- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Waterways Leisure Tourism IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Waterways Leisure Tourism IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

About Waterways Leisure Tourism Limited

Waterways Leisure Tourism, under its flagship brand Cordelia Cruises, is India’s only premium cruise line operating in cruise tourism and hospitality. It currently sails the “MV Express” vessel to popular domestic destinations like Mumbai, Goa, Kochi, Chennai, Lakshadweep, Visakhapatnam, and Puducherry. The cruise line also explores international routes, including Sri Lankan ports like Hambantota, Trincomalee, and Jaffna, and has sold tickets for new destinations such as Phuket, Singapore, Kuala Lumpur, and Langkawi. Cordelia Cruises brings a vibrant cruise experience, combining international standards with Indian flavours in food, entertainment, and hospitality.

Waterways Leisure Tourism Limited IPO Overview

The Waterways Leisure Tourism IPO is a book-built issue of ₹727 crore and consists entirely of a fresh issue of shares. The IPO dates, price band, and lot size are yet to be announced, and the allotment date remains pending. Centrum Capital Limited is the book-running lead manager, while MUFG Intime India Private Limited (Link Intime) is the registrar for the issue. The shares will be listed on both BSE and NSE. The face value is ₹10 per share. Promoters include Global Shipping and Leisure Limited and Rajesh Chandumal Hotwani, holding 99.27% pre-issue.

Waterways Leisure Tourism Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹727 crore

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 6,51,54,444 shares |

| Shareholding post -issue | 6,51,54,444 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Waterways Leisure Tourism Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Waterways Leisure Tourism Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (18.55) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 218.94% |

| Net Asset Value (NAV) | (17.74) |

| Return on Equity | 3.08% |

| Return on Capital Employed (ROCE) | 4.01% |

| EBITDA Margin | 0.34%S |

| PAT Margin | 0.34% |

| Debt to Equity Ratio | 0.18 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Payment towards deposit/ advanced lease rental and monthly lease payments to step-down the company’s subsidiary, Baycruise Shipping and Leasing (IFSC) Private Limited | 5525.29 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

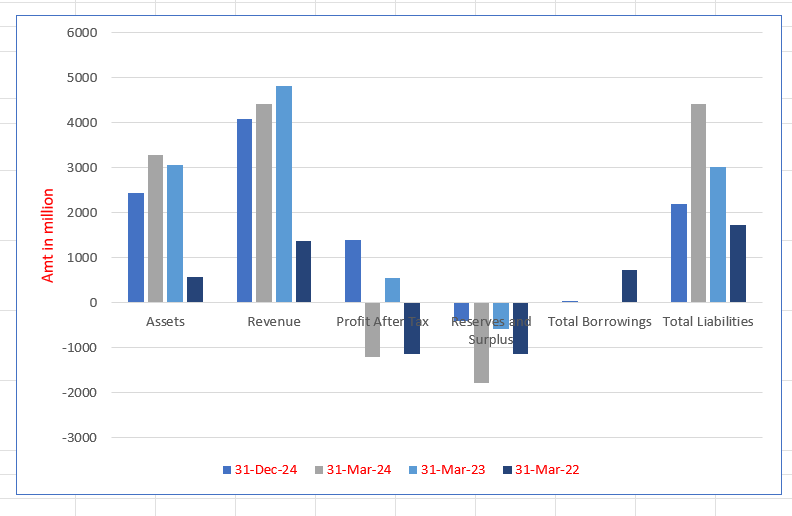

Waterways Leisure Tourism Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2437.89 | 3279.33 | 3070.23 | 578.02 |

| Revenue | 4094.52 | 4421.10 | 4819.20 | 1361.77 |

| Profit After Tax | 1392.54 | (1199.63) | 553.14 | (1149.68) |

| Reserves and Surplus | (403.04) | (1794.55) | (594.94) | (1148.58) |

| Total Borrowings | 44.01 | – | – | 733.05 |

| Total Liabilities | 2194.11 | 4427.06 | 3018.35 | 1726.50 |

Financial Status of Waterways Leisure Tourism Limited

SWOT Analysis of Waterways Leisure Tourism IPO

Strength and Opportunities

- Sole domestic ocean cruise operator in India with around 65% market share by value.

- Strong Indian-centric brand with cuisine, festivals, and entertainment tailored to local preferences.

- Plans to expand fleet with upcoming vessels to enhance domestic and Southeast Asian itineraries

- Supported by government initiatives promoting cruise tourism through infrastructure and policy reforms.

- Domestic cruises without passport requirements increase accessibility for Indian tourists.

- Strong presence in niche markets like weddings and corporate events on cruises

- Integrated onboard experiences including casino, spa, kids’ activities, and diverse cuisines

- Solid financial performance with growing revenue and profitability.

- IPO to raise ₹727 crore aims to fund fleet expansion and service upgrades.

Risks and Threats

- Limited fleet; currently operates only one vessel (MV Empress).

- High capital requirements for fleet expansion and significant lease obligations.

