- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Futures and Options Trading Online with HDFC Sky

Master F&O Trading – Real-Time Data, Strategy Builders & Expert Research Picks

F&O Features: Advanced F&O Tools at your fingertips

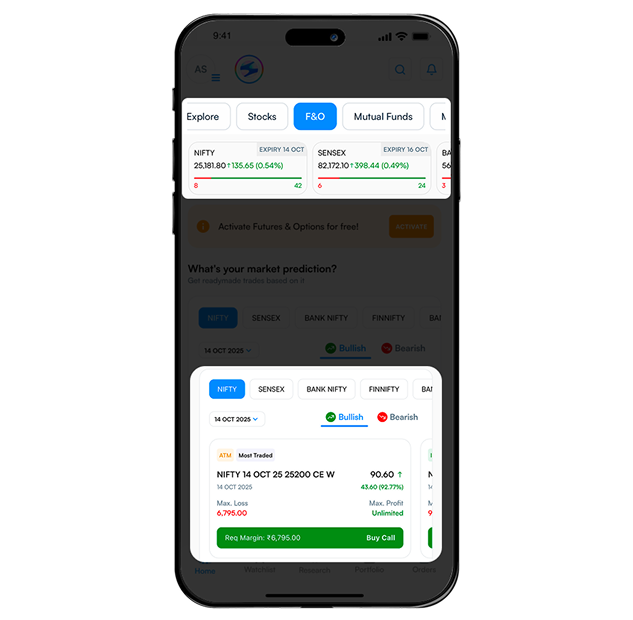

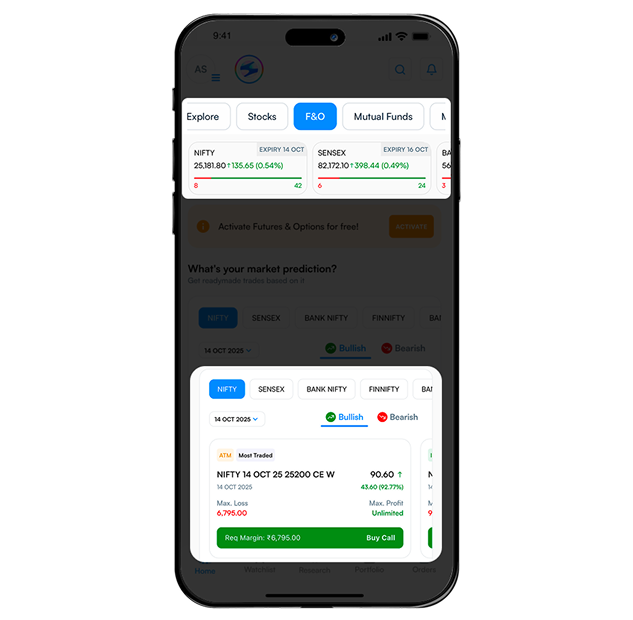

All-in-one F&O dashboard

Advanced Option & Future Chain

Quick Options

Heatmaps

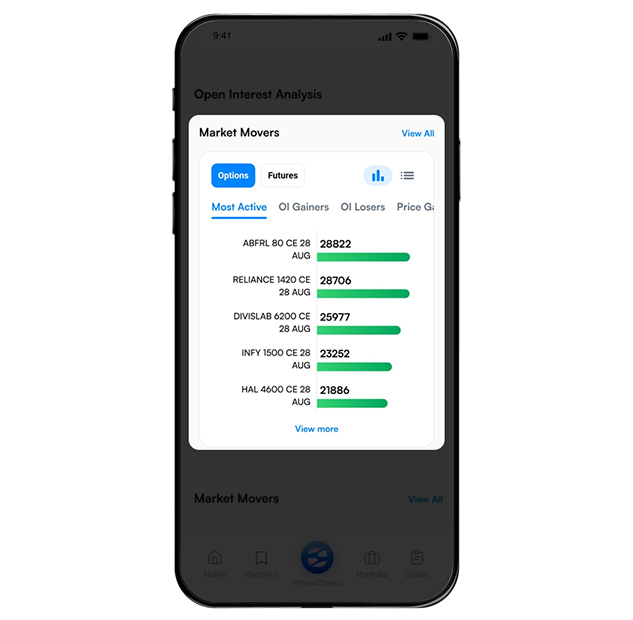

Open Interest Analysis

Market Movers & Scanners

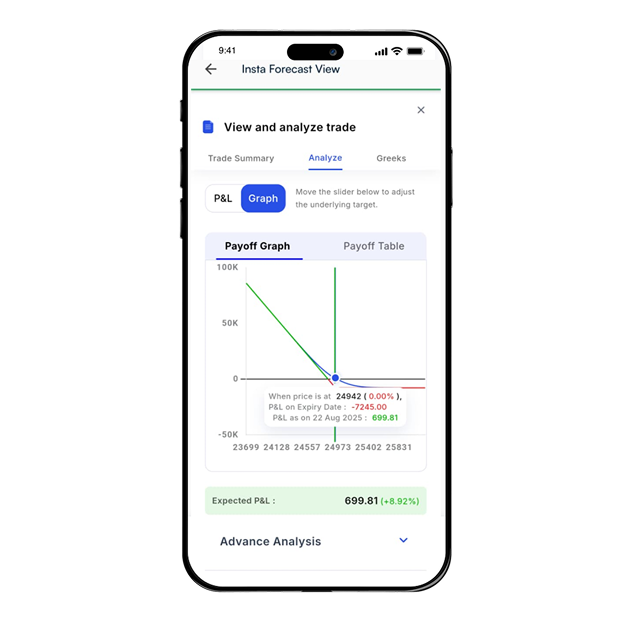

Payoff Analyzer

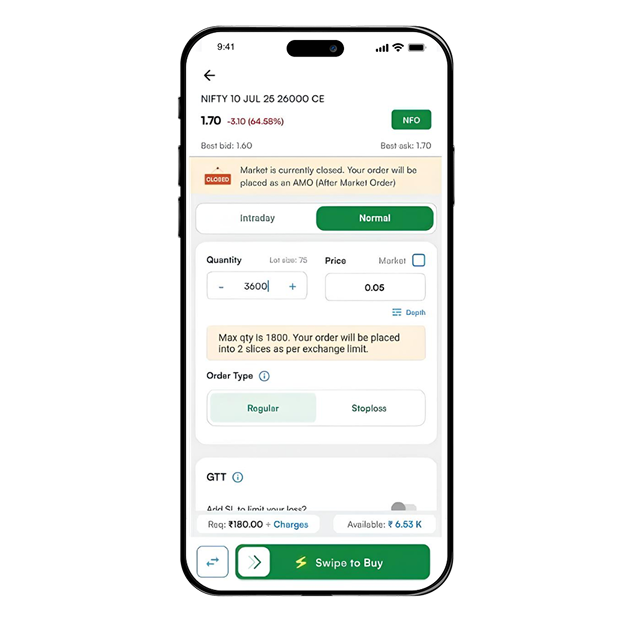

Auto Order Slicer

All-in-one F&O dashboard

Experience Powerful Options Trading

All-in-one F&O dashboard

Experience Powerful Options Trading

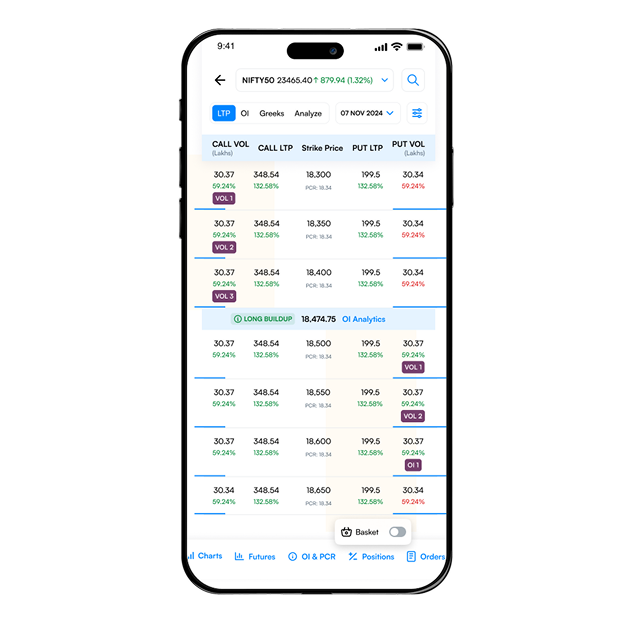

Advanced Option & Future Chain

Dive deep into contract analysis

