- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- REITs Meaning

- How are REITs Formed?

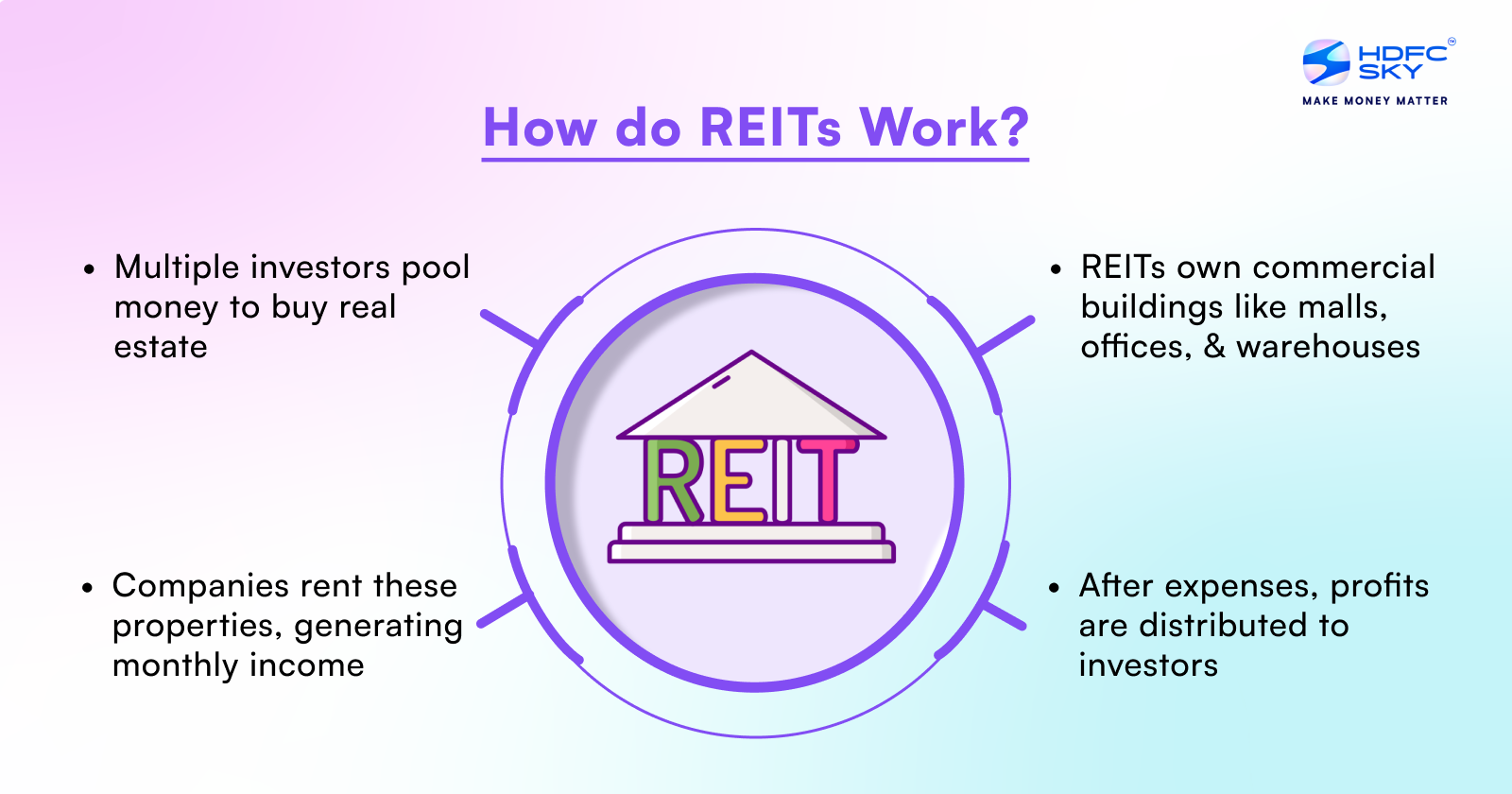

- How do REITs Work?

- Features of REITs

- What Criteria Must a Company Meet to Qualify as a REIT?

- Advantages of REITs: Why They’re a Game-Changer for Investors

- Limitations of REITs: Understanding the Risks Before You Dive In

- How to Invest in Real Estate Investment Trusts?

- REITs in India

- Are Real Estate Investment Trusts (REITs) a Good Investment? A Practical Evaluation

- Who Should Invest in REITs?

- Steps to Assess Real Estate Investment Trusts

- Conclusion: Are REITs a Good Investment?

- FAQs on What are REITs?

- REITs Meaning

- How are REITs Formed?

- How do REITs Work?

- Features of REITs

- What Criteria Must a Company Meet to Qualify as a REIT?

