- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

WeWork India Management IPO

₹14,145/23 shares

Minimum Investment

IPO Details

03 Oct 25

07 Oct 25

₹14,145

23

₹615 to ₹648

NSE, BSE

₹3,000 Cr

10 Oct 25

WeWork India Management IPO Timeline

Bidding Start

03 Oct 25

Bidding Ends

07 Oct 25

Allotment Finalisation

08 Oct 25

Refund Initiation

09 Oct 25

Demat Transfer

09 Oct 25

Listing

10 Oct 25

WeWork India Management Limited

WeWork India Management Limited, launched in 2017, is a leading premium flexible workspace operator in India. According to CBRE, it has been the largest operator by revenue for the past three fiscal years. Recognised by AGR as a category-defining brand, it ranks among the top 10 operators per Everest Industry Report. As the exclusive WeWork brand licensee in India, it is majority owned by Embassy Group, which developed over 85 million square feet of real estate. Its model involves leasing, fitting out, and managing modern workspaces.

WeWork India Management Limited IPO Overview

The WeWork India Management Ltd. IPO is a book-built issue worth ₹3,000 crore, consisting entirely of an offer for sale of 4.63 crore shares. The IPO opens for subscription on October 3, 2025, and closes on October 7, 2025, with the allotment expected to be finalized on October 8, 2025. The shares are set to list on both the BSE and NSE, with a tentative listing date of October 10, 2025. The price band for the IPO is fixed between ₹615 and ₹648 per share. The minimum investment for retail investors is ₹14,904 for a lot size of 23 shares, based on the upper price band. For non-institutional investors (NII), the lot size is 14 lots (322 shares), amounting to ₹2,08,656, while qualified institutional buyers (QIB) have a lot size of 68 lots (1,564 shares), amounting to ₹10,13,472. JM Financial Ltd. is the book running lead manager for the issue, and MUFG Intime India Pvt. Ltd. serves as the registrar.

WeWork India Management Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): 4,62,96,296 shares (aggregating up to ₹3,000.00 Cr) |

| IPO Dates | 3 October 2025 to 7 October 2025 |

| Price Bands | ₹615 to ₹648 per share |

| Lot Size | 23 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 13,40,23,259 shares |

| Shareholding post -issue | 13,40,23,259 shares |

India Management IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 23 | ₹14,904 |

| Retail (Max) | 13 | 299 | ₹1,93,752 |

| S-HNI (Min) | 14 | 322 | ₹2,08,656 |

| S-HNI (Max) | 67 | 1,541 | ₹9,98,568 |

| B-HNI (Min) | 68 | 1,564 | ₹10,13,470 |

WeWork Indian Management Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

WeWork India Management Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 9.56 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 63.80% |

| Net Asset Value (NAV) | (34.55) |

| Return on Equity | 63.80% |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | 63.41% |

| PAT Margin | – |

| Debt to Equity Ratio | – |

Objectives of the IPO Proceeds

The entire proceeds from the Offer, after deducting the respective portion of Offer expenses and applicable taxes, will be allocated to the Selling Shareholders. The Company will not receive any funds from the Offer.

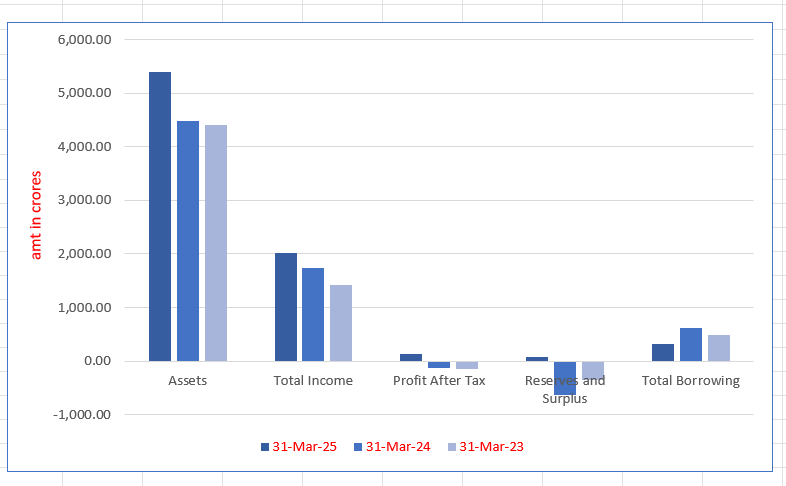

WeWork India Management Limited Financials (in crore)

| Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,391.67 | 4,482.76 | 4,414.02 |

| Total Income | 2,024.00 | 1,737.16 | 1,422.77 |

| Profit After Tax | 128.19 | -135.77 | -146.81 |

| Reserves and Surplus | 65.68 | -634.75 | -346.92 |

| Total Borrowing | 310.22 | 625.83 | 485.61 |

Financial Status of WeWork India Management Limited

SWOT Analysis of WeWork India Management IPO

Strength and Opportunities

- Strong brand recognition in India's flexible workspace sector.

- Exclusive licensee of the WeWork brand in India.

- Majority ownership by Embassy Group, a leading real estate developer.

- Diverse portfolio with 65 centres across 8 cities.

- Expertise in creating fully managed, tech-enabled workspaces.

- Ability to cater to a wide range of clients, from startups to large enterprises.

- Recognised as a category-defining, aspirational brand with a loyal customer base.

- Contribution to the evolution of flexible workspace products and services.

- Potential for growth in emerging markets and tier-2 cities.

Risks and Threats

- Exposure to cyclicality in the office leasing segment.

- High level of indebtedness impacting financial flexibility.

- Vulnerability to external factors affecting occupancy rates.

- Business model susceptible to replication by competitors.

- Financial instability due to overexpansion and high operational costs.

- Damaged company image from past controversies.

- Dependency on leasing agreements, leading to potential long-term liabilities.

- Susceptibility to market saturation in major urban centres.

- Fluctuations in real estate prices affecting operational costs.

WeWork India Management IPO Live News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About WeWork India Management Limited IPO

WeWork India Management Limited IPO Strengths

- Aspirational Brand with Strong International Recognition

WeWork India leads the flexible workspace sector with strong brand recognition, premium locations, and exceptional customer loyalty. Its high-end infrastructure, global appeal, and vibrant community drive its market dominance. While operating in India, WeWork Global’s reputation attracts international enterprises seeking seamless, high-quality office solutions in the country.

- Leadership in a Rapidly Growing Market

WeWork India is the leading premium flexible workspace operator, consistently dominating revenue rankings, according to CBRE. Its total income surged 70.05% in Fiscal 2023 and 22.10% in Fiscal 2024, with operational revenue and EBITDA significantly surpassing peers. India’s booming economy and rising demand for flexible workspaces further drive its growth.

- Strong Backing and Strategic Partnerships

WeWork India benefits from Embassy Group’s leadership in real estate, securing premium office spaces and tenant access. Its relationship with WeWork Global enhances its global reach, offering members seamless international workspace access. These strategic alliances strengthen its market position, operational efficiency, and financing capabilities.

- Strategic Presence in Premium Locations

WeWork India maintains a strong presence in Grade A properties across Tier 1 cities, leveraging relationships with top developers. With 93% of its portfolio in premium office spaces, it ensures high-quality work environments. Favourable lease terms, prime locations, and efficient asset management strengthen its market leadership.

- Comprehensive Workspace Solutions

WeWork India offers one of the most extensive ranges of flexible workspace solutions, including enterprise suites, managed offices, private offices, co-working spaces, and hybrid digital solutions. With flexible lease terms and seamless booking through the WeWork app, members can scale their spaces effortlessly, ensuring adaptability and convenience.

