- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Xtranet Technologies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Xtranet Technologies IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Xtranet Technologies Limited

Xtranet Technologies is an integrated IT solutions provider offering comprehensive services in enterprise applications, digital transformation, managed services, proprietary platforms, and strategic technology partnerships. The company caters to clients across diverse industries through a blend of onsite and offshore delivery models, supported by subsidiaries and joint ventures. Its key offerings include ERP implementation, IT system integration, data centre management, cloud solutions, and infrastructure services. Revenue is generated from fixed-price projects, time-based contracts, and recurring agreements, with a strong presence among government and PSU clients.

Xtranet Technologies Limited IPO Overview

Xtranet Technologies Ltd. filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on September 25, 2025, marking a key step towards its proposed Initial Public Offering (IPO). The company’s promoters include Sukhbir Singh Kukreja, Jogendrapal Singh Alagh, and Shiney Sukhbir, who have played a central role in the organisation’s growth and strategic direction. As per the DRHP, the promoter shareholding before the IPO stands at 83.63%, which is expected to reduce post-issue once the fresh equity shares are allotted to new investors. The filing of the DRHP signifies Xtranet Technologies’ intent to strengthen its financial base, enhance visibility in the public markets, and fund its future business expansion plans.

Xtranet Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹190 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,91,51,700 shares |

| Shareholding post-issue | TBA |

Xtranet Technologies IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Xtranet Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Xtranet Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹7.60 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 31.18% |

| Net Asset Value (NAV) | ₹129.55 |

| Return on Equity (RoE) | 31.12% |

| Return on Capital Employed (RoCE) | 38.01% |

| EBITDA Margin | 17.26% |

| PAT Margin | 10.86% |

| Debt to Equity Ratio | 0.41 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/pre-payment, in full or in part, of certain outstanding borrowings availed by the company | 2199.15 |

| Capital expenditure by the company for purchase and installation of systems and hardware | 730.14 |

| To meet working capital requirements | 10200 |

| General corporate purposes | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

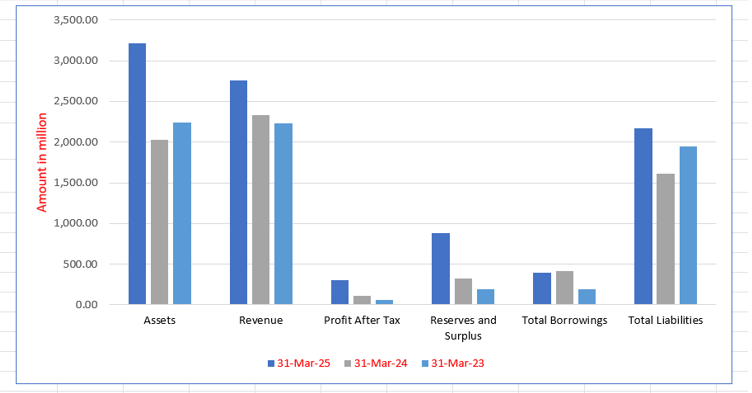

Xtranet Technologies Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,217.93 | 2,029.41 | 2,239.91 |

| Revenue | 2,760.82 | 2,329.41 | 2,225.59 |

| Profit After Tax | 300.35 | 109.43 | 59.80 |

| Reserves and Surplus | 876.58 | 318.80 | 193.01 |

| Total Borrowings | 392.40 | 411.90 | 191.55 |

| Total Liabilities | 2,166.92 | 1,614.02 | 1,943.18 |

Financial Status of Xtranet Technologies Limited

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Xtranet Technologies Limited

Xtranet Technologies Limited IPO Strengths

Comprehensive Cross-Industry Domain Expertise

Xtranet Technologies Limited delivers deep domain expertise through comprehensive services and solutions across six major operating segments: Government and Public Sector, Financial Services, Manufacturing and Industrial, Infrastructure and Utilities, Healthcare and Life Sciences, and Retail and Consumer Services. The firm’s ability to tailor solutions across diverse sub-verticals within these segments highlights its extensive capability to meet specific client needs.

Strong Track Record and Marquee Client Relationships

The company possesses a proven track record, evidenced by the successful execution of numerous projects, including 147 direct projects for Government and PSU clients in the last three fiscals, demonstrating reliability in complex engagements. This performance, coupled with long-standing relationships with approximately 27 customers associated for three continuous years, showcases a strong customer retention and stable revenue base.

