- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Western Overseas Study Abroad IPO

₹1,12,000/2000 shares

Minimum Investment

IPO Details

04 Dec 25

08 Dec 25

₹1,12,000

2000

₹56 to ₹56

BSE

₹10.07 Cr

11 Dec 25

Western Overseas Study Abroad IPO Timeline

Bidding Start

04 Dec 25

Bidding Ends

08 Dec 25

Allotment Finalisation

09 Dec 25

Refund Initiation

10 Dec 25

Demat Transfer

10 Dec 25

Listing

11 Dec 25

Western Overseas Study Abroad Limited

Western Overseas Study Abroad Limited is a leading educational and immigration consultancy established in 2013. The company provides a comprehensive suite of services, including visa advisory, language proficiency training for exams like IELTS and PTE, and foreign language courses. It acts as a one-stop solution for students, offering guidance on scholarships, education loans, and career opportunities abroad. With a strong presence across multiple states in North India, the company empowers clients to achieve global educational and professional success through its experienced team and personalized service approach.

Western Overseas Study Abroad Limited IPO Overview

The Western Overseas Study Abroad Limited IPO is a fixed price issue of ₹10.07 crores, which is entirely a fresh issue of 17.98 lakh shares. The IPO opens for subscription on December 4, 2025, and closes on December 8, 2025. The allotment is tentatively scheduled for December 9, 2025, with shares expected to be listed on the BSE SME on December 11, 2025. The lot size is 2,000 shares, setting the minimum investment at ₹2,24,000 for retail investors. Sobhagya Capital Options Pvt. Ltd. is the book running lead manager, and Skyline Financial Services Pvt. Ltd. is the registrar for this public offer.

Western Overseas Study Abroad Limited IPO Details

| Particulars | Details |

| IPO Date | December 4, 2025 to December 8, 2025 |

| Listing Date | December 11, 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹56 per share |

| Lot Size | 2,000 Shares |

| Total Issue Size | 17,98,000 shares (aggregating up to ₹10.07 Cr) |

| Fresh Issue | 17,98,000 shares (aggregating up to ₹10.07 Cr) |

| Offer for Sale | NA |

| Issue Type | Fixed Price IPO |

| Listing At | BSE SME |

| Share Holding Pre Issue | 42,14,000 shares |

| Share Holding Post Issue | 60,12,000 shares |

| Market Maker Portion | 90,000 shares |

Western Overseas Study Abroad Limited IPO Reservation

| Investor Category | Shares Offered |

| Market Maker | 90,000 (5.01%) |

| NII (HNI) | 8,54,000 (47.50%) |

| Retail | 8,54,000 (47.50%) |

Western Overseas Study Abroad Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 2 | 4,000 | ₹2,24,000 |

| Retail (Max) | 2 | 4,000 | ₹2,24,000 |

| HNI (Min) | 3 | 6,000 | ₹3,36,000 |

Western Overseas Study Abroad Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue | 70.09% |

Western Overseas Study Abroad Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.25 |

| Price/Earnings (P/E) Ratio | 10.67 |

| Return on Net Worth (RoNW) | 33.86% |

| Net Asset Value (NAV) | ₹15.49 |

| Debt to Equity Ratio | 0.63 |

| PAT Margin | 9.73% |

Objectives of the Proceeds

- To finance Advertisement expenses for brand visibility. (₹3.43 Crore)

- To finance acquisition and installation of Software. (₹3.00 Crore)

- Prepayment or repayment of certain outstanding borrowings. (₹2.00 Crore)

- To meet General corporate purposes. (₹0.74 Crore)

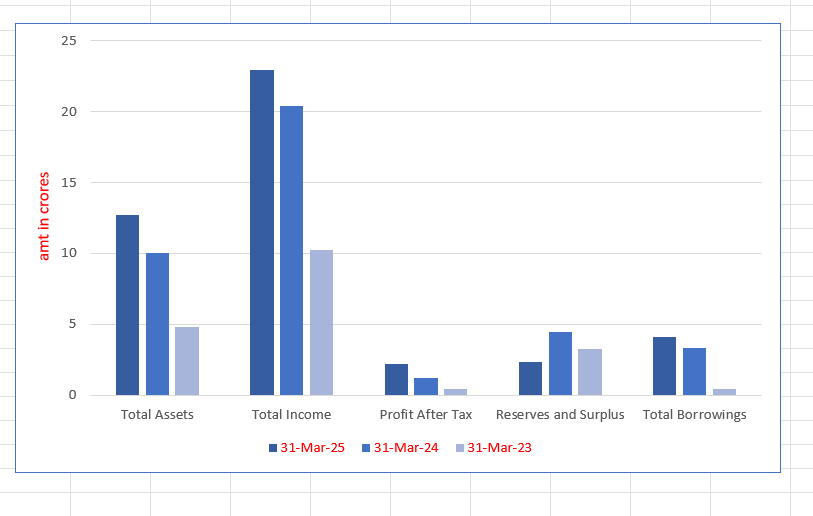

Key Financials (in ₹ crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Total Assets | 12.69 | 10.05 | 4.79 |

| Total Income | 22.96 | 20.37 | 10.21 |

| Profit After Tax | 2.21 | 1.19 | 0.45 |

| Reserves and Surplus | 2.32 | 4.47 | 3.27 |

| Total Borrowings | 4.09 | 3.31 | 0.47 |

SWOT Analysis of Western Overseas Study Abroad IPO

Strength and Opportunities

- Experienced and knowledgeable team.

- Comprehensive range of services under one roof.

- Strong financial performance with growing revenue.

- Growing demand for overseas education in India.

- Potential for geographic expansion across India.

Risks and Threats

- High dependence on promoter-driven strategy.

- Intense competition in the immigration consultancy sector.

- Regulatory changes in international student visa policies.

- Geopolitical tensions affecting student mobility.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Western Overseas Study Abroad Limited

Western Overseas Study Abroad IPO Strengths

- Promoters and management team possess extensive experience in the education sector.

- Well-established presence with a network of branches in North India.

- Maintains long-term client relationships through successful admissions and visas.

- Offers a comprehensive one-stop solution for study abroad needs.

- Strong integration of technology and training services under one roof.

- Adheres to quality service standards with a transparent and clear process.

Peer Group Comparison

| Company Name | EPS (Basic) | P/E (x) | RoNW (%) | NAV |

| Western Overseas Study Abroad Limited | 5.25 | 10.67 | 33.86 | 15.49 |

| Peer Group | ||||

| Winny Immigration & Education Services Limited | -22.97 | -3.09 | -78.48 | 27.20 |

| Landmark Global Learning Ltd | 6.37 | 8.24 | 15.63 | 40.75 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Western Overseas Study Abroad Limited IPO

How can I apply for Western Overseas Study Abroad Limited IPO?

You can apply via HDFCSky using your UPI ID through the ASBA process.

What is the lot size for the Western Overseas IPO?

The lot size is 2,000 shares, making the minimum investment amount ₹2,24,000.

When will the Western Overseas IPO allotment be finalized?

The share allotment is tentatively scheduled for Tuesday, December 9, 2025.

Is this IPO a fresh issue?

Yes, the entire issue is a fresh issue of shares worth ₹10.07 crores.