- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

HDFC SKY

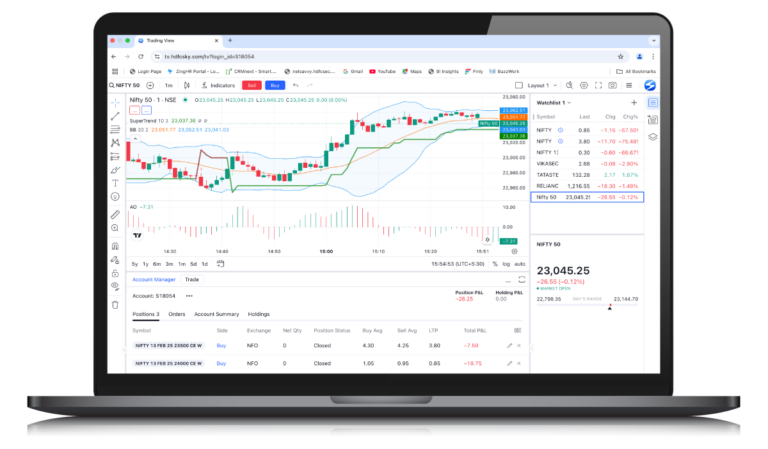

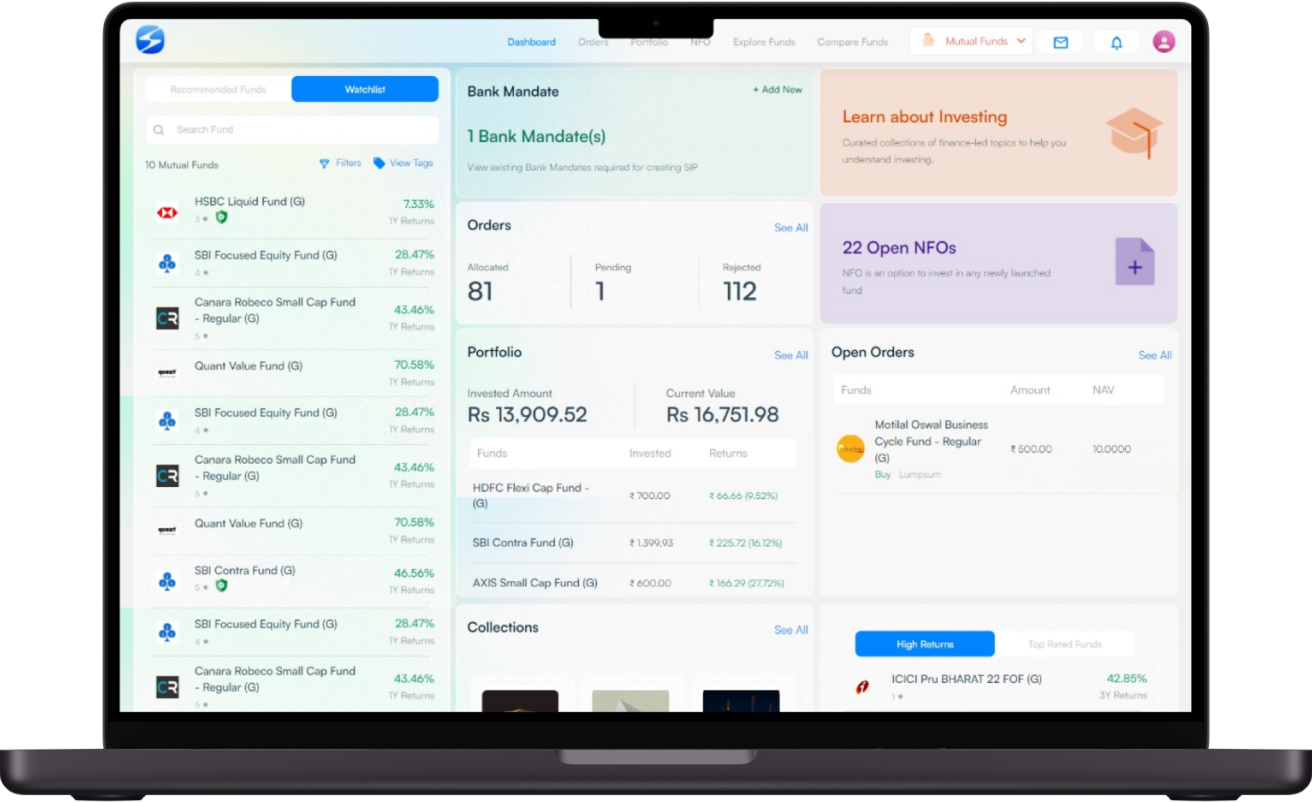

Web Trading Platform

Secure and Reliable Web Trading with HDFC SKY

Smarter Trading Experience

Grow financially with the power of advanced web trading with our cutting-edge platform designed for both, beginner and expert traders.