Experienced Leadership and Technical Talent Pool

Xtranet Technologies Limited benefits from an experienced management team, including its promoters with over 25 years of industry experience, who strategically guide the business. This leadership is complemented by a qualified employee base, where over 50% of the 242 total employees possess core technical knowledge, ensuring the capability to execute complex projects and drive future growth.

Strategic Multi-Location and Geographic Presence

The company maintains a strategic, distributed operational model across multiple key commercial centers in India, including its corporate headquarters in Bhopal, and international operations. This multi-city presence enables Xtranet to tap into diverse talent pools, serve clients efficiently across various regions, and leverage cost advantages, reducing concentration risk through geographic diversification.

More About Xtranet Technologies Limited

Xtranet Technologies Limited is an integrated information technology solutions provider offering a comprehensive range of end-to-end services that include enterprise applications, digital services, managed services, proprietary platforms, and strategic technology partnerships. Established in 2002 and headquartered in Bhopal, Madhya Pradesh, the company brings over 23 years of experience in delivering innovative IT solutions to clients across industries and geographies.

Integrated Operations and Delivery Model

Xtranet operates through a hybrid delivery model, combining onsite and offshore operations to ensure efficiency and flexibility in meeting diverse client requirements. Its ecosystem is strengthened by subsidiaries, joint ventures (JVs), and proprietary platforms that enhance specialized capabilities and enable seamless technology integration.

Key platforms include:

- Synergy: A low-code digital transformation platform designed for process automation and enterprise-scale digital solutions.

- XtraTrust: A Licensed Certifying Authority (CA) and eSign Service Provider (ESP), authorised to issue and manage Digital Signature Certificates and provide PKI-based services such as e-signing, authentication, and time stamping.

These platforms form a crucial part of Xtranet’s digital transformation and secure technology offerings.

Business Growth and Evolution

The company began operations with System Integration Services, focusing on data networks, IT security, and smart city infrastructure. Over time, it expanded into:

- 2008: Application Development

- 2012: Data Centre Services

- 2014: ERP Implementation

- 2021: PKI and Digital Signature Services through XtraTrust Digisign Pvt. Ltd.

- 2022: Business Intelligence and Analytics Solutions via XtraSynergy Solutions Pvt. Ltd.

Xtranet holds CMMI SVC/5 and several ISO certifications (9001, 27001, 20000, and 22301), reflecting its strong focus on quality and business continuity.

Financial and Market Overview

For FY25, Xtranet reported consolidated revenues of ₹27,608.15 lakhs. The company earns through fixed-price contracts, time-and-material arrangements, and recurring service agreements.

It serves both Government/Public Sector Undertakings (PSUs) and Private Enterprises, with a majority of its revenue coming from government projects.

Industry Presence

Xtranet caters to multiple verticals, including Defence, Railways, Manufacturing, Financial Services, Telecom, Healthcare, Agriculture, Logistics, and Education, addressing diverse technological and operational requirements across sectors.

Industry Outlook

The Indian Information Technology (IT) and Digital Transformation industry continues to be one of the fastest-growing sectors globally. Valued at approximately USD 39.83 billion in 2024, the Indian IT services market is projected to reach USD 75 billion by 2033, growing at a CAGR of around 7.3%. Meanwhile, the digital transformation segment is estimated at USD 124 billion in 2025 and expected to expand to USD 267 billion by 2030, reflecting a CAGR of nearly 16.5%.

Growth Drivers

Several factors are driving this rapid expansion:

- Accelerated adoption of cloud computing, artificial intelligence (AI), machine learning (ML), and automation.

- Government initiatives such as Digital India and the push for data localisation.

- Growing demand for cybersecurity, PKI-based digital authentication, and enterprise software solutions.

- Increasing reliance on offshore delivery models and India’s strong base of skilled IT professionals.

Key Figures and Market Value

- Indian IT and business services exports were valued at approximately USD 194 billion in FY23.

- System infrastructure software and managed services segments are expected to maintain a CAGR of 9–12% through 2030.

- Total IT spending in India is projected to reach USD 160 billion in 2025, marking a double-digit year-on-year increase.

