- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

VMS TMT Limited IPO

₹14,100/150 shares

Minimum Investment

IPO Details

17 Sep 25

19 Sep 25

₹14,100

150

₹94 to ₹99

NSE, BSE

₹148.50 Cr

24 Sep 25

VMS TMT Limited IPO Timeline

Bidding Start

17 Sep 25

Bidding Ends

19 Sep 25

Allotment Finalisation

22 Sep 25

Refund Initiation

23 Sep 25

Demat Transfer

23 Sep 25

Listing

24 Sep 25

VMS TMT Limited

VMS TMT Limited is involved in the manufacturing of Thermo Mechanically Treated (TMT) Bars at its facility in Bhayla Village, Ahmedabad, Gujarat. These high-strength steel bars, known for their durability, ductility, and corrosion resistance, are widely used in the construction industry. The company primarily operates in Gujarat, generating over 96% of its revenue from this region across recent financial periods. TMT Bars account for the majority of its revenue, with retail sales dominating. VMS TMT also sells scrap, binding wires, and billets and operates under a retail licence with Kamdhenu Limited.

VMS TMT Limited IPO Overview

The VMS TMT IPO is a book-built issue worth ₹148.50 crores, comprising a fresh issue of 1.50 crore shares. The subscription window will open on September 17, 2025, and close on September 19, 2025, with allotment expected to be finalised on September 22, 2025. The IPO is set to list on both BSE and NSE, with a tentative listing date of September 24, 2025. The price band has been fixed at ₹94 to ₹99 per share, and the lot size is 150 shares. For retail investors, the minimum investment required is ₹14,850 (based on the upper price band). For sNII investors, the minimum application size is 14 lots (2,100 shares), amounting to ₹2,07,900, while for bNII investors, it is 68 lots (10,200 shares), translating to ₹10,09,800. Arihant Capital Markets Ltd. is acting as the book-running lead manager, while Kfin Technologies Ltd. has been appointed as the registrar to the issue.

VMS TMT Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1.50 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | 17 September 2025 to 19 September 2025 |

| Price Bands | ₹94 to ₹99 per share |

| Lot Size | 150 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,46,31,210 shares |

| Shareholding post -issue | 4,96,31,210 shares |

VMS TMT IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 150 | ₹14,850 |

| Retail (Max) | 13 | 1,950 | ₹1,93,050 |

| S-HNI (Min) | 14 | 2,100 | ₹2,07,900 |

| S-HNI (Max) | 67 | 10,050 | ₹9,94,950 |

| B-HNI (Min) | 68 | 10,200 | ₹10,09,800 |

VMS TMT Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

VMS TMT Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.01 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 28.96% |

| Net Asset Value (NAV) | 13.82% |

| Return on Equity | 28.96% |

| Return on Capital Employed (ROCE) | 16.70% |

| EBITDA Margin | 4.72% |

| PAT Margin | 1.54% |

| Debt to Equity Ratio | 4.25 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or part, of all or a portion of certain borrowings availed by the company | 1150 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

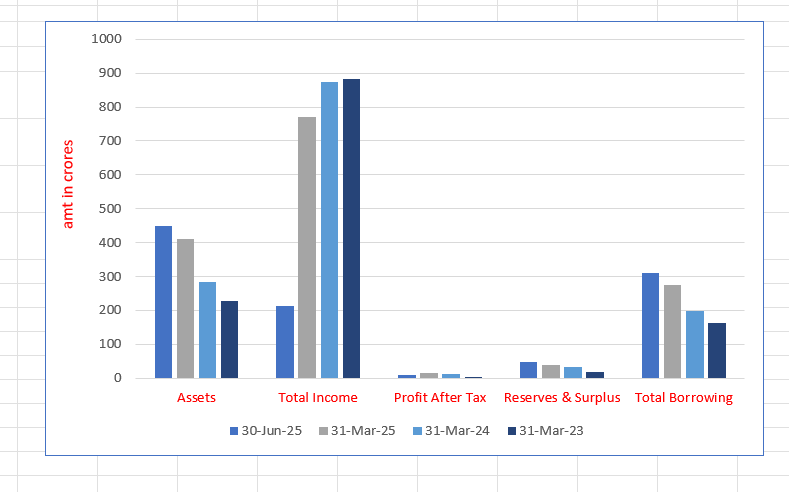

VMS TMT Limited Financials (in crore)

