- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Commodity Trading: Invest in Commodities in India

Tap into Commodity Trading to Diversify Your Investment Portfolio

What is Commodity Trading ?

Commodity trading is the exchange of raw materials, agricultural products, or other well-defined items on a commodities market. allows investors to gain exposure to a wide range of assets beyond traditional stocks and bonds. It also gives investors a chance to diversify their portfolios and capitalize on price fluctuations in the global marketplace.

- Portfolio diversification

- Variety of asset types

- Hedge against Price Volatility

Commodity trading allows you to curate a balanced portfolio and can serve as a valuable portfolio diversification tool.

Commodity Trading With HDFC Sky

Comprehensive research tools and market analysis

Competitive brokerage fees on commodity trades

Involves the exchange of physical and financial instruments

Represents tangible assets like metals, energy, agriculture

Lightning-fast trading with Quick Trade

How Commodity Trading Works at HDFC Sky?

Open Your Demat Account with HDFC Sky

Add Funds to your HDFC Sky Account

Select commodity from Research Recommendation

Place Your Buy/Sell Order on Web or App

Lightning-Fast Trade with Quick Trade

Open Your Demat Account with HDFC Sky

Add Funds to your HDFC Sky Account

Select commodity from Research Recommendation

Place Your Buy/Sell Order on Web or App

Lightning-Fast Trade with Quick Trade

Benefits of Investing in Commodities

Portfolio Diversification

Unique asset class that can help diversify your investment portfolio

Access to Global Markets

Gain exposure to a wide range of international markets and industries

Inflation Hedging

Commodity trades can be used for hedging against inflation

Flexible Trading Strategies

Utilize a variety of trading instruments to suit your trading approach

Speculative Opportunities

Capitalize on price fluctuations in the commodity markets

Hedging

Those having real exposure to commodities can hedge their exposure through commodity future Markets.

Portfolio Diversification

Unique asset class that can help diversify your investment portfolio

Access to Global Markets

Gain exposure to a wide range of international markets and industries

Inflation Hedging

Commodity trades can be used for hedging against inflation

Flexible Trading Strategies

Utilize a variety of trading instruments to suit your trading approach

Speculative Opportunities

Capitalize on price fluctuations in the commodity markets

Hedging

Those having real exposure to commodities can hedge their exposure through commodity future Markets.

Commodity Trading Charges with HDFC Sky

Explore our affordable commodity trading charges, tailored for seamless trading across a range of commodities.

Commodity Futures Carry Forward

₹20 or 2.5% (whichever is lower)

Commodity Futures Intraday

₹20 or 2.5% (whichever is lower)