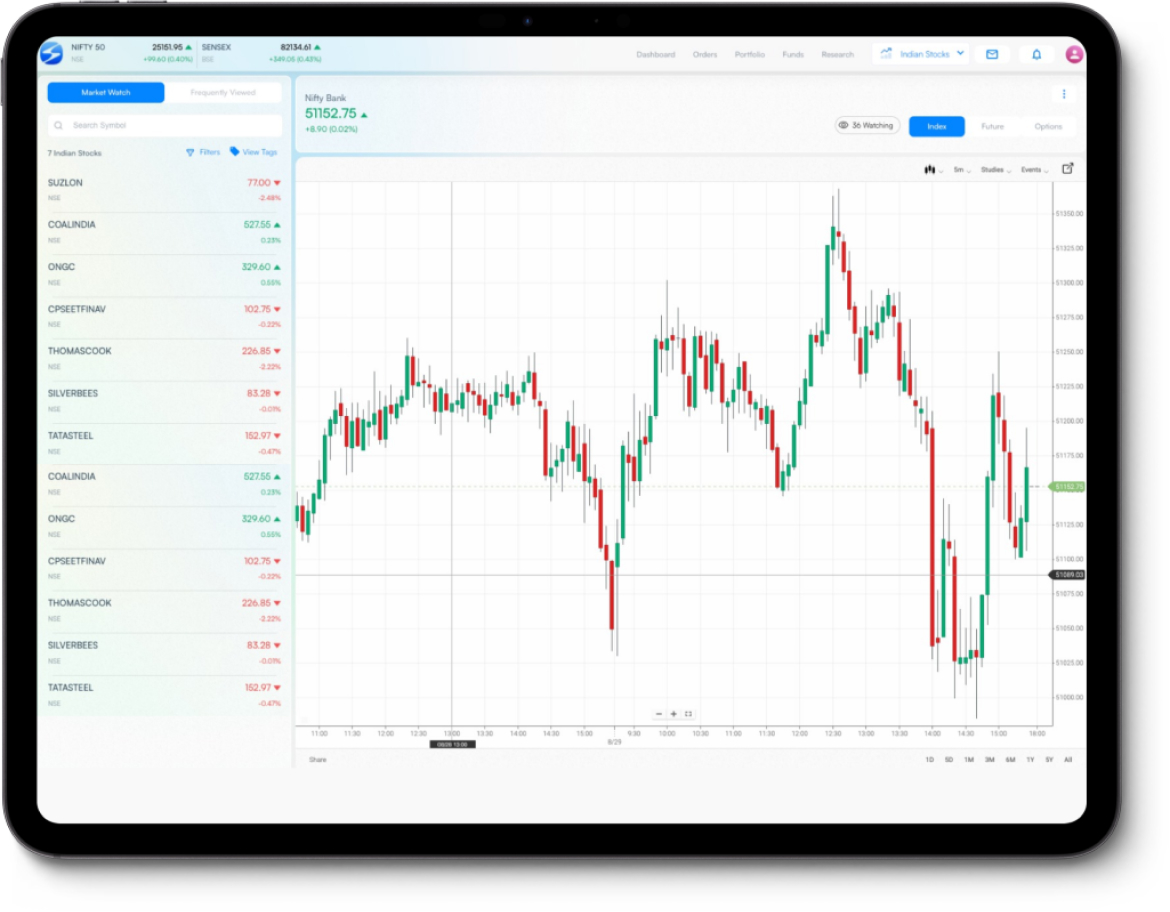

Advance Chart Powered By Trading View

Technical Indicator

Tailor your analysis with a wide range of technical indicators. These advanced technical indicators help you interpret market trends, identify potential trading opportunities, and make well-informed decisions.

