- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Online Demat Account for Young Investors

By Shishta Dutta | Updated at: Jul 14, 2025 02:42 PM IST

Investing early is essential to financial independence, particularly for young people. With the proliferation of accessible digital tools, first-time investors can begin their adventure by creating a Demat account online. For young investors who prefer managing their finances digitally, a seamless Demat Account App offers the flexibility to invest, track portfolios, and trade on the go all from a smartphone. According to a recent report, the number of Demat accounts in India surged by 4.4 million to 175 million in September 2024 “as per Economic Times”, reflecting a substantial increase in participation from young people. For tech-savvy individuals, investing now increases wealth and fosters disciplined financial habits for a safe future.

What is a Demat Account?

A Demat (Dematerialised) account is a digital account that stores and manages investments such as equities, bonds, mutual funds, and exchange-traded funds (ETFs). It removes the need for physical certificates, which reduces the possibility of loss, theft, or damage. A Demat account, regulated by authorities such as SEBI in India, is required for stock market trading. It makes investment tracking and transactions more accessible for beginner investors while providing convenience and security. Official figures suggest a significant growth in Demat account openings, owing to the growing interest of young, tech-savvy investors.

Why Young Investors Should Start Early?

Investing early has several benefits that can help form a successful financial future. The most prominent advantage is the power of compounding, which increases profits on investments enormously over time. Starting early gives first-time and beginning investors a longer investing horizon, allowing them to recover from market volatility and take sensible risks.

Young investors frequently have fewer financial commitments, making it more straightforward to devote cash to wealth-building possibilities. Furthermore, early exposure to investment promotes disciplined financial behaviours such as budgeting and saving, which are critical for long-term success.

Government programs encouraging financial awareness and internet platforms have made investing more accessible than ever. With youth engagement in investments continuously increasing, as indicated by the spike in Demat account openings, starting early provides young people with the knowledge and confidence they need to navigate the financial markets and achieve their goals effectively.