- Growing and Diverse Member Base

WeWork India’s member base has consistently expanded, reaching 73,762 members as of September 30, 2024. Our premium workspace solutions in Grade A buildings attract enterprises, MNCs, startups, and individuals. Strong client retention and upgrade trends reflect the value of our offerings, with enterprise clients contributing significantly to revenue.

- Strong Financial Performance and Operational Efficiency

WeWork India has demonstrated consistent financial growth, expanding operational desk capacity from 62,950 in March 2022 to 94,440 as of September 30, 2024, while maintaining high occupancy levels. Revenue from operations grew by 26.67% in Fiscal 2024, reaching ₹16,651.36 million. With a revenue-to-rent multiple of 2.7, exceeding industry standards, and optimised operational costs, we have strengthened our EBITDA margins and reduced break-even occupancy levels.

- Experienced Leadership Driving Growth and Innovation

Led by CEO & MD Karan Virwani, our experienced leadership team has shaped India’s workspace industry, earning accolades like the Times Business Award (2020) and ASSOCHAM MSME Excellence Award (2024). With strong governance and core values, we drive innovation, growth, and excellence in the flexible workspace sector.

More About WeWork India Management Limited

WeWork India Management Limited, launched in 2017, is a leading premium flexible workspace operator in India. According to the CBRE Report, it has been the largest operator by total revenue for the past three fiscals. Recognized as a category-defining and aspirational brand, it has significantly contributed to the growth and evolution of the flexible workspace sector in India. As the exclusive licensee of the WeWork brand in India, the company offers high-quality, flexible workspaces to a diverse customer base.

Workspace Solutions and Services

- Caters to large enterprises, small and mid-size businesses, startups, and individuals.

- Leases primarily Grade A office spaces, designing and operating them as per global standards.

- As of June 30, 2024, 93% (5.87 million sq. ft.) of its portfolio was in Grade A developments.

- Provides adaptable terms, allowing businesses to scale their workspace as needed.

Key Markets and Presence

- Operates in Bengaluru, Mumbai, Pune, Hyderabad, Gurgaon, Noida, Delhi, and Chennai.

- Bengaluru holds the largest presence, emerging as a major office market in Asia.

- As of September 30, 2024, the portfolio included 94,440 desks across 59 operational centres with a leasable area of 6.48 million sq. ft.

Comprehensive Offerings

- Provides managed offices, enterprise office suites, private offices, co-working spaces, and hybrid digital solutions.

- Value-added services include office customization, event spaces, advertising, F&B services, and workspace management solutions.

- Offers digital products such as WeWork On Demand, WeWork All Access, Virtual Office, and WeWork Workplace.

Customer Satisfaction and Ownership

- Enterprise members contributed 76.06% of net membership fees as of September 30, 2024.

- Achieved high NPS scores, improving from 61.0 in Fiscal 2022 to 74.1 in September 2024.

- Majority-owned by Embassy Group, India’s leading real estate developer with over 85 million sq. ft. of commercial real estate.

Industry Outlook

- Market Size and Growth: The Indian co-working space market was valued at approximately USD 0.71 billion in FY2024 and is projected to reach USD 1.96 billion by FY2032, growing at a Compound Annual Growth Rate (CAGR) of 13.47% during FY2025-FY2032.

- Future Growth Outlook: The demand for flexible workspaces is expected to rise, driven by the expansion of startups, especially in Tier-2 and Tier-3 cities, and the increasing adoption of hybrid work models by large enterprises.

- Key Growth Drivers:

- Startup Ecosystem Expansion: India’s booming startup sector, with over 80,000 recognized startups in 2022, is fueling the demand for cost-effective and flexible workspace solutions.

- Hybrid Work Models: Post-pandemic, companies are adopting hybrid work models, increasing the need for flexible workspace solutions.

- Technological Advancements: The integration of Artificial Intelligence (AI), Internet of Things (IoT), and automation enhances operational efficiency and user experience.

- Asset-Light Expansion: Operators are focusing on asset-light models, partnering with landlords through revenue-sharing agreements to expand without heavy capital investment.

