- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What are International ETFs? Popular International ETF Options for Indian Investors

By Shishta Dutta | Updated at: Jun 2, 2025 02:24 PM IST

International ETFs are focused on stocks and assets from markets outside of India. These ETFs allow the Indian investor to diversify their portfolio beyond the Indian market. It also allows them to spread risk and investment across countries, currencies, and economies. So, international ETFs help mitigate the risks associated with a country’s economic performance.

With international ETFs, investors can access sectors and industries that are not heavily represented in the Indian market. This also helps maximise potential returns. After all, different countries and regions might experience economic cycles differently. With international ETFs and diversification, traders can benefit from growth opportunities from different corners of the world.

So, let’s examine the key factors to consider when evaluating international ETFs, the popular global ETFs available to Indian investors, and their long-term value.

Key Factors to Evaluate in International ETFs

International Exchange Traded Funds (or ETFs) have several benefits. But traders must assess them based on their investment goals and risk profiles. Here are a few things that you must consider before investing in international ETFs.

- Regional Focus: Different global ETFs have distinct regional focuses. Some might target specific markets like Europe or Asia, whereas others might provide broad exposure across multiple regions.

Decide whether you want to focus on developed or emerging markets to select the right ETF for you.

- Currency Diversification: You gain access to foreign currencies when you invest internationally. This might or might not work in your favour based on currency movements. Currency diversification can act as a hedge during periods of domestic currency depreciation. However, if the foreign currency weakens against the Indian Rupee, it could erode your returns.

So, you must understand currency movements, their impact on your returns, and whether the ETF hedges against these risks.

- Expense Ratios and Liquidity – Low-cost international ETFs with competitive expense ratios help maximise returns. Additionally, ensuring the fund has sufficient liquidity is necessary to trade properly. High liquidity means you can quickly enter or exit positions without high transaction costs.