- Advantages of REITs: Why They’re a Game-Changer for Investors

- Limitations of REITs: Understanding the Risks Before You Dive In

- How to Invest in Real Estate Investment Trusts?

- REITs in India

- Are Real Estate Investment Trusts (REITs) a Good Investment? A Practical Evaluation

- Who Should Invest in REITs?

- Steps to Assess Real Estate Investment Trusts

- Conclusion: Are REITs a Good Investment?

- FAQs on What are REITs?

What Are REITs and How Do They Work in India?

By Ankur Chandra | Updated at: Jul 28, 2025 01:27 PM IST

Summary

- REIT Definition:

Real Estate Investment Trusts (REITs) pool investor capital to invest in income-generating real estate assets such as commercial buildings, malls, and warehouses. - SEBI Regulation:

REITs in India are regulated by SEBI, ensuring transparency and governance. They are listed on stock exchanges, providing liquidity similar to stocks. - Structure and Income:

REITs must distribute at least 90% of their net distributable income to investors, primarily sourced from rent or lease income. - Types of REITs:

Includes Equity REITs (own properties), Mortgage REITs (invest in loans), and Hybrid REITs (combine both). - Taxation Benefits:

Income from REITs is taxed based on the type—interest, dividend, or capital gain—with certain exemptions under Indian tax law. - Investment Suitability:

Ideal for retail investors seeking regular income, portfolio diversification, and exposure to real estate without direct property ownership.

Imagine walking past a shiny office tower in Mumbai’s Bandra-Kurla Complex or a busy shopping mall in Bengaluru. Now think about owning a small share of these high-value properties without spending crores just starting with ₹10,000. This is what Real Estate Investment Trusts (REITs) let you do. Similar to how mutual funds made stock investing easy, REITs make owning real estate simple and affordable.

- Since REIT’s inception in India in 2019, REITs have paid out over ₹16,800 crore in dividends, outperforming the NIFTY Realty Index.

- The sector is expected to grow to a market size of US$ 1 trillion by 2030, up from US$ 200 billion in 2021, and contribute about 13% to India’s GDP by 2025.

- REITs are changing how people invest in property. But how do they work, and are they the right choice for you? Let’s find out.

REITs Meaning

REITs pool money from multiple investors to purchase and manage income-generating properties. REITs have made commercial real estate investment accessible to everyone.

Let’s understand this with a simple example: Imagine a premium office building worth ₹500 crores. While you cannot buy the whole building, you can definitely buy a tiny part of it through REITs, which divide ownership into smaller units worth ₹50-100 each. Before REITs, this facility was not available for real estate investors in India – everyday investors had no way to participate in premium commercial real estate opportunities.

How are REITs Formed?

Here’s how REIT works:

- A real estate company (called the sponsor) decides to create a REIT

- It puts some of its existing buildings into this new REIT

- It invites regular people like you and me to invest by buying units (like buying shares)

- The money collected is used to buy and manage more properties

- The rent from these buildings is shared with all investors

How do REITs Work?

Imagine you and your friends want to buy and rent out a shopping mall. Instead of one person having to buy the whole mall, everyone puts in some money. The mall earns rent from shops, and at the end of each month, everyone gets their share of the rent. That’s exactly how a REIT works, just on a much bigger scale!

Here’s the basic flow:

- The REIT buys commercial buildings (offices, malls, warehouses)

- Companies rent these buildings

- The REIT collects rent every month

- After paying for maintenance and other costs, the rest of the profit is given to investors

Features of REITs

What makes REITs special? Here are their key features in simple terms:

- Regular Income

- Get your share of rent money every few months

- Usually pays more than a savings account

- Professional Management

- Experts handle all the headaches of managing buildings

- You don’t need to worry about finding tenants or fixing problems

- Easy to Buy and Sell

- You can trade REIT units just like stocks.

- You do not need to wait for months for a physical property purchase.

- Affordable Starting Point

- Begin with as little as ₹10,000-15,000

- No need for huge property down payments

What Criteria Must a Company Meet to Qualify as a REIT?

For a company to become a real estate investment trust, it needs to follow certain important rules. Think of these rules like a checklist that helps protect investors like us:

- Size and Structure

- Must have assets worth at least ₹500 crore

- Should have at least 200 investors (called unitholders)

- No single person can own more than 25% of the REIT

- Income Distribution

- Must share 90% of their earnings with investors

- Payments are usually made every three months

- The remaining 10% can be used to buy more properties or make improvements

- Different Types of Real Estate Investment Trust (REIT): Exploring Your Options

Just as there are different types of properties, there are different types of REITs to invest in. Let’s explore each type:

- Equity REITs: The Cornerstone of Property Investments: Equity REITs own and manage income-generating properties like office buildings, shopping malls, and apartments. They earn revenue primarily from rental income and are ideal for investors seeking steady returns.

