- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What Are Equities In The Stock Market

By Shishta Dutta | Updated at: Apr 24, 2025 02:32 PM IST

Did you know you can own a part of the country’s biggest companies and earn profits as they grow? This can be done by investing in equities of the companies listed on the stock exchanges.

In this blog, we will discuss equities how they work, their types, and the advantages and disadvantages of investing in them Let’s get understanding equities.

What is Equity in Share Market

Equity and share refer to a part of the company you own when you invest in shares of the companies via the stock market.

When you invest in a company’s shares, you become a fractional company owner known as ‘a shareholder. As a result, you get benefits as the company earns more profits, which can be reflected in the stock price, and large companies also give regular dividends to their shareholders. The dividend that you get is in proportion to your share of the company.

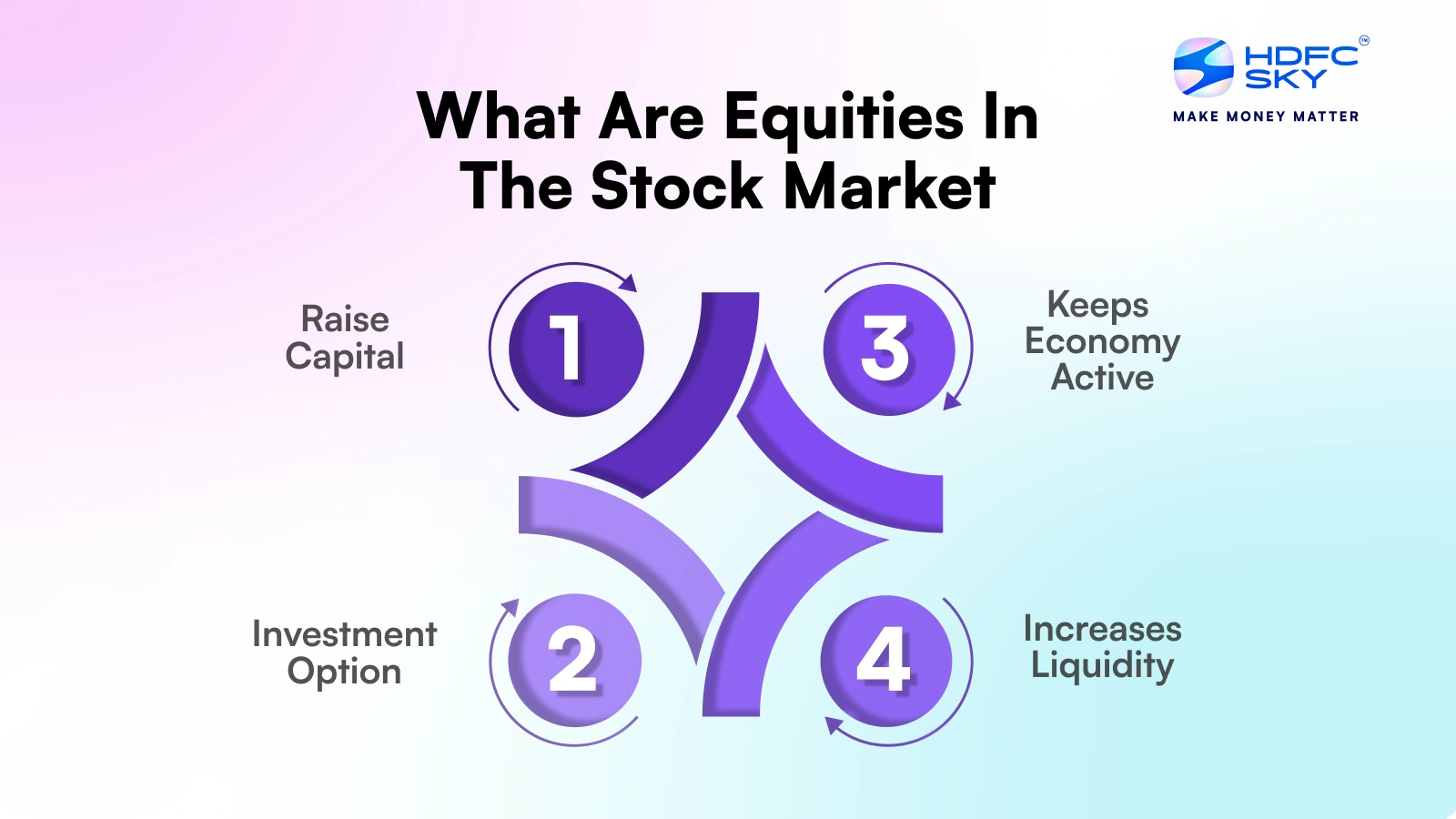

How Do Equity Markets Work

Equity markets are places where companies trade stocks and shares. In India, there are two prominent stock exchanges, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), where equities or stocks are traded.