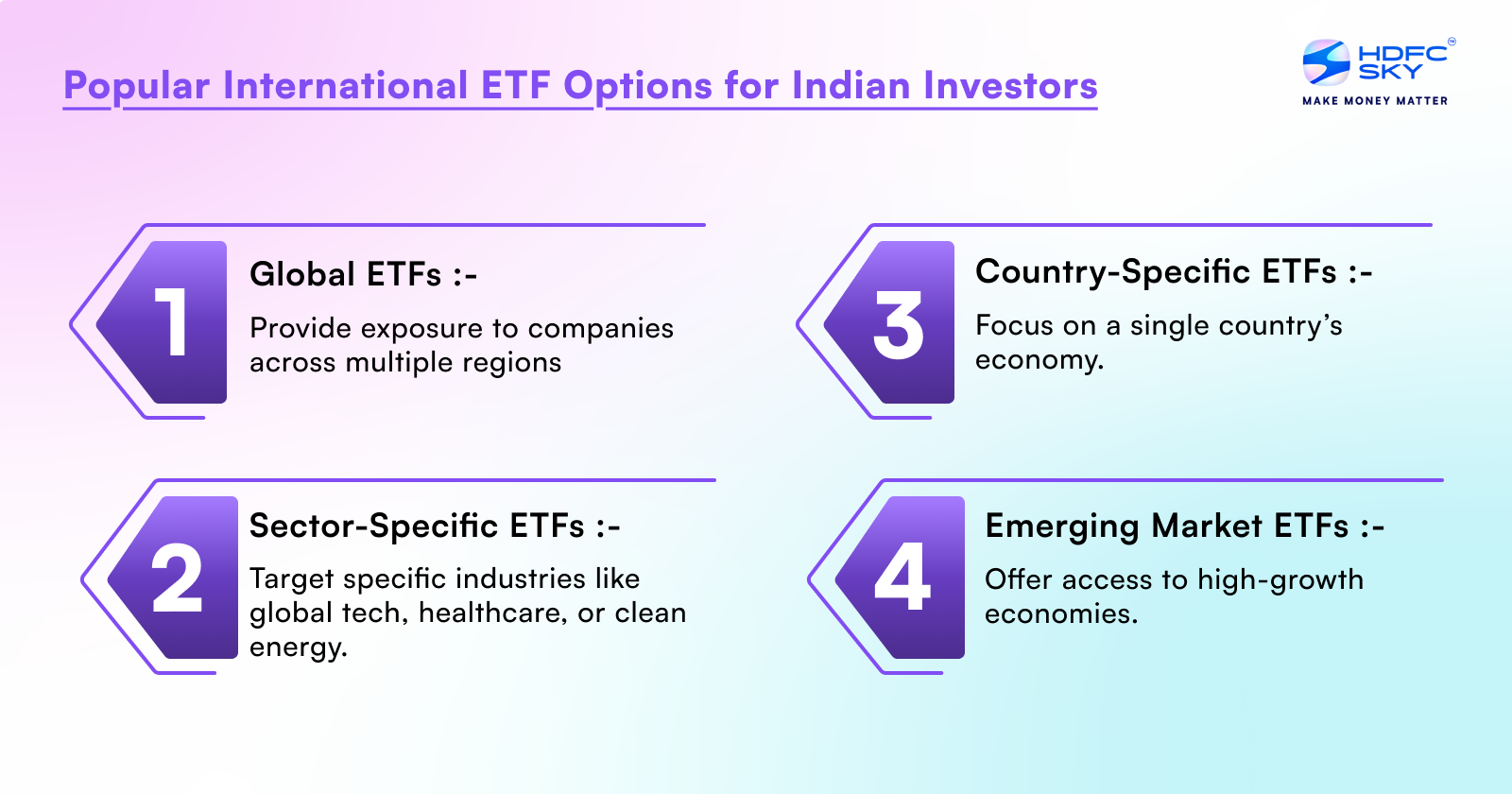

Popular International ETF Options for Indian Investors

A few types of international ETFs that Indian investors frequently consider are:-

- Global ETFs: These funds provide exposure to companies worldwide, from the US to Europe and Asia. Global equity markets ETFs are great for investors looking to capture worldwide growth without concentrating their investments in one region.

- Country-Specific ETFs: For those who want targeted exposure to a particular economy, country-specific ETFs can be a great choice. For example, US-based international ETFs allow traders to invest in top US companies like Amazon, Apple, and Tesla.

- Emerging Market ETFs: These foreign ETFs offer exposure to high-growth economies like China, South Korea, and Brazil. These markets tend to have higher volatility but also provide opportunities for significant growth, especially for long-term investors.

- Sector-Specific International ETFs: Some investors prefer focusing on specific industries, such as global tech, healthcare, or clean energy. These funds allow traders to target industries that might be underrepresented in India but thriving globally.

Long Term Value of International ETFs

Over the long term, international ETFs can play a critical role in reducing the overall risk of your portfolio while allowing you to tap into growth opportunities in foreign markets. The key is to remain diversified across multiple regions and sectors. This ensures you are not overly exposed to a single market or currency.

Diversifying through international ETFs also allows you to take advantage of innovative sectors, such as artificial intelligence, biotechnology, and renewable energy, which might not have as much presence in India. These areas are set to experience significant growth in the coming years, and gaining exposure through international exchange-traded funds can position your portfolio for long-term success.

Conclusion

Investing in international ETFs opens the door to a global marketplace, allowing you to diversify across countries, sectors, and currencies. Whether you want to gain exposure to high-growth emerging markets or stable developed economies, international stock ETFs can provide the balance and potential returns crucial for any modern investment strategy. Keep in mind the risks, such as currency fluctuations and market volatility, but with careful research, these funds can be a valuable addition to your portfolio.

Related Articles

FAQs on What are International ETFs?

How do International ETFs provide global diversification?

International ETFs provide access to global equity markets, allowing investors to diversify across countries, industries, and currencies. Investing in international exchange-traded funds reduces reliance on a single economy, spreading risk and capturing growth from various regions worldwide.

What are the benefits of investing in International ETFs?

International ETFs provide exposure to global markets, offering diversification, access to sectors not well-represented in India, and the potential for enhanced returns. They allow Indian investors to benefit from economic cycles in other countries, reducing the risk associated with domestic market fluctuations.

What risks should I consider when investing in International ETFs?

Investing in International ETFs carries risks such as market volatility in foreign countries, geopolitical instability, and fluctuations in global interest rates. Additionally, currency risk and differences in regulatory environments can impact returns, making it important to assess the region and sectors before investing.

How does currency exchange affect my investment in International ETFs?

Currency exchange rates can significantly impact returns from International ETFs. If the foreign currency weakens against the Indian Rupee, your returns may decrease. Some international exchange-traded funds hedge against currency fluctuations, while others don’t, so choose based on your risk tolerance.