- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What are Inverse ETFs?

By HDFC SKY | Updated at: Jul 24, 2025 05:47 PM IST

- Inverse ETFs Definition: Inverse ETFs are specialized funds designed to deliver the opposite returns of a specific index or benchmark, allowing investors to profit from market declines.

- Mechanism: These ETFs achieve inverse returns using derivatives like futures and options. For instance, if the tracked index falls by 1%, an inverse ETF targeting it may rise by approximately 1%.

- Trading Like Stocks: Inverse ETFs can be bought and sold like regular stocks on exchanges, offering flexibility and real-time price tracking.

- Short-Term Investment Tool: Due to daily rebalancing and compounding effects, inverse ETFs are ideal for short-term strategies rather than long-term holding.

- Risks Involved: They carry significant risk, especially in volatile or trending markets, and may underperform over longer periods even if the market declines.

- Use Cases: Typically used for hedging existing positions or speculating on downturns in sectors or indices.

- Example Mentioned: Motilal Oswal Nifty 50 ETF is cited to explain how inverse ETFs work in India.

In a volatile market environment, investors constantly seek ways to protect and grow their wealth in all market conditions. While traditional investments make money when markets rise, inverse ETFs offer a unique opportunity to profit when markets decline.

When market headlines turn negative or economic indicators signal potential downturns, inverse ETFs become particularly relevant as they turn market declines into potential gains. This makes them valuable tools for both hedging existing investments and capitalising on market corrections.

Understanding these investment tools opens new possibilities for portfolio protection and profit potential in bearish markets.

What is an Inverse ETF?

Inverse ETFs meaning refers to Exchange Traded Fund (ETF) which make money when markets fall instead of regular ETFs which profit from the rise in markets. They are mirror images of regular market movements. When an index drops 1%, an inverse ETF tracking that index aims to rise 1%. An inverse ETF tracks an index, which when falls by 1%, the inverse ETF increases by around 1%. These funds use special financial tools called derivatives, including futures contracts and options, to create these opposite returns.

How Do Inverse ETFs Work?

Inverse ETFs rely on complex financial instruments to deliver returns that are opposite to those of their target index. They typically invest in daily futures contracts, which are agreements to buy or sell assets at set prices in the future. Fund managers actively adjust these positions each day to maintain the inverse relationship.

For example, if the NIFTY 50 falls 2% in a trading day, an inverse NIFTY ETF aims to gain 2%. This daily adjustment makes inverse ETFs better suited for short-term trading rather than long-term holding, as compound effects can impact returns over time.