- Heavy dependence on the Indian market and limited global footprint

- Low cruise tourism awareness and adoption among Indian travellers

- Port infrastructure and immigration processes still developing in India

- Potential competition from international cruise lines entering the Indian market

- Vulnerable to economic fluctuations and travel disruptions

- Dependence on leased vessels adds financial and operational risk

- Regulatory delays or policy changes could affect expansion plans.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Waterways Leisure Tourism Limited

Waterways Leisure Tourism Limited IPO Strengths

Pioneer in the Ocean Cruise Tourism in India, Well-Positioned to Capitalise on Industry Tailwinds

Waterways Leisure Tourism Limited, India’s only domestic ocean cruise operator, is poised to benefit from robust industry growth, supportive government initiatives, rising luxury travel demand, and high entry barriers—leveraging its flagship MV Empress cruise, strong brand presence, and expanding itineraries across domestic and international destinations to lead India’s premium cruise tourism sector.

India-Focused Cruise Experience with Diverse Amenities

Waterways Leisure Tourism Limited delivers a culturally immersive Indian cruise experience tailored to both domestic and international travellers. With authentic cuisine, themed entertainment, and over 85 performers, it celebrates Indian cinema and hospitality. Guests enjoy diverse dining, bars, spa, casino, rock climbing, and kid-friendly activities. Year-round itineraries and strategic relocations ensure seamless operations despite monsoons.

Margin-Boosting Direct Bookings with Growing In-House Expertise

Waterways Leisure Tourism Limited secures most cabin sales through direct channels, with 66.12% of bookings in the nine months ending December 2024 made without intermediaries. A growing team of 157 cruise holiday experts ensures smooth customer engagement. Direct bookings optimise margins, reduce commission costs, and foster personalised guest relationships and stronger brand loyalty.

Strategic Outsourcing Enhances Cruise Efficiency and Guest Experience

Waterways Leisure Tourism Limited enhances operational efficiency by outsourcing key functions like crewing, housekeeping, F&B, and entertainment to expert third parties. This scalable model reduces overheads, optimises labour costs, ensures high service quality, and lets the company focus on core offerings, guest satisfaction, and expanding premium cruise experiences in line with seasonal demand

Experienced Leadership Driving Strategic and Financial Growth

Waterways Leisure Tourism Limited thrives under a seasoned leadership team with deep expertise in cruise, hospitality, and tourism. With Jurgen Bailom as CEO, Nishikant Upadhyay as CFO, and Aditya Gupta as Executive Director, the company benefits from strategic vision, strong financial oversight, and industry-focused marketing—ensuring sustainable growth and consistent business performance.

More About Waterways Leisure Tourism Limited

India’s Leading Domestic Cruise Operator

As of December 31, 2024, Waterways Leisure Tourism Limited is the only domestic ocean cruise operator in India, commanding around 65% of the market share by value. Operating under the flagship brand Cordelia Cruises, the company focuses on delivering luxury cruises infused with Indian experiences—ranging from cuisine to entertainment and hospitality.

Their sole operational vessel, MV Empress, has sailed over 2,25,000 nautical miles with more than 5.4 lakh guests since launch. The cruise primarily covers popular domestic destinations such as:

- Mumbai, Goa, Kochi, Chennai, Lakshadweep

- Visakhapatnam and Puducherry

International itineraries include:

- Hambantota, Trincomalee, Jaffna

- Phuket, Singapore, Kuala Lumpur, and Langkawi

Guest Experience and Amenities

The MV Empress offers 796 cabins, including:

- Chairman’s Suite, Mini Suites, Ocean-View Staterooms, and Interior Cabins

- Prices range from ₹25,230 to ₹1,15,536 per night, depending on cabin type and occupancy

Catering to Indian and international guests, the cruise experience includes:

- Indian and international cuisine (including Jain food)

- Themed entertainment shows like Indian Cinemagic, Balle Balle, and Razzmatazz

- A children’s academy, gaming arcade, spa, casino, and fitness centre

- Rock climbing wall, swimming pools, and onboard retail shops

- MICE and wedding services with full event support

Operations and Direct Sales Strategy

To ensure operational efficiency, the company outsources key services such as crewing, housekeeping, and F&B. This flexible model enables quick scalability and quality assurance.

A majority of cabins are booked directly through the company’s website, app, or call centre, with direct bookings reaching 66.12% for the nine months ending December 2024. This reduces reliance on agents and enhances customer engagement.

Industry Outlook

India’s cruise tourism sector is witnessing strong growth momentum, driven by rising domestic travel demand, expanding infrastructure, and supportive government initiatives. The industry generated approximately USD 138.8 million in 2024 and is projected to grow to between USD 322–417 million by 2030, reflecting a CAGR of around 12% to 15%.

Ocean cruising remains the dominant revenue contributor, while river cruises are the fastest-growing sub-segment, aligning with government plans to develop 51 new inland water circuits across 14 states by 2027.

Segment Insights

- Ocean Cruises: The primary focus for operators like Waterways Leisure Tourism. These cover long-haul and short-haul domestic and international itineraries along India’s 7,500 km coastline.