Commodity Options Carry Forward

₹20 / Order

Commodity Options Intraday

₹20 / Order

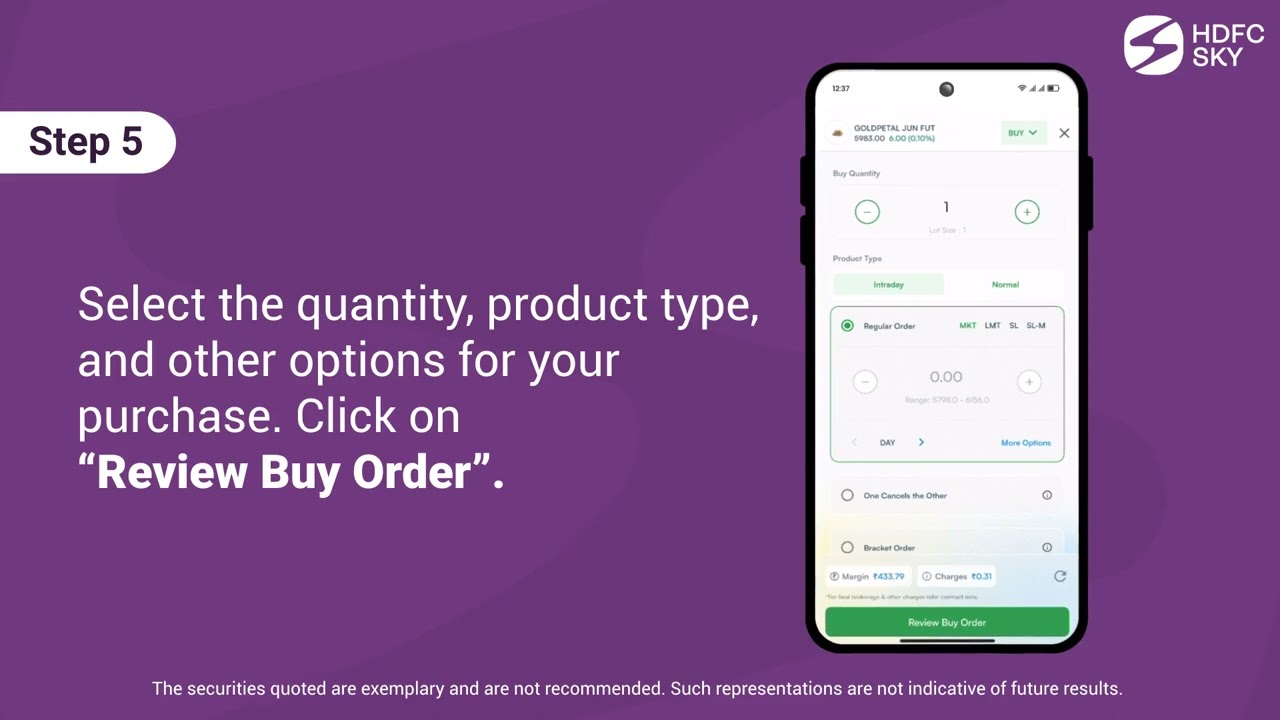

How to Start Commodity Trading on HDFC Sky App

Commodity trading is the exchange of raw materials, agricultural products, or other well-defined items on a commodities market. allows investors to gain exposure to a wide range of assets beyond traditional stocks and bonds. It also gives investors a chance to diversify their portfolios and capitalize on price fluctuations in the global marketplace.

Basics of Commodity Trading

Commodity trading involves the exchange of physical or financial instruments representing a variety of underlying assets, including precious metals, energy resources, agricultural products, and more.

These tangible assets are traded on dedicated commodity exchanges, with prices influenced by global supply and demand, geopolitical events, and economic conditions.

Types of Commodities

The commodity market encompasses a wide range of physical assets, each with its own unique characteristics and trading dynamics. The commodities are generally categorized into four main groups:

Precious & Industrial Metals: This category includes precious metals like gold, silver, and platinum, as well as industrial metals like copper, aluminum, zinc, lead and nickel. Precious Metals are often used as a hedge against inflation and currency fluctuations.

Energy Resources: Energy commodities include crude oil, natural gas, gasoline, and coal. These are critical for the functioning of economies, as they are used for transportation, manufacturing, and power generation.

Agricultural Products: This group includes crops like wheat, corn, soybeans, coffee, sugar, and cotton. Agricultural commodities are essential for food production and textile manufacturing.

Livestock and Meat: This category covers live animals such as cattle and hogs, as well as processed meats. These commodities are integral to the food industry.

It is important to note that each of these commodity types has its own supply and demand drivers. This makes each commodity subject to varying price fluctuations and market influences.

Types of Commodity Markets

Spot Markets: These markets facilitate the immediate delivery and payment of commodities, allowing for the physical exchange of the underlying asset. These are also known as cash markets where the price is agreed upon, and the exchange of goods occurs on the spot.

Futures Markets: Futures markets involve trading contracts that obligate the buyer to purchase, and the seller to sell, a commodity at a predetermined price on a future date. Futures contracts are standardized and traded on exchanges. This market is primarily used by speculators and hedgers looking to earn a return from price fluctuations or protect against price risks.

Options: Options provide the right, but not the obligation, to buy or sell a commodity at a specified price and time, offering traders additional flexibility and risk management tools.

How the Commodity Market Works

The commodity market operates on the principles of supply and demand, similar to other financial markets. Prices are influenced by various factors, including geopolitical events, weather patterns, natural disasters, and changes in supply and demand dynamics. The intricate relationship between these factors creates a dynamic and often volatile commodity trading environment, presenting both opportunities and risks for investors.

Key Components of the Commodity Market

Exchanges: Commodity exchanges, such as the Multi Commodity Exchange (MCX) in India and the Chicago Mercantile Exchange (CME) in the U.S., are central to the trading process. They provide a platform for buyers and sellers to trade commodities and ensure that transactions are conducted in a regulated and transparent environment.

Future Contracts: These are standardized agreements to buy or sell a specific quantity of a commodity at a set price on a future date. Futures contracts are traded on exchanges, and they play a crucial role in price discovery and risk management.

Hedgers and Speculators: Hedgers use the futures market to protect against price fluctuations in the commodities they produce or consume. Speculators, on the other hand, aim to profit from price changes by buying low and selling high.

