- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is Systematic Investment Plan?

- How Does SIP Work?

- When to Invest in SIP?

- Features of SIP (Systematic Investment Plan)

- Types of SIP (Systematic Investment Plan)

- Benefits of Investing in SIP

- How to Calculate SIP(Systematic Investment Plan)

- How to Invest in Mutual Funds Through SIP?

- Important Things To Remember Before Investing In SIPs

- Conclusion

- FAQs on What is SIP (Systematic Investment Plan)?

- What is Systematic Investment Plan?

- How Does SIP Work?

- When to Invest in SIP?

- Features of SIP (Systematic Investment Plan)

- Types of SIP (Systematic Investment Plan)

- Benefits of Investing in SIP

- How to Calculate SIP(Systematic Investment Plan)

- How to Invest in Mutual Funds Through SIP?

- Important Things To Remember Before Investing In SIPs

- Conclusion

- FAQs on What is SIP (Systematic Investment Plan)?

What is SIP (Systematic Investment Plan)? Meaning, Features & Types

By HDFC SKY | Updated at: Nov 19, 2025 12:43 PM IST

A SIP, or Systematic Investment Plan, is a method of investing in mutual funds through small, regular contributions rather than a lump sum. It allows investors to build wealth gradually over time while benefiting from rupee cost averaging and the power of compounding. SIPs are ideal for those looking for disciplined, long-term investing.

What is Systematic Investment Plan?

A Systematic Investment Plan (SIP) is a disciplined way to invest in mutual funds where you contribute a fixed amount regularly monthly or quarterly. The SIP full form is Systematic Investment Plan, and the SIP meaning refers to a method that helps investors build wealth over time by investing in small, consistent amounts. It reduces the impact of market volatility through rupee cost averaging and encourages financial discipline.