To simply break it down, companies need cash flow to grow, and listing their shares in the stock market allows them to raise capital from the public in exchange for fractional ownership of the company.

Moreover, once the company is listed on a stock exchange, it increases its reputation, ultimately attracting more partners and investors who bring capital to the company.

When a company goes public for the first time, it undergoes a process known as an Initial Public Offering (IPO) to list its shares.

Once a company is listed, its shares are displayed in the stock market, and investors can buy and sell them. A broker is present to complete this transaction.

The price of the shares of the listed companies then fluctuates depending on the demand and supply of their shares. Many other factors impact the price, such as market conditions, investor sentiments, geopolitical issues, industry performance, etc.

Types of Equity

-

Common Stock

This refers to the shares issued by companies to the shareholders, which represent ownership in the company. Shareholders are allowed to claim the assets of the company by their percentage in case a company dissolves, and common shareholders also have voting rights in the company

-

Preferred Stocks

Preferred shareholders get preference when the company distributes dividends, and they get guaranteed dividends, but they do not have voting rights.

-

Bonus Shares

The company offers bonus shares when it issues extra shares to shareholders from retained earnings. In this way, the company distributes its profits among shareholders by issuing bonus shares instead of dividends.

-

Rights Share

Right shares are issued by the company to the existing shareholders. They are issued when the company gives rights to its existing shareholders to invest in new shares based on their previous holdings, at a discounted rate.

-

Sweat Equity

Sweat equity shares are issued by the company to directors and employees. Typically, senior-level employees are offered these shares, sometimes at a discount.

-

Employee Stock Options (ESOPs)

It is a type of incentive companies offer their employees and acts as a retention strategy to retain high-performing employees. ESOPs may have the option to purchase shares at a fixed price in future despite the company’s valuation change.

Features of Equity

Here are some of the features of equity shares:

-

Voting Rights

Owners of common shares carry voting rights.

-

Dividends

The company distributes its extra profits to its shareholders. The company has the option to distribute dividends to the shareholders or to reinvest the profits into the business.

-

Returns

Equity shares generate returns in two forms: dividends and stock price appreciation. As the company grows over the years, the stock price appreciates. At the same time, the stock price depends on several factors, such as demand and supply, investor sentiment, geopolitics, industry performance, and the company’s growth.

-

Liquidity

Listed shares usually have high liquidity. You can buy or sell shares during the trading hours of the stock market. However, companies that face issues with their management or operational challenges may face liquidity issues because there may be fewer buyers available for such companies’ shares.

-

Limited Liability

The shareholders of a company are not liable for the company’s liabilities. However, if a company has financial issues, they can be reflected in the stock prices.

Benefits of Investing in Equity Share

The following are the benefits of investing in equity shares:

-

Higher Returns

Investing in equity may give you higher returns than many other investment options. But at the same time, it involves higher risk. Stock prices may fluctuate according to market conditions.

-

Diversification

If you invest in debt instruments and other fixed-income securities, investing in equity shares can be a great way to diversify your portfolio. Equities may have higher growth potential, which can grow your portfolio.

-

Hedge Against Inflation

Higher returns given by some stocks may act as a hedge against inflation.

-

Invest in Companies

When you invest in equities, you become a part owner of the company, allowing you to benefit from the growth and operations of these companies.

-

Easy to Invest

Investing in equities is easy. Open a demat account online with a reliable broker, like HDFC Securities, and you can start investing in shares of companies from your mobile phone.

Disadvantages of Investing in Equities

-

Market Risk

Investing in equities always involves market risk & unique risks. Prices of shares may fluctuate because of market wide factors. They may also vary because of risks unique to the stocks.

-

Economic Changes

Performances of many companies and businesses vary with changes in economic cycle. Or they may be affected by broader economic changes. The performance of their stocks may also vary accordingly.

-

Company’s Performance

The value of the share of a company highly depends on the company’s performance. If the company cannot grow or generate high profits, the share price can be highly volatile.

-

Uninformed decision-making

Many people tend to make uninformed investment decisions when it comes to stocks. This increases the risk of their investments. Informed decisions should be made with respect to stocks.

Conclusion

Investing in equities can be lucrative if you follow the correct approach, are disciplined in investing for the long term, and understand everything properly before investing. Happy Investing!

HDFC Sky is the smarter route to wealth creation. Open your demat and trading account today with zero account opening fees.

Related Articles

FAQs

How do equities work?

When you buy equity or stock in a company, you buy ownership in that company.

How do you invest in stocks?

You need to open a demat & trading account with a broker, add funds to your account and invest in stocks of your choice to start investing.