- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Wakefit Innovations IPO

₹14,060/76 shares

Minimum Investment

IPO Details

08 Dec 25

10 Dec 25

₹14,060

76

₹185 to ₹195

NSE, BSE

₹1,288.89 Cr

15 Dec 25

Wakefit Innovations IPO Timeline

Bidding Start

08 Dec 25

Bidding Ends

10 Dec 25

Allotment Finalisation

11 Dec 25

Refund Initiation

12 Dec 25

Demat Transfer

12 Dec 25

Listing

15 Dec 25

Wakefit Innovations Limited

Wakefit Innovations Limited is a leading Indian D2C home and sleep solutions company, known for its affordable mattresses, furniture, and home décor. It began with online sales of memory foam mattresses, removing middlemen to offer better prices. The brand later expanded into furniture and furnishings, serving modern Indian homes. Operating mainly through digital platforms, Wakefit ensures broad reach via efficient logistics and customer support. As of December 31, 2024, it employed 2,085 people, including 1,504 regular employees and 581 skilled and unskilled labourers.

Wakefit Innovations Limited IPO Overview

Wakefit Innovations IPO is a book-built issue worth ₹1,288.89 crore, comprising a fresh issue of 1.93 crore shares amounting to ₹377.18 crore and an offer for sale of 4.68 crore shares valued at ₹911.71 crore. The IPO will open for subscription on December 8, 2025, and close on December 10, 2025, with allotment expected on December 11, 2025. The company is set to list on both the BSE and NSE, with a tentative listing date scheduled for December 15, 2025. The price band for the offer is fixed between ₹185 and ₹195 per share, and the minimum lot size is 76 shares. Retail investors need to invest at least ₹14,820 at the upper price band. For sNII applicants, the minimum bid is 14 lots (1,064 shares) amounting to ₹2,07,480, while bNII investors must bid for at least 68 lots (5,168 shares), totalling ₹10,07,760. Axis Capital Ltd. is the book-running lead manager for the issue, and MUFG Intime India Pvt. Ltd. is acting as the registrar.

Wakefit Innovations Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1,288.89 crore (Fresh Issue: ₹377.18 crore + OFS: ₹911.71 crore) |

| Fresh Issue | ₹377.18 crore (1,93,42,461 shares) |

| Offer for Sale (OFS) | ₹911.71 crore (4,67,54,405 shares) |

| IPO Dates | December 8, 2025 to December 10, 2025 |

| Price Bands | ₹185 – ₹195 per share |

| Lot Size | 76 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 30,74,86,214 shares |

| Shareholding Post-Issue | 32,68,28,675 shares |

Wakefit Innovations IPO Timelines

| Event | Date |

| IPO Open Date | Mon, Dec 8, 2025 |

| IPO Close Date | Wed, Dec 10, 2025 |

| Tentative Allotment | Thu, Dec 11, 2025 |

| Initiation of Refunds | Fri, Dec 12, 2025 |

| Credit of Shares to Demat | Fri, Dec 12, 2025 |

| Tentative Listing Date | Mon, Dec 15, 2025 |

Wakefit Innovations IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 76 | ₹14,820 |

| Retail (Max) | 13 | 988 | ₹1,92,660 |

| S-HNI (Min) | 14 | 1,064 | ₹2,07,480 |

| S-HNI (Max) | 67 | 5,092 | ₹9,92,940 |

| B-HNI (Min) | 68 | 5,168 | ₹10,07,760 |

Wakefit Innovations Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Wakefit Innovations Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (0.50) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (2.77%) |

| Net Asset Value (NAV) | 17.92 |

| Return on Equity | -6.58% |

| Return on Capital Employed (ROCE) | -0.68% |

| EBITDA Margin | 7.13% |

| PAT Margin | -2.75% |

| Debt to Equity Ratio | 0.53 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure to be incurred by the company for setting up of 117 new COCO – Regular Stores and one COCO- Jumbo Store | 308.4 |

| Expenditure for lease, sub-lease rent and license fee payments for our existing COCO – Regular Stores | 1614.7 |

| Capital expenditure to be incurred by our Company for purchase of new equipment and machinery | 154.08 |

| Marketing and advertisement expenses towards enhancing the awareness and visibility of our brand | 1084.04 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