Real Time Update

Access live data for accurate decision-making, ensuring you always have the latest market information at your fingertips. Stay ahead of market trends and make informed trading choices with up-to-the-minute updates directly on your charts.

Chart Comparison

Compare multiple charts side by side to analyze different markets or time frames simultaneously. This feature allows you to spot correlations, divergences, and overall market sentiment across various assets, helping to diversify your trading strategy.

Drawing Tools

Highlight key trends, support and resistance levels, and other critical information. Use trend lines, Fibonacci retracements, and other drawing tools to visually map out your trading strategy and enhance your analysis.

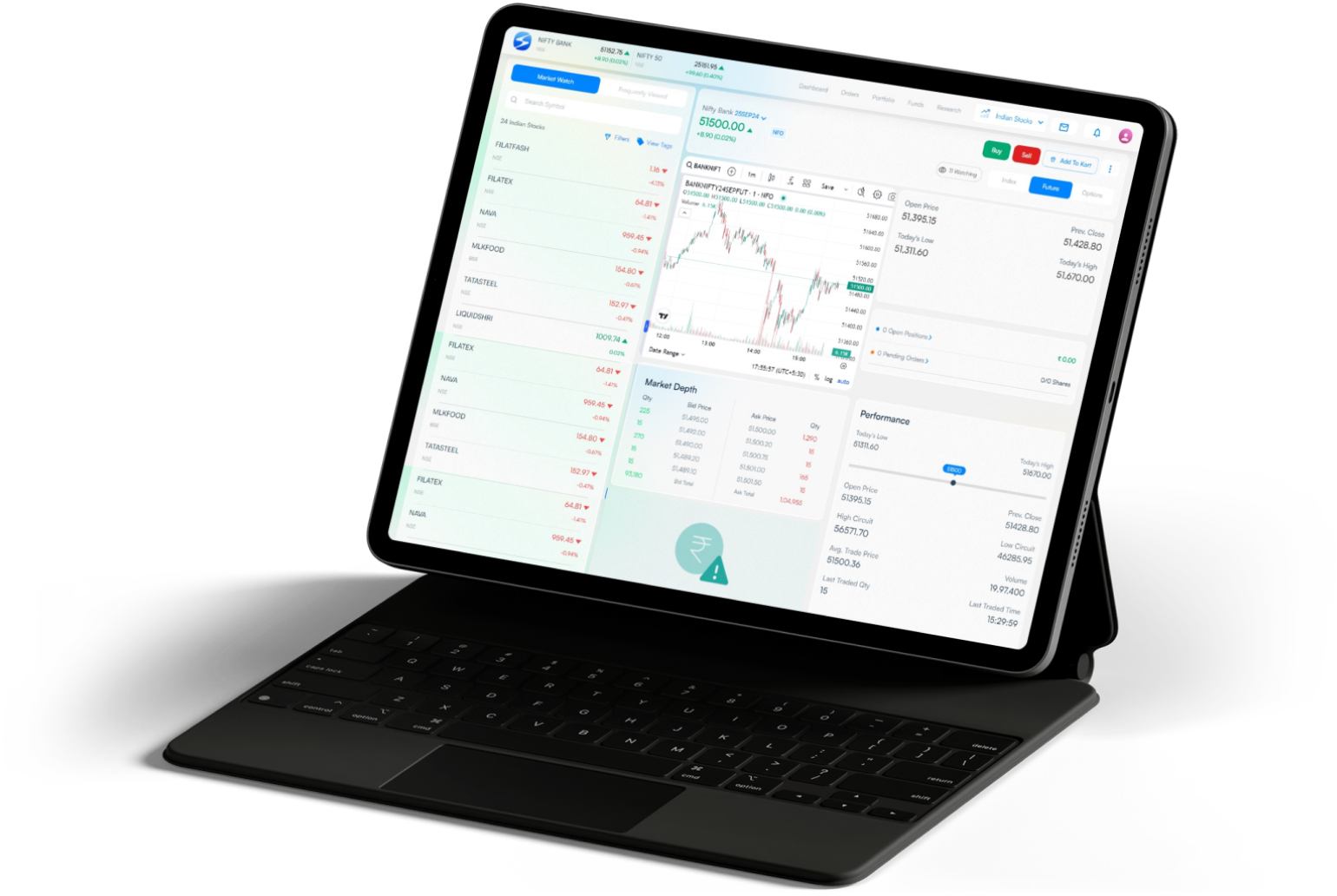

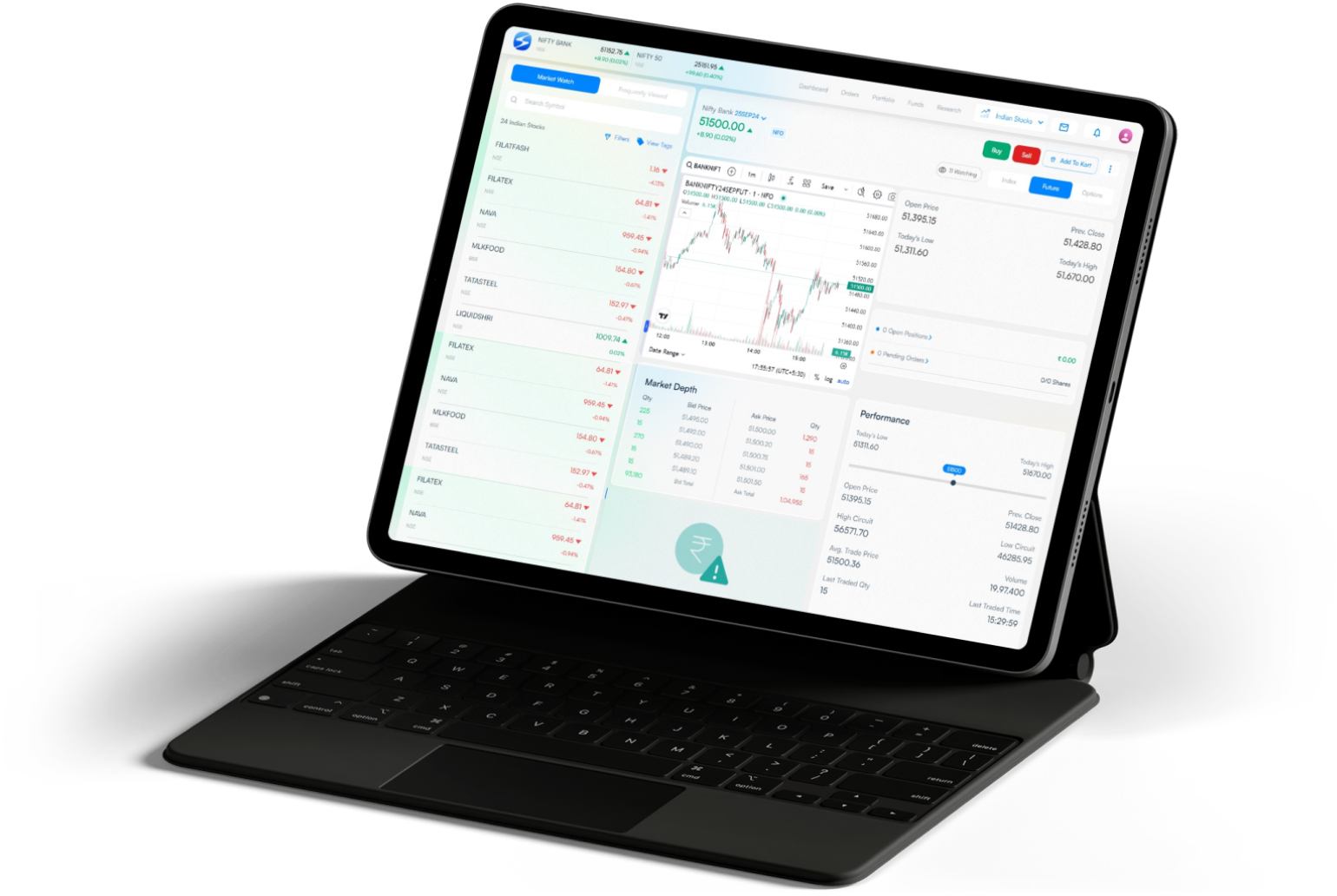

Features of HDFC SKY Web Trading Platform

Experience unmatched web trading with HDFC SKY’s feature-rich platform designed to empower traders of all levels. With a seamless blend of advanced technology and a user-friendly interface, you have all the important trading tools needed to invest wisely.