The Indian co-working space industry is set for strong growth, supported by a thriving startup culture, shifting work trends, tech-driven enhancements, and innovative expansion strategies.

How Will WeWork India Management Limited Benefit

- Enhanced Market Leadership: With a CAGR of 13.47%, India’s co-working market expansion will strengthen WeWork India’s position as the top premium workspace provider.

- Rising Demand from Startups: India’s thriving startup ecosystem fuels the need for cost-effective office spaces, benefiting WeWork India’s extensive portfolio of flexible workspace solutions.

- Growing Hybrid Work Trends: The shift towards hybrid work models increases demand for flexible office solutions, reinforcing WeWork India’s growth in premium co-working spaces.

- Technological Advancements: AI, IoT, and automation in workspace management will enhance WeWork India’s efficiency, improving member experience and operational scalability.

- Strategic Partnerships: Backed by Embassy Group and WeWork Global, WeWork India secures premium locations and international enterprise clientele, ensuring continued expansion.

- Premium Location Advantage: With 93% of its portfolio in Grade A properties, WeWork India attracts top-tier businesses seeking high-quality work environments.

- Strong Financial Performance: Rising revenue, high occupancy levels, and optimized costs improve WeWork India’s profitability, making it a financially resilient market leader.

- Experienced Leadership: Under Karan Virwani’s leadership, WeWork India drives industry innovation, operational excellence, and strategic expansion in India’s evolving workspace sector.

WeWork India Management Limited IPO Overview

WeWork India Management Ltd has filed draft papers with SEBI for an initial public offering (IPO). The Embassy Group-backed IPO is entirely an Offer for Sale (OFS) of up to 4.37 crore equity shares. Promoter Embassy Buildcon LLP and investor 1 Ariel Way Tenant Ltd will offload shares, with no proceeds going to the company. The objective is to list equity shares on stock exchanges. This book-built issue includes 4.37 crore equity shares, with proceeds benefiting the selling shareholders.

WeWork India Management Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): 4.37 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

WeWork India Management IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | TBA |

| IPO Close Date | TBA |

| Basis of Allotment Date | TBA |

| Refunds Initiation | TBA |

| Credit of Shares to Demat | TBA |

| IPO Listing Date | TBA |

WeWork India Management IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

WeWork India Management Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (10.73) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | – |

| Net Asset Value (NAV) | (34.55) |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | 54.05% |

| EBITDA Margin | 27.07% |

| PAT Margin | – |

| Debt to Equity Ratio | -1.41 |

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue from Operations

(₹ million) |

EPS (₹) | P/E | RoNW (%) | NAV (₹) |

| WeWork India Management Limited | 10 | 16,651.36 | (10.73) | [●] | NA | (34.55) |

| Peer Group | ||||||

| Awfis Space Solutions Limited | 10 | 8,488.19 | (2.79) | NA | (6.99%) | 39.87 |

Key Insights

- Revenue: WeWork India reported revenue from operations of ₹16,651.36 million, nearly double that of Awfis Space Solutions Limited, which recorded ₹8,488.19 million. This indicates a larger scale of operations, suggesting a stronger market presence.

- Earnings Per Share (EPS): The EPS for our company stands at ₹(10.73), significantly lower than Awfis Space Solutions Limited’s ₹(2.79). A negative EPS indicates that both companies are incurring losses, but WeWork India’s losses per share are much higher. This suggests weaker profitability or higher costs relative to earnings, potentially impacting investor confidence.

- Price-to-Earnings (P/E): The P/E ratio for the company has not been provided, while Awfis Space Solutions Limited has no P/E due to negative earnings. The absence of a P/E ratio indicates that neither company is currently profitable, making valuation challenging. Investors typically consider P/E ratios when companies generate positive earnings, offering insights into market expectations.