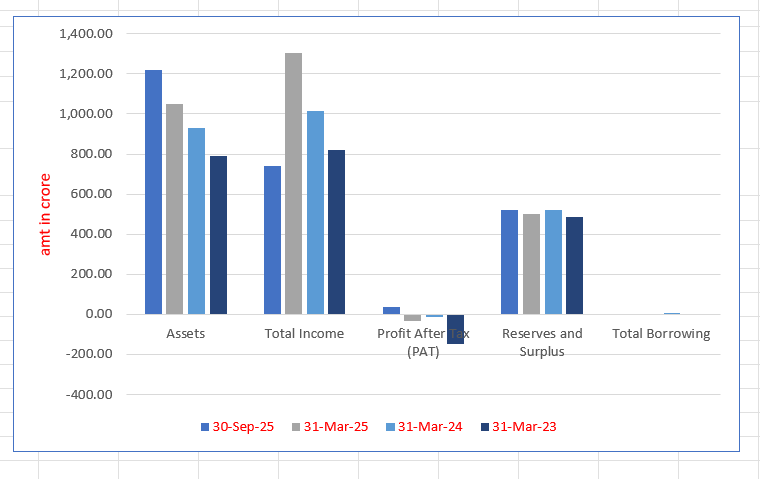

Wakefit Innovations Limited Financials (in crore)

| Period Ended | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,220.34 | 1,050.75 | 928.30 | 791.80 |

| Total Income | 741.30 | 1,305.43 | 1,017.33 | 820.01 |

| Profit After Tax (PAT) | 35.57 | -35.00 | -15.05 | -145.68 |

| Reserves and Surplus | 522.34 | 500.27 | 523.33 | 486.99 |

| Total Borrowing | — | — | 7.36 | — |

Financial Status of Wakefit Innovations Limited

SWOT Analysis of Wakefit Innovations IPO

Strength and Opportunities

- Strong directtoconsumer (D2C) model with vertical integration from design to delivery.

- Costcontrolled manufacturing and strict quality assurance.

- Competitive pricing (~30% lower than traditional brands).

- High brand recall aided by strong marketing campaigns (“Right to Nap”)

- Broadening product portfolio from mattresses to furniture and home furnishings.

- Rapid revenue growth, trendtoward ₹1,300 crore in FY25

- Strong recovery of losses: net loss narrowing from ₹145 crore in FY23 to ₹8.8 crore in 9M FY25.

- Opportunity in the growing Indian organised mattress market projected at ₹25,500 crore by 2026.

- Growing healthconscious consumer base allows segmentation (e.g. elderly, allergy, pregnant).

- Expansion potential into Tier II/III cities and sleeptech offerings.

Risks and Threats

- Persistent net losses even as EBITDA turns positive.

- Heavy capex and expansion costs for COCO stores may strain cash flows.

- Weak offline store traffic and conversion at experience centres.

- Rising competition from both online-first players and legacy organised furniture brands.

- Volatility in rawmaterial costs (foam, wood, textiles).

- Legal and regulatory overhang from pending tax/criminal cases involving management.

- Need for continuous product innovation in sleeptech to fend off techdriven entrants.

- Overhang of founder/investor share sales in IPO may pressure valuation postlisting.

- Scalability challenges inherent in D2C model, including lower web conversion rate.

- Intensifying margin pressure from marketplace commission (e.g. Amazon/Flipkart ~24%).

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Wakefit Innovations Limited

Wakefit Innovations Limited IPO Strengths

Innovative Product Development and Design Excellence

Wakefit Innovations Limited employs a strategic product development approach, launching thousands of SKUs annually. By producing small batches initially, it gauges customer interest and mitigates inventory risks. Their creative, tech-driven design process—powered by global trend analysis and software tools—ensures each product is functional, aesthetic, cost-effective, and aligned with evolving market preferences.

Vertically Integrated Operations and Smart Manufacturing

Wakefit Innovations Limited’s full-stack operations span design, engineering, manufacturing, and customer experience. Advanced tools like CAD/CAM, cloud-based manufacturing systems, and linked machinery enable high efficiency and real-time design updates. This automation reduces errors, improves precision, and ensures seamless production. Their integrated model gives the company tighter control, efficiency, and a competitive edge.