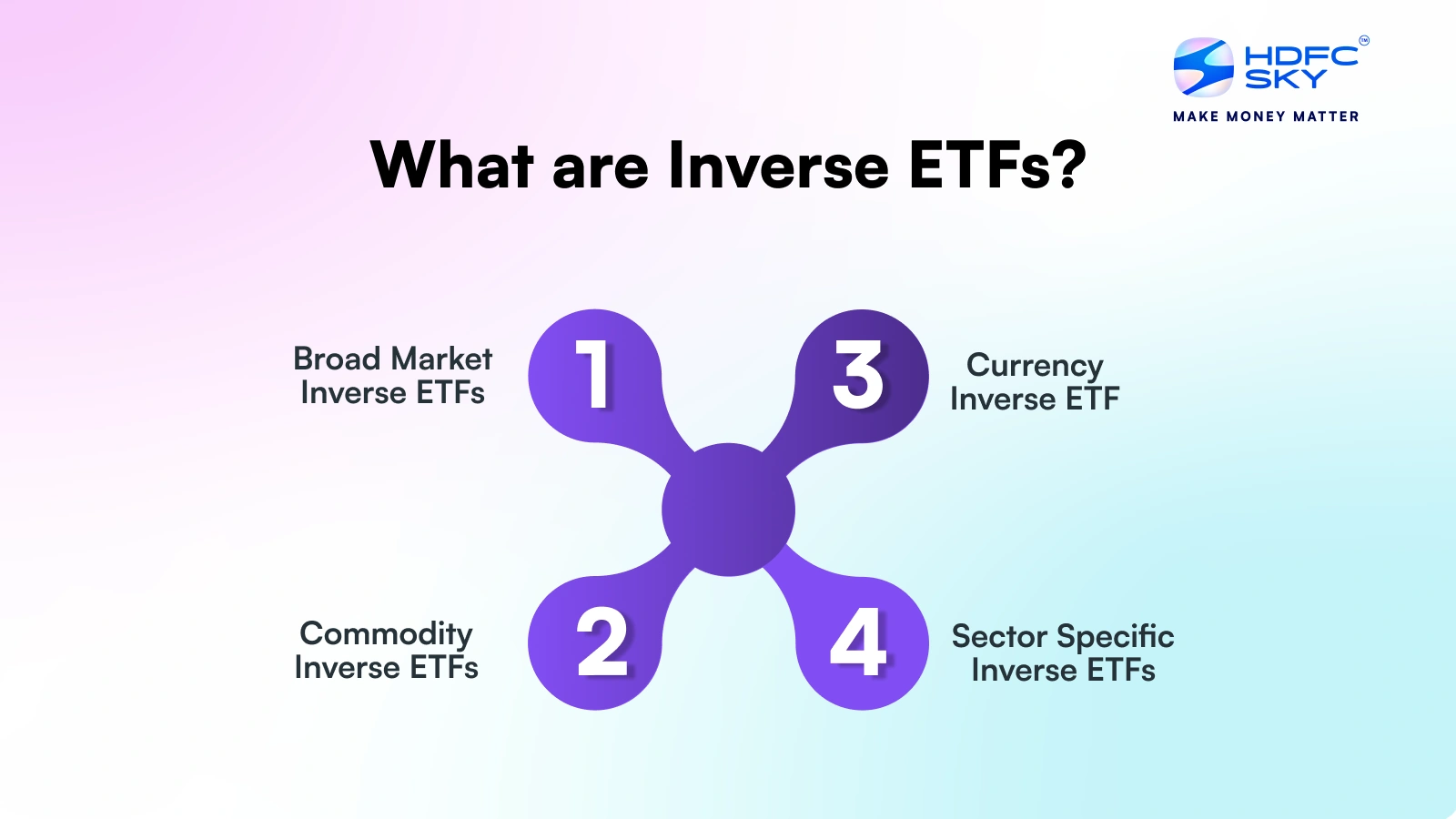

Types of Inverse ETFs

Market players can choose from several types of inverse ETFs:

- Broad Market Inverse ETFs: These funds track major market indices in reverse, such as the NIFTY 50 or Sensex. When these broad market indicators fall, these ETFs rise proportionally. They provide the widest market coverage and often show the highest trading volumes, making them suitable for large-scale hedging of portfolios.

- Sector Specific Inverse ETFs: These ETFs target particular industries, such as technology, banking, or healthcare. They become especially valuable when these sectors face challenges. For instance, financial inverse ETFs might offer protection or profit opportunities during banking sector stress.

- Commodity Inverse ETFs: These inverse ETFs move opposite to commodity prices such as gold, oil, or agricultural products. They help investors manage commodity exposure or bet against commodity price increases during inflationary periods.

- Currency Inverse ETFs: These ETFs trade against specific currency movements, helping investors hedge currency risks or profit from anticipated currency weaknesses in global markets.

What are Leveraged Inverse ETFs?

Leveraged inverse ETFs are designed to amplify the opposite movement of their target index, utilising financial derivatives to achieve this goal. A 2x leveraged inverse ETF, for example, aims to move twice as much in the inverse direction, meaning a 1% drop in the index could result in a 2% gain for the ETF.

Some ETFs even offer 3x leverage, significantly increasing potential gains but also substantially escalating risk and potential losses. These ETFs are designed for daily performance tracking, with a daily reset that impacts long-term holdings.

This daily reset, combined with leverage, introduces significant risks, including increased volatility and the potential for compounding losses, known as volatility decay. Consequently, leveraged inverse ETFs are generally considered unsuitable for long-term investments and are better suited for short-term tactical trades or hedging strategies.

Advantages & Disadvantages of Inverse ETFs

Inverse ETFs provide easy access to shorting markets without complex trading accounts. But these funds come with significant risks:

Advantages of Inverse ETFs

- Allows investors to profit from a market decline without short selling.

- Provides a hedging strategy for protecting portfolios against falling prices.

- Easier to trade compared to short selling, as it does not require a margin account.

- Available for various market indices and sectors, offering flexibility.

- Lower cost than traditional short selling, as borrowing fees are not required.

Disadvantages of Inverse ETFs

- Can lead to quick losses if the market moves in the opposite direction.

- Not suitable for long-term investments due to daily rebalancing and compounding effects.

- Higher management fees compared to traditional ETFs.

- Requires precise market timing, as losses can accumulate rapidly.

- Can diverge from actual inverse performance over longer holding periods.

When You Can Buy an Inverse ETF?