- Return on Net Worth (RoNW): WeWork India’sRoNW is not available, while Awfis Space Solutions Limited has an RoNW of (6.99%). A negative RoNW implies that shareholders are experiencing a decline in their equity value due to sustained losses. WeWork India’s significantly lower net worth suggests that its RoNW could be even worse, highlighting financial instability.

- Net Asset Value (NAV): WeWork India’s NAV per equity share is ₹(34.55), compared to Awfis Space Solutions Limited’s ₹39.87. A negative NAV indicates that liabilities exceed assets, putting our company in a riskier financial position. In contrast, Awfis Space Solutions Limited maintains a positive NAV, suggesting better financial stability despite losses.

Objectives of the IPO Proceeds

The entire proceeds from the Offer, after deducting the respective portion of Offer expenses and applicable taxes, will be allocated to the Selling Shareholders. The Company will not receive any funds from the Offer.

WeWork India Management Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 50,683.54 | 44,827.61 | 44,140.17 | 39,723.06 |

| Revenue | 9181.86 | 16,651.36 | 13,145.18 | 7844.35 |

| Profit After Tax | 1745.72 | (1357.73) | (1468.10) | (6429.98) |

| Reserves and Surplus | (4571.82) | (6347.53) | (3469.17) | (2095.39) |

| Total Borrowings | 7975.01 | 6169.07 | 4811.16 | 2919.74 |

| Total Liabilities | 53,281.23 | 49,204.06 | 47,063.86 | 41,270.39 |

Key Strategies for WeWork India Management Limited

- Strengthening Presence in Key Markets

WeWork India Management Limited aims to deepen its presence in existing cities and expand into high-demand micro-markets for flexible workspace solutions. Expansion decisions are data-driven, considering member demand, office infrastructure, and demographics. Strong relationships with institutional landlords facilitate access to lucrative opportunities. This clustering strategy enhances brand visibility, economies of scale, and revenue growth while positioning the company to explore new markets based on demand trends.

- Enhancing Unit Economics and Operational Efficiency

WeWork India Management Limited continues to refine unit economics by maintaining premium pricing, optimizing cost structures, and achieving economies of scale. Mature Centres achieve breakeven at approximately 54.40% occupancy, typically within four to six months. By strengthening relationships with Large Enterprise Members and implementing targeted retention strategies, the company enhances renewal rates, reduces customer acquisition costs, and sustains profitability. Internal cash accruals are expected to fund future growth without additional borrowings.

- Driving Revenue Diversification Through Innovation

WeWork India Management Limited prioritizes product innovation and digital advancements to expand revenue streams. The company enhances its core offerings, introduces premium and budget-friendly options, and strengthens its value-added services, such as meeting rooms, catering, and workspace access across locations. A key focus is on attracting Global Capability Centre (GCC) customers, leveraging its managed office model to provide customized, scalable workspaces with advanced infrastructure tailored to large enterprises.

- Leveraging Data and Technology for Expansion

WeWork India Management Limited adopts a data-driven and technology-led approach to expansion and margin improvement. Proprietary tools and analytics platforms, such as REScout for site selection and Spatial Analytics for space optimization, enable efficient decision-making. This strategy has contributed to improved desk density and reduced capital expenditure per desk. With advanced workflow automation, the company aims to enhance operational efficiencies, maximize EBITDA margins, and scale effectively across markets.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the size of the WeWork India IPO?

The IPO comprises an offer for sale of up to 43.75 million equity shares by existing shareholders.

Who are the selling shareholders in the IPO?

The selling shareholders include Embassy Group, offering 33 million shares, and 1 Ariel Way Tenant, offering 10.3 million shares.

Will WeWork India receive any proceeds from the IPO?

No, the company will not receive any proceeds, as the IPO is entirely an offer for sale by existing shareholders.

What is the expected valuation of WeWork India through this IPO?

Reports suggest a potential valuation between $2 billion and $2.5 billion.

When was the Draft Red Herring Prospectus (DRHP) for the IPO filed?

WeWork India filed its DRHP with the Securities and Exchange Board of India (SEBI) on January 31, 2025.