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 449.35 | 412.06 | 284.23 | 227.28 |

| Total Income | 213.39 | 771.41 | 873.17 | 882.06 |

| Profit After Tax | 8.58 | 15.42 | 13.47 | 4.20 |

| Reserves & Surplus | 47.14 | 38.56 | 33.18 | 18.23 |

| Total Borrowing | 309.18 | 275.72 | 197.86 | 162.70 |

Financial Status of VMS TMT Limited

SWOT Analysis of VMS TMT Limited IPO

Strength and Opportunities

- State-of-the-art automated manufacturing facility near Ahmedabad, Gujarat.

- Production of patented double ribbed TMT bars enhancing structural integrity.

- ISO-certified operations ensuring adherence to quality standards.

- Strategic alliance with Kamdhenu Limited for brand leverage.

- Robust distribution network comprising distributors and dealers.

- Significant increase in operating income, indicating a growth trajectory.

- Experienced leadership with a background in the metal industries.

- Focus on retail sales, capturing a substantial market segment.

- Potential for expansion beyond current geographic limitations.

- Opportunity to capitalize on infrastructure development initiatives in India.

Risks and Threats

- High dependence on the Gujarat market, limiting geographic diversification.

- Exposure to fluctuations in raw material prices impacting cost structures.

- Operating in a highly competitive industry with numerous established players.

- Relatively recent commencement of commercial production in September 2021.

- Potential delays in IPO timelines, affecting capital infusion plans.

- Vulnerability to changes in the construction industry demand cycles.

- Challenges in maintaining consistent profit margins amidst market volatility.

- Dependence on third-party brands for market penetration, affecting brand autonomy.

- Regulatory changes in the steel manufacturing sector pose compliance challenges.

- Environmental concerns and sustainability regulations are impacting operational practices.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About VMS TMT Limited IPO

Poised to Capture Growth in the TMT Bar Market

VMS TMT Limited manufactures TMT bars at its integrated facility in Gujarat, catering to both retail and institutional customers. With strong production capacity, backward integration, and a robust distribution network, it is well-positioned to capitalise on rising demand in India’s steel market, supported by consistent sales growth and strategic raw material sourcing.

Long-Term Customer Relationships Augmented by Large Distribution Network

VMS TMT Limited primarily operates in Gujarat, serving retail and institutional clients through a strong distribution network of 3 distributors and 227 dealers. With high customer retention, zonal market segmentation, and focus on Tier II and III cities, the company leverages scale benefits and brand partnerships to drive sustained growth.

Established Infrastructure with Backward Integration and Strong Logistics Support

VMS TMT Limited operates a backward-integrated facility near Ahmedabad, manufacturing TMT Bars primarily from scrap. With a 216,000 MT annual capacity, 22MW power support, and a planned 15MW solar plant, the company ensures cost efficiency. A robust Gujarat-based supply chain and third-party logistics enable efficient doorstep delivery to Tier II and III cities.

Consistent Growth in Financial Performance

VMS TMT Limited has demonstrated a robust financial growth trajectory, supported by integrated operations, high-capacity utilisation, and cost efficiency. From FY22 to FY24, total income, EBITDA, and PAT have grown significantly, with improved margins and reduced debt ratios, reflecting strong operational discipline and effective financial management strategies.

Strong Leadership and Experienced Management Team

VMS TMT Limited is guided by experienced Promoters and a skilled senior management team. With decades of diverse industry expertise, the leadership brings strategic insight, operational acumen, and market foresight, enabling the Company to anticipate trends, drive growth, manage operations efficiently, and adapt to evolving customer needs.

More About VMS TMT Limited

VMS TMT Limited is engaged in the manufacturing of Thermo Mechanically Treated Bars (TMT Bars) at its facility located in Bhayla Village, Ahmedabad, Gujarat. TMT Bars are high-strength reinforcement steel products widely used in the construction industry due to their superior strength, ductility, and corrosion resistance.

Geographic Focus and Revenue Mix

The company predominantly operates within Gujarat (excluding Saurashtra and Kutch districts), generating the majority of its revenue from this region. For the nine months ended December 31, 2024, and fiscal years 2024, 2023, and 2022, Gujarat accounted for over 96% of VMS TMT’s total revenues.