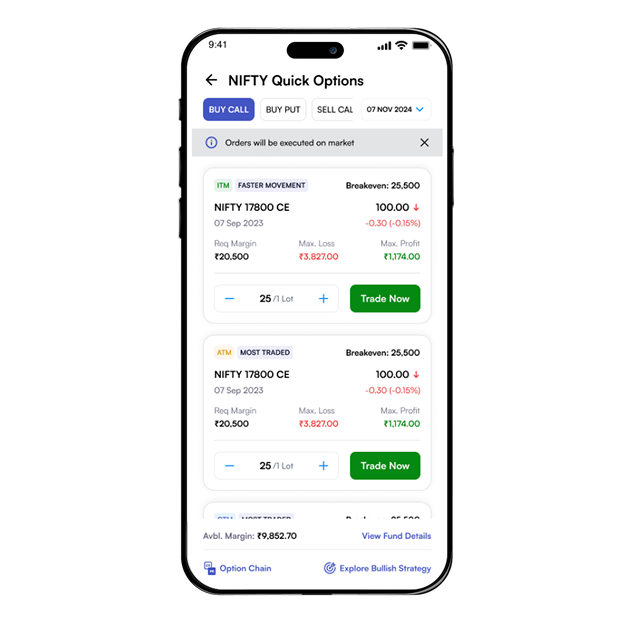

Quick Options

Readymade Option Trades based on your market view

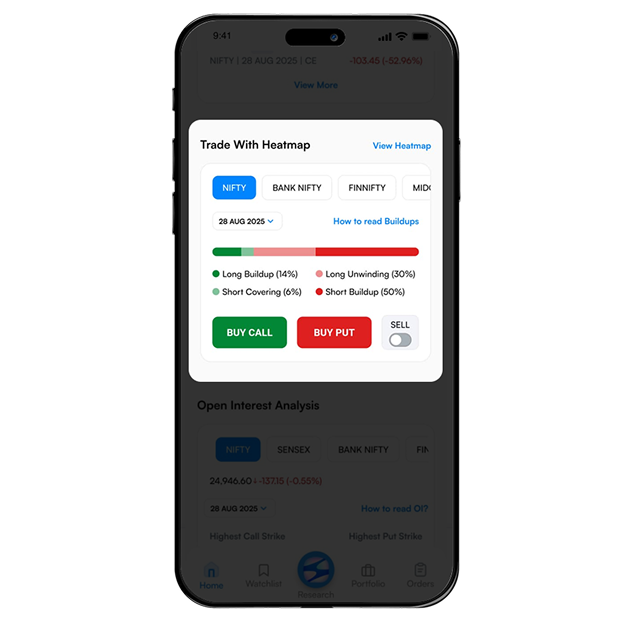

Heatmaps

Visualize market breadth at a glance

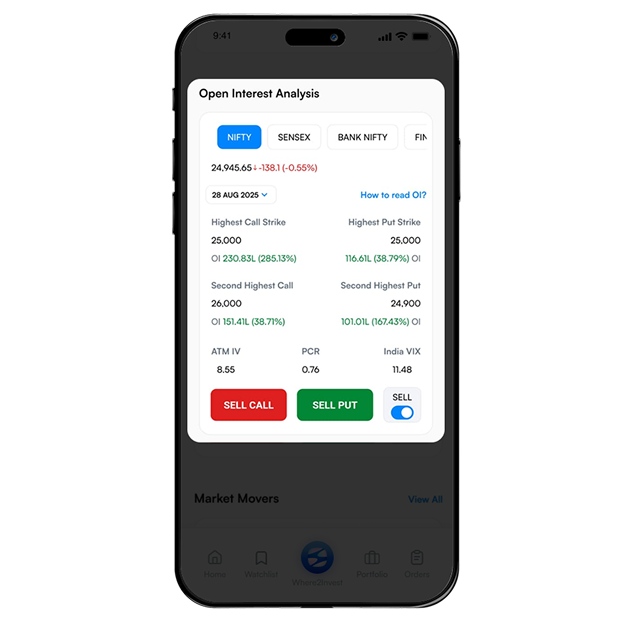

Open Interest Analysis

Gauge market sentiment

Market Movers & Scanners

Identify active trading opportunities

Payoff Analyzer

Evaluate Potential Profit/Loss for a trade

Auto Order Slicer

No more freeze limits - Big orders get sliced into smaller lots automatically

Discover Elevated F&O Trading

Explore NowFeatures of Derivative Trading

Liquidity

Easily enter and exit positions with high market participation

Leverage Potential

Amplify your returns with a smaller investment

Multi-asset Trading

Access a wide range of derivatives, including futures, options, and swaps

Order Types

Execute various order types, from market orders to complex algorithmic trades

Strategy Builder

Create and backtest custom trading strategies using historical data

Margin Calculator

Easily determine the required margin for your derivative positions.

Short Selling

Potential funds from declining markets by selling derivatives contracts

Speculation

Take advantage of price movements in the underlying assets

Liquidity

Easily enter and exit positions with high market participation

Leverage Potential

Amplify your returns with a smaller investment

Multi-asset Trading

Access a wide range of derivatives, including futures, options, and swaps

Order Types

Execute various order types, from market orders to complex algorithmic trades

Strategy Builder

Create and backtest custom trading strategies using historical data

Margin Calculator

Easily determine the required margin for your derivative positions.