Relevance to Xtranet Technologies Limited

With offerings in enterprise applications, digital services, managed services, and secure technology platforms such as low-code automation and PKI solutions, Xtranet is strategically positioned to benefit from India’s expanding IT ecosystem. The company’s integrated structure and focus on digital innovation align perfectly with industry trends driving long-term growth.

How Will Xtranet Technologies Limited Benefit

- The rapid expansion of India’s digital transformation market will increase demand for low-code automation platforms like Xtranet’s Synergy, supporting enterprise-level digital adoption.

- Growing focus on data security, digital signatures, and authentication will drive demand for PKI-based services, benefitingXtranet’sXtraTrust platform.

- Government initiatives under Digital India and rising public sector digitalisation will create new opportunities for Xtranet’s system integration and managed services.

- Expansion of cloud computing, AI, and automation across industries will boost the need for integrated IT solutions, aligning with Xtranet’s end-to-end service offerings.

- Increasing outsourcing trends and hybrid delivery models will strengthen the company’s onsite-offshore operations and improve global competitiveness.

- The forecasted growth in India’s IT spending to USD 160 billion by 2025 will open new revenue streams across Xtranet’s core verticals, ensuring sustainable, long-term growth

Peer Group Comparison

| Particulars | Revenue from Operations (₹ in lakh) | Face Value (₹ per share) | EPS (Basic) (₹) | EPS (Diluted) (₹) | P/E | RoNW (%) | NAV (₹) |

| Xtranet Technologies Limited | 27,608.15 | 10.00 | 7.60 | 7.60 | N.A | 31.18% | 129.55 |

| Peer Group | |||||||

| Silver Touch Technologies Limited | 28,838.01 | 10.00 | 17.50 | 17.50 | 39.04 | 16.42% | 94.30 |

| Dynacons Systems & Solutions Limited | 1,26,721.96 | 10.00 | 57.01 | 56.95 | 15.16 | 31.17% | 198.50 |

| Coforge Limited | 12,05,070.00 | 10.00 | 123.01 | 122.03 | 13.09 | 14.67% | 191.62 |

Key Strategies for Xtranet Technologies Limited

Platform and Service Portfolio Augmentation

Xtranet is expanding its portfolio by strengthening managed and digital services alongside proprietary platforms like Synergy and XtraTrust. This strategy focuses on enhancing IT operations, bolstering cybersecurity (including managed PKI), and increasing cloud model adoption (IaaS/PaaS/SaaS). This delivers tailored solutions for enterprises and government digital transformation needs.

Continued Geographical Footprint Expansion

The company plans to broaden its domestic presence by participating in new state government digital initiatives and expanding its international reach into high-growth regions like the Middle East, Africa, and Asia-Pacific. Xtranet will leverage global partnerships and deploy its proprietary platforms Synergy and XtraTrust to achieve revenue diversification and mitigate geographic concentration risks.

Strategic Technology Innovation Investment

Xtranet continues to invest in technology innovation by integrating AI, ML, Blockchain, and IoT into its services and proprietary platforms. This is aimed at delivering future-ready, scalable solutions that enhance efficiency, security, and decision-making for clients. Key applications include AI/ML-driven predictive analytics and advanced cybersecurity in XtraTrust.

Data Centre and Infrastructure Expansion

Xtranet plans to expand its data center footprint both domestically and internationally in selected markets, including the UAE and USA. New facilities will be developed to Tier-III and Tier-IV standards to ensure high reliability and uptime. This leverages their established track record in creating and managing data center and disaster recovery infrastructure for government and PSU clients.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Xtranet Technologies Limited IPO

How can I apply for Xtranet Technologies Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Xtranet Technologies Limited IPO?

The IPO size is ₹190 crore, consisting entirely of a fresh issue of equity shares with no offer for sale.

On which stock exchanges will Xtranet Technologies shares be listed?

The equity shares of Xtranet Technologies Limited will be listed on both NSE and BSE.

Who are the lead manager and registrar for the Xtranet Technologies IPO?

Share India Capital Services Pvt. Ltd. is the lead manager, and Kfin Technologies Ltd. is the registrar.

What are the main objectives of the Xtranet Technologies IPO?

Funds will be used for loan repayment, capital expenditure, working capital, and general corporate purposes.

Who are the promoters of Xtranet Technologies Limited?

The company’s promoters are Sukhbir Singh Kukreja, Jogendrapal Singh Alagh, and Shiney Sukhbir