- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

How to Calculate and Use Option Greeks: Strategic Use of Option Greeks

By Shishta Dutta | Updated at: May 18, 2025 10:41 PM IST

For those who have just started exploring options trading, learning how to calculate option Greeks could seem like a paramount task. However, HDFC Sky breaks it down, making it easy to understand, even for beginners. Once you understand these terms, you will know more about using Greeks in options trading.

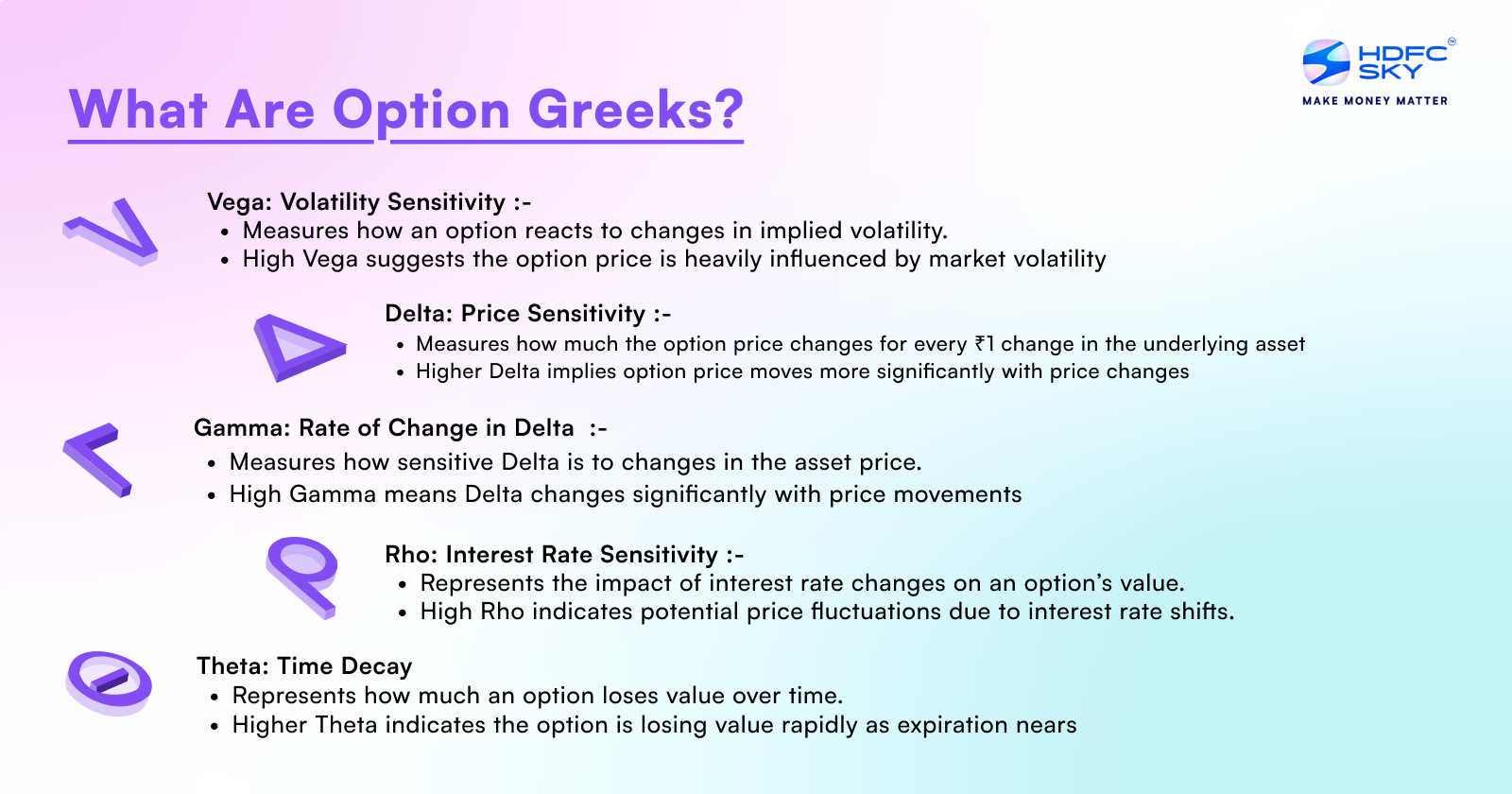

What Are Option Greeks?