Timing plays a critical role in inverse ETF investing. These instruments work best as short-term tactical tools rather than long-term holdings. Market experience and careful analysis become essential for successful inverse ETF trading.

The most effective use comes when protecting existing investments during anticipated market declines. For instance, investors holding significant technology sector positions might consider inverse ETFs before major industry events or economic announcements that could impact tech stocks negatively.

Although you must keep in mind that, using inverse ETFs requires advanced market knowledge. Successful implementation depends primarily on precise entry and exit timing. Correct market direction predictions might not guarantee profits due to daily rebalancing effects and market volatility.

These are the key factors you must keep in mind when using inverse ETFs:

- Market conditions showing clear downward trends

- Specific events that might trigger market declines

- Portfolio protection needs during uncertain periods

- Short-term trading windows, typically days rather than weeks

- Clear exit strategies before entering positions

Remember that inverse ETFs serve better as tactical tools rather than strategic investments. Their complexity demands thorough research and careful position sizing to manage risks effectively.

Inverse ETFs vs Short Selling

Short selling involves borrowing shares to sell high and buy back low, with unlimited potential losses. Inverse ETFs on the other hand limit losses to your investment amount and don’t require margin accounts or borrowed shares. However, short selling offers precise timing control and avoids daily compounding effects.

| Feature | Inverse ETFs | Short Selling |

| Maximum Loss | Limited to the investment amount | Potentially unlimited |

| Account Requirements | Standard trading account | Margin account needed |

| Costs | Management fees and trading costs | Borrowing costs and margin interest |

| Time Horizon | Best Better suited for short-term trades | Flexible holding periods |

| Complexity | Simpler execution | More complex process |

| Control | Less control over the timing | More precise entry/exit control |

| Margin Calls | No margin calls | Possible margin calls |

| Corporate Actions | Handled by the fund manager | Investor responsibility |

| Dividend Treatment | Built into ETF price | Must pay dividends on borrowed shares |

| Market Access | Instant exposure to sectors | Limited by stock availability |

Are Inverse ETFs Allowed in India?

Currently, SEBI hasn’t approved inverse ETFs for trading in India. For those wondering where to buy inverse ETFs, international platforms offer access, though this requires understanding additional regulations. Many Indian investors ask how to invest in inverse ETFs – while direct access isn’t available domestically, alternative strategies like put options provide similar benefits.

Conclusion

Inverse ETFs offer a way to potentially profit from market declines, but they demand careful consideration. They are best used as short-term trading tools rather than long-term investments.

Understanding their daily rebalancing, higher costs, and timing requirements proves essential for success. While not available in India yet, knowing how they work helps investors prepare for possible future opportunities.

Related Articles

FAQs on What are Inverse ETFs?

How Are Inverse ETFs Different from Traditional ETFs?

While traditional ETFs aim to match market performance, inverse ETFs move in the opposite direction using derivatives. When markets fall 1%, inverse ETFs try to rise 1%. Traditional ETFs hold actual stocks or bonds, but inverse ETFs use futures and options for reverse returns.

Who Should Invest in Inverse ETFs?

Inverse ETF trading suits experienced investors who understand market trends and can handle higher risks. They’re best for active traders seeking short-term market protection or those implementing specific hedging strategies.

What are the risks of inverse ETFs?

The main inverse ETF risks include daily rebalancing effects, which can erode long-term returns. Market timing becomes crucial, and leveraged inverse ETFs multiply potential losses. Additional risks include higher management fees, tracking errors, and the complexity of derivatives trading.

Can you hold inverse ETF long-term?

Long-term holding of inverse ETFs isn’t usually recommended due to daily rebalancing and compound effects. These products work best for short-term trading, typically days rather than months. Extended holding periods often result in performance that doesn’t match the opposite of market returns.

Do Inverse ETFs Pay Dividends?

Unlike traditional ETFs, inverse ETFs rarely pay regular dividends. Any returns come primarily from price movements opposite to the tracked index. The derivative contracts used in retail inverse ETFs focus on capital appreciation rather than income generation.

Can an inverse ETF go to zero?

While inverse ETFs can lose significant value, and theoretically they can go to zero, but they rarely go to zero unless the market rises dramatically. However, leveraged inverse ETFs face higher risks of substantial losses. Understanding how inverse ETFs work helps investors manage these risks effectively.

How much does an inverse ETF cost?

Inverse ETF costs include management fees, trading commissions, and potential bid-ask spreads. The total cost of inverse ETF trading can be higher than traditional ETFs due to active management and derivative expenses.