- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- Understanding Cost Inflation Index (CII)

- What Is the Cost Inflation Index?

- What Is the Purpose of the Cost Inflation Index (CII)?

- Cost Inflation Index (CII) Table

- What Does a Base Year in CII Mean?

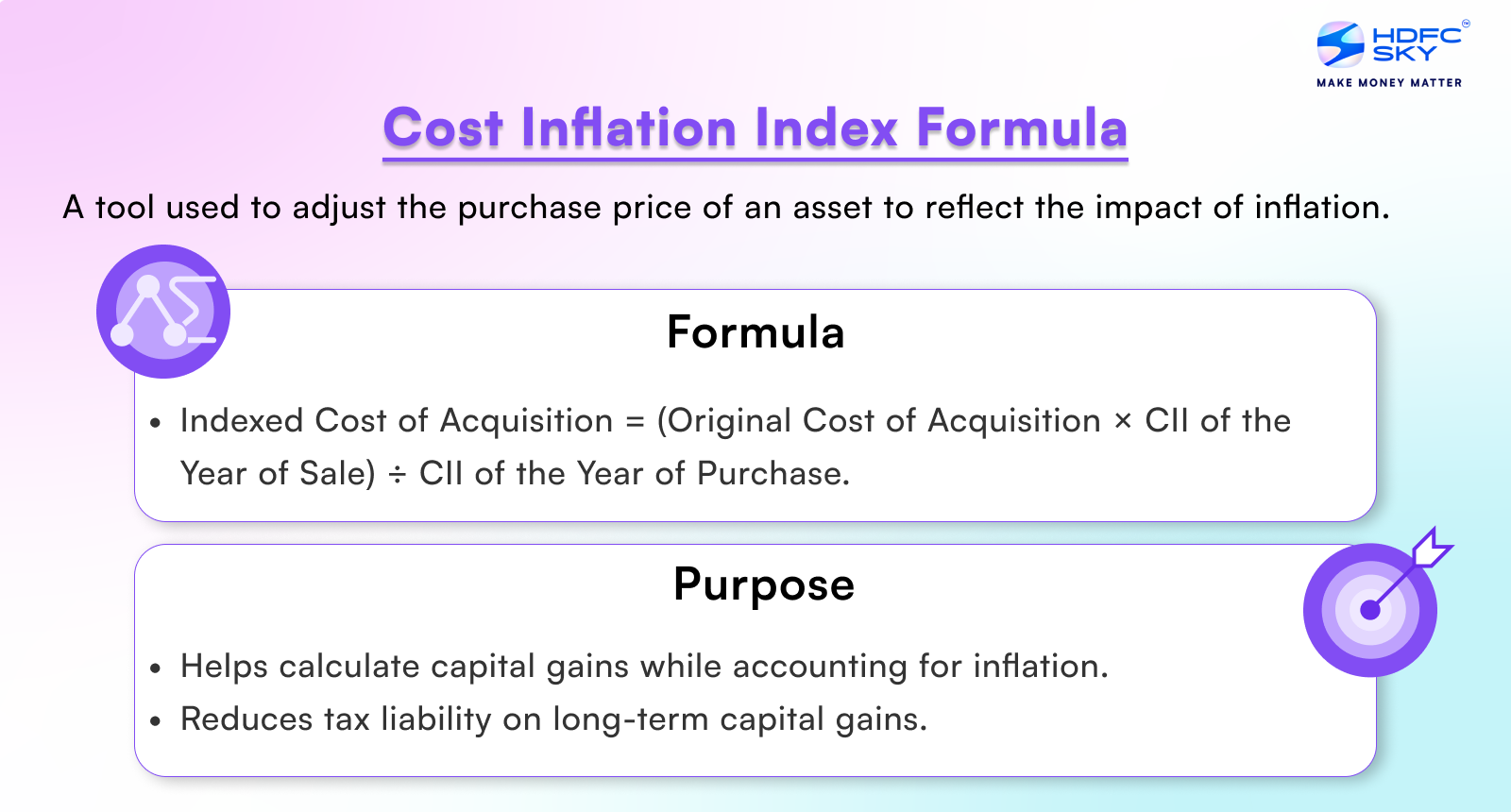

- Cost Inflation Index Formula

- What Is the Difference between CII and CPI?