Robust Supply Chain, Logistics, and Customer-Centric Systems

Wakefit Innovations Limited operates a multi-tiered supply chain with centralized and regional hubs for faster delivery. Innovations like roll-pack mattresses, reusable sofa covers, and flat-pack furniture enhance logistics efficiency. SAP-ERP integration, CRM automation, A/B testing, and the Wixy chatbot create superior customer experiences, streamlining support and fostering brand trust and satisfaction.

Expansive Omnichannel Presence and Store Network

Wakefit Innovations Limited has built a robust omnichannel ecosystem blending its website, COCO–Regular Stores, marketplaces, and MBOs. Strategic store placements based on data insights ensure reach and capital efficiency. With 1,107 MBOs and 98 COCO–Regular Stores across India, the company ensures product accessibility and a unified brand experience both online and offline.

Multi-Faceted Marketing and Brand Engagement Strategy

Wakefit Innovations Limited’s marketing efforts include community-centric campaigns, celebrity partnerships, cultural integration, and digital performance marketing. Initiatives like the Sleep Internship and Great Indian Sleep Score reinforce brand identity. Creative campaigns and influencer collaborations enhance visibility, while sustained customer engagement and high product ratings reflect strong retention and growing consumer trust.

Proven Financial Growth and Scalable Business Model

Wakefit Innovations Limited demonstrates consistent financial improvement by leveraging operational efficiency and cost optimisation. With increasing revenue, improved EBITDA margins, and a rising share of offline sales, the business showcases scalability. Strategic investments, efficient manufacturing, and disciplined marketing contribute to sustained growth, improved margins, and reduced losses over the past years.

More About Wakefit Innovations Limited

Wakefit Innovations Limited emerged as India’s largest D2C home and furnishings brand by revenue in Fiscal 2024. Within just nine years of operation, the company achieved a total income exceeding ₹10,000 million, with ₹9,863.53 million from operations. Its operational revenue grew at a CAGR of 24.87% between Fiscal 2022 and 2024—approximately 1.64 times faster than that of its organised peers.

Omnichannel Presence and Product Categories

The company offers a comprehensive product range—including mattresses, furniture, and home furnishings—through an omnichannel strategy, integrating:

- A strong online platform (Wakefit website)

- 98 COCO–Regular stores across 18 states and 2 union territories

- 1,107 MBO stores across 278 cities

- Presence on major e-commerce and quick commerce platforms

Each of Wakefit’s three product categories generated over ₹1,000 million in Fiscal 2024:

- Mattresses: Memory foam, latex, dual comfort, spring models, and smart mattresses with sleep-tech integration.

- Furniture: Engineered wood, metal beds, sofas, tables, recliners, cabinets, and kids’ furniture.

- Furnishings: Curtains, pillows, rugs, towels, lights, dinnerware, wall décor, and more.

Operational Excellence

Wakefit follows a full-stack vertically integrated model, overseeing R&D, design, manufacturing, and distribution. It uses roll-packing and flat-pack technology to cut logistics costs and optimise storage and installation efficiency.

Customer-Centric Flywheel

With over half of revenue consistently from its own channels, the company:

- Boosts average order value and customer retention

- Enables cross-selling and upselling

- Gathers real-time feedback for innovation

Repeat customers make up 17–22% of new furniture and furnishings buyers.

Marketing and Community Initiatives

Marketing efforts such as the “Sleep Internship” and quirky campaigns like “Kumbhakaran” and “Andar Ke Bacche Ko Jagao” enhance brand engagement. Celebrity endorsements and social media strategies amplify reach.

Leadership and Sustainability

Led by Ankit Garg and Chaitanya Ramalingegowda, supported by investors like Peak XV Partners and Elevation Capital, the brand upholds ESG values through recycling, reusable packaging, and vocational training initiatives like the “Gurukul” programme.

Industry Outlook

The Indian home and furnishings industry is poised for significant growth, driven by rapid urbanisation, rising disposable incomes, evolving lifestyle preferences, and the expansion of e-commerce platforms.

Market Size and Growth

- The Indian home furnishings market was valued at approximately ₹56,330 crore in 2024 and is expected to grow to around ₹1,03,880 crore by 2033, reflecting a CAGR of about 6.7%.

- Broader estimates place the industry at USD 18 billion in 2024, with projections of reaching USD 55 billion by 2032, growing at a CAGR of approximately 14.9%.

Growth Drivers

- Rising demand for stylish, customisable, and space-saving products.

- Growth in online retail, quick commerce, and omnichannel retailing.