Portfolio Tracker

Monitor your investments effortlessly in one consolidated view.

Customisable Alerts

Get notified of market movements that allow you to act quickly and efficiently.

Automated Trading

Set up and execute trades automatically based on predefined parameters.

Risk Management Tools

Monitor and control your exposure with advanced risk assessment features.

Portfolio Tracker

Monitor your investments effortlessly in one consolidated view.

Customisable Alerts

Get notified of market movements that allow you to act quickly and efficiently.

Automated Trading

Set up and execute trades automatically based on predefined parameters.

Risk Management Tools

Monitor and control your exposure with advanced risk assessment features.

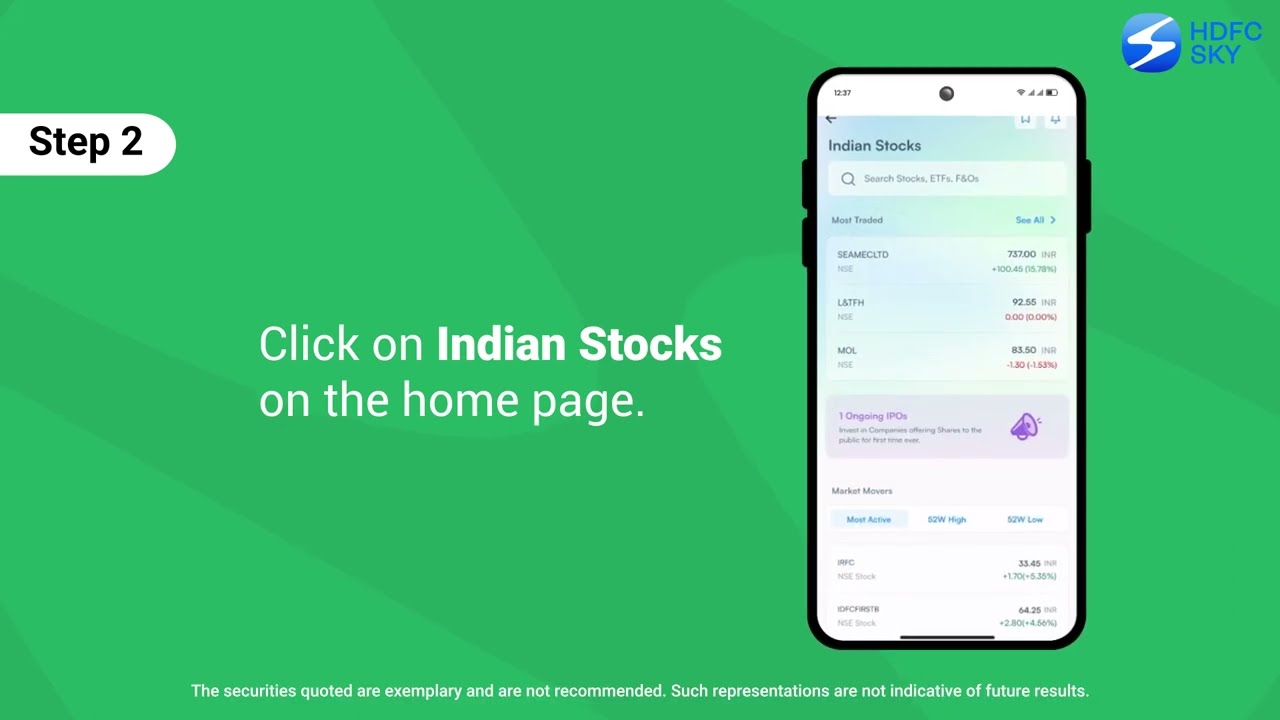

Why Choose HDFC Sky for Mobile Trading?

