- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What are Blue Chip Stocks

By Shishta Dutta | Updated at: May 9, 2025 01:21 PM IST

Did you know that, according to data published in January 2024, there are over 5,000 listed companies on the Bombay Stock Exchange (BSE)? Selecting the safest investments in the market can be overwhelming for you.

If you want to invest in safe and consistently growing companies, consider Blue Chip Stocks. They are known for their stability and are a good choice for conservative investors. In this blog, we will discuss Blue Chip Stocks, their features, and reasons to invest in them.

What are Blue Chip Stocks?

Blue-chip stocks refer to shares of well-established and financially stable companies with a good track record. These companies are industry leaders and offer financial stability. Many investors invest in these big companies because of their stable stock prices and regular dividends. There are many blue-chip stocks on the NSE.

You may wonder where the name ‘Blue Chip’ comes from. Blue chips refer to the chips of poker, where blue-coloured chips hold the highest value. Later, the term was used in stocks to refer to financially stable and large companies in the stock market.

Features of Blue Chip Stocks

To understand the functionality of blue chip stocks, let’s have a look at their features:

-

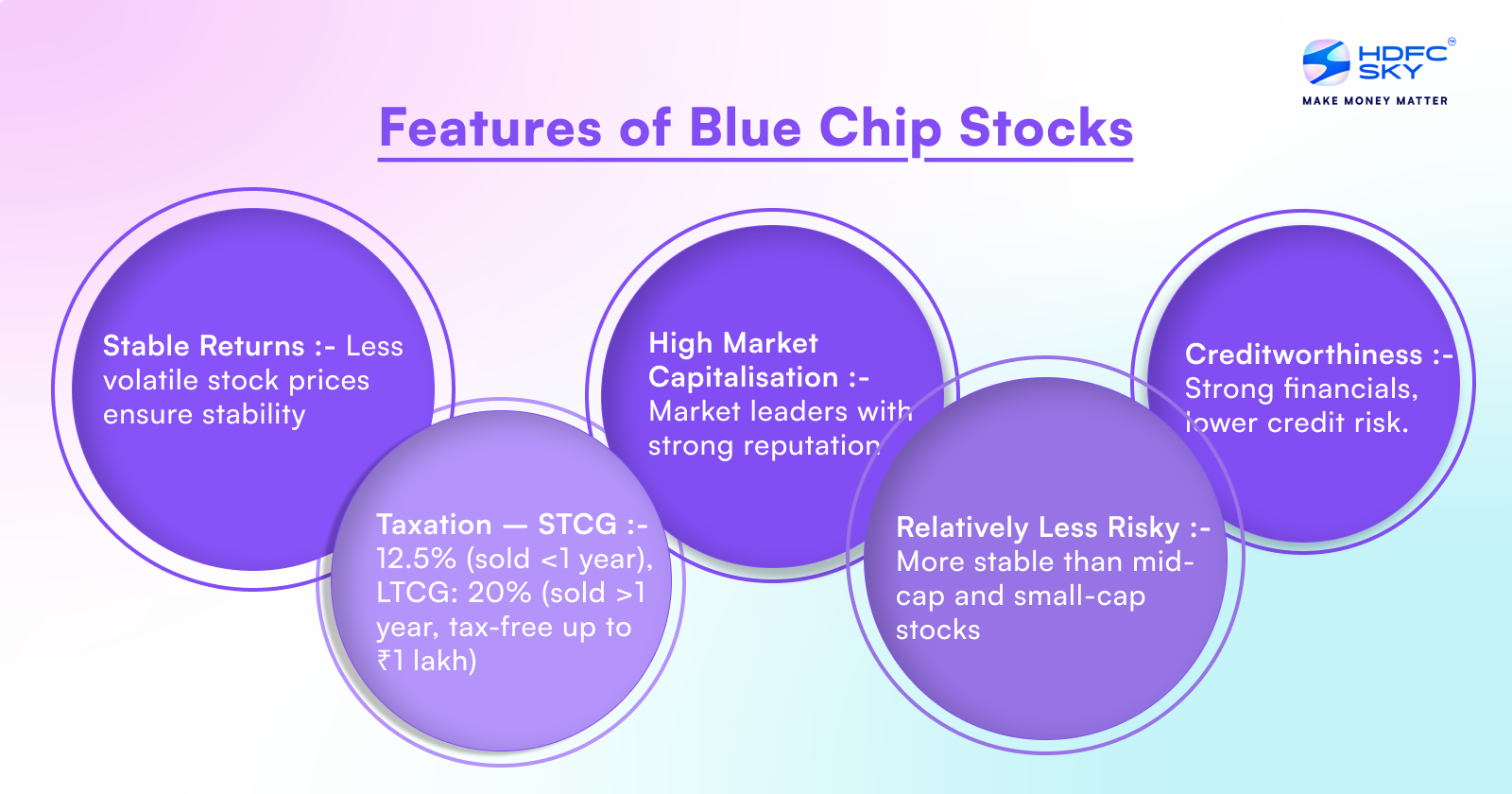

Stable Returns

One reason investors prefer investing in blue chip stock companies is their more stable stock price. Because these are stocks of reputed companies, their stock prices tend to be less volatile.

-

Taxation

The gains from returns and dividends of blue chip stocks attract taxes just like other stocks. Any gains from the dividends are added to your yearly income and are taxed as per your income tax slab. On the other hand, gains from stock price appreciation attract long-term and short-term capital gain taxes.

Short-term capital gain (STCG) of 12.5% is applicable if you sell your investments in less than a year, and a Long-term capital gain (LTCG) of 20% is applicable if you sell your investments after a year; LTCG is tax exempted up to Rs. 1 lakh. It is important to note that STCG and LTCG are applicable if you sell your investments in profits. -

High Market Capitalisation

Large Cap blue chip stocks have a larger market capitalisation and are typically market leaders in their industry, which increases the reputation of the stock.

-

Credit Worthiness

Large companies have solid financials and can clear their dues smoothly, thereby reducing their credit risk.

-

Less Risky

Investing in blue-chip equities are less risky than mid-cap and small-cap companies to invest in because of their stable financials and market value.

Advantages of Investing in Blue Chip Stocks in India

Some of the advantages of blue chip stocks are as follows:

-

Bluechip investments are Liquid

