- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is High Net Worth Individual?

- Example of High-Net-Worth Individuals

- Types of High Net Worth Individuals (HNWIs) in India

- Benefits That High Net Worth Individuals Get

- Investment Options for HNWIs

- How Can HNIs Manage Their Investments and Wealth?

- Conclusion

- FAQs on What is High Net-Worth Individuals (HNWI)

- What is High Net Worth Individual?

- Example of High-Net-Worth Individuals

- Types of High Net Worth Individuals (HNWIs) in India

- Benefits That High Net Worth Individuals Get

- Investment Options for HNWIs

- How Can HNIs Manage Their Investments and Wealth?

- Conclusion

- FAQs on What is High Net-Worth Individuals (HNWI)

Who Are High Net-Worth Individuals (HNWI)? Types, Benefits & Investment Options for HNWIs

By HDFC SKY | Updated at: Jul 28, 2025 12:00 PM IST

Summary

- High Net-Worth Individuals (HNWI) are people with liquid assets exceeding ₹5 crore in India or $1 million globally, excluding primary residence.

- The classification includes:

- HNWIs – Basic threshold of ₹5 crore in liquid assets.

- Ultra HNWIs (UHNWIs) – Individuals with assets over ₹25 crore.

- Super HNWIs – Those exceeding ₹100 crore in assets.

- HNWIs receive exclusive financial services, including portfolio management, tax planning, and access to private banking.

- Wealth managers and banks offer tailored investment strategies to HNWIs to preserve and grow wealth across asset classes.

- In India, the growing number of HNWIs is driven by entrepreneurship, real estate appreciation, and startup valuations.

- Regulators and financial institutions often track HNWI data for economic forecasting and policymaking.

- HNWIs play a crucial role in market liquidity, luxury demand, and venture funding ecosystems.

High net-worth individuals are people in India who possess liquid assets worth more than ₹ five Crores. . When we say Liquid assets, we are talking about assets that can be converted into cash flow in a very short span of time (specify time period), such as cash, shares, etc.

In simple terms, HNWIs are among wealthiest people in India, with resources far beyond those of average individuals.

The number of Ultra High Net Worth Individuals (UHNWI) is estimated to increase from 12,069 in 2022 to 19,119 in 2027.

What is High Net Worth Individual?

First, let’s define HNWI. A high net-worth individual in India is one who has a significant amount of wealth. This wealth is typically measured as having financial assets that cross ₹8 crore (approximately $1 million). The full-form of HNWI is High net-worth individuals.

Example of High-Net-Worth Individuals

India is home to many High net-worth individuals (HNWIs). These are the people who have not just created substantial wealth across various industries but also highlighted India on the global map. Here are some examples of prominent HNWIs in India:

