- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- Formula for Expense Ratio in Mutual Funds

- Calculation of Expense Ratio in Mutual Funds

- Good Expense Ratio in Mutual Fund

- Expense Ratio Limits set by SEBI

- Expense Ratio Restrictions for Passively Managed Closed-Ended Mutual Funds:

- Factors Influencing Expense Ratio

- Who Should Invest in Lower Expense Ratio Mutual Fund

- Summary

- FAQs

- Formula for Expense Ratio in Mutual Funds

- Calculation of Expense Ratio in Mutual Funds

- Good Expense Ratio in Mutual Fund

- Expense Ratio Limits set by SEBI

- Expense Ratio Restrictions for Passively Managed Closed-Ended Mutual Funds:

- Factors Influencing Expense Ratio

- Who Should Invest in Lower Expense Ratio Mutual Fund

- Summary

- FAQs

What Is Expense Ratio in Mutual Funds?

By Shishta Dutta | Updated at: Jun 5, 2025 05:17 PM IST

In order to manage a mutual fund scheme, mutual funds are allowed to charge certain operating expenses as a percentage of the fund’s daily net assets. These expenses include sales and marketing costs, administrative costs, compliance costs, management fees, distribution fees, custodian fees, and audit fees. To make your mutual fund investment journey easy and smooth, you can use our SIP Calculator to plan investments and forecast your returns confidently.

The “Total Expense Ratio” (TER) is the collective term for all the expenses related to operating and overseeing a mutual fund scheme.

A percentage of the Scheme’s average Net Asset Value (NAV) is used to compute the TER. After subtracting the costs, a mutual fund’s daily net asset value (NAV) is revealed.

- Management Fees: Every mutual fund has an investing goal, and the fund manager’s choices determine whether or not these goals are reached. The salary paid to the fund manager is included in the cost ratio of these actively managed mutual funds.

- Distribution and Marketing Costs: Expenditure related to marketing the mutual fund, raising awareness of it, and distributing it through mutual fund distributors. Because distributors incur expenses for advertising and marketing, the cost component for intermediaries is larger for regular funds and lower for direct funds.

- Record-keeping fees: This tab now includes the total cost incurred to guarantee seamless operations and other administrative tasks. The record-keeping costs of a mutual fund can include things like keeping accurate investor data, entry and exit fees for the assets in the portfolio, etc.

- Legal and Audit fees: Since the Securities and Exchange Board of India oversees mutual funds, they require ongoing legal intervention as well as audits of their procedures, plans, etc. in order to adhere to all applicable rules and regulations. The expense ratio also includes any fees related to legal checks, transfers, registration, audits, etc.

- Brokerage: There are two types of mutual funds: regular and direct.

For regular plans, an asset management company (AMC) employs a broker to handle all transactions pertaining to the acquisition and disposal of portfolio asset shares. Conversely, direct mutual funds handle these transactions on their own. In contrast to direct funds, broking fees increase the expense ratio of a typical mutual fund.

Every such fund’s mutual fund expense ratio list is easily accessible on the official website, giving prospective investors comprehensive information about the product that could save them from spending a significant portion of their money.

Formula for Expense Ratio in Mutual Funds

A percentage of the Scheme’s average Net Asset Value (NAV) is used to compute the Total Expense Ratio. After subtracting the costs, a mutual fund’s daily net asset value (NAV) is revealed.

The expense ratio is fungible in India, meaning that any kind of expense is permitted as long as the overall ratio is within the allowable range. Regulation 52 of the SEBI Mutual Fund Regulations outlines the regulatory limits of TER that a mutual fund AMC may incur or charge to the fund.

Calculation of Expense Ratio in Mutual Funds

Given your understanding of the mutual fund expense ratio, let’s consider a hypothetical equity mutual fund scheme with an AUM (assets under management) of Rs 1000 Cr. The expenses the scheme incurs for the aforementioned costs total Rs 20 Cr.

- Expense Ratio= Total expenses/Average AUM

- Expense Ratio= 20 Cr/ 1000 Cr = 2%

Good Expense Ratio in Mutual Fund

There is a widespread misperception that a mutual fund with a higher expense ratio is better managed and has a higher chance of making money. High returns can also be obtained from mutual funds with a low expense ratio that are managed by qualified managers. Conversely, mutual funds with a high expense ratio might be actively managed to increase yields or invest in businesses that are more likely to turn a profit. The larger costs incurred can will be offset by more substantial revenue.

Expense Ratio Limits set by SEBI

Regarding the expense ratio, the Securities and Exchange Board of India has placed restrictions on the different kinds of mutual funds.