Daily Investment & Trades Ideas

Global Stocks

Market trends and global economic impacts

Risk management suggestions

Sector-specific recommendations

Portfolio Diversification Ideas

Customer Stories

The testimonials from our clients highlight exceptional experience we deliver. Explore the testimonials to see why we are the preferred choice for investors and traders alike.

Sahil More

Trading on HDFC SKY

Abhishek Gharat

Trading on HDFC SKY

Mahesh R Nair

Trading on HDFC SKY

Watch to Discover The Power of Web Trading

The Evolution of Trading: From Floor to Screen

Trading has come a long way from the bustling trading floors of stock exchanges to the quiet clicks of a mouse. Introduced in the late 1990s, web trading marked a significant milestone in the democratization of financial markets. Through web trading, individual investors had access to tools and information previously reserved for professional traders and large institutions. This allowed almost everyone to trade safely and move closer to their financial goals..

Advantages of Web Trading Accessibility:

Trade from any location with internet access, providing flexibility and convenience. Whether you’re at home or on the go, you can manage your trades without being tied to a specific device.

Cost-Effectiveness:

Web trading platforms often have lower commissions and fees compared to traditional broking services.

Control:

Manage your trades with a high level of control and customization. Set specific parameters and automate trading strategies to fit your individual needs and preferences.

Educational Resources:

Many platforms offer built-in educational resources, including tutorials and market analysis. These tools help you learn and improve your trading skills directly from the platform. It is also highly helpful to practice trading risk-free on web trading platforms.

Challenges and Considerations :

While web trading offers numerous advantages, it’s important to be aware of potential challenges.

Information Overload:

The abundance of data can be overwhelming for new traders. The constant stream of market news, real-time data, and technical indicators can lead to analysis paralysis, where too much information makes it difficult to make clear decisions. To manage this, focus on filtering relevant data and using tools that streamline information.

Technical Issues:

Platform downtime or connectivity problems can impact trading activities. Ensure you use a reliable platform, have a backup plan for critical trades, and regularly check your internet connection.

Emotional Trading:

The ease of access that comes with web trading has been known to lead to impulsive decisions. Traders might react impulsively to market fluctuations, driven by fear or greed, rather than following a disciplined trading strategy. To avoid this, establish a clear trading plan and adhere to risk management strategies. Risk Management Strategies in Web Trading Effective risk management is vital to protecting your investments and ensuring long-term success in web trading.

Here are some key strategies:

1. Set Stop-Loss Orders –

A stop-loss order automatically closes a trade when the price reaches a certain level, limiting potential losses. This helps protect your capital from significant downturns.

2. Diversify Your Portfolio –

Avoid putting all your investments into a single asset or market. Diversifying your portfolio across different assets and sectors reduces the risk of substantial losses from any single investment.

3. Use Take-Profit Orders –

A take-profit order locks in gains by automatically closing a trade when it reaches a target profit level. This strategy helps you secure profits and prevent the reversal of favorable price movements.

Latest Articles

Check out the latest articles on web development and programming.

FAQ's on Web Trading Platform

What types of orders can I place in web trading?

Common order types include market orders (buy/sell at current prices), limit orders (buy/sell at a specified price), stop-loss orders (sell when a price falls below a set level), and take-profit orders (sell when a price reaches a target level).

How can I track trading performance?

Use the platform’s reporting and analysis tools to track your trading performance. HDFC SKY offers features like trade history, performance charts, and analytics to help you review your trades and assess your success.

How can I protect myself from fraud while trading online?

Protect yourself by using a secure, reputable trading platform with strong encryption and two-factor authentication. Avoid sharing your login details, be cautious of phishing attempts, and regularly monitor your account for any suspicious activity.

How do I understand and use trading charts effectively?

Learn to read and interpret trading charts by studying key elements like price trends, support and resistance levels, and technical indicators (e.g., moving averages, RSI).

What are margin and leverage in web trading?

Margin refers to the amount of capital required to open and maintain a trading position. Leverage allows you to control a larger position with a smaller amount of your own money. While leverage can amplify profits, it also increases the risk of significant losses, so use it cautiously.