Option Greeks simply represent the impact that certain risk factors may have on the price of an options contract. The term ‘Option Greek’ is used because each level of influence (or sensitivity) is represented by a Greek alphabet, starting from Delta to Rho.

Effectively, each Greek alphabet (Delta, Gamma, Vega, Theta, and Rho) provides a quantitative measurement of how much the price of an option could change depending on factors like price movements, market volatility, and time decay. So, let’s take a closer look at these in simple words.

- Option Delta: Price Sensitivity

This is the first Option Greek that focuses on price sensitivity. It measures the changes in the price of the option’s underlying asset right down to a single Rupee. For example, if a call option has a Delta of 0.6, it means that for every ₹1 that the price of the underlying asset moves, the price of the call option moves by ₹0.60.

- Option Gamma: Rate of Change in Delta

This is the second Option Greek and measures the rate of change in the first Option Greek (i.e., Delta). This rate of change is calculated for every ₹1 change in the price of its underlying asset. For example, if an options contract’s Gamma value is high, its Delta is highly susceptible to changes.

- Option Theta: Time Decay

This Option Greek measures the impact of the price of an option as time passes (i.e., time decay). Since option contracts lose their value and executability after the expiration date, Theta quantitatively calculates the loss you incur after expiration. For example, a higher Theta value may indicate that an option rapidly loses its value with time.

- Option Vega: Volatility Sensitivity

This Option Greek measures the volatility aspect of an option contract. The Vega value of an option is determined by the implied volatility of the underlying asset. For example, if the Vega value is high, the underlying asset’s implied volatility is also high.

- Option Rho: Interest Rate Sensitivity

Finally, this Greek option, the Rho, represents the impact on an option due to changing interest rates. While most traders do not account for Rho values, seasoned investors know all too well not to ignore this Greek. For example, a high Rho value could indicate that the interest rates are about to undergo significant changes (either increase or decrease).

The Strategic Use of Option Greeks

Once you understand how to calculate Greek Options, they can be used in the following cases:

- Delta Hedging: If your portfolio has a Delta value of 100, you could offset your risk exposure by shorting the shares you hold for the same underlying asset.

- Gamma Management: If you wish to reduce the fluctuations in your portfolio’s delta values, you should use Gamma management, a Delta-neutral strategy.

- Leveraging Theta: On the other hand, if you want to profit from time decay, you could choose to sell off some options. However, leveraging Theta values allows you to determine the optimum time to do so without incurring much loss.

- Vega and Volatility: If you buy options that have high Vega values, you could do so when the economy is on the verge of an economic recession. Since these periods have high volatility, you could use the Vega values to indicate when to buy options.

- Rho Considerations: Finally, if you plan to hold long-term positions in a particular option, then the Rho values could help you forecast changes in interest rates, which could significantly boost your profits.

Conclusion

By understanding how to use Greeks in options trading, you can begin your options trading journey using a data-driven approach.

Related Articles

FAQs

Can you calculate Option Greeks manually?

Yes, you can do it using the Black-Scholes or the Binomial Model. However, you should know that this includes complex calculations using Calculus.

What tools can traders use to calculate Option Greeks?

You can do it using online calculators or the tools offered by online trading platforms like HDFC Sky.

How can I use Delta to create a hedging strategy?

You can do this by changing the positions/holdings in your shares of the same underlying asset as the option. This could offset the price changes in the option contract, making your portfolio Delta-neutral.

What factors influence the calculation of Vega in options?

Factors like implied volatility of the underlying asset, the option’s expiration time, and even the price changes of the underlying asset.