- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Risk Management in Intraday Trading

By HDFC SKY | Updated at: Apr 24, 2025 04:19 PM IST

Research suggests 80% of intraday traders quit within the first two years. Within three years, only 13% continue to day trade. After five years, only 7% remain. And why do so many traders quit? Because their central focus is on making a quick buck, inherently making them vulnerable to risk. Remember, things that hurt us the most are those we don’t foresee.

Hence, we feel a better approach to intraday trading goes through risk management. If you are protected on the downside, anything in excess is a positive, right?

Let’s look at seven ways in which you can minimise your intraday trading risks:

Use trailing stop-loss

How to Manage Risk in Intraday Trading

As we have learnt earlier in this course, stop-loss limits your downside risk. A normal stop-loss order is set at a particular price point, the breach of which triggers a market order.

The trailing stop-loss is its natural evolution. Not only does it limit your downside risk, but it also protects your profits. Here, instead of setting an absolute figure as stop-loss, traders set a predetermined loss percentage. Hence, if the market moves in your favour, the stop-loss level also rises.

Let’s understand it with the help of an example.

Suppose you bought a stock at Rs 100 and set the trailing stop-loss at 2% or less. At this point, your stop-loss would be Rs 98. Assume that later in the day, the price moves up to Rs 105; the new stop-loss would now be Rs 102.90. Hence, a sell order would only be triggered if the stock falls below this level. As you can see, this assures you a profit of Rs 2.9.

Trailing stop-loss works the best in a trending market. It lets you ride the momentum till the stock eventually retraces.

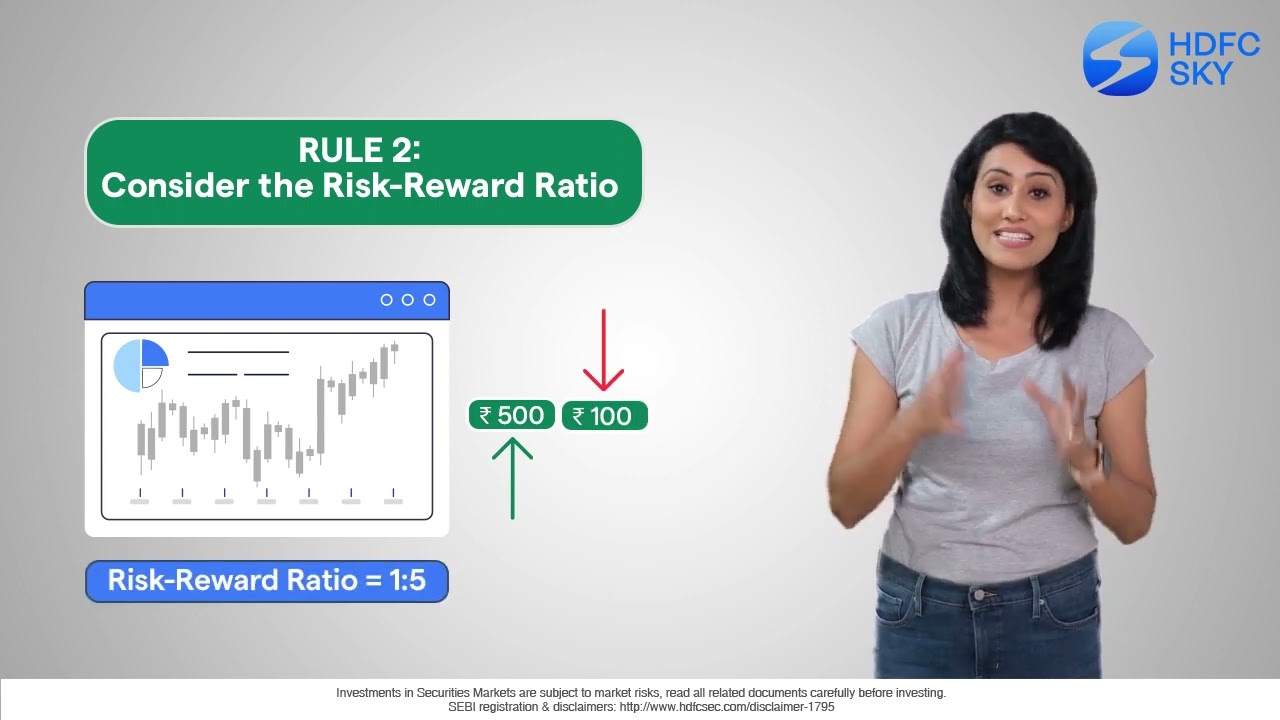

Check risk-reward ratio

The risk-reward ratio compares a trade’s profit potential to its potential loss. Risk is the price difference between the entry point and the stop-loss. Reward is the price difference between the entry point and the profit target.

Risk/reward ratio formula: (Entry point – Stop-loss) / (Profit target – Entry point) For example, if you buy a stock at Rs 100 and set the stop-loss at Rs 95. In this case, your risk exposure is Rs 5. If you expect the stock to reach Rs 110, the potential reward is Rs 10. This equates to a risk/reward ratio of 1:2.

Typically, a trader would have a profit expectation from a position, but they often lose sight of the risk involved. A prudent trader always looks at a trade’s risk/reward ratio before taking a position. The general rule of thumb is to only go for trades with a risk/reward ratio of at least 1:2.

The 2% rule: The 2% rule is a strategy where you risk no more than two percent of your available capital on any single trade. This can be an effective risk management strategy even for intraday traders.

For instance, if you have a total capital of Rs 10,00,000, you should not bet more than Rs 20,000 on any trade.

This is to prevent the urge of cost averaging in case the trade goes sideways. Often intraday traders fall into the trap of averaging their position in the hope of a reversal. In the domain of economics, this tendency to prefer avoiding losses is known as ‘Loss Aversion’. The 2% rule puts a hard cap on the money you can put in a single trade. So, if you reach this cap, take it on the chin and move on.

As we have seen earlier in this module, margin trading facility allows you to buy more stocks than your money could otherwise buy.

In case your trade goes wrong, it could really hurt your financial health. So be cautious and understand the risk of margin. If you are new to the world of trading and/or want to know more about margin, read our chapter 14.1.

Technical analysis

An in-depth understanding of technical analysis is critical to your success as an intraday trader. It is so important that we have dedicated two modules to it. If you haven’t followed this course chronologically, we suggest you go back and read it.

Make trend your friend

Contrarian trade goes against the prevailing sentiment and therefore opposes a recent move in a market. While this might be a good approach to investing, it doesn’t work in intraday trading – simply because there is no time for the market to correct itself if it is wrong. Hence, your best bet is to go with the trend.

Stay away from online forums

In the dark annals of the Internet, there exist chat rooms that entice inexperienced traders with the poisonous fruit of stock recommendations. Don’t be Snow White.

Jokes aside, please do your own research.

Quiz Time:

- What is the maximum amount of capital you should put in one trade?

A) 3%

B) 2%

C) 5%

D) 6%

Answer: B - Which of the following risk/reward ratio is the best?

A. 5:1

B. 1:1

C. 1:5

D. 3:1

Answer: C - Margin allows you to ___?

A. Limit your losses

B. Book your profit when it reaches target

C. Maximize risk/ reward ratio

D. Get bigger exposure than your trading capital

Answer: D - Stop loss allows you to ____?

A. Limit your losses

B. Book your profit when it reaches target

C. Maximize risk/reward ratio

D. Get bigger exposure than your trading capital

Answer: A - What type of study is necessary for intraday trading?

A. Fundamental analysis

B. Technical analysis

C. Both

D. None

Answer: B