Leverage: Commodity trading often involves leverage, which allows traders to control a large position with a relatively small amount of capital. While leverage can generate profits, it also increases the risk of losses.

Commodity Exchange in India

In India, the primary commodity exchanges include the Multi Commodity Exchange (MCX), the National Commodity and Derivatives Exchange (NCDEX), and the Indian Commodity Exchange (ICEX).

These exchanges provide a regulated and transparent platform for commodity trading, offering a wide range of products and trading mechanisms to cater to the diverse needs of market participants.

The Indian commodity market is overseen by the Securities and Exchange Board of India (SEBI). It is responsible for ensuring the integrity, fairness, and efficiency of these exchanges. SEBI’s regulatory framework aims to protect investors, promote market development, and prevent unfair trade practices.

How Are Prices Determined in Commodity Exchanges?

Commodity prices are determined by the complex interaction of supply and demand factors, as well as the expectations and sentiments of market participants. Some of the key determinants of commodity prices include:

Supply and Demand: The most fundamental factor in determining commodity prices is the balance between supply and demand. When demand exceeds supply, prices tend to rise, and when supply exceeds demand, prices tend to fall. For example, a poor harvest due to unfavorable weather conditions can reduce the supply of an agricultural commodity, leading to higher prices.

Geopolitical Events: Political instability, conflicts, and trade policies can significantly impact the supply of commodities, particularly in regions that are major producers. For instance, tensions in the Middle East can disrupt the supply of crude oil, causing prices to increase.

Currency Exchange Rates: Commodities are often priced in U.S. dollars on the global market. Therefore, changes in the value of the dollar can affect commodity prices. A stronger dollar makes commodities more expensive for buyers using other currencies, which can reduce demand and lower prices.

Economic Indicators: Indicators such as GDP growth, inflation rates, and employment data can influence commodity prices. For example, strong economic growth may increase demand for energy and metals, driving up prices.

Speculation: Traders and investors in the futures and options market also play a role in price determination. Speculators buy and sell futures contracts based on their expectations of future price movements, and their actions can influence market prices.

The commodity exchanges act as central hubs, where these various supply and demand factors converge to establish transparent and efficient pricing mechanisms for the trading of physical and financial commodity instruments.

Interdependence of Commodity Market and Stock Market

Company Earnings: Many companies listed on stock exchanges are involved in the production, processing, or consumption of commodities. For example, an oil company’s earnings are directly tied to the price of crude oil. Therefore, changes in commodity prices can impact the stock prices of these companies.

Inflation and Economic Conditions: Commodity prices tend to rise with inflationary pressures, which can have a corresponding impact on stock market performance as companies’ costs and profit margins are affected.

Hedging Strategies: Companies often use the commodity futures market to hedge against price risks. For example, an airline might hedge against rising fuel prices by purchasing futures contracts. These hedging activities can influence both the commodity and stock markets.

Investor Sentiment: Changes in investor sentiment and risk appetite can lead to capital flows between the stock and commodity markets, as investors seek to diversify their portfolios or capitalize on market opportunities.

Participants in Commodity Market Trading

The commodity market is made up of various participants, each with different objectives and strategies. The interaction and trading activities of these diverse participants contribute to the liquidity, price discovery, and overall efficiency of the commodity market. Therefore, it is important to understand the participants in commodity trading. These participants include

Arbitrageurs: Arbitrageurs take advantage of price discrepancies between different markets or exchanges. They simultaneously buy and sell the same commodity in different markets to gain from the price difference. Arbitrage helps ensure that prices remain aligned across markets.

Hedgers: Hedgers are typically producers, consumers, or processors of commodities who use the futures market to protect themselves against price risks. For example, a farmer might sell futures contracts on their crop to lock in a price and protect against a decline in prices.

Speculators:: Speculators aim to profit from price movements in the commodity market. Unlike hedgers, they do not have a physical commodity to buy or sell. Instead, they take positions in futures contracts based on their expectations of future price changes. Speculators play a crucial role in providing liquidity to the market.

Investors and Brokers: Investors include individuals and institutional investors who include commodities in their portfolios for diversification purposes. They may invest in commodity futures, exchange-traded funds (ETFs), or commodity-linked stocks.

Brokers, on the other hand, act as intermediaries between buyers and sellers in the commodity market. They facilitate trades and provide market insights, research, and analysis to their clients.

Advantages of Commodity Trading

Portfolio Diversification: Some commodities may have low correlation with traditional asset classes like stocks and bonds. Adding these commodities to your portfolio can help diversify your investments and reduce overall risk.