- Conclusion

- FAQs on What is the Cost Inflation Index (CII)?

- Understanding Cost Inflation Index (CII)

- What Is the Cost Inflation Index?

- What Is the Purpose of the Cost Inflation Index (CII)?

- Cost Inflation Index (CII) Table

- What Does a Base Year in CII Mean?

- Cost Inflation Index Formula

- What Is the Difference between CII and CPI?

- Conclusion

- FAQs on What is the Cost Inflation Index (CII)?

What is the Cost Inflation Index (CII)? Table and Calculation

By Ankur Chandra | Updated at: Jul 28, 2025 12:55 PM IST

Summary

- Definition: The Cost Inflation Index (CII) is used to adjust the purchase price of capital assets for inflation, thereby reducing the taxable capital gains.

- Purpose: Helps taxpayers account for inflation when calculating long-term capital gains (LTCG) on the sale of assets such as real estate, gold, or mutual funds.

- Issued by: Central Board of Direct Taxes (CBDT), annually under the Income Tax Act, Section 48.

- Base Year: The base year was revised from 1981 to 2001 to simplify calculations and reflect more accurate inflation trends.

- Usage: Indexed Cost = (Purchase Price × CII of Sale Year) ÷ CII of Purchase Year.

- Example Provided: Demonstrates how applying CII can significantly reduce LTCG tax liability by increasing the purchase cost through indexation.

- Relevance: Especially crucial for investors and property holders aiming for tax-efficient exit strategies in long-term holdings.

Which index is used to calculate inflation in India? You can imagine that 20 years ago, you could buy a Pen for just one rupee. Fast forward to today, and the same Pen could cost you anywhere between ten to hundred rupees, depending on where you are. This is a clear reflection of inflation your purchasing power is being eroded as prices rise over time. In simple terms, the amount you pay today for that Pen is worth what one rupee was two decades ago.

This phenomenon of price increase over time is where the Cost Inflation Index (CII) comes into play. It helps you calculate how inflation affects the value of assets and investments, giving you a more accurate understanding of their real value over time. Let’s dive deeper into how the CII works, along with a table to make the calculation process clearer.

When it comes to long-term investments, inflation can significantly erode the value of your returns. In India, the Cost Inflation Index (CII) plays a crucial role in accounting for this inflation when calculating capital gains.

Let us explore CII in detail. We will cover the following:

- the cost inflation index meaning

- intricacies of the cost inflation index,

- The value of cost inflation index and its purpose

- calculation and,

- its significance in financial planning.

Understanding Cost Inflation Index (CII)

So, what is cost inflation index in income tax? The Cost Inflation Index or CII is a tool used to measure the impact of inflation on the price of goods and services over time. In the context of investments, it helps adjust the purchase price of assets for inflation, ensuring that you’re taxed only on the real gains you’ve made, not on the illusory gains caused by inflation. This is particularly important when calculating long-term capital gains tax on assets like property or shares.

What Is the Cost Inflation Index?

The Cost Inflation Index (CII) is a “number” published annually by the Income Tax Department of India. It reflects the increase in the prices of goods and services over time, using a base year as a reference point.

What Is the Purpose of the Cost Inflation Index (CII)?

The Cost Inflation Index (CII) is not just a number; it is a crucial tool for understanding the real value of your investments over time. It serves several crucial purposes, especially for those dealing with long-term assets like property or shares:

- Adjusting Cost of Assets

If you bought a house 10 years ago, its price in today’s rupees would be much higher due to inflation. The CII helps adjust that original cost to reflect today’s value. This ensures you’re not taxed for the notional price increase while calculating capital gains. Without the Cost Inflation Index, your profit would seem artificially high, leading to a larger tax burden. CII helps in correcting this extra tax burden for long-term investors.