- Government-backed housing schemes and increased home ownership.

- Increased consumer awareness around sustainable and functional interiors.

Mattress Segment

- Estimated at USD 2.11 billion in 2024, the Indian mattress market is projected to grow to USD 3.48 billion by 2030, with a CAGR of approximately 8.5%.

- Growth is driven by health awareness, real estate expansion, and demand for smart-tech integrated sleep solutions.

Furniture Segment

- The home furniture market stood at around USD 49 billion in 2022 and is expected to reach USD 89.47 billion by 2030, growing at a CAGR of 7.7–8.8%.

- Demand is fuelled by urbanisation, modular living trends, and the rise in remote work and compact homes.

Home Décor and Furnishings

- The home décor segment was valued at USD 17.2 billion in 2024, with projections of reaching USD 27.63 billion by 2030, growing at a CAGR of approximately 8.4%.

- Fastest growth is seen in textiles and decorative accessories like rugs, curtains, lights, and tableware.

How Will Wakefit Innovations Limited Benefit

- Wakefit’s direct-to-consumer model positions it well to capitalise on the growing digital and e-commerce adoption in India.

- Its diverse product range aligns with increasing consumer demand for mattresses, furniture, and home décor.

- Vertically integrated operations help reduce costs, maintain quality, and respond quickly to market trends.

- The company’s focus on smart, space-saving, and customisable products caters to evolving urban lifestyles.

- Rising home ownership and real estate development in Tier I, II, and III cities support Wakefit’s market expansion.

- The projected 8.5% CAGR in the mattress segment enhances growth potential for Wakefit’s tech-driven sleep solutions.

- Sustainability-focused packaging and design practices align with growing consumer preference for eco-friendly brands.

- Government housing initiatives and urbanisation are expected to boost demand across its core product categories.

- Wakefit’s strong omnichannel presence ensures consistent reach across online and offline customer segments.

- Direct customer interaction enables continuous product innovation, better retention, and higher lifetime value.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Wakefit Innovations Limited

Strategic Retail Expansion and Website Growth

Wakefit Innovations Limited aims to expand its COCO–Regular and COCO–Jumbo Stores across India, complemented by initiatives to boost online sales. The strategy includes tailored store formats, regional hubs, and digital upgrades to improve accessibility, customer experience, and sales performance across all channels.

Data-Led Product Diversification and Category Expansion

Wakefit Innovations Limited plans to broaden its product range using a data-driven approach, expanding within home and furnishing categories. This includes launching new SKUs, introducing premium offerings, and leveraging consumer insights to support growth across mattresses, furniture, and potential entry into interior design services.

Strengthening Brand Awareness and Identity

Wakefit Innovations Limited will invest in marketing, brand-building, and community engagement through digital campaigns, influencer partnerships, and sub-brand development. Their aim is to increase brand recall, connect with diverse audiences, and launch targeted brands across different price points to tap into evolving consumer preferences.

Enhancing Customer Experience through Technology

Wakefit Innovations Limited will leverage technology to personalize customer interactions, improve website usability, and streamline order tracking. Initiatives include video demos, chatbot integration, A/B testing, and RFID-based inventory tracking to optimize logistics and enhance the digital and offline shopping journey.

Maximizing Customer Lifetime Value

Wakefit Innovations Limited seeks to increase customer lifetime value by cross-selling complementary products, encouraging repeat purchases, and fostering brand loyalty. Through engaging retail experiences, targeted communication, product upgrades, and trust-building initiatives like 100-day trials, the company aims to deepen customer relationships and wallet share.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Wakefit Innovations Limited IPO

How can I apply for Wakefit Innovations Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Wakefit’s upcoming IPO?

Wakefit plans to raise ₹468.2 crore via a fresh issue plus an OFS of ~5.83 crore shares.

Who are the lead managers for Wakefit’s IPO?

The IPO is being managed by Axis Capital, IIFL Capital Services, and Nomura.

How will the fresh issue proceeds be used?

Funds allocated include retail expansion, new equipment, leases, marketing, and general corporate purposes.

How much capital is earmarked for new COCOstores expansion?

Wakefit intends to spend approximately ₹82 crore on establishing 117 new COCO Regular Stores and one Jumbo Store.

Does the IPO include any preIPO placement?

Yes, Wakefit may undertake a preIPO placement of up to ₹93.6 crore, reducing the fresh issue size if executed.