- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

How IPO Allotment Works? Know IPO Allotment Rules & Factors Affecting IPO Allotment Chances

By Shishta Dutta | Updated at: Sep 8, 2025 04:30 PM IST

Understanding how IPO allotment works is essential for investors eager to participate in a company’s public offering. IPO allotment is the process by which shares are distributed to investors who apply during the subscription period. Given the high demand in popular IPOs allotment is often done through a lottery system especially for retail investors. This ensures a fair and transparent allocation based on regulatory guidelines

IPO Allotment Rules

IPO Allotment Rules are set by SEBI to ensure fairness and transparency in the distribution of shares.

- Retail Investor Quota: 35% of shares are reserved for retail investors.

- Minimum Lot Size: Investors must bid in multiples of the lot size set by the company.

- Oversubscription Handling: In case of oversubscription, allotment is done via lottery.

- Proportional Allotment: For HNIs and QIBs, shares are allotted proportionally based on the application size.

- PAN Verification: PAN is mandatory to ensure no duplicate applications.

- Refunds: Refunds are processed for unallotted shares post-allotment.

These rules ensure a structured and unbiased allotment process.

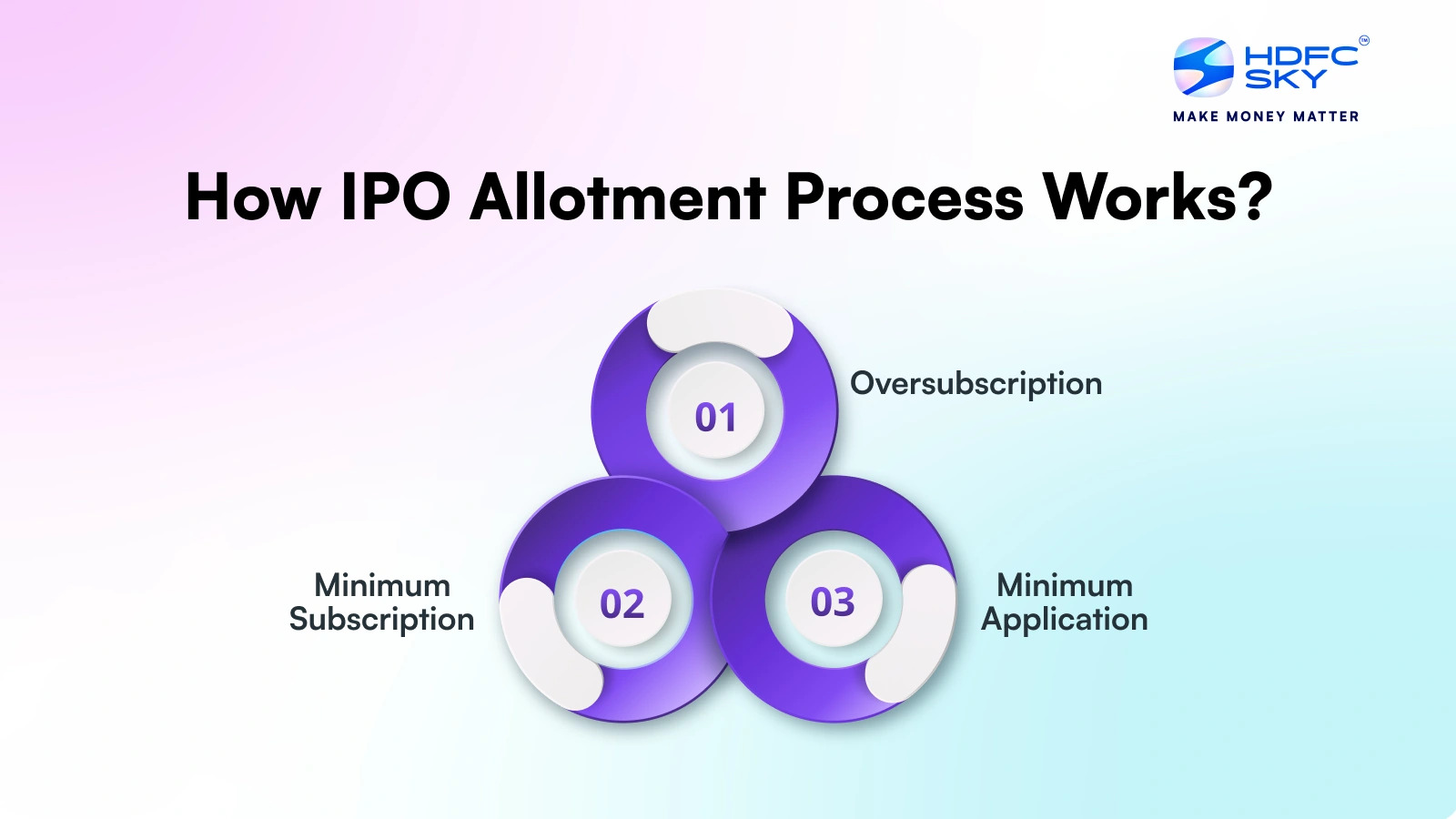

IPO Allotment Process

Understanding the IPO share allotment process might be a little challenging because ordinary investors are frequently given fewer shares or none at all. Below is a step-by-step guide to how an IPO allotment process happens:

Minimum Application: This is the smallest amount you can invest in an IPO, which is usually around Rs 15,000. You can apply for this amount or in multiples of it, depending on the lot size. For example, if the lot size is 25 shares, you can apply for 25 shares, 50 shares, 75 shares, and so on.

Minimum Subscription: This is the minimum number of shares that must be applied for in an IPO. If this minimum subscription is not met (usually set at 90% of the total shares offered), the IPO is cancelled. For instance, if a company wants to sell Rs 10 lakh worth of shares, it needs applicants willing to buy at least Rs 9 lakh worth across categories.

Oversubscription: This happens when a company receives more applications than it can allot. For example, if a company sets aside 100 lots for retail investors and receives bids for 150 lots, the retail category is oversubscribed by 1.5 times.

How Shares are Allotted in IPO