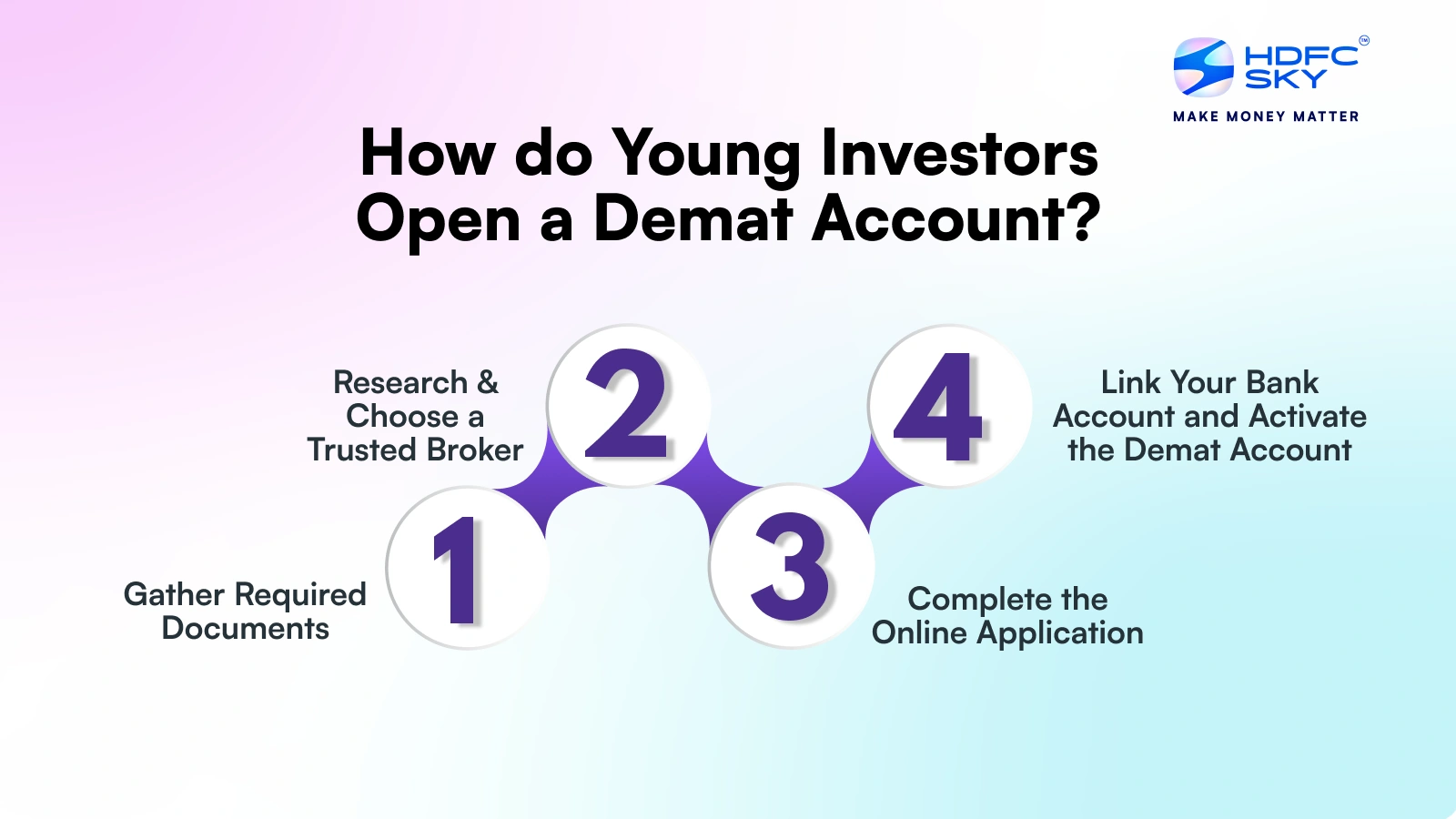

Step-by-Step Guide to Open a Demat Account Online

Opening a Demat account online is a quick and straightforward process that allows first-time and novice investors to access and manage their money from anywhere.

1. Research and Choose a Trusted Broker

Choosing the correct broker is critical for beginner investors. Look for brokers who provide user-friendly interfaces, minimal broking costs, and excellent customer service. Assess their reputation, services provided, and ease of access to learning materials. Trustworthy brokers frequently offer resources suited to young investors, such as demo accounts and instructional information. Verify the broker’s registration with regulatory bodies such as SEBI in India. Conduct careful research to verify that your selected broker corresponds with your investing objectives and provides a simple onboarding process.

2. Gather Required Documents

First-time investors must provide a few papers to create a Demat account online. These usually include:

- PAN Card: Required for identification verification.

- Aadhaar Card or Other ID Proof: This is for address verification.

- Bank details: You must provide a cancelled check or bank statement to link your accounts.

- Photo: A recent passport-sized photograph.

To speed up the procedure, ensure these papers are in digital format (scanned copies). Accurate and thorough paperwork leads to speedier verification and hassle-free account activation.

3. Complete the Online Application

Filling out the online application for a Demat account is a simple process for first-time and beginner investors. Begin by navigating the broker’s website or app and choosing the “Open Demat Account” option. Enter your name, date of birth, and contact information. Upload the needed papers, such as PAN, Aadhaar, and bank information. Complete the e-KYC procedure, which may include Aadhaar OTP or video verification. Double-check all entries before submitting them to guarantee seamless processing and rapid approval.

4. Link Your Bank Account and Activate the Demat Account

Once your Demat account application has been submitted, the following step is to link your bank account. This enables the smooth movement of cash for acquiring or selling shares. Please provide your bank account information and a cancelled check or bank statement for verification. After successful verification, your Demat account will be authorised. Depending on the broker, This procedure might take several hours to several days. Once activated, you may begin investing in stocks, bonds, and other financial products using your connected account.

Spotlight on HDFC SKY Youth Plan

The HDFC SKY Youth Plan is primarily aimed at young investors, particularly those aged 18 to 25. This plan provides various benefits suited to the needs of new investors, providing a seamless transition into the stock market.

- Booking Details: This plan provides young investors one year of brokerage-free trading across all opted-in categories, making it an appealing alternative for those just starting in the financial world. ETF fees are waived for the rest of one’s life, making them an affordable option for long-term development.

- MTF & Offers: The plan provides Rs 500 interest-free for the first 30 days of margin trading, allowing new investors to test the waters without incurring upfront charges.

- Other Benefits: The Annual Maintenance Charges (AMC) are eliminated for the first year, allowing young investors to focus on developing their money without the stress of early expenses.

- Plan Options: The plan is termed PLAN B, focusing on youth-centric characteristics. Furthermore, there are no renewal fees, resulting in additional savings.

The HDFC SKY Youth Plan is a complete investment plan designed to meet the financial needs of young, tech-savvy investors, laying a solid basis for their wealth-building journey.

Conclusion

Creating a Demat account online is a simple yet effective way for young investors to begin their financial adventure. Following the simple procedures, first-time investors may begin managing their accounts quickly and safely. Starting early lets young people reap the benefits of compounding and build good financial habits. For those seeking a more personalised investing strategy, youth-focused plans such as the HDFC SKY Youth Plan provide fantastic options with minimal initial deposits and user-friendly features, making it easier for young investors to build wealth.