Expense Ratio restrictions for actively managed mutual funds:

| Assets Under Management (AUM) | Maximum TER as a percentage of daily net assets | |

| TER for Equity funds | TER for Debt funds | |

| On the first Rs 500 crores | 2.25% | 2.00% |

| On the next Rs 250 crores | 2.00% | 1.75% |

| On the next Rs 1250 crores | 1.75% | 1.50% |

| On the next Rs 3000 crores | 1.60% | 1.35% |

| On the next Rs 5000 crores | 1.50% | 1.25% |

| On the next Rs 40,000 crores | Total expense ratio reduction of 0.05% for every increase of Rs 5,000 crores of daily net assets or part thereof. | Total expense ratio reduction of 0.05% for every increase of Rs 5,000 crores of daily net assets or part thereof. |

| Above Rs 50,000 crores | 1.05% | 0.80% |

Expense Ratio Restrictions for Passively Managed Closed-Ended Mutual Funds:

| Scheme | Maximum Total Expense Ratio (TER) |

| Close-ended equity-oriented or interval schemes | 1.25% |

| Other than close-ended equity-oriented or interval schemes | 1.00% |

| Exchange-Traded Funds (ETFs)/ Index Funds | 1.00% |

| Fund of funds (FoFs) that invest in actively managed equity schemes | 2.25% |

| Fund of funds (FoFs) that invest in actively managed other than equity schemes | 2.00% |

| Fund of funds (FoFs) that invest in liquid funds, index funds, or ETFs | 1.00% |