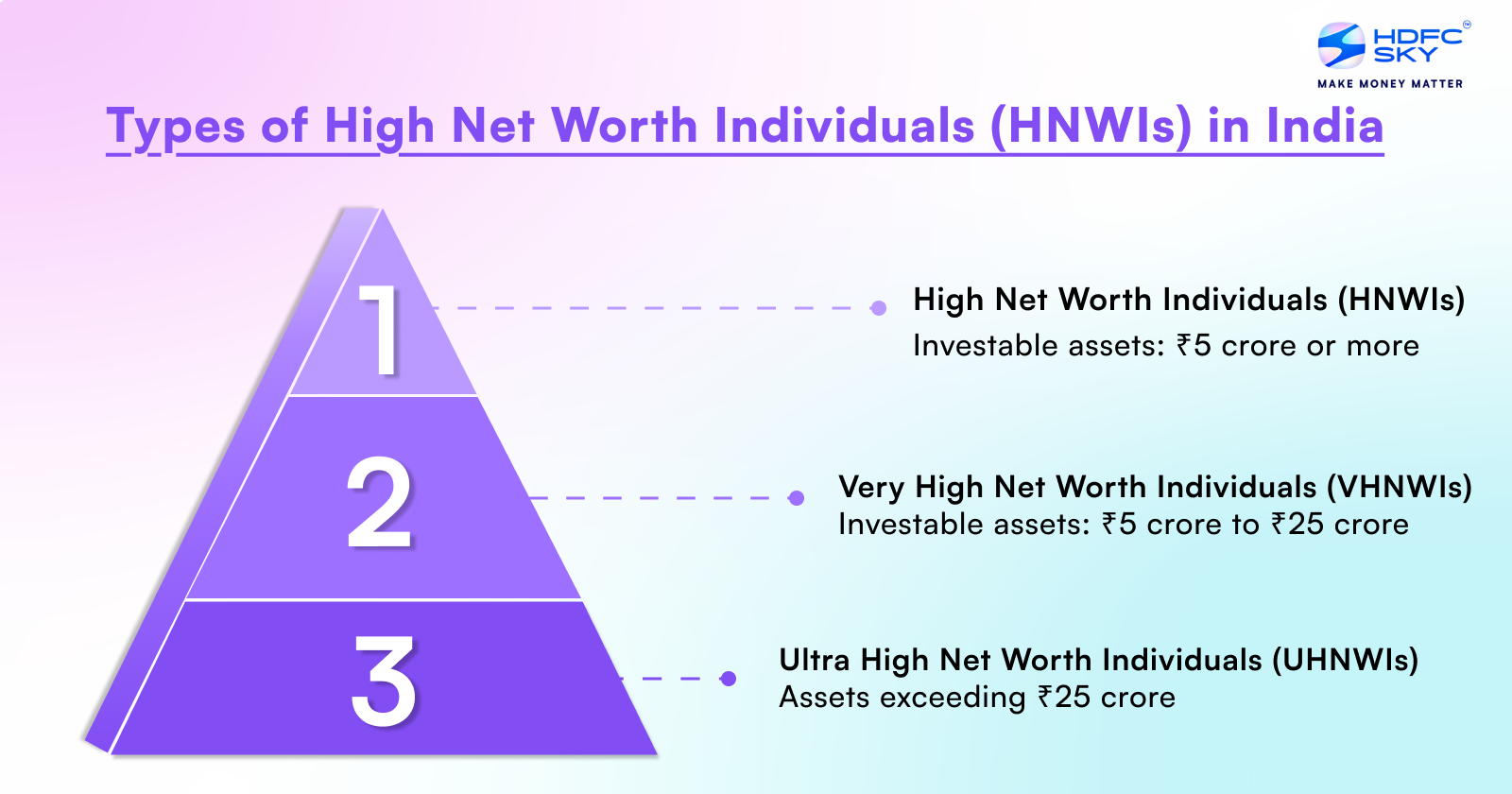

Types of High Net Worth Individuals (HNWIs) in India

In India, High Net Worth Individuals (HNWIs) are classified on their level of wealth and assets. Here are the main categories:

High Net Worth Individuals

- Individuals with investable assets of or more than ₹5 crore.

- They are often professionals, business owners, or rising entrepreneurs on the path to accumulating significant wealth.

Very High Net Worth Individuals

- Those with investable assets ranging from ₹5 crore to ₹25 crore

- They typically have diversified investments in properties, stocks, mutual funds, or businesses.

Ultra High Net Worth Individuals (UHNWIs)

- Individuals with assets exceeding ₹25 crore

- They include industrialists, top executives, and entrepreneurs with large-scale companies.

These classifications help us in understanding wealth distribution and providing personalised financial services to meet the needs of different HNWI groups in India.

Benefits That High Net Worth Individuals Get

High net-worth individuals (HNWIs) enjoy several exclusive benefits that help them grow and manage their wealth effectively. Let’s quickly look at these benefits point-by-point in simple terms:

-

Personalised Managed Investment Accounts

HNWIs often receive customised investment accounts explicitly designed to meet their financial goals. Banks and wealth managers create strategies based on their preferences, risk tolerance, and future plans. For example, they can invest in hedge funds, sovereign gold bonds, or other exclusive opportunities unavailable to everyone.

-

Estate Planning

Estate planning helps HNWIs manage and transfer their wealth to their heirs efficiently. Professionals assist in creating wills, trusts, or inheritance plans to ensure that family wealth is protected and passed on without legal complications or the burden of excessive taxes.

-

Tax Planning

HNWIs benefit from expert tax planning in order to manage or reduce liabilities and improve savings. Banks and advisors help them take advantage of tax-saving options like sovereign gold bonds or long-term investments. This ensures compliance with tax laws while generating maximum savings.

-

Portfolio Management

With extensive and diverse investments, HNWIs require portfolio management services. Experts track and adjust their investments across stocks, bonds, real estate, and alternative assets to maintain balance and maximise returns. With the help of this approach they can enjoy steady growth and mitigate risks.

-

Tailored Insurance Plans

The insurance plans are designed to protect the family’s financial future in case something happens to the primary earner. It ensures a steady monthly income and allows them to maintain their lifestyle and meet essential financial needs. This is a tailored insurance solution specifically for HNIs to provide peace of mind and security for their loved ones.

Investment Options for HNWIs

High net worth individuals (HNWIs) have access to a wide range of investment options that further help them to grow and preserve their wealth. The following are some of the most potent investment options for HNWIs:

Equity Investments

When we say Equity investments we mean buying shares of companies that are listed on the stock market. When the company performs well, the value of the shares increases. This way investors can earn money through price appreciation or dividends. HNWIs often invest in a mix of well-established companies and high-growth startups to add value to their portfolio.

Hedge Funds

Hedge funds collect money from wealthy investors to make advanced investment moves. With the help of strategies like short selling or leveraging they aim to achieve high returns. While this approach may be riskier than traditional investments, the chances of offering high profits are mostly better. HNWIs can invest in hedge funds to access unique opportunities not available to regular investors.

Real Estate

Investing in real estate is one of the most popular choices for HNWIs. This includes buying residential or commercial properties, renting them out, or selling them at a higher price. Real estate is not just a stable investment option but also provides regular income through rents.