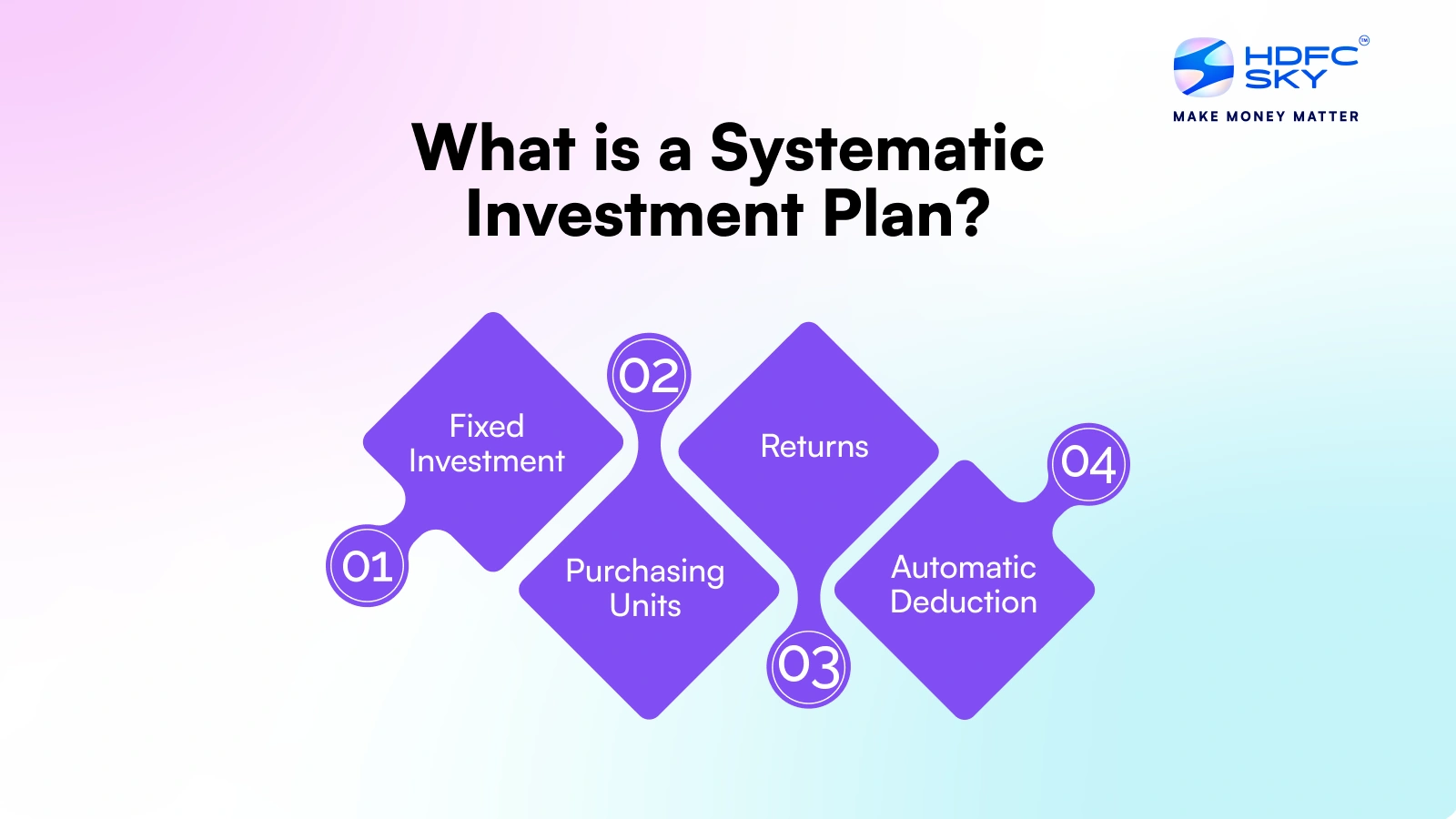

How Does SIP Work?

A systematic investment plan works on the simple principle of automatic deduction and investment. This means that a fixed amount of money is deducted from your account and put into the fund of your choice at regular intervals.

- Fixed Investment: You choose the amount and intervals at which you want to invest in a fund of your choice.

- Automatic Deduction: Once you start SIP, the amount is deducted from your bank account on a fixed date.

- Purchasing Units: The money you invest is used to purchase varying units of mutual funds based on their NAV (Net Asset Value). Know that if the NAV is low in that interval, you get more units, and if the NAV is high, you get fewer units.

- Returns: With rupee cost averaging and compounding in mutual funds, you generate returns.

When to Invest in SIP?

The best time to invest in a SIP is as early as possible to benefit from compounding. SIPs work well in all market conditions due to rupee cost averaging. Ideal times include:

- When starting your career to build long-term wealth

- During market volatility to average out costs

- For goal-based investing like retirement, education, or buying a home

- When seeking financial discipline through regular investing

Starting early and staying consistent is key.

Features of SIP (Systematic Investment Plan)

SIP offers a disciplined and hassle-free way to invest in mutual funds. It helps build wealth gradually through small, regular investments

- Regular Investment: Invest a fixed amount monthly or quarterly, which helps in building wealth gradually.

- Rupee Cost Averaging: You buy more units when the market is low and fewer when it is high, reducing the impact of market volatility.

- Power of Compounding: Long-term SIP investments grow significantly due to compounding returns.

- Low Starting Amount: You can start a SIP with as little as ₹500, making it affordable for all income levels.

- Flexible Tenure: You can choose the duration and frequency of your SIP as per your financial goal.

- Auto-Debit Option: The amount is automatically debited from your bank account on a set date, ensuring consistent investment.

- Goal-Based Planning: SIPs help in planning for long-term goals like child’s education, buying a house, or retirement.

SIPs encourage disciplined investing and are a convenient way to participate in the equity market without the need for active monitoring.

Types of SIP (Systematic Investment Plan)

SIP (Systematic Investment Plan) offers flexible options to suit different investment needs. Here are the main types:

- Regular SIP: Fixed amount invested at regular intervals (monthly/quarterly).

- Top-up SIP: Lets you increase your SIP amount periodically to match rising income.

- Flexible SIP: Allows you to change the investment amount based on market conditions or cash flow.

- Trigger SIP: Executes investments based on pre-set market conditions or index levels.

- Perpetual SIP: No fixed end date continues until the investor instructs to stop.

Benefits of Investing in SIP

SIP or Systematic Investment Plan offers a simple and consistent way to grow your wealth over time. It is ideal for both new and seasoned investors.

- Disciplined Investing: Encourages regular savings and investment habits.

- Rupee Cost Averaging: Reduces the impact of market volatility over time.

- Power of Compounding: Helps grow wealth exponentially with long-term investments.