When an IPO is oversubscribed, share allotment is done based on SEBI rules and investor categories. Here’s how the process works:

- Categorization of Investors:

- Retail Investors (RIIs)

- High Net-worth Individuals (HNIs)

- Qualified Institutional Buyers (QIBs)

- Retail Investors:

- If oversubscribed allotment is done via a lottery system.

- Each eligible applicant may receive at least one lot depending on availability.

- HNIs and QIBs:

- Shares are allotted proportionally based on the size of the application.

- Minimum Subscription:

- The IPO must receive at least 90% subscription for allotment to happen.

- Refund and Credit:

- Unsuccessful applicants receive refunds and successful ones get shares in their demat account.

This process ensures fair and transparent distribution of IPO shares.

Types of IPO Investors in India

When a company launches an IPO, investors are grouped into different categories based on their profile. The IPO allotment process also varies slightly for each group.

- Retail Individual Investors (RIIs)

Individuals who invest up to ₹2 lakh. Allotment is usually done through a lottery if oversubscribed. - High Net-Worth Individuals (HNIs)

Investors who apply for more than ₹2 lakh. Allotment is done proportionally, based on demand. - Qualified Institutional Buyers (QIBs)

Includes mutual funds, banks, and insurance companies. They are allotted shares on a discretionary basis. - Anchor Investors

A sub-category of QIBs who invest before the IPO opens to the public. Their involvement adds credibility.

Procedure for Allotment of Shares in IPO

Here is the step-by-step process followed for IPO share allotment in India:

- IPO Closes: The subscription window (usually 3 days) ends and all investor bids are recorded.

- Application Verification: The registrar checks for valid applications and ensures the required funds are blocked in the investors’ bank accounts.

- Oversubscription Handling:

- If oversubscribed shares are allotted via a lottery system (for retail investors).

- In other categories allotment is proportional to the applied amount.

- Basis of Allotment Finalized: The registrar prepares the “Basis of Allotment” in coordination with stock exchanges and SEBI.

- Credit of Shares: Allotted shares are credited to investors’ demat accounts.

- Refund Initiation: If not allotted or partially allotted, the remaining amount is unblocked or refunded.

- Listing on Stock Exchange: Shares are listed on the stock exchange within a few days after allotment.

This process is designed to ensure fair and transparent distribution of IPO shares to investors.