- Commercial REITs: Building the Backbone of Business Spaces: These REITs focus on office buildings, IT parks, and warehouses, offering stable income due to long-term leases with businesses.

- Residential REITs: Your Gateway to Rental Income: Residential REITs deal with rental apartments and housing complexes. They are popular in markets with strong demand for residential properties and rental income.

- Healthcare REITs: Investing in Wellness and Growth: Healthcare REITs invest in medical facilities like hospitals, clinics, and senior living spaces. They cater to the growing demand for healthcare infrastructure.

- Mortgage REITs: Profit from Real Estate Financing: Mortgage REITs invest in real estate loans and mortgage-backed securities, earning income through interest payments. These offer higher returns but come with greater risk.

Advantages of REITs: Why They’re a Game-Changer for Investors

- REITs offer a way to invest in premium commercial properties without needing enormous capital. While a single office in Mumbai’s business district might cost several crores, you can start investing in REITs with as little as ₹10,000-15,000.

- Regular income stands as another significant advantage. Indian REITs currently offer dividend yields between 6-8% annually, considerably higher than traditional fixed deposits which typically offer 3-4%.

- Rather than an individual dealing with tenant issues, maintenance matters, or property tax concerns, experienced management teams handle all these responsibilities in a professional manner. This removes the typical headaches of real estate ownership from investors.

- Liquidity advantage- Some REITs are traded on exchanges, they provide much-needed liquidity, unlike physical real estate.

- Portfolio diversification- An investment portfolio gets a much-needed diversification into real estate without putting aside large sums of money.

- Capital Appreciation: REITS also provide you with a good scope of capital appreciation over the long-run of 5-10 years.

Limitations of REITs: Understanding the Risks Before You Dive In

While REITs offer numerous benefits, it’s important to understand the disadvantages of REIT’s in order to make informed investment decisions.

- Market volatility affects REIT prices since they trade on stock exchanges.

- Interest rate sensitivity presents another challenge. When interest rates rise, REIT prices often decline because higher rates make their dividend yields less attractive compared to fixed-income investments.

- Additionally, REITs must distribute 90% of their income, leaving little for growth through property acquisitions.

- Taxation of dividends reduces the ultimate yield on investments.

- Sector-specific risks can be huge if a particular sector like hospitals, malls, or any other is having poor demand and the REIT is only exposed to that particular type of real estate.

How to Invest in Real Estate Investment Trusts?

Getting started with REIT investing involves a straightforward process that any investor can follow:

Open a Demat Account:

- Required for buying and selling REIT units

- Choose a reputable broker registered with SEBI

- Complete KYC documentation

Research Available Options:

- As of December 2024, there are five listed REITs in India: Brookfield India Real Estate Trust, Embassy Office Parks REIT, Mindspace Business Parks REIT, Nexus Select Trust, and 360 ONE Real Estate Investment Trust.

- Compare their portfolios, performance, and dividend history

- Review occupancy rates and tenant quality

Start Small:

- Begin with a minimum investment in REITs

- Understand how distributions work

- Monitor performance regularly

REITs in India

Here are some REITs to invest in based on your objective. Indian investors currently have five main REIT options available on the stock market:

1. Nexus Select Trust: Diversified Retail and Commercial Strategy

Positioned as an innovative player in India’s real estate landscape, Nexus Select Trust specialises in retail and commercial property investments. The trust distinguishes itself through a strategic portfolio spanning 17 shopping centres across 14 major metropolitan cities, encompassing approximately 9.8 million square feet of prime real estate. With notable properties like Select Citywalk in Delhi and Nexus Seawoods in Navi Mumbai, the trust offers investors exposure to high-growth sectors with substantial market potential.

2. Mindspace Business Parks: Comprehensive Commercial Real Estate Solutions

As a prominent commercial real estate developer, Mindspace Business Parks has carved a significant niche in India’s property market. The trust manages an impressive portfolio of five integrated business parks and five premium independent office buildings, totaling 32.3 million square feet of leasable area. Its strategic approach includes investing in prime commercial locations and maintaining a diversified tenant mix featuring leading IT and technology companies. From fiscal year 2022 to 2023, the trust demonstrated robust financial performance, increasing revenues from ₹1,201 crores to ₹1,278 crores.

3. Embassy Office Parks: Pioneering REIT Investments

Distinguished as India’s first publicly listed Real Estate Investment Trust, Embassy Office Parks represents a sophisticated investment vehicle in the commercial real estate sector. The trust has strategically developed a portfolio of Grade A office spaces across key urban centers including Bengaluru, Pune, Mumbai, and Noida. A joint venture between Embassy Group and global investment firm Blackstone, the trust offers investors a professionally managed platform with long-term lease arrangements and steady revenue streams from premium commercial properties.