When calculating long-term capital gains tax, the CII helps ensure you’re taxed only on the real increase in your asset’s value, not the portion attributable to inflation. This is essential for fair taxation and reflects the actual profit you’ve made.

- Financial Planning

The CII is not just for tax purposes; it’s a valuable tool for financial planning. You can make more informed investment decisions by understanding how inflation erodes purchasing power. For example, if you know the Cost Inflation Index has been rising steadily, you might choose investments that outpace inflation to maintain your real returns.

- Tax Calculations

In essence, the Cost Inflation Index helps bridge the gap between the nominal value of your assets and their real value in today’s rupees. Whether you’re calculating taxes, planning your finances, or simply trying to understand the impact of inflation on your investments, the CII is a crucial tool. Now, coming to how to use cost inflation index? Let’s look at what CII tables are.

Cost Inflation Index (CII) Table

The CII table is a crucial table for calculating capital gains. The Income Tax Department of India publishes the Cost Inflation Index (CII) table annually. This table is a crucial tool for anyone dealing with long-term capital assets, such as property or shares, as it provides the CII values for different financial years. These values allow you to adjust the cost of acquisition of your assets for inflation, ensuring that you are taxed only on the real gains you’ve made, not on the illusory gains caused by inflation.

Old CII Table

The Cost Inflation Index old table provides CII values for previous financial years, which are still relevant for calculating capital gains on assets acquired in those years.

New CII Table

The Cost Inflation Index table is updated every year. The new table provides the latest CII values for the current and upcoming financial years.

What Does a Base Year in CII Mean?

The base year in the Cost Inflation Index is a reference point used to measure inflation. The CII for the base year is usually set at 100. The CII values for subsequent years reflect the increase in prices relative to the base year.

Cost Inflation Index Formula

How to calculate cost inflation index? The cost inflation index formula is used to calculate the indexed cost of acquisition of an asset:

Indexed Cost of Acquisition = (Original Cost of Acquisition × CII of the year of sale) / CII of the year of purchase

What Is the Difference between CII and CPI?

Earlier we discussed, what is cost inflation index? While both CII and CPI measure inflation, they have distinct purposes and calculations:

- CII (Cost Inflation Index): Specifically used to adjust the cost of acquisition of capital assets for inflation in income tax calculations.

- CPI (Consumer Price Index): Measures the average change in prices paid by urban consumers for a basket of consumer goods and services. It’s a broader measure of inflation used for various economic analyses.

In India, the CPI is used to calculate the cost inflation index.

Conclusion

Understanding the Cost Inflation Index is crucial for anyone dealing with long-term investments and capital gains. You can calculate your real gains, minimise your tax liability, and make informed financial decisions. You can also effectively manage your investments and tax planning by staying updated on the latest CII values and understanding its application in capital gains calculations.

Related Articles

FAQs on What is the Cost Inflation Index (CII)?

How to calculate the cost inflation index on property?

To calculate the indexed cost of acquisition for a property, use the formula: (Original cost of acquisition x CII of the year of sale) / CII of the year of purchase. This adjusted cost helps determine the capital gain for tax purposes.

Which index is used to calculate inflation in India?

While the Consumer Price Index (CPI) measures general inflation, the Cost Inflation Index (CII) is specifically used to calculate inflation for long-term capital gains tax purposes.

What is the cost inflation index in income tax?

In income tax, the cost inflation index helps adjust the cost of acquisition of assets for inflation, ensuring fair taxation of long-term capital gains.

When is the cost inflation index announced?

The cost inflation index is usually announced by the Indian government in the annual budget, along with other tax-related updates.

How to compute capital gain tax based on cost inflation index

- Calculate the indexed cost of acquisition using the cost inflation index formula.

- Subtract the indexed cost from the selling price to determine the capital gain.

- Apply the applicable tax rate on the capital gain.

How is cost inflation index beneficial for long term capital gain computation?

The cost inflation index benefits long-term capital gain computation by adjusting the asset’s purchase price for inflation, reducing the taxable gain and your overall tax liability.