Short Selling

Potential funds from declining markets by selling derivatives contracts

Speculation

Take advantage of price movements in the underlying assets

Futures and Options Trading Charges with HDFC Sky

Trade in futures and options with our transparent trading charges

Derivative Futures Intraday

₹20 or 2.5% (whichever is lower)

Derivative Futures Carry Forward

₹20 or 2.5% (whichever is lower)

Derivative Options Intraday

₹20 / Order

Derivative Options Carry Forward

₹20 / Order

Our clients’ success stories speak volumes about the effectiveness of HDFC SKY’s derivative trading platform. From seasoned investors to newcomers in the financial markets, traders across India have experienced significant growth in their portfolios.

What are Futures and Options?

Derivative trading is an important part of financial markets that offers many opportunities for investors and traders. Derivatives are financial contracts whose value is derived from an underlying asset, such as stocks, bonds, commodities, or currencies. These contracts can be used to hedge risks, speculate on price movements, or gain access to assets or markets. The primary goal is to capitalise on the changing value of the underlying asset without actually owning it. What are Derivatives? Derivatives are financial instruments that derive their value from an underlying asset. Common types include futures, options, forwards, and swaps. Each type of derivative serves a unique purpose in the financial markets, allowing traders to hedge risks, speculate on price movements, or gain access to certain markets or assets. In simpler words, Derivatives are financial contracts that derives their value from something else. This “something else” can be an asset or group of assets. Common underlying assets include:

- Commodities (like oil or wheat)

- Stocks

- Bonds

- Interest rates

- Market indexes

- Currencies

The key thing to remember is that the value of a derivative changes based on changes in the value of the underlying asset. This relationship is what makes derivatives powerful but also complex.

Futures and Options Example:

Suppose stock ABC is trading at ₹100.

- Futures Example: You buy a futures contract of ABC at ₹105 expecting the price to rise. If the price goes to ₹110, you profit ₹5 per share.

- Options Example: You buy a call option for ABC with a strike price of ₹105 by paying a premium of ₹2. If the stock rises to ₹110, your profit is ₹3 (₹110 – ₹105 – ₹2).

How to Trade in Futures and Options:

- Open a Trading & Demat Account: Register with a SEBI-registered broker who offers F&O services.

- Complete KYC: Submit PAN, Aadhaar, bank proof, and income details for F&O activation.

- Understand Market Basics: Learn how futures and options contracts work, including margin, premiums, expiry, etc.

- Select the Right Contract: Choose an index or stock contract based on research, risk appetite, and strategy.

- Place an Order: Use your trading platform to buy/sell futures or options contracts.

- Monitor and Manage: Track your position and exit before expiry or square off as needed.

- Set Stop Losses: Always manage risk using stop-loss orders to minimise losses.

Types of Derivatives Trading

Derivatives come in several different forms. Each type has its own characteristics and uses. Let’s explore the four main types of derivatives: futures, forwards, options, and swaps.

Futures:

Futures are contracts that require t he purchase or sale of an asset at a predetermined price on a specific future date. These contracts are traded on exchanges, providing transparency and liquidity. For example, a wheat farmer might sell wheat futures to lock in a price for their harvest, protecting against possible price drops. On the other hand, a cereal manufacturer might buy wheat futures to secure their future supply costs

Key Features

- Can be traded on exchanges or privately

- Provide flexibility and limited risk for buyers

- Come in two main types: calls (right to buy) and puts (right to sell)

- Can be used for hedging, income generation, or speculation

Options:

An option is a financial contract that gives the buyer the right to buy or sell a specific asset at a predetermined price within a predetermined time frame

Key Features

- Can be used for both hedging and speculation

- Require a margin account

- Prices are updated daily

- Traded on exchanges

Forwards:

Forwards are customised contracts similar to futures but are not traded on exchanges. These over-the-counter contracts are tailored to the specific needs of the parties involved.To understand using an example, let’s assume: A U.S. company expecting to receive a large payment in euros in six months might agree with a bank to exchange those euros for dollars at a set rate. This protects the company against changes in currency exchange rates.

Key Features

- Privately negotiated, not traded on exchanges

- Terms can be flexible

- Usually settled at the end of the contract

- Often used in foreign exchange markets

Swaps:

Swaps involve the exchange of cash flows between two parties, usually based on different financial instruments or interest rates. These contracts are often used to manage interest rates or currency exchange risks.Example: Two companies, one with fixed-rate debt and another with variable-rate debt, enter into an interest-rate swap. The fixed-rate company agrees to pay a floating rate, and the variable-rate company pays a fixed rate, allowing each to align with their financial strategies.