Inflation Hedge: Commodity prices tend to rise with inflation, making them an effective tool to protect the purchasing power of your investments. As the cost of living goes up, the value of your commodity holdings can increase to offset the impact of inflation.

Speculative Opportunities: The inherent volatility in commodity prices creates opportunities for traders to generate returns by capitalizing on price movements. Skilled investors can potentially profit from both rising and falling commodity markets.

Global Market Exposure: Investing in commodities gives you exposure to a wide range of international markets and industries, beyond what you might find in a typical stock or bond portfolio. This can help you tap into growth and trends in various regions and economic sectors.

Flexible Trading Strategies: The commodity market offers a diverse range of trading instruments, including futures, options, and exchange-traded funds (ETFs). This allows you to implement trading strategies tailored to your investment objectives and risk tolerance.

Tangible Asset Ownership: Investing in physical commodities, such as gold or silver, can provide a sense of security and diversification compared to purely financial assets. Some investors find comfort in holding a tangible asset as part of their portfolio.

Potential for High Returns: While commodity trading carries risks, successful strategies can potentially generate substantial returns, especially for investors with a higher risk appetite and a well-developed trading approach.

Dedicated Support: Reputable commodity trading platforms, like HDFC SKY, offer specialized guidance, research, and tools to help investors navigate the complexities of the commodity markets and make informed decisions.

Disadvantages of Commodity Trading

While commodity trading offers several advantages, it also carries inherent risks and drawbacks that investors should be aware of:

Price Volatility: Commodity prices can be highly volatile, subject to sudden and significant fluctuations due to a variety of market factors. This price volatility can lead to substantial losses if not managed properly.

Leverage-Induced Losses: While leverage can generate returns, it can also magnify losses. Traders using leverage may find themselves in a position where they owe more than their initial investment if the market moves against them.

Regulatory Changes: The commodity market is subject to regulatory oversight, and changes in policies or rules can impact the trading environment and profitability. Investors need to stay up to date with regulatory developments that may affect their investments.

Counterparty Risk: When trading in the physical market, investors are exposed to the risk of default or non-performance by their trading counterparties, . This counterparty risk can result in financial losses. In the case of trading on commodity exchanges, this risk is minimized or eliminated.

Liquidity Concerns: Certain commodity markets may experience periods of low liquidity, making it difficult for investors to enter or exit positions at favorable prices. Illiquid markets can exacerbate price volatility and increase trading costs.

Complex Market Dynamics: Understanding the intricacies of commodity trading, including the factors that influence prices, can be challenging, particularly for inexperienced investors. Navigating the complexity of the commodity market requires significant research and experience.

Speculative Nature: Commodity trading sometimes involves speculation, which can lead to unpredictable outcomes. Speculators may experience significant losses if their predictions about price movements are incorrect.

Storage and Transportation Costs: Physical commodities like oil or agricultural products involve storage and transportation costs, which can crowd out the gains. Even in futures trading, where physical delivery is not required, these costs are often factored into prices.

How to Invest in Commodity Trading

Participating in the commodity market can be a valuable addition to your investment portfolio, but it requires a good understanding of the available options and the risks involved. Let’s explore the various ways you can invest in commodities and the key considerations for each approach.

1. Commodity Futures and Options

One of the most direct ways to invest in commodities is through futures and options. Commodity futures contracts allow you to buy or sell a specific quantity of a commodity at a predetermined price and delivery date in the future. Options, on the other hand, give you the right, but not the obligation, to buy or sell a commodity at a specified price within a certain time period.

Investing in commodity futures and options can provide you with direct exposure to the price movements of the underlying assets, such as gold, crude oil, or agricultural products. This can be a powerful way to potentially profit from market fluctuations, but it also carries significant risks. Futures and options trading often involve the use of leverage, which can amplify both your gains and losses. It’s crucial to understand the mechanics of these instruments, the margin requirements, and the overall risk management involved.

2. Commodity Exchange-Traded Funds (ETFs)

For investors who want a more passive and diversified approach to commodity investing, commodity ETFs can be an excellent option. These funds track the performance of a basket of commodity futures contracts, providing exposure to a broad range of commodities in a single investment.

Commodity ETFs offer several advantages, such as:

- Diversification : By investing in a diversified portfolio of commodities, you can reduce the overall risk of your investment.

- Liquidity :Commodity ETFs are traded on major stock exchanges, making them easy to buy and sell.

- Simplicity Investing in a commodity ETF eliminates the need to manage individual futures or options contracts.