- Flexibility: Start with as little as ₹500 and increase anytime.

- Convenience: Automated monthly deductions make it hassle-free.

- Goal-based Planning: Helps in achieving financial goals systematically.

- Low Entry Barrier: Suitable for beginners and small investors alike.

How to Calculate SIP(Systematic Investment Plan)

To calculate SIP (Systematic Investment Plan) returns, you can use a standard formula or a SIP calculator available online.

The formula used is: FV = P × [(1 + r)^n – 1] × (1 + r) / r

where:

- FV is the future value of your investment

- P is the monthly SIP amount

- r is the monthly interest rate (annual rate divided by 12)

- n is the total number of months.

For example, if you invest ₹5,000 every month for 10 years at an expected annual return of 12%, the monthly rate becomes 1% (or 0.01) and the total months are 120. Plugging these into the formula gives you a future value of around ₹11.6 lakhs. However, rather than calculating manually, most investors prefer using SIP calculators offered by financial websites or apps. These tools are quick and accurate, helping you plan your investments better by simply entering the SIP amount, duration, and expected rate of return.

How to Invest in Mutual Funds Through SIP?

Investing in mutual funds through SIP is simple, structured, and ideal for long-term wealth creation. Follow these steps to get started:

- Choose a Reliable Fund House or Platform: Select an AMC or use platforms.

- Complete KYC: Submit PAN, Aadhaar, and bank details to complete your Know Your Customer process.

- Select a Mutual Fund Scheme: Pick a fund based on your goals, risk appetite, and performance history.

- Decide SIP Amount and Frequency: Set the investment amount and whether you want to invest monthly, quarterly, etc.

- Set Auto-Debit: Link your bank account to enable automatic monthly deductions.

- Monitor and Review: Regularly track your SIP performance and rebalance if needed.

Important Things To Remember Before Investing In SIPs

SIPs are a great way to build wealth over time, but careful planning is key. Here are some important points to keep in mind:

- Define Your Financial Goals: Know why you are investing, retirement, education, or wealth creation.

- Assess Risk Appetite: Choose funds that match your risk tolerance and investment horizon.

- Start Early and Stay Consistent: The earlier you start, the more you benefit from compounding.

- Review Fund Performance: Periodically check if the fund is meeting your expectations.

- Avoid Stopping During Market Lows: SIPs work best during volatility continue investing for long-term benefits.

- Understand Exit Loads and Taxation: Know applicable charges and tax implications before redeeming.

- Choose the Right Fund Type: Equity, debt, or hybrid select based on your goal and time frame.

Conclusion

A systematic investment plan is designed to offer a simple and disciplined investment approach that typically brings impressive returns. You can build a sizable corpus in the long run through the power of compounding, rupee cost averaging, and disciplined investment. However, just like any other investment plan, you must perform due diligence before starting an SIP for a fund of your choice.

Related Articles

FAQs on What is SIP (Systematic Investment Plan)?

Is FD Better Than SIP?

When comparing Fixed Deposit (FD) and Systematic Investment Plan (SIP), the better option depends on your financial goals and risk appetite.

If you prefer stability and short-term goals, FD may be better. But for long-term wealth creation and beating inflation, SIP is often the smarter choice.

How can I make an online SIP investment?

To make an online SIP investment, you first need to select a platform where you wish to invest. You can purchase mutual funds through SIP directly from a fund house, a demat account, or a trading account. Once you have your account ready, you can start SIP in any fund of your choice by selecting the amount and frequency of your investment.

What exactly is NAV in SIP?

The NAV in SIP is the Net Asset Value of units in mutual funds. It reflects the fund value at a specific point in time. If the NAV of a unit is lower, you get more units with the same investment amount, and if the NAV is higher, you get fewer units.

Is SIP better than FD?

SIP and FD are two different types of investments with varying returns and risks. For instance, a fixed deposit typically has fixed annual returns. Returns in a systematic investment depend on many factors, including the performance of the mutual funds.

Is SIP risk-free?

No, SIP is not completely risk-free. It comes with risks associated with the performance of underlying assets in mutual funds, and your returns are not promised or fixed.

Can I withdraw from the SIP anytime?

SIP withdrawal depends on the kind of scheme. Typically, SIPs allow early withdrawal; however, if your SIP has a lock-in period, then withdrawals are allowed only under certain conditions.