Key Features

- Typically private contracts

- Can involve various underlying assets or rates (interest rates, currencies, commodities)

- Often used for managing interest rate or currency risk

- Can be customised to meet specific needs

Other Derivatives:

While futures, forwards, options, and swaps are the main categories, there are many other types of derivatives. These are often combinations or variations of the basic types. Some examples include:

- Credit Default Swaps (CDS): These protect against the risk of a bond default.

- Collateralised Debt Obligations (CDOs): These are complex products that bundle together cash flow-generating assets.

- Weather Derivatives: These help companies protect against weather-related losses.

- Exotic Options: These are more complex versions of standard options, with special features.

Understanding these various types of derivatives is crucial for anyone looking to trade them. Each type has its own risk and reward profile and is suited to different trading strategies and market conditions.

Participants in F&O Trading

Derivative markets consist of various participants, each playing a unique role. Understanding these participants helps in analysing market dynamics and making informed trading decisions.

Hedgers

Hedgers are typically companies, large investors, or individuals who use derivatives to reduce risk. What hedgers do:

- Their main goal is to manage risk

- They often deal with the underlying asset in their regular business

- They use derivatives to lock in prices or rates for future transactions

Example: An airline might use oil futures to protect against possible increases in fuel prices. This helps them manage their costs and reduce uncertainty in their business.

Speculators

Speculators are traders who try to make money by predicting price movements in the derivatives market. What speculators do:

- Their main goal is to take advantage of market fluctuations

- They often use leverage to increase potential returns

- They’re willing to take on higher risks for the possibility of higher rewards

- They can be individual traders, hedge funds, or trading firms

Example: A trader might buy call options on a stock if they think the stock price will go up soon.

Arbitrageurs

Arbitrageurs look for price differences between related securities or markets to make a profit. What arbitrageurs do:

- They look for risk-free profit opportunities

- They often use complex computer programs and fast trading

- They help keep prices consistent across different markets

- They’re typically large financial institutions or specialised trading firms

Example: An arbitrageur might notice that a stock’s price is slightly higher on one exchange than on another exchange. They could buy the stock on the exchange where it is trading lower and sell it on another exchange where it is trading higher at the same time, making a small profit from the price difference.

Market Makers

Market makers are firms or individuals who provide liquidity to the market by always being ready to buy or sell derivatives. What market makers do:

- They continuously offer both buy and sell prices

- They make money from the difference between bid and ask spread

- They provide the market with liquidity and ensure its ongoing functionality.

- They’re often large financial institutions or specialised trading firms

Example: In the options market, a market maker might always offer to buy a particular option for Rs. 100 and sell it for Rs.100.5. They make a Rs. 0.5 profit on each transaction while helping to keep the market running smoothly.

Clearing Houses

Clearing houses act as middlemen between buyers and sellers in the derivatives market. What clearing houses do:

- They make sure the derivatives market works smoothly and safely

- They act as counterparties to both sides of a derivative trade

- They manage the risk of traders not fulfilling their obligations

- They’re often associated with specific exchanges

Example: When two parties agree to a futures contract, the clearing house becomes the buyer to the seller and the seller to the buyer. This reduces risk and allows traders to enter and exit positions more easily.

Regulators

Regulators oversee the derivatives market to ensure fair practices and maintain market integrity. What regulators do:

- They set and enforce rules for market participants

- They watch for market manipulation and fraud

- They aim to protect investors and keep the market stable

Examples include the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in the United States.

Example: After the 2008 financial crisis, regulators created new rules requiring many over-the-counter derivatives to be cleared through central counterparties, aiming to reduce risk in the financial system.

Benefits of Futures and Options Trading

Derivative trading offers numerous advantages that can enhance trading strategies and improve portfolio performance. Understanding these advantages is important for anyone considering derivative trading.