When choosing a commodity ETF, consider factors such as the specific commodities included, the fund’s tracking method, the expense ratio, and the fund’s overall performance history.

3. Commodity Index Funds

Similar to commodity ETFs, commodity index funds provide exposure to a broad range of commodities by investing in a diversified portfolio of commodity futures contracts. These funds are designed to track the performance of leading commodity market indexes, such as the Bloomberg Commodity Index or the S&P GSCI Index.

Commodity index funds offer the benefits of diversification and reduced volatility compared to investing in individual commodities. They also provide a more passive, low-cost way to gain exposure to the commodity market as a whole.

4. Physical Commodity Holdings

Some investors prefer to hold physical commodities, such as gold, silver, or other precious metals, as a direct investment. This approach allows you to own the tangible asset and potentially benefit from price appreciation over time.

Investing in physical commodities can provide a sense of security and act as a hedge against inflation. However, it also comes with additional considerations, such as storage, insurance, and transportation costs. Investors in physical commodities must also account for the costs associated with buying, selling, and securely storing the physical assets.

5. Commodity-Related Stocks and Equities

Another way to gain exposure to the commodity market is by investing in the stocks of companies that are involved in the production, processing, or distribution of commodities. These can include mining companies, energy firms, agricultural businesses, and other commodity-related industries.

Investing in commodity-linked stocks can provide diversification benefits, as the performance of these companies may be influenced by factors beyond just the fluctuations in commodity prices. However, it’s important to remember that these investments carry additional risks, such as company-specific operational and financial risks, in addition to the volatility of the underlying commodity markets.

Factors to Consider When Investing in Commodities

Regardless of the investment approach you choose, there are several key factors to consider when investing in the commodity market:

1. Risk Tolerance : Commodity investments can be highly volatile, so it’s essential to evaluate your risk appetite and ensure your commodity allocation aligns with your overall investment strategy and risk profile.

2.Investment Horizon : Commodity prices can fluctuate significantly in the short term, so it’s generally recommended to have a medium to long-term investment horizon to potentially ride out the volatility and benefit from longer-term trends

3.Portfolio Diversification :Incorporating commodities into a diversified investment portfolio can help reduce overall portfolio risk and potentially enhance returns over the long run.

4. Research and Education: Thoroughly understanding the commodity markets, the factors that drive prices, and the various investment options is crucial for making informed decisions and managing the risks effectively.

5.Seek Professional Guidance: Consulting with a financial advisor or a commodity trading specialist can be beneficial in developing a well-informed and tailored commodity investment strategy

When considering how to invest in the commodity market, it’s essential for investors to carefully assess their investment objectives, risk tolerance, and the level of expertise they possess.

A well-diversified approach that combines various commodity investment vehicles, along with proper risk management strategies, can help mitigate the inherent volatility and complexities of the commodity market.

It’s also important for investors to thoroughly research and understand the specific features, costs, and risks associated with each investment option before committing their capital.

Seeking guidance from experienced commodity trading professionals or financial advisors can also be beneficial in navigating the nuances of the commodity investment landscape.

Commodity Market Regulations and Compliance:

Understanding the regulatory environment is crucial for anyone involved in commodity trading. In India, the Securities and Exchange Board of India (SEBI) regulates commodity exchanges and ensures that trading practices are transparent and fair. Regulations govern various aspects of trading, including:

- Trading Limits: SEBI and exchanges impose position limits to prevent market manipulation and excessive speculation. These limits restrict the maximum number of contracts that a single trader can hold.

- Margin RequirementsTraders are required to maintain a margin in their trading accounts to cover potential losses. The margin acts as a financial safeguard for both the trader and the exchange.

- Risk Management:Exchanges and traders must adhere to strict risk management practices, including maintaining sufficient capital and using risk assessment tools.

- Reporting ObligationsTraders and exchanges are required to report their positions and transactions to SEBI, ensuring transparency and market integrity.

Compliance with these regulations is essential to operate within the legal framework and protect against risks associated with non-compliance.

Commodity Trading Strategies

Developing a robust trading strategy is key to succeeding in the commodity market. Here are some popular strategies:

Trend Following: Traders analyze historical price data to identify trends and enter positions in the direction of the trend. For example, if a commodity’s price has been consistently rising, a trend follower may buy futures contracts with the expectation that the trend will continue.

Mean Reversion: This strategy assumes that commodity prices will revert to their historical averages over time. Traders using mean reversion buy when prices are low and sell when prices are high, capitalizing on price fluctuations.