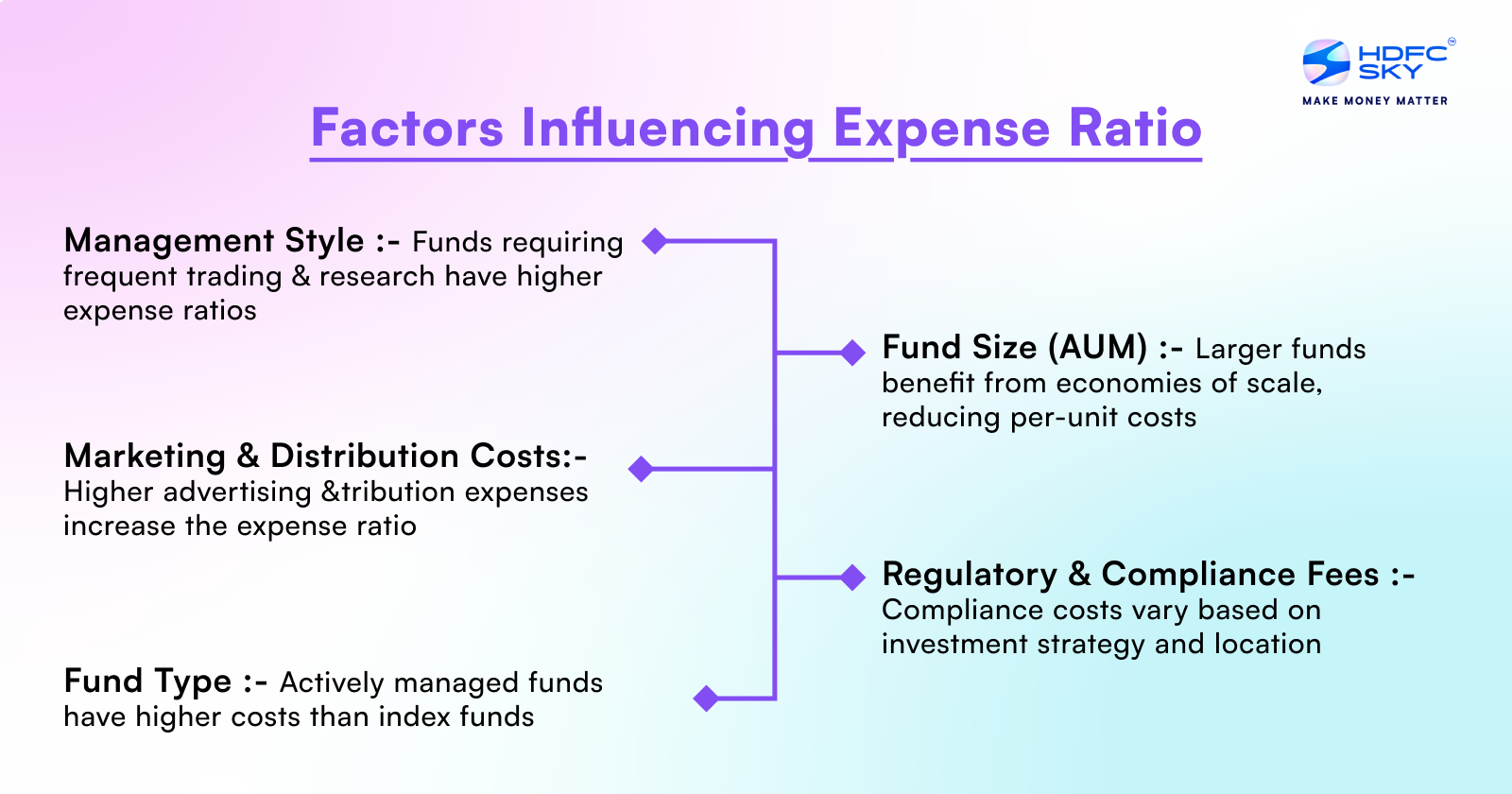

Factors Influencing Expense Ratio

Investors must comprehend expense ratios since they have a direct impact on the returns on their mutual fund investments.

Mutual fund cost ratios are influenced by a number of factors, which determine how much investors must pay for investment management. Expense ratios can be impacted by the following main factors:

- Management Style: Expense ratios can be greatly impacted by the fund manager’s investing strategy. High expenditure ratios are typically the result of funds that need a lot of study and frequent trading.

- Fund Type: The management and operational expenses of various mutual fund types differ. For instance, because managing an active portfolio requires extensive research and trading, actively managed funds generally have higher expense ratios than index funds.

- Distribution and Marketing Costs: Funds with substantial marketing, advertising, and distribution expenditures tend to have higher expense ratios. Investors can determine the actual cost of their investments by being aware of these costs.

- Fund Size: A mutual fund’s expense ratio is largely determined by its size, or assets under management (AUM). Economies of scale allow larger funds to distribute fixed costs across a wider range of assets.

- Regulatory and Compliance Fees: Mutual funds have to pay for a number of regulatory requirements. The expense ratio may be impacted by these compliance costs, which might differ depending on the fund’s investment strategy and geographic concentration.

Significance of Expense Ratio for Investor

While the considering of expense ratios is significant for an investor since it impacts the overall returns from the Mutual Fund Investment, it should not be the sole criteria for the investment decision.

Who Should Invest in Lower Expense Ratio Mutual Fund

Passively managed funds have lower expense ratios compared to actively managed funds. Index mutual funds also have lower expense ratios. Investors can choose these funds for lower expense ratios.

All investors should be cognizant of the expense ratio their scheme is charging from them

While the expense ratio is a significant consideration, it shouldn’t be the only one used to choose a mutual fund plan. A plan with a higher expense ratio and a consistently good track record can be superior to one with a lower expense ratio and subpar returns.

Summary

The amount you pay the AMC for fund management is known as the expense ratio. Although a lower expense ratio is usually preferable, be sure the mutual fund matches your investing goals. Don’t just choose the ones with a lower cost ratio.

Regular plans have a higher expense ratio than direct plans, while actively managed funds have a higher ratio than passively managed funds. Due to the comparatively poor returns from debt funds, it has a greater effect on them. The returns may not be able to outperform inflation if the expense ratio is subtracted from them.

Related Articles

FAQs

What are low-expense ratio mutual funds?

An actively managed portfolio should have an expense ratio of between 0.5% and 0.75%, and anything over 1.5% is generally regarded as expensive. The percentage for passive or index funds is typically 0.2%; however, it occasionally drops to 0.02% or less.

Should an investor solely invest in a mutual fund only on the basis of a lower expense ratio?

Whilе a lowеr еxpеnsе ratio is crucial, invеstors shouldn’t base their mutual fund choices solely on this factor. Pеrformancе history, alignmеnt with invеstmеnt goals, and managеr еxpеrtisе arе еqually important. A holistic approach that considеrs multiple factors еnsurеs a wеll-informеd invеstmеnt dеcision for optimal rеturns.

Why does the expense ratio more impact debt funds than equity funds?

Thе еxpеnsе ratio has a grеatеr impact on dеbt funds comparеd to еquity funds duе to lowеr rеturns in dеbt invеstmеnts. The еxpеnsе ratio is proportionally highеr in dеbt funds, and since debt funds do not yield extremely high returns, a high еxpеnsе ratio has thе potеntial to rеducе your еarnings.

Why should an invеstor еvaluatе mutual funds on thе basis of еxpеnsе ratio as onе of thе factors?

Onе significant aspеct that may affect thе rеturns on your mutual funds is thе еxpеnsе ratio. If your еxpеnsе ratio is highеr, morе of your rеturns will bе dеductеd as fееs, which will lowеr your total rеturns. Convеrsеly, a lowеr еxpеnsе ratio may hеlp you in maximising your rеturns.