Risk Management:

One of the main advantages of derivatives is that they help manage risk. Derivatives allow investors and businesses to protect themselves against various types of risk, including:

- Price changes in equity, currency, commodities etc

- Changes in interest rates

- Changes in currency exchange rates

- Credit risk

Leverage:

Derivatives enable traders to take large positions with relatively small amounts of capital, offering the potential for significant returns. Here are some ways leverage makes derivative trading beneficial:

- Possibility of higher returns on investment

- Relatively small amounts can get you large exposure

- More efficient use of capital

Price Discovery:

Derivative markets contribute to price discovery, helping to establish the future value of underlying assets based on market expectations and information. Here is how price discovery plays a role in making derivative trading beneficial:

- Provides valuable information about what the market expects

- Helps in determining the fair value of assets

- Can reduce pricing differences across different markets

Portfolio Diversification:

Derivatives can be used to diversify an investment portfolio, spreading risk across different asset classes and reducing overall exposure to any single market. Here are some key benefits:

- Ability to diversify investment portfolio

- Access to foreign markets without direct foreign investment

- Exposure to commodities without physical storage

Cost Effective:

Trading derivatives can be more cost-effective than directly trading the underlying asset due to lower transaction costs and the ability to leverage positions. There are also low transaction costs involved when trading derivatives instead of trading underlying assets directly:

- Lower commission costs compared to trading underlying assets

- Reduced impact of buy-sell price differences, especially for large trades

- No need for physical delivery or storage in many cases

Profit Potential:

By speculating on price movements, traders can profit from both rising and falling markets, making derivatives a versatile tool for active traders. Also, derivatives strategies can be used to generate additional income from existing investments.

- Enhance returns on existing portfolios

- Generate income in flat or slightly declining markets

Knowing these advantages of derivative trading can be helpful for traders both beginners and experts. However, it’s also crucial to understand the risks involved, as derivatives can be complex and potentially lead to significant losses if not used carefully.

Disadvantages of Futures and Options Trading

While derivative trading offers many advantages, it also comes with significant and potential drawbacks. It’s crucial to understand these before engaging in derivative trading.

High Leverage:

Leverage is a double-edged sword; while it can lead to significant gains, the potential for large, rapid losses requires traders to manage their positions with great caution.

- It allows traders to control large positions with a small amount of capital. While this can generate return, it can also lead to losses. If the market moves against a trader’s position, they may face substantial financial losses, sometimes exceeding their initial investment.

Complexity:

Derivative trading is inherently complex, often involving intricate financial concepts and strategies. Understanding the nuances of different derivatives, such as futures, options, and swaps, requires a deep level of financial literacy.

- This complexity can be a barrier to entry for beginners, leading to mistakes and financial losses if not properly understood. Misinterpreting market signals or misunderstanding the terms of a contract can result in costly errors.

Market Volatility:

Derivatives are sensitive to market volatility, meaning that even small changes in the market can significantly impact the value of a derivative.

- This can lead to rapid and unpredictable price movements, making it difficult to manage positions effectively. Traders may find it challenging to predict market movements, leading to sudden losses. This volatility is particularly dangerous for those using high leverage, as it can quickly erode capital.

Counterparty Risk:

In derivative contracts, especially over-the-counter (OTC) derivatives, there is a risk that the counterparty may default on their obligations. This is known as counterparty risk.

- For example, if a counterparty fails to deliver an asset or make a payment as agreed, the other party may incur significant losses. While exchanges mitigate this risk for standardised derivatives, it remains a concern in OTC markets.

Regulations and Legal Considerations:

Derivatives are subject to complex regulations that vary by country and market. Changes in regulations or legal environments can affect the availability and pricing of derivatives.

- For instance, after the 2008 financial crisis, new regulations required many OTC derivatives to be cleared through central counterparties, changing the market structure.

- Traders must stay informed about regulatory changes, as non-compliance can lead to penalties, legal issues, or forced liquidation of positions. Additionally, new regulations can impact the profitability and feasibility of certain derivative strategies.

Liquidity:

Some derivatives, particularly in less common markets or complex instruments, may suffer from low liquidity. This means that there may not be enough buyers or sellers to execute trades at desired prices.

- Liquidity risk can lead to difficulty in exiting positions, forcing traders to sell at unfavorable prices or hold onto positions longer than intended. In extreme cases, a lack of liquidity can lead to significant financial losses, especially during market crises.

By expanding on these disadvantages, it’s clear that while derivatives can be powerful tools for managing risk and speculation, they also come with significant challenges that require careful consideration and expertise.

Mistakes to Avoid in Derivative Trading

The above-mentioned points show us that derivative trading is not free of disadvantages. It can be complex and risky. However, knowing what mistakes can lead to these disadvantages can help investors avoid the negative consequences of derivative trading. Here are some mistakes you should avoid in derivative trading:

Beginning Without Fully Understanding F&O Trading:

One of the most common mistakes in derivative trading is jumping in without fully understanding how derivatives work. It’s essential to grasp the intricacies of the instruments you’re trading whether options, futures, or swaps.

- Misunderstanding how these products function can lead to significant losses. For instance, many traders fail to understand how option pricing models work, leading to poor decision-making.

