making capabilities.

Ensure Prudent Financial Management

Vishvaraj Environment will maintain its prudent financial management practices to ensure disciplined capital allocation and sustainable value creation. This involves enforcing minimum gross contribution and strict cost discipline for EPC work. For investment projects, the strategy includes leveraging low-cost financing, setting minimum IRR thresholds, and optimizing the capital structure.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Vishvaraj Environment Limited IPO

How can I apply for Vishvaraj Environment Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When did Vishvaraj Environment Limited file its Draft Red Herring Prospectus (DRHP)?

Vishvaraj Environment Limited filed its DRHP with SEBI on September 29, 2025, for its upcoming IPO.

What is the total issue size of the Vishvaraj Environment Limited IPO?

The total issue size is ₹2,250 crore, comprising a fresh issue of ₹1,250 crore and an offer for sale of ₹1,000 crore.

On which stock exchanges will Vishvaraj Environment Limited list its shares?

The equity shares of Vishvaraj Environment Limited are proposed to be listed on both NSE and BSE.

Who are the lead manager and registrar for the Vishvaraj Environment IPO?

JM Financial Ltd. is the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

How will the company utilise the IPO proceeds?

Funds will support subsidiary debt repayment, new water and solar projects, and general corporate purposes.