- Revenue from TMT Bars comprised approximately 91% to 97% of total revenues during the same periods.

- Retail sales formed 77% to 80% of total revenue.

- Institutional sales accounted for the remaining 20% to 23%.

- Other revenue sources include scrap, binding wires, and billets, contributing around 3% to 9%.

Distribution and Marketing

VMS TMT markets its TMT Bars under the Kamdhenu Brand, operating through a retail licence agreement with Kamdhenu Limited (dated November 7, 2022). The company’s sales network includes:

- 3 distributors, each responsible for the central, north, and south Gujarat zones.

- 227 dealers as of February 28, 2025.

- A fleet of over 50 trucks is managed via third-party logistics providers, ensuring timely doorstep delivery.

Manufacturing and Capacity

- Annual installed capacity: 200,000 metric tonnes of TMT Bars.

- Production in the nine months ended December 2024: 92,175 MT.

- Manufacturing uses both scrap and billets, processed through induction furnaces, continuous casting machines, reheating furnaces, and rolling mills.

In September 2024, backward integration enabled the company to manufacture TMT Bars directly from scrap, reducing dependence on billet suppliers.

Raw Materials and Sustainability Initiatives

- Key raw materials include scrap, manganese, non-coking coal, dolomite, limestone, and bentonite.

- Over 64% to 93% of raw materials are sourced locally within Gujarat, optimizing cost and delivery times.

- To reduce electricity costs and carbon footprint, VMS TMT is setting up a 15 MW solar power plant on 74 acres in Banaskantha district under an MoU with Prozeal Green Energy Limited.

- The company holds ISO certifications for quality (ISO 9001:2015), health & safety (ISO 45001:2018), and environment management (ISO 14001:2015).

Leadership and Workforce

VMS TMT is led by promoters with over 30 years of combined steel industry experience and supported by a team of 215 permanent employees (as of January 31, 2025). The strong leadership and skilled workforce drive operational efficiency and business growth.

Strategic MoU with Group Company

A Memorandum of Understanding with Aditya Ultra Steel Limited (a Group company) restricts each entity to specific geographic zones within Gujarat, allowing focused market penetration without overlap. VMS TMT concentrates on Gujarat districts excluding Saurashtra and Kutch, while Aditya Ultra Steel operates solely in Saurashtra and Kutch.

Industry Outlook

Indian Steel Industry Outlook

The Indian steel industry is poised for significant growth, driven by robust domestic demand and strategic policy initiatives.

- Projected Growth: India’s steel demand is anticipated to increase by 8–9% in 2025, outpacing global growth rates.

- Production Expansion: The National Steel Policy 2017 aims to elevate India’s steel production capacity to 330 million tonnes per annum by 2030.

- Government Initiatives: Infrastructure projects like Bharatmala, Sagarmala, and the Smart Cities Mission are expected to bolster steel consumption.

TMT Bar Market Dynamics

Thermo Mechanically Treated (TMT) bars are integral to India’s construction and infrastructure sectors.

- Market Size & Growth: The TMT steel bar market was valued at approximately USD 80 billion in 2024 and is projected to reach USD 120 billion by 2033, growing at a CAGR of about 4.5%.

- Demand Surge: The market size of TMT bars is expected to expand by 153.02 million tons between 2021 and 2026 at a CAGR of 3.5%.

- Infrastructure Demand: The infrastructure sector’s demand for higher quantities of TMT bars, coupled with government support for large-scale projects, makes it the most influential segment driving market growth.

Growth Drivers

Several factors are propelling the growth of the TMT bar industry:

- Urbanization: Rapid urban development increases the need for durable construction materials.

- Government Policies: Initiatives like the National Steel Policy and infrastructure development programs stimulate demand.

- Infrastructure Projects: Large-scale projects such as smart cities and transportation networks require substantial steel reinforcement.

- Technological Advancements: Innovations in manufacturing processes enhance the quality and efficiency of TMT bars.

Key Figures

- Market Value (2024): ~USD 80 billion

- Projected Market Value (2033): ~USD 120 billion

- CAGR (2025–2033): ~4.5%

- Demand Expansion (2021–2026): 153.02 million tons at a CAGR of 3.5%

How Will VMS TMT Limited Benefit

- VMS TMT Limited is well-positioned to benefit from India’s growing steel demand, especially with Gujarat contributing over 96% of its revenue, aligning with regional infrastructure growth.