Arbitrage: Arbitrage involves taking advantage of price discrepancies between different markets or exchanges. For example, a trader might buy a commodity at a lower price in one market and simultaneously sell it at a higher price in another, locking in a profit.

Hedging: Hedging is used by producers and consumers of commodities to protect against adverse price movements. For example, a farmer might sell futures contracts on their crop to lock in a price and hedge against the risk of a price decline at harvest time.

Speculation: Speculators attempt to earn from price movements by predicting market direction. They may use fundamental analysis, which examines supply and demand factors, or technical analysis, which focuses on price charts and indicators. Each strategy has its own risk profile and requires a thorough understanding of the market, as well as disciplined execution.

Mistakes to Avoid in Commodity Trading

Effective risk management is essential for long-term success in commodity trading. Key risk management techniques include:

1.Diversification: Spreading investments across different commodities or asset classes to reduce exposure to any single asset.

2.Stop-Loss Orders: Placing stop-loss orders to automatically sell a position if the price reaches a certain level, limiting potential losses.

3.Position Sizing: Determining the appropriate size of each trade based on the traders risk tolerance and market conditions.

4.Use of Hedging Instruments: Utilizing futures, options, and other derivatives to hedge against adverse price movements.

5.Continuous Monitoring: Regularly reviewing and adjusting positions based on market conditions, economic indicators, and global events.

By employing these risk management techniques, traders can protect their capital and navigate the inherent uncertainties of the commodity market.

Learn More About Commodity Trading

FAQ's on Commodity Trading Online

What is commodity trading?

Commodity trading refers to the trading of commodities such as agricultural commodities, industrial commodities etc.

Is commodity trading safe?

Commodity trading, like any investment, carries inherent risks. However, with proper research, risk management, and a well-diversified portfolio, commodity trading can be a prudent part of an investment strategy. HDFC SKY provides guidance and tools to help investors navigate the commodity markets responsibly.

Is commodity trading profitable?

Commodity trading can generate returns, but it also involves risks. The profitability of commodity trading depends on factors such as market conditions, trading strategies, risk management, and individual investor circumstances. HDFC SKY can provide insights and support to help investors make informed decisions and potentially realize profitable outcomes.

What is traded in the commodity market?

The commodity market encompasses a diverse range of physical assets, including precious metals, energy resources, agricultural products, and livestock. Some of the most commonly traded commodities include gold, silver, crude oil, natural gas, wheat, corn, soybeans, and cattle.

Who regulates the commodity market in India?

In India, the commodity market is primarily regulated by the Securities and Exchange Board of India (SEBI). SEBI is responsible for overseeing the operations of the country’s commodity exchanges, such as the Multi Commodity Exchange (MCX), the National Commodity and Derivatives Exchange (NCDEX), and the Indian Commodity Exchange (ICEX).

Are commodities traded internationally?

Yes, commodities are actively traded globally through various commodity exchanges and over-the-counter markets. The international commodity trade involves the exchange of raw materials, agricultural products, and other physical assets across national borders, driven by global demand and supply dynamics.

What are the risks associated with commodity trading?

Commodity trading carries several risks, including price volatility, leverage-induced losses, regulatory changes, counterparty risk, and liquidity concerns. It’s essential for investors to understand these risks, develop a well-informed trading strategy, and practice effective risk management to mitigate potential losses.

Do I need any prior experience to start commodity trading?

No you do not need any prior expetrience. While prior experience can be beneficial, it’s not strictly necessary to begin commodity trading. Many brokerage firms offer educational resources, market analysis tools, and even simulated trading platforms to help beginners understand the basics. However, given the inherent risks involved, it’s advisable to start with a smaller investment amount and gradually increase your exposure as you gain experience.

How do I choose which commodities to trade?

Selecting the right commodities to trade involves a combination of factors. Consider your investment goals, risk tolerance, and market outlook. Some investors focus on commodities that align with their existing investment portfolio, while others may prefer to diversify into commodities that have a low correlation with traditional asset classes. Fundamental analysis, which involves studying economic factors affecting supply and demand, can also be helpful in identifying potential trading opportunities.

Can I use leverage in commodity trading?

Yes, leverage is available in commodity trading, primarily through futures contracts. Leverage allows traders to control a larger position with a smaller amount of capital. However, it’s important to understand that leverage amplifies both profits and losses. Using leverage can increase the potential for significant gains, but it also increases the risk of substantial losses. It’s crucial to use leverage cautiously and with a clear understanding of the associated risks.