These companies have strong reputations in the market and more stable stock prices because they are liquid, and buyers and sellers are always available for blue chip stocks. If you wish to exit, you can sell your stocks anytime in the market hours.

-

Portfolio Diversification

Legendary investor Mr. Warren Buffet once said, ‘Never put all your eggs in one basket.’ That means you must invest in different categories of stocks and assets to diversify your portfolio well. Diversification acts as a shield in cases of volatile market conditions. If one sector does not perform well, it can be covered with another sector/ investment.

-

Regular Dividends

Many Blue-chip companies are known to provide regular dividends on their investments. Typically, these companies offer dividends even in volatile market conditions. Dividends are a kind of extra profit distributed to shareholders every quarter.

Disadvantages of Investing in Blue Chip Stocks

Apart from all the advantages it offers, even the best bluechip stocks may have these disadvantages:

-

Slow Growth Rate

Blue-chip companies are already well established and may have grown in the past. Though they are more stable, when you invest in blue-chip stocks, their stock prices tend to grow slower than mid-cap and small-cap stocks. Hence, it is not ideal for aggressive investors looking for higher returns.

-

Higher Valuations

Blue-chip shares tend to be more reliable. Because of this, they tend to trade at more expensive valuations, which may sometimes make them overvalued.

-

Industry Disruptions

Blue-chip companies may face the threat of new players entering the market with the latest trends or if there is a change in market dynamics. For example, the growth of EVs is disrupting the automobile industry, and companies are forced to shift towards EVs slowly and with innovation.

-

International Exposure

Many blue-chip companies have a presence in foreign countries, which can portray a strong company image. However, fluctuations in currencies and changing geopolitics can impact the stock price.

Conclusion

Investing in blue-chip stocks can be a wise choice to diversify your investment portfolio and have a balanced chunk invested in them, as they offer stability and dividends. However, relying heavily even on top blue-chip stocks in India can impact your portfolio in case of changes in the market and limit your returns. Always do thorough research and consult a financial advisor if required. Happy Investing!

Upgrade your investing experience with HDFC Sky and open your free trading & demat account today.

Related Articles

FAQs

How do you find blue chip stocks?

Blue-chip stocks are shares of large and established corporations. They have large market capitalisations, are listed on all major stock exchanges, and have a good track record of regular dividend payments.

What makes a company blue chip?

You can consider various factors such as they have consistent annual revenue growth, a stable debt-to-equity ratio, a strong interest cover ratio and a decent price-to-earnings (PE) ratio.