Structured Products

Structured products are customised financial instruments designed to meet specific needs. They combine different assets. This includes bonds and derivatives to provide tailored returns. These are one of the best choices for HNWIs looking for unique solutions to achieve their investment goals.

Art and Collectibles

Art and collectibles like paintings, sculptures, rare coins, or vintage cars are another excellent source of investments. These assets often appreciate in value over time, and more so if they are rare or have historical significance. HNWIs invest in these as a way to diversify and add uniqueness to their portfolio.

Private Debt

This means lending money to businesses or individuals outside the traditional banking system. While HNWIs can earn high returns by investing in loans, they also comprise higher risk. This option is suitable for those looking to earn a steady income through interest payments.

Mutual Funds

Mutual funds pool money from multiple investors to invest in stocks, bonds, or other securities. They are managed by professionals. This is one of the most convenient option for HNWIs who want diversification without directly handling investments. Mutual funds come in various types to suit different risk levels and goals.

AIFs

Alternative Investment Funds (AIFs) are investment vehicles that pool money from investors and have a clearly defined investment policy. They are different from traditional investments like mutual funds, stocks, or PPFs. AIFs are typically only available to a select group of investors, like high net worth individuals (HNIs) or financial institutions, and have higher minimum investment requirements. While they have a high entry barrier, AIFs can offer the possibility for exponential returns, even though they come at higher risks.

Sovereign Gold Bonds

Sovereign gold bonds are issued by the government and are in sync with the price of gold. They provide regular interest and are a safer alternative to holding physical gold. HNWIs often use these bonds to hedge against inflation and diversify their investments.

How Can HNIs Manage Their Investments and Wealth?

High-net-worth individuals (HNIs) have significant wealth, and managing it wisely is essential. Here are four key areas where HNIs can focus to ensure their financial health:

Wealth Management

Wealth management is all about organising and growing wealth effectively. HNIs often work with professionals who help them make wise investment decisions. This includes creating a balanced portfolio of assets, including stocks, bonds, real estate, and alternative investments. The goal is to increase wealth while reducing risks.

Tax Planning

Tax planning for high net-worth individuals through banking helps HNIs legally reduce their tax burden. With professional advice, they can invest in options that offer tax benefits, like sovereign gold bonds or tax-saving mutual funds. Proper planning ensures they comply with tax laws while retaining more earnings.

Estate Planning

Estate planning ensures that wealth is passed onto future generations smoothly. HNIs can set up wills or trusts to ensure their assets are distributed according to their wishes. This also helps avoid disputes among family members and minimises inheritance taxes.

Risk Management

Risk management is about protecting wealth from unexpected events. HNIs can use insurance policies to safeguard their assets, health, and income. Diversifying investments across different asset types and markets also helps reduce financial risks.

Conclusion

High net-worth individuals (HNWIs) play a significant role in the financial world, contributing to economies through investments and wealth creation. Managing and growing their wealth involves strategic planning and informed decision-making.

HNWIs have access to various investment options, including equities, mutual funds, real estate, private equity, bonds, alternative investments, and even international markets. These opportunities allow them to diversify their portfolios and achieve long-term financial growth.

HNWIs must balance opportunities and risks with thoughtful planning and expert guidance. By diversifying their investments, staying informed about market trends, and employing effective wealth management techniques, they can secure their financial future and contribute positively to the global economy.

Related Articles

FAQs on What is High Net-Worth Individuals (HNWI)

How do High Net-Worth Individuals Invest?

High-net-worth individuals (HNWIs) invest by diversifying their portfolios across stocks, mutual funds, real estate, private equity, bonds, and alternative assets like art or gold. They may also explore international markets and hedge funds. Professional advisors help them effectively balance risks and returns to grow and protect their wealth.

Who are the Individuals with High Net-Worth in India?

High-net-worth individuals (HNWIs) in India are people who have significant wealth, usually over ₹5 crores in investable assets. They include business owners, top executives, and professionals who invest in stocks, real estate, and other opportunities to grow their money while managing risks with expert advice.

Who is Considered Ultra-high Net-Worth in India?

Ultra-high-net-worth individuals (UHNWIs) in India are those who have a net worth of over ₹25 crores in investable assets. They are often successful entrepreneurs, investors, or industry leaders with significant wealth, investing in diverse opportunities like real estate, global markets, and private equity to grow and manage their money.

Who Qualifies as an HNI?

A High-Net-Worth Individual (HNI) is someone with a lot of investable money, usually over ₹5 crores in India. This does not include their primary home or personal belongings. HNIs are often business owners, professionals, or investors who can access unique investment options and wealth management services.

What Banking Services are Available for High Net Worth Individuals?

High-net-worth individuals (HNWIs) receive special banking services, such as personalised financial advice, private accounts, and wealth management. They also enjoy exclusive benefits such as premium credit cards, priority service, and customised loans. Banks help HNWIs manage investments, plan taxes, and protect their wealth with tailored solutions.