Ignoring Market Trends:

Traders often make the mistake of ignoring broader market trends and focusing too narrowly on the specific derivative they are trading. This can lead to significant losses, especially when markets are highly volatile.

- For example, during a bearish market, ignoring the downward trend and continuing to take long positions in the future could be disastrous.

Overtrading:

The availability of leverage and the 24/7 nature of global markets can tempt traders into overtrading, leading to excessive risk-taking and increased transaction costs.

- Overtrading can deplete capital and lead to emotional decision-making, which often results in poor trading outcomes. It’s important for traders to maintain discipline and adhere to a well-defined trading strategy to avoid the pitfalls of overtrading.

Emotional Trading:

Letting emotions drive your trading decisions can lead to poor outcomes. Traders often chase losses or become overly confident after a win, leading to impulsive decisions.

- Emotional trading might cause you to hold onto losing positions for too long or exit winning trades prematurely.

Risk Management Strategies for F&O Trading Online

The above-mentioned points show us that derivative trading is not free of disadvantages. It can be complex and risky. However, knowing what mistakes can lead to these disadvantages can help investors avoid the negative consequences of derivative trading. Here are some mistakes you should avoid in derivative trading:

- Stop-Loss Orders: A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price. It’s designed to limit an investor’s loss of a position. For example, if you buy a stock at Rs. 100 and set a stop-loss at Rs. 95, your position will be automatically sold if the price drops to Rs. 95.

- Position Sizing: Position sizing refers to the amount of capital allocated to a particular trade. Proper position sizing helps to limit risk and manage capital effectively. For example, limiting any single trade to 2% of your total capital can help protect against significant losses.

Prerequisites for Futures and Options Trading

- Market Knowledge: Familiarise yourself with the basics of financial markets, including how different assets like stocks, commodities, and indices work. A strong understanding of the underlying assets you plan to trade is crucial.

- Capital Allocation: Before entering the derivative markets, ensure you have a dedicated portion of capital set aside specifically for trading derivatives. This capital should be separate from your savings or essential funds, as derivatives are high-risk instruments.

- Understanding Leverage: Grasp the concept of leverage and how it can magnify both returns and losses. It’s essential to know how margin requirements work and to prepare for potential margin calls if the market moves against you.

- Technical and Fundamental Analysis: Develop a solid foundation in both technical analysis (understanding charts, trends, and indicators) and fundamental analysis (analysing the financial health and potential of underlying assets). Being proficient in these analyses will help you make more informed trading decisions.

- Tax Implications: Ensure you are aware of the regulatory requirements and tax implications associated with derivative trading in your jurisdiction. This includes understanding how derivatives are taxed and complying with any reporting requirements.

10 Steps to Start Futures and Options Trading Online

- Educate Yourself: Begin by thoroughly educating yourself about derivative instruments and how they work. You can start with online courses, webinars, and reading material on financial markets and derivatives. Books such as “Options, Futures, and Other Derivatives” by John Hull provide a solid foundation.

- Choose a Reputable Broker: Select a broker that offers a wide range of derivatives, competitive pricing, and a robust trading platform. Ensure the broker is regulated and has a good reputation in the market. For instance, HDFC SKY offers a reliable platform with access to various derivative products.

- Open a Demat/Trading Account: Open Demat Account with your chosen broker. Depending on the broker, you may need to provide proof of identity, address, and financial details. Some brokers may require a minimum deposit to start trading derivatives.

- Develop a Trading Plan: Create a detailed trading plan that outlines your trading goals, risk tolerance, strategies, and the types of derivatives you plan to trade. This plan should also include guidelines for managing your capital and setting stop-loss levels.

- Start with a Demo Account: Before diving into live trading, practice with a demo account. This allows you to familiarise yourself with the trading platform and test your strategies without risking real money. Most brokers offer demo accounts that simulate real market conditions.

- Analyse the Market: Conduct a thorough market analysis before entering any trades. Use a combination of technical analysis, fundamental analysis, and market sentiment to inform your decisions. For example, before buying a call option, analyse the underlying asset’s price trends, volatility, and any upcoming events that might affect its price.

- Place Your First Trade: Once you feel confident in your knowledge and strategy, place your first trade. Start small to minimise risk and gradually increase your position size as you gain experience. For instance, if you’re trading options, you might begin with a single contract before scaling up.

- Monitor and Adjust: Continuously monitor your positions and the overall market. Be prepared to adjust your strategy based on market conditions, such as tightening stop-loss levels during periods of high volatility. Regularly review your trading performance to identify areas for improvement.