How to Check IPO Allotment Status

You can check your IPO allotment status online through any of the following methods:

- Registrar’s Website

- Visit the website of the IPO’s registrar (e.g., Link Intime, KFintech).

- Enter your PAN, application number, or DP/Client ID to check status.

- Stock Exchange Website

- Go to BSE or NSE IPO allotment page.

- Select the IPO, enter your PAN and application details to view status.

- Through Broker or Demat Account

- Log in to your trading app or demat account (like HDFC SKY).

- The allotment status is often updated automatically once released.

- Email/SMS Notification

- You may receive an official email or SMS from the registrar about your allotment result.

- Allotment status is usually available 3–7 days after IPO closing.

Factors Affecting IPO Allotment Chances

Your chances of IPO allotment depend on factors like subscription levels, bid price and investor category. Understanding these can help you plan better.

- Investor Category

- Allotment quotas vary for retail, HNI, QIB and employee categories.

- Retail investors have a reservation of up to 35%.

- Oversubscription Level

- Heavily oversubscribed IPOs reduce individual chances of allotment.

- In such cases allotment is done via a lottery system.

- Lot Size & Number of Applications

- Applying with multiple PANs or lots doesn’t guarantee allotment.

- Only one lot is allotted in case of high oversubscription.

- Timing of Application

- Applying earlier doesn’t improve allotment chances SEBI uses a fair process not time-based.

- Bid Price in Book Building IPOs

- Bidding at the cut-off price improves allotment chances in book-built issues.

- Technical Errors

- Incorrect details (like wrong PAN or insufficient funds) can lead to rejection.

Understanding these can help you make informed decisions while applying for IPOs.

Conclusion

Understanding how the IPO allotment process works helps investors set realistic expectations and avoid confusion after applying. Since allotment depends on factors like subscription level and investor category, it is important to know how shares are distributed. Whether it’s a lottery for retail investors or proportional allotment for others, being aware of the process allows investors to make informed decisions and manage their investments with more confidence.

Related Articles

FAQs on How IPO Allotment Works?

What are the chances of IPO allotment?

IPO allotment chances depend on demand and the number of retail applicants. In oversubscribed IPOs, allotment is done through a lottery system, giving each applicant an equal chance, regardless of bid amount.

Can I apply through multiple Demat accounts?

Yes, you can apply through multiple Demat accounts, but only if each application is linked to a unique PAN. Multiple applications with the same PAN may be rejected.

Is IPO Allotment First Come First Serve?

When applying for an Initial Public Offering (IPO), many investors believe that applying early increases the chances of getting shares. But is IPO allotment really based on a first come, first serve basis? The short answer is no. IPO allotment in India does not follow a first come, first serve process.

What Happens If I Don’t Get IPO Allotment

If you don’t get IPO allotment, the blocked funds in your bank account are released, usually within a few days. No shares will be credited to your demat account, and there are no penalties or charges involved. You can apply for future IPOs without any restrictions.

How is it decided who gets an IPO allotment?

Investors are categorised as per SEBI rules, and shares are allotted accordingly. If the IPO is undersubscribed, all applicants get full allotment. In case of oversubscription, shares are allotted through a lottery or pro-rata basis

What is IPO allotment?

As and when an IPO is announced, various investors apply for shares. The number of shares that are credited to the Demat account of the applicants, is called IPO allotment.

What happens after IPO allotment?

The shares of the issuing company are listed and are open for trading within 7 days of the IPO allotment process. Investors can then sell their current holdings or even buy some more.

How can I increase my chance of getting an IPO allotment?

To increase your chances of getting an IPO allotment, it is not necessary that you make way too large an application.. Ensure there are no errors in your application. Also, if you are already a shareholder of the parent firm, your allotment chances can be higher. Lastly, make applications from multiple Demat accounts. You can use the account of your family members or friends.

How do you check if an IPO is allotted or not?

You can visit the official website of the stock exchange where the IPO is listed. Go to their investor application section, enter details of your application and check its status. Additionally, you can also visit the registrar’s website.

What are the reasons for no allotment of shares in an IPO?

Usually, oversubscription and erroneous applications are the two major reasons for no share allotment of shares in an IPO.