- The company’s focus on TMT Bars, which represent 91%-97% of its revenue, taps directly into the expanding construction sector driven by urbanization and government projects.

- Backward integration and the ability to manufacture from scrap reduce raw material dependency, improving cost efficiency amid rising demand.

- Local sourcing of over 64% of raw materials within Gujarat lowers transportation costs and supports timely production.

- The planned 15 MW solar power plant enhances sustainability and reduces operational expenses, aligning with industry trends toward greener manufacturing.

- A robust distribution network with 3 distributors, 227 dealers, and over 50 trucks ensures strong market reach across Gujarat’s growing urban and rural areas.

- The MoU with Aditya Ultra Steel allows focused geographic penetration, minimizing competition and maximizing market share within Gujarat.

- Experienced leadership and a skilled workforce enable VMS TMT to capitalize on technological advancements and scale production to meet rising demand.

Peer Group Comparison

| Name of the Company | Face Value per Share (₹) | Total Income (₹ million) | EPS (₹) | NAV (₹) | P/E | RoNW (%) |

| VMS TMT Limited | 10.00 | 8731.68 | 4.01 | 113.82 | [●] | 28.96 |

| Peer Groups | ||||||

| Kamdhenu Limited | 10.00 | 7382.94 | 18.59 | 88.13 | 27.37 | 21.12 |

| Vraj Iron and Steel Limited | 10.00 | 4242.70 | 21.89 | 76.19 | 10.49 | 28.73 |

| BMW Industries Limited | 1.00 | 5394.31 | 2.62 | 28.22 | 27.70 | 9.30 |

| Electrotherm (India) Limited | 10.00 | 4275.84 | 250.73 | Negative | 760.75 | Negative |

Key Strategies for VMS TMT Limited

Integration of Renewable Energy for Cost Efficiency and Sustainability

VMS TMT Limited is transitioning to renewable energy to manage rising power costs. With a 15 MW solar plant underway in Gujarat, the Company aims to reduce dependence on conventional electricity, cut operational expenses, and support sustainable, green steel manufacturing aligned with industry trends.

Backward Integration for Cost Control and Supply Chain Strengthening

To secure raw materials and reduce costs, VMS TMT Limited has implemented in-house billet manufacturing with a 30-ton electric induction furnace. This reduces reliance on external suppliers, improves quality control, and enhances production efficiency, strengthening supply chain resilience and operational stability.

Product Portfolio Diversification to Drive Growth

VMS TMT Limited pursues diversification by exploring new business verticals, such as MS Pipes manufacturing, leveraging existing expertise and market reach. Strategic partnerships and optimized operations support expansion efforts, enabling the Company to capture synergies, expand distribution, and ensure sustainable, long-term growth.

Market Penetration and Expansion of TMT Bars in Gujarat

With a 200,000 MT capacity, VMS TMT Limited targets growth in Gujarat’s expanding infrastructure sector. The phased expansion plan includes job work arrangements, plant acquisitions, and capacity scale-up, ensuring efficient capital use and strengthening market share amid rising demand for earthquake-resistant TMT bars.

Commitment to Sustainability, Quality, and Safety

VMS TMT Limited emphasizes sustainability by maintaining rigorous quality systems across manufacturing and supply chains. The upcoming 15 MW solar power plant will reduce electricity costs and fossil fuel dependence, reinforcing environmental responsibility while ensuring consistent product quality, safety, and operational excellence.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On VMS TMT Limited IPO

How can I apply for the VMS TMT Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of the VMS TMT Limited IPO?

The IPO comprises a fresh issue of up to 1.5 crore equity shares.

When is the VMS TMT Limited IPO expected to open?

The IPO is anticipated to open on 17 September 2025 and close on 19 September 2025

Who is the registrar for the VMS TMT Limited IPO?

KFin Technologies Limited is the appointed registrar.

What is the face value per equity share in the VMS TMT IPO?

The face value is ₹10 per equity share.

Which exchanges will list the VMS TMT Limited IPO?

The shares are expected to be listed on the BSE and NSE.

Please note that specific details such as the issue price and lot size are yet to be announced.

Investors are advised to stay updated with the latest information.