4. Brookfield India Real Estate Trust: Global Investment Expertise

Backed by the internationally renowned Brookfield Asset Management, this trust provides investors with a sophisticated approach to real estate investments. With a carefully curated portfolio spread across Mumbai, Gurugram, Noida, and Kolkata, the trust manages approximately 14 million square feet of high-end properties. Its investment strategy focuses on securing long-term leases with multinational corporations and leveraging global real estate investment expertise to create value for stakeholders.

5. 360 ONE Real Estate Investment Trust

360 ONE Asset, formerly IIFL Wealth & Asset Management, is launching a ₹1,000 crore special opportunities fund focused on real estate. The fund plans to execute quasi-equity deals ranging from ₹150-200 crore, targeting opportunities in land buying, redevelopment, and acquisitions.

Are Real Estate Investment Trusts (REITs) a Good Investment? A Practical Evaluation

REITs offer an interesting mix of returns when compared to traditional investments. Let’s look at what you can expect: While regular real estate properties typically give you 3-4% yearly rent and bank fixed deposits offer 6-7% interest, REITs have performed better.

Looking at specific REITs in India – Embassy, Mindspace, Brookfield, and Nexus Select Trust – returns have varied from 6% to 39%. To put this in perspective, the overall real estate market (measured by BSE Realty Index) has grown by 317% in about 5.5 years. What makes REITs especially attractive is their predictable income – their properties have long rental agreements of 5-9 years, with regular rent increases built into the contracts.

Who Should Invest in REITs?

REITs particularly suit certain types of investors. If you’re seeking regular income, similar to rent from property but without the hassles of being a landlord, REITs deserve consideration. They work well for:

- Income-focused investors nearing retirement

- Young professionals looking to build a diversified investment portfolio

- Anyone wanting exposure to real estate without large capital commitments

However, REITs might not suit investors who:

- Need immediate access to their capital

- Can’t tolerate any market volatility

- Prefer direct control over their real estate investments

Steps to Assess Real Estate Investment Trusts

Before investing in REITs, follow these evaluation steps:

Financial Health Assessment

- Review debt levels (should be below 49% of asset value)

- Check dividend consistency

- Analyse occupancy trends

Property Portfolio Quality

- Location of properties

- Type and age of buildings

- Quality of tenants

Market Position

- Competitive advantages

- Growth opportunities

- Market share in key locations

Conclusion: Are REITs a Good Investment?

Real estate investment trusts offer a compelling way to participate in India’s growing residential and commercial real estate market. With their combination of regular income, professional management, and relatively low investment thresholds, REITs provide an accessible entry point for many investors. However, REITS investing requires understanding its characteristics, benefits, and limitations.

As the Indian REIT market matures, we’ll likely see more offerings across different property types, providing even more opportunities for diversification. For investors willing to do their homework and maintain a long-term perspective, REITs can serve as a valuable component of a well-rounded investment portfolio.

Related Articles

FAQs on What are REITs?

How many REITs are listed in India?

As of 2024, India has five listed REITs: Embassy Office Parks (2019), Mindspace Business Parks (2020), Brookfield India (2021), Nexus Select Trust (2023), and 360 ONE Real Estate Trust. More developers are preparing to launch REITs in coming years.

What is the purpose of a REIT?

REITs make commercial real estate investment accessible to everyday investors by dividing large properties into affordable units. They solve two main challenges: high capital requirements of direct property investment and liquidity issues. Professional managers handle all property-related responsibilities.

How long does a REIT last?

REITs operate like listed companies with no fixed end date. They continue indefinitely as long as they meet SEBI’s requirements. Investors can exit anytime by selling their units on the stock exchange, offering flexibility in investment duration.

What is the minimum investment for a REIT?

The minimum investment requirement for REITs in India has been intentionally kept accessible for retail investors. You can start investing in Indian REITs with just ₹10,000-15,000. Some brokers even allow purchase of single units, making it much more accessible than direct commercial real estate investment, which requires substantial capital.

Are REITs better than stocks?

Neither is “better” – they serve different purposes. REITs offer stable rental income with moderate growth, while stocks often provide higher growth potential with more volatility. Consider including both for a balanced portfolio.

What happens when a REIT fails?

SEBI regulations require REITs to maintain conservative debt and high occupancy rates to minimize risk. If a REIT fails, its premium properties can be sold to repay investors, providing capital protection.

Are REIT dividends passive income?

Yes, REIT dividends are passive income since investors earn regular returns without managing properties. REITs must distribute 90% of taxable income quarterly. However, these dividends are taxed at your income tax slab rate.

Are REITs worth it for beginners?

REITs suit beginners due to low investment thresholds, professional management, and transparency. Start small, perhaps through SIPs to manage market volatility. Regular review of quarterly presentations helps track performance.