- Offerings

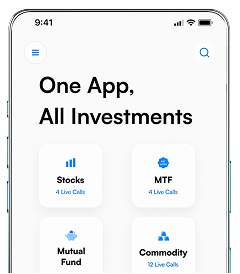

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Leverage in Futures and Options: How to Use Leverage Safely in F&O Trading

By Shishta Dutta | Updated at: May 18, 2025 10:44 PM IST

It is nothing but controlling a large position using a comparatively smaller capital. Some seasoned investors even call this margin trading. So when you practice F&O leverage you are actually increasing your market exposure. This can amplify your profits depending on how much margin you put up.

Let’s understand this with a simple example. If you have a margin of ₹1 Lakh and a 10 times leverage then you could control ₹10 Lakhs. However when this happens, even a 1% change in the market can cause you to either gain or lose 10%.

When you go for Futures and Options trading you could try out leverage but not without understanding the risks involved. So to provide a clearer picture, let us elaborate on the benefits and drawbacks involved.

Advantages of F&O Leverage

Potential to gain returns: One of the biggest advantages of leverage is that it increases the chances of a faster returns. You can do this with the same base capital. This means that even minor upwards price movement can bring you significant profits.

Lower Capital Outlay: By practicing leverage trading in F&O you need to invest less capital. The best part is that this allows you to control larger positions in futures and options trades. You can also diversify your portfolio by doing this.

Easier Goal Achievement: Another advantage is that you can achieve your financial goals faster by leveraging. If you have a positive idea about market movements then you can tailor your goals accordingly. With F&O leverage you can then achieve these goals faster.

Disadvantages of F&O Leverage

Amplified Losses: With the advantages comes some inevitable disadvantages too. Leverage in F&O trading means your losses can also get amplified like your profits. So if you see that the market is moving unfavourably it means your losses could go beyond your predetermined margin.

Total Capital Erosion: The worse-case scenario is that you could end up losing all your capital. This may happen if you use leverage without understanding how it works. There is also a chance that your losses could go beyond your initial invested capital.

How to Use Leverage Safely in F&O Trading

To prevent such losses from happening you can use these risk management strategies in F&O leverage trading.

- Understand Margin Requirements

When thinking of how to rollover futures you should first think of your margin requirements. Your broker usually sets these margin requirements. Based on this you can get an idea of how much capital you need for opening a position in F&O.

For example if your broker has set a margin of 5% it means you could then control a position that is 20 times your initial capital.

- Use Stop-Loss Orders

We suggest that you can use stop-loss orders to further reduce your losses. This type of order automatically closes your position whenever the underlying asset reaches the strike price.

For example: if you start a stop-loss order at 1-3% lower than the purchase price then it means you could protect yourself from losses. These losses are generally in the form of unfavourable market movements.

- Diversify Your Portfolio

After this you need to begin diversifying your investment portfolio. Some investors ignore this and end up missing the benefits. To do this you must avoid putting all your investment into a single trade. So in leveraged trading in F&O you should ensure that you are not going all-in for any single underlying assets. What your should so is to distribute this risk.

- Set Realistic Profit Targets

One of the most crucial tricks in rollover techniques like F&O leverage is to set achievable goals. Your profit forecasts need to be realistic based on the current market trends. To do this you first need to have more realistic targets and understand your risk-reward ratio. This can enable you to lock-in your profits before the prices rise of fall.

- Monitor Transaction Costs

The final step is to keep monitoring your investments. When doing this you need to check for transaction costs. You could also simultaneously check for issues that have resulted in lower profits.

Conclusion

F&O Leverage amplifies gains and increases transaction costs, including brokerage fees and taxes. High transaction costs can quickly eat into your profits, so it’s essential to ensure that your trading strategy accounts for these expenses. Always keep an eye on your overall cost-to-profit ratio.

Related Articles

FAQs

What are the risks associated with using leverage in F&O trading?

Using leverage can amplify losses, lead to margin calls, and increase volatility, risking substantial financial losses for traders.

Is there a maximum leverage limit in F&O trading?

Regulatory authorities often impose maximum leverage limits, typically ranging from 5x to 40x, depending on the underlying asset’s volatility.

What are the benefits of using leverage in F&O trading

Leverage allows traders to control larger positions with smaller capital, potentially increasing profits and enhancing investment opportunities in the market.