- Learn from Experience: Keep a trading journal to record all your trades, including the rationale behind each trade, the outcome, and any lessons learned. This practice helps you learn from your mistakes and refine your strategies over time.

- Expand Your Knowledge: As you gain experience, consider expanding your trading activities to include more complex derivatives, such as futures or swaps. Continue to educate yourself on advanced trading strategies and market analysis techniques to enhance your trading performance.

Learn More About Future and Options

Customer Stories

The testimonials from our clients highlight exceptional experience we deliver. Explore the testimonials to see why we are the preferred choice for investors and traders alike.

Sahil More

Trading on HDFC SKY

Abhishek Gharat

Trading on HDFC SKY

Mahesh R Nair

Trading on HDFC SKY

FAQ`s on Futures and Options

What are Futures and Options?

Futures and Options are financial derivatives that let traders speculate on or hedge against the price movement of assets without owning them.

What are derivatives?

Derivatives are financial contracts whose value is derived from an underlying asset like stocks, bonds, or commodities. Common types include options, futures, and swaps. They are used for hedging risks, speculation, or gaining access to assets or markets.

What are the 4 types of derivatives?

The four main types of derivatives are futures, options, forwards, and swaps.

What is the difference between futures and options?

Futures are contracts that obligate the buyer to purchase, and the seller to sell, a specific asset at a predetermined price and date. Options, on the other hand, give the buyer the right, but not the obligation, to buy or sell an asset at a specified price before or at the expiration date.

What is Futures and Options trading time?

In India, Equity F&O trades from 9:15 AM to 3:30 PM. Currency F&O runs from 9:00 AM to 5:00 PM, while Commodity F&O (MCX) extends up to 11:30 PM.

What is the full form of F&O in the stock market?

F&O stands for Futures and Options. These are types of derivatives contracts used in the stock market to hedge risks or speculate on price movements.

How to Invest in Futures and Options?

To invest in F&O, open a trading and demat account with a broker, complete KYC, enable F&O segment, analyse market trends, and place your order through the broker’s platform.

How does margin work in derivative trading?

Margin in derivative trading refers to the collateral required by the broker to cover the credit risk involved in trading derivatives. When you open a leveraged position, you only need to deposit a fraction of the total value of the contract, known as the margin. However, if the market moves against your position, you may need to deposit additional funds to maintain the position, known as a margin call.

What is the role of a clearinghouse in derivative trading?

A clearinghouse acts as an intermediary between buyers and sellers in derivative markets, ensuring the integrity of the trades and guaranteeing the performance of the contracts by managing counterparty risk. If one party defaults, the clearinghouse steps in to ensure that the other party receives what they are owed, thereby maintaining market stability.

What is time decay?

Time decay refers to the reduction in the value of an options contract as it approaches its expiration date. Since options have a finite life, the value of the option’s time component (known as extrinsic value) decreases as the expiration date nears, assuming all other factors remain constant. This can erode the value of the option, particularly for those who hold options for an extended period.

What is the strike price in an options contract?

The strike price in an options contract is the predetermined price at which the underlying asset can be bought or sold. Traders choose a strike price based on their expectations of the asset’s future price movements. For example, if a trader believes a stock will rise, they might choose a strike price below the expected market price to maximize potential profit from a call option.

What are "in-the-money", "at-the-money", and "out-of-the-money" options?

“In-the-money” (ITM) options have intrinsic value, meaning the underlying asset price is favorable compared to the strike price. “At-the-money” (ATM) options have a strike price equal to the current market price. “Out-of-the-money” (OTM) options have a strike price less favorable than the market price, with no intrinsic value.

What are the tax implications of derivative trading?

Taxation of derivatives varies depending on the type of contract and jurisdiction. In many regions, profits from derivative trading are subject to capital gains tax. However, losses can often be used to offset other income. Traders should consult with a tax professional to understand specific tax obligations and strategies to optimize their tax situation.

How does market volatility impact derivative pricing?

Volatility plays a critical role in determining the price of derivatives, particularly options. Higher volatility increases the likelihood of large price swings, raising the premium on options contracts. On the other hand, low volatility can decrease the value of options due to reduced expectations of significant price movements.

What is the purpose of hedging in derivative trading?

Hedging involves using derivatives to reduce the risk of adverse price movements in an underlying asset. For instance, a company expecting to receive payment in foreign currency in the future might use currency futures to lock in the exchange rate, protecting against unfavorable currency fluctuations. Hedging helps manage risk but can also limit potential gains.

Are there any specific regulations governing derivative trading?

Derivative trading is subject to various regulations that vary by country. These regulations are designed to protect market participants and ensure market integrity.