- River Cruises: Expected to surge in popularity with strong policy backing and infrastructure investment.

Growth Drivers

- Cruise Bharat Mission aims to double cruise passenger traffic to 1 million by 2029 and increase river cruise passengers to 1.5 million.

- Major cruise terminals are under development at Mumbai, Kochi, Goa, Chennai, and Visakhapatnam.

- Rising disposable incomes and a growing middle class are driving demand for premium travel experiences.

- Increase in experiential travel and enhanced port connectivity are adding to cruise attractiveness.

Key Figures and Projections

- Average revenue per cruise user is projected to reach USD 492 by 2030.

- Online bookings are expected to contribute 18% of total revenue by 2030.

- India’s cruise penetration stands at only 0.01%, compared to around 4.74% in North America—highlighting massive untapped potential.

Outlook

With robust policy support, expanding infrastructure, and increasing consumer interest, India’s cruise tourism industry is poised for substantial growth. Operators like Waterways Leisure Tourism Limited are well-positioned to lead this expansion, capitalising on both ocean and river cruise segments through strategic offerings and elevated guest experiences

How Will Waterways Leisure Tourism Limited Benefit

- India’s low cruise penetration (0.01%) offers Waterways Leisure Tourism Limited significant first-mover advantage to tap into emerging demand.

- The cruise market is projected to grow to USD 322–417 million by 2030, creating strong long-term revenue potential.

- Increasing domestic demand for luxury and experiential travel aligns with the company’s premium cruise offerings.

- Expansion and development of ports like Mumbai, Chennai, Kochi, and Goa will support route flexibility and operational scale.

- Government support through initiatives such as the Cruise Bharat Mission encourages growth and infrastructure expansion.

- Rising disposable income among Indian consumers enhances affordability and market size for cruise vacations.

- A strong direct booking ratio of 66.12% boosts profitability by reducing third-party commission costs.

- Addition of new ships like the Norwegian Sky and Norwegian Sun will increase fleet capacity and route options.

- Growing interest in MICE tourism and destination weddings adds diversified onboard revenue opportunities.

- As India’s only major cruise line, the brand enjoys high visibility, loyalty, and competitive dominance.

Peer Group Comparison

| Name of the Company | Revenue (₹) | Face value (₹) | P/E | EPS (Basic) (₹) | RoNW (%) | NAV per share (₹) |

| Waterways Leisure Tourism Limited | 4,421.10 | 10 | [●] | (18.55) | 218.94% | (17.74) |

| Peer Groups | ||||||

| Chalet Hotels Limited | 14,172.52 | 10 | 68.15 | 13.54 | 15.02% | 90.07 |

| Lemon Tree Hotels Limited | 10,711.22 | 10 | 73.80 | 1.88 | 2.50% | 75.26 |

| Juniper Hotels Limited | 8,176.62 | 10 | 215.75 | 1.46 | 1.22% | 119.34 |

Key Strategies for Waterways Leisure Tourism Limited

Expansion Through New Cruise Vessels

Waterways Leisure Tourism Limited plans to introduce two leased cruise ships—Norwegian Sky and Norwegian Sun—by Fiscal 2026 and 2027 respectively. This strategy supports asset-light fleet expansion, enhances operational efficiency, and positions the company to meet growing market demand with optimised service and guest capacity.

Strengthen Guest Experience Onboard

The company aims to elevate the onboard experience through expanded dining options, engaging entertainment, and tailored recreational activities. This includes improving crew training and support to deliver premium hospitality, ensuring guests enjoy luxury, culture, and memorable moments during their voyage with Waterways Leisure Tourism Limited.

Diversify Domestic and International Itineraries

Waterways Leisure Tourism Limited seeks to expand its cruise routes across India and international locations such as Malaysia, Thailand, and Maldives. These additions aim to increase customer engagement, repeat bookings, and loyalty while catering to evolving travel preferences and India’s rising cruise tourism demand.

Leverage Government-Led Cruise Initiatives

Aligned with India’s Cruise Bharat Mission, Waterways Leisure Tourism Limited intends to capitalise on government-backed infrastructure, digitalisation, and fiscal incentives. These developments support their goal to position the company as a leading cruise provider amid projected growth in India’s domestic and international cruise markets.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Waterways Leisure Tourism Limited IPO

How can I apply for Waterways Leisure Tourism Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Waterways Leisure Tourism IPO?

The IPO aims to raise ₹727 crore entirely through a fresh issue of shares.

Will the IPO include an offer-for-sale component?

No, the issue is entirely a fresh sale with no offer-for-sale component.

How will the IPO proceeds be utilised?

Approximately ₹552.5 crore will fund lease payments; the rest supports general corporate use.

What is the IPO allocation structure?

It follows a bookbuilding model: 75% QIBs, 15% NIIs, and 10% retail investors.

Who manages the IPO process and listing?

Centrum Capital, Motilal Oswal & Intensive Fiscal Services are lead